Table of Contents

Overview

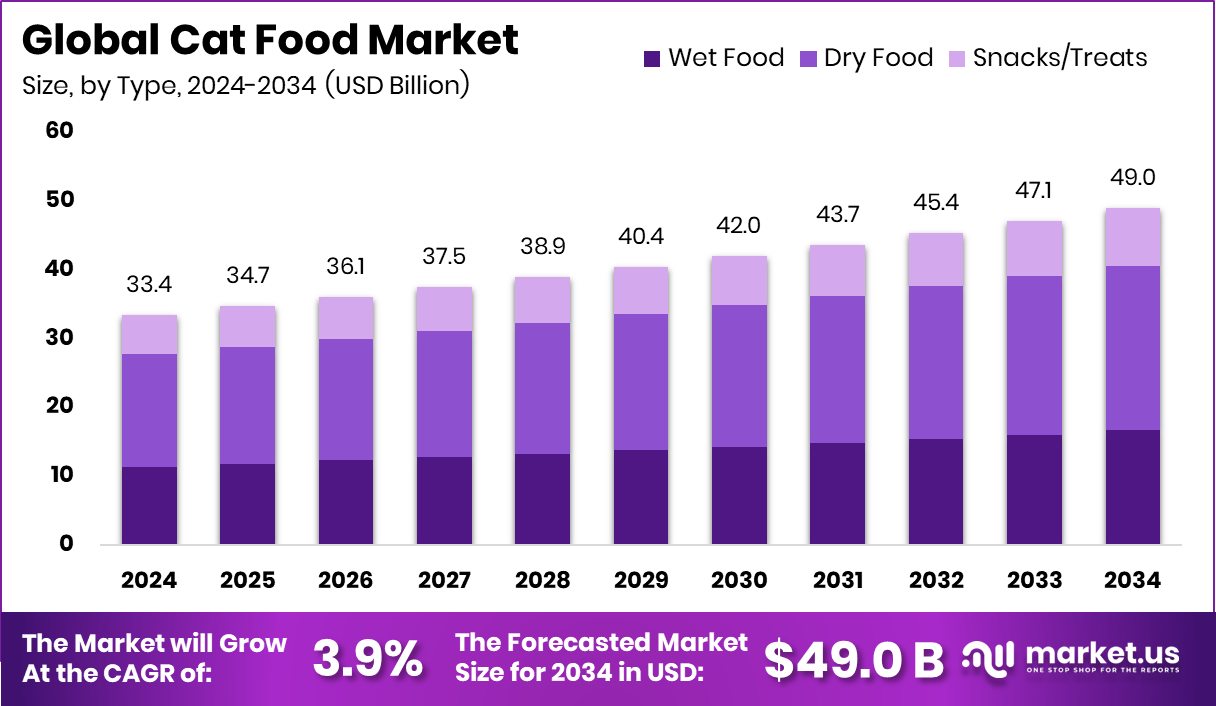

New York, NY – September 02, 2025 – The Global Cat Food Market is expected to reach USD 49.0 billion by 2034, growing from USD 33.4 billion in 2024 at a steady CAGR of 3.9% between 2025 and 2034. North America remains the leading region, accounting for 45.2% of the market share, which translates to USD 15.0 billion.

Cat food is specially formulated to meet the nutritional requirements of domestic cats, providing essential proteins, fats, vitamins, and minerals that support their health and well-being. Available in dry, wet, and semi-moist formats, these products cater to cats across different life stages from kittens to seniors, and also address specific dietary needs such as weight management and digestive sensitivity.

The market includes diverse offerings, ranging from conventional to premium, organic, and grain-free options, available through supermarkets, pet specialty stores, and increasingly popular online channels. The market’s expansion is supported by the rising trend of pet humanization, where owners treat pets as family members and prioritize their health. Growing pet ownership, coupled with urban lifestyles and higher disposable incomes, has driven the demand for premium and nutritionally advanced cat food products.

This shift is further accelerated by increasing awareness of feline health, leading owners to choose diets enriched with functional ingredients that enhance immunity, coat health, and longevity. Investment activity in the sector highlights its growth potential. For instance, Untamed secured USD 12.8 million in a recent funding round, while a human-grade cat food company raised USD 19 million to expand its operations.

Similarly, a cat nutrition startup attracted USD 28 million in new investments, and Drools, a leading pet food unicorn, reported that 40% of its revenue comes from cat food. These developments reflect strong industry momentum and underline the growing importance of innovation, premiumization, and health-focused formulations in shaping the future of the cat food market.

Key Takeaways

- The Global Cat Food Market is expected to be worth around USD 49.0 billion by 2034, up from USD 33.4 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In the cat food market, dry food holds a 48.9% share due to its long shelf life.

- Animal derivatives lead the cat food market with 72.4% share, offering high protein for feline health.

- Supermarkets and hypermarkets account for 44.8% of the cat food market sales, offering variety and accessibility.

- Cat food sales in North America reached USD 15.0 Bn, 45.2%.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-cat-food-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 33.4 Billion |

| Forecast Revenue (2034) | USD 49.0 Billion |

| CAGR (2025-2034) | 3.9% |

| Segments Covered | By Type (Wet Food, Dry Food, Snacks/Treats), By Ingredient Type (Animal Derivatives, Plant Derivatives), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, Others) |

| Competitive Landscape | Mars Petcare, Nestle Purina PetCare Company, Hill’s Pet Nutrition, J.M. Smucker, Diamond Pet Foods, Affinity Petcare SA, Evanger’s Dog and Cat Food Company Inc., Fromm Family Foods LLC, Nutro Products Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155246

Key Market Segments

By Type Analysis

Dry food commands a 48.9% share of the cat food market in 2024, maintaining its dominance in the By Type segment. Its popularity stems from a long shelf life, affordability, and ease of storage and transport, requiring no refrigeration. This makes it a practical choice for busy pet owners.

The crunchy texture promotes dental health by reducing plaque and tartar buildup. Available in various flavors and nutritional profiles, dry food caters to cats of all ages and dietary needs, fortified with essential nutrients like vitamins, minerals, and taurine for a balanced diet. Its cost-effectiveness compared to wet or specialty foods, combined with the growth of online sales and subscription services, solidifies dry food’s market leadership.

By Ingredient Type Analysis

Animal derivatives lead the By Ingredient Type segment with a 72.4% share in 2024. As obligate carnivores, cats require high-protein diets rich in animal-based ingredients like meat meals, organ meats, and fish extracts, which provide essential amino acids and taurine for vision and heart health.

These ingredients are highly digestible, palatable, and support coat health, skin condition, and energy levels. Consumer preference for animal-derived ingredients reflects their association with quality and alignment with a cat’s natural diet. Product innovation, including premium cuts and sustainable sourcing, further reinforces the dominance of animal derivatives in cat food formulations.

By Distribution Channel Analysis

Supermarkets and hypermarkets hold a 44.8% share of the cat food market in 2024, leading the By Distribution Channel segment. Their dominance is driven by a wide product range, competitive pricing, and the convenience of one-stop shopping, allowing consumers to compare brands and sizes easily.

Promotions, bulk discounts, and loyalty programs encourage repeat purchases, while their extensive presence in urban and suburban areas ensures accessibility. Offering both premium and budget-friendly options, supermarkets and hypermarkets cater to diverse consumer needs. In-store displays and sampling campaigns further boost product visibility and drive sales.

Regional Analysis

North America dominates the global cat food market in 2024 with a 45.2% share, valued at USD 15.0 billion. High pet ownership, strong purchasing power, and the trend of pet humanization in the U.S. and Canada fuel this leadership. Well-developed retail networks, including supermarkets, hypermarkets, and online platforms, provide convenience and variety.

Demand for premium, grain-free, organic, and functional cat foods is rising due to increased awareness of feline nutrition. Marketing emphasizing quality, sustainability, and tailored diets, along with advanced manufacturing and regulatory standards, supports market growth. North America’s focus on premium products and robust distribution makes it a key driver of the global cat food industry.

Top Use Cases

- Premium Nutrition for Health Needs: Cat food brands are creating specialized diets for issues like weight control, urinary health, and dental care. Owners want high-quality, vet-recommended food to keep their cats healthy. These products use natural ingredients and avoid artificial additives, appealing to pet parents who prioritize their cat’s long-term wellness.

- Organic and Natural Options: More cat owners are choosing organic cat food free of chemicals, preservatives, and artificial flavors. These products promise better health and fewer diseases, driving demand. Brands are expanding their organic lines to meet this trend, as pet parents focus on sustainable and eco-friendly packaging for their cats’ food.

- Convenience Through Online Sales: E-commerce is booming for cat food, offering convenience and variety. Online platforms provide premium and specialty brands not found in stores, with subscription models for regular deliveries. This trend is growing as busy pet owners prefer easy, contactless shopping, especially for tailored nutrition plans for their cats.

- Humanization of Pets: Pet owners treat cats like family, boosting demand for premium and gourmet cat food. They seek high-protein, meat-based diets that mimic a cat’s natural diet. This trend pushes brands to innovate with tasty, nutrient-rich options, ensuring cats enjoy meals while meeting their health needs.

- Functional Treats and Snacks: Cat treats and supplements are gaining popularity for rewarding cats or addressing specific health issues. These include dental chews, hairball control, and vitamin-enriched snacks. Owners love these for their convenience and health benefits, making them a fast-growing segment in the cat food market.

Recent Developments

1. Mars Petcare

Mars is advancing its sustainability and science-backed nutrition goals. They launched a new Cats Can Too campaign to promote indoor cat wellbeing and are expanding their premium brands like Sheba into the premium wet food segment with new recipes. Their Waltham Petcare Science Institute continues to publish research on feline health to inform product innovation.

2. Nestlé Purina PetCare Company

Purina is heavily investing in sustainability, aiming for 100% recyclable packaging by 2025. They recently expanded their popular Beyond Grain-Free and Tidy Cats lines with new formulas. A significant development is their investment in a new North Carolina factory, focusing on high-demand wet pet food and litter, signaling strong growth expectations in the cat category.

3. Hill’s Pet Nutrition

Hill’s continues to emphasize science-led veterinary nutrition. Their recent development is the launch of the new Prescription Diet k/d + Metabolic Care, a multi-benefit food addressing both kidney disease and weight management. They are also enhancing their digital tools for veterinarians and pet parents to improve dietary management and compliance for cats with chronic health conditions.

4. The J.M. Smucker Company

Smucker is focusing on brand integration and market expansion for its acquired brands. A key move is relaunching the Rachael Ray Nutrish line into the natural channel with new packaging and formulas to compete more directly with premium brands. They are also leveraging their distribution network to increase availability for brands like Meow Mix in new retail markets.

5. Diamond Pet Foods

Diamond Naturals, a key brand under Diamond Pet Foods, recently launched a new line of Grain-Free dry cat food recipes. This expansion addresses the sustained consumer demand for grain-free options and includes formulas featuring real meat as the first ingredient, probiotics for digestive health, and antioxidants to support the immune system, strengthening their position in the premium, affordable segment.

Conclusion

The Cat Food Market is growing steadily due to rising pet ownership and the humanization of cats. Owners are spending more on premium, organic, and health-focused products to ensure their cats’ well-being. Online sales and subscription services are making it easier to access specialized diets. Brands that innovate with natural ingredients and convenient options will lead this expanding market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)