Table of Contents

Overview

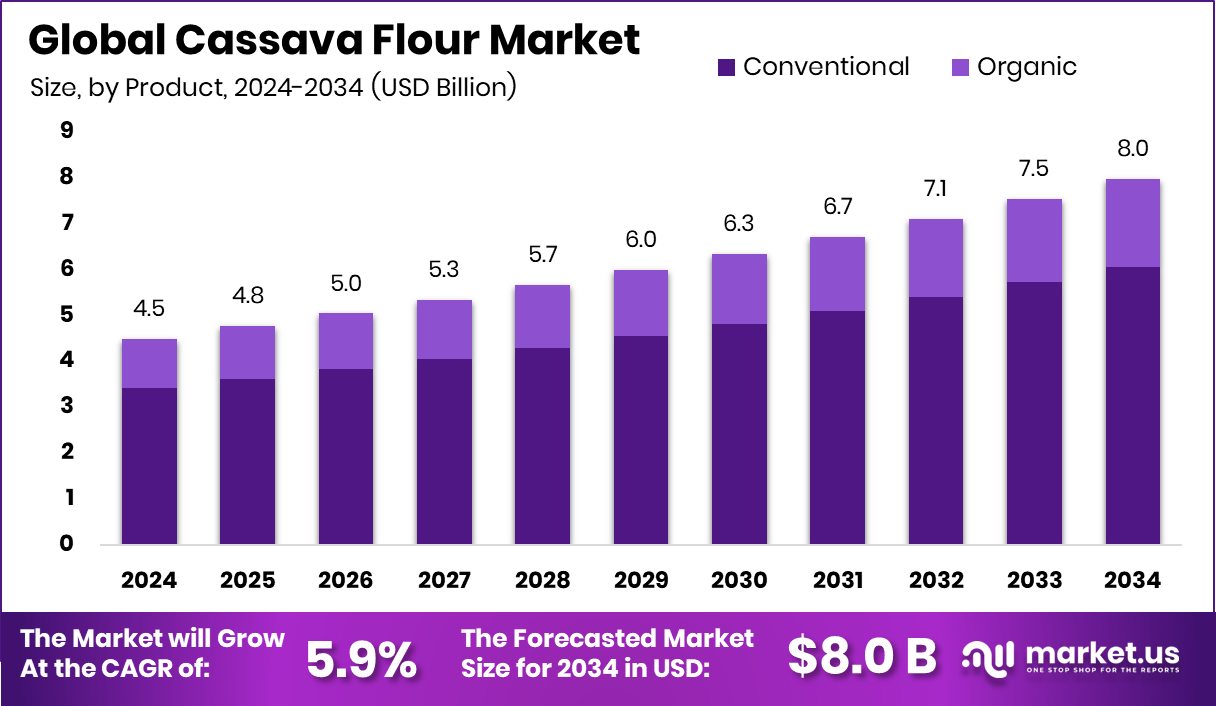

New York, NY – October 06, 2025 – The Global Cassava Flour Market is projected to reach USD 8.0 billion by 2034, rising from USD 4.5 billion in 2024 at a CAGR of 5.9% between 2025 and 2034. Strong government policies helped Asia Pacific dominate the market, valued at USD 2.2 billion with a 49.7% share.

Cassava flour, derived from the whole cassava root (Manihot esculenta), is increasingly popular as a gluten-free alternative to wheat. Unlike tapioca starch, which isolates only the starch content, cassava flour retains fiber and essential nutrients, giving it a unique texture and nutritional advantages. It is widely used in baking, cooking, and thickening, valued for its mild taste and ease of blending with wheat flour.

Cassava cultivation thrives in tropical regions where the crop performs better than cereals in poor soil and drought conditions, making it a reliable food security source. Rising global awareness of health and wellness, particularly among those adopting gluten-free diets for medical or lifestyle reasons, continues to drive cassava flour demand. Its adaptability to climate change and low input requirements also attract smallholder farmers seeking stable income sources.

Technological advances in drying and milling have improved cassava flour’s consistency and shelf life, encouraging industrial investment. Demand is expanding across both traditional regions that rely on cassava as a staple and international markets, including bakeries, snack producers, and health food manufacturers. Urban consumers with higher incomes increasingly purchase ready-to-use cassava-based products, supporting market expansion.

Major public and private investments are accelerating growth in Nigeria’s Federal Government, alongside AfDB, IFAD, and IsDB, which have committed over USD 150 million through Special Agro-Processing Zones to support cassava value chains. Similarly, the Bill & Melinda Gates Foundation provided USD 28 million to improve cassava productivity in Sub-Saharan Africa. These initiatives enhance research, infrastructure, and farmer capacity, reinforcing cassava flour’s role in global food sustainability.

Key Takeaways

- The Global Cassava Flour Market is expected to be worth around USD 8.0 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- Conventional cassava flour led the market with a 76.9% share, showing strong dominance.

- Food and Beverage applications captured a 58.2% share, highlighting cassava flour’s growing role in everyday consumption.

- Supermarkets and Hypermarkets accounted for a 37.4% share, proving essential in distributing cassava flour to global consumers.

- Strong demand in the Asia Pacific, valued at USD 2.2 billion, reflects its 49.7% dominance.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/cassava-flour-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.5 Billion |

| Forecast Revenue (2034) | USD 8.0 Billion |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Product (Conventional, Organic), By Application (Food and Beverage, Animal Feed, Pharmaceutical, Personal Care and Cosmetics, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others) |

| Competitive Landscape | DADTCO Rivers Cassava Processing Company, Psaltry International, Green Hills Natural Foods, MHOGO Foods, Mocaf Factory, Cargill, Archer Daniels Midland Company (ADM), Tereos Group, Thai Wah Public Company Limited, Roquette Frères |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158271

Key Market Segments

By Product Analysis

Conventional cassava flour commands a dominant 76.9% market share in 2024, driven by its widespread use in household and industrial applications, particularly in regions where cassava is a staple. Its affordability, lower production costs, and established farming practices make it a preferred choice for bakeries, snack producers, and food manufacturers, especially in emerging economies where wheat imports are costly. This segment’s dominance underscores its critical role in food security, supporting substitution policies and sustaining steady demand globally.

By Application Analysis

The food and beverage sector leads cassava flour usage, capturing a 58.2% share in 2024. Its versatility in bakery products, snacks, sauces, and ready-to-eat meals, combined with its gluten-free and mild flavor profile, makes it a popular wheat flour substitute, especially in health-conscious urban markets. The rising demand for clean-label, grain-free, and allergen-free products fuels its adoption by food manufacturers. Additionally, its prominence in traditional diets across Africa, Asia, and Latin America, alongside growing use in industrial bakeries and packaged foods, ensures consistent growth.

By Distribution Channel Analysis

Supermarkets and hypermarkets lead distribution, holding a 37.4% share in 2024. Their extensive product variety, ample shelf space, and appeal to both bulk and retail buyers drive sales. These outlets enhance visibility and accessibility for cassava flour brands, catering to health-conscious consumers and mainstream households alike. Promotional campaigns, discounts, and strategic product placement further boost sales, making supermarkets and hypermarkets the preferred purchasing channel for cassava flour globally.

Regional Analysis

In 2024, the Asia Pacific region dominates the cassava flour market with a 49.7% share, valued at USD 2.2 billion, fueled by abundant cassava production, growing gluten-free trends, and integration into mainstream packaged foods. North America sees strong demand due to clean-label and allergen-friendly baking trends, with cassava flour used in tortillas, snacks, and premium bakery mixes.

Europe benefits from reformulation goals and the rise of gluten-free artisanal and industrial bakeries, leveraging cassava flour for texture and simplicity. The Middle East & Africa capitalize on cassava’s role in staple foods and improved milling for bakery and quick-service applications.

Latin America, rooted in local culinary traditions, expands processing for export-ready flours and blends for snacks and bakery products. Across regions, manufacturers focus on consistent granulation, low cyanogenic content, and traceable supply chains to meet retailer and brand demands, supported by strategic grower partnerships and investments in drying and milling capacity.

Top Use Cases

- Gluten-Free Baking: Cassava flour is a top choice for gluten-free breads, cakes, and pastries. Its fine texture and neutral taste make it a perfect wheat flour substitute, appealing to health-conscious consumers and those with gluten sensitivities, driving demand in bakeries and home kitchens.

- Snack Production: Cassava flour is widely used in making chips, crackers, and puffed snacks. Its ability to create crispy textures and blend with spices makes it popular among snack manufacturers, especially in regions seeking affordable, local ingredients for mass production.

- Sauces and Soups: Cassava flour acts as a thickener in sauces, gravies, and soups. Its smooth consistency and ability to blend without clumping make it ideal for both home cooking and industrial food processing, enhancing product quality and shelf appeal.

- Traditional Dishes: In Africa, Asia, and Latin America, cassava flour is a staple in dishes like fufu, garri, and flatbreads. Its cultural significance and versatility in local recipes ensure steady demand in households and regional food markets.

- Animal Feed: Cassava flour is used in animal feed, particularly for poultry and livestock. Its cost-effectiveness and nutritional value make it a viable ingredient for feed manufacturers, supporting agricultural industries in cassava-growing regions.

Recent Developments

1. DADTCO Rivers Cassava Processing Company

DADTCO is expanding its innovative Autonomous Mobile Processing Unit (AMPU) technology, which processes cassava directly in farming communities to reduce post-harvest losses. Recent focus has been on integrating more smallholder farmers into its supply chain in Rivers State, improving local incomes, and ensuring a consistent flow of raw material for its high-quality cassava flour, used by major food industries.

2. Psaltry International

Psaltry has commissioned a new ethanol plant, diversifying its product line beyond food-grade cassava flour. This strategic expansion utilizes surplus cassava and lower-grade stock, adding value and reducing waste. The company continues to empower local farmers in Oyo State, strengthening its out-grower network to meet the increased raw material demand for both its established flour and new bio-product lines.

3. Green Hills Natural Foods

Green Hills is focusing on value-added products by developing and promoting gluten-free cassava flour blends and pre-mixes for specific applications like bread and cakes. Their recent development involves enhancing packaging and increasing production capacity to meet growing domestic and international demand for healthy, gluten-free alternatives, directly targeting the health-conscious consumer market.

4. MHOGO Foods

MHOGO Foods is a rising player emphasizing direct-to-consumer e-commerce and supplying small businesses. A key recent development is the launch of fortified cassava flour, enriched with essential vitamins and minerals to combat malnutrition. They are actively expanding their digital marketing to raise brand awareness and tap into the growing urban demand for convenient, healthy, and locally sourced food ingredients.

5. Mocaf Factory

The Mocaf Factory continues to scale its Modified Cassava Flour (Mocaf) production, a specialty flour with improved functional properties for industries. Recent developments include securing partnerships with more large-scale food manufacturers who use Mocaf as a key ingredient in snacks, biscuits, and noodles. They are also investing in farmer training on best practices to ensure a consistent and high-quality raw cassava supply.

Conclusion

Cassava flour’s versatility, affordability, and gluten-free nature make it a rising star in global food markets. Its use in baking, snacks, traditional dishes, and even animal feed highlights its broad appeal. With growing demand for clean-label and allergen-free products, cassava flour is poised for strong growth, especially in regions with abundant cassava production and health-conscious consumer trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)