Table of Contents

Overview

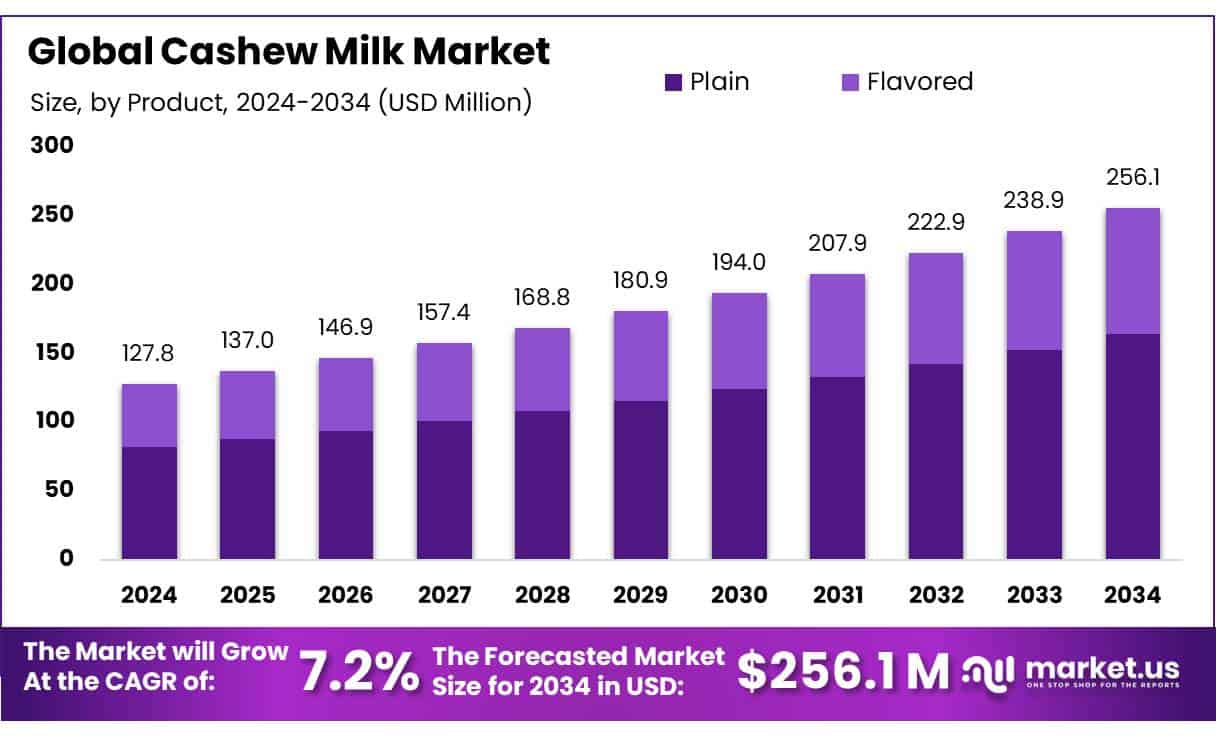

New York, NY – May 06, 2025 – The global Cashew Milk Market is gaining popularity as a healthy, dairy-free alternative, with demand rising due to increasing lactose intolerance, vegan diets, and health-conscious consumers. The market is expected to grow from USD 127.8 million in 2024 to around USD 256.1 million by 2034, expanding at a 7.2% CAGR from 2025 to 2034.

In 2024, unflavored/original cashew milk dominated with a 65.2% market share, reflecting consumers’ love for its natural, nutty flavor. Conventional cashew milk commands a 79.3% market share. Its popularity stems from affordability and widespread availability compared to organic options. Bottled cashew milk held a 67.1% market share, favored for its convenience, recyclability, and durability. Bottles offer easy storage and portability, appealing to individuals and families alike. Supermarkets and hypermarkets accounted for a 45.3% share of cashew milk distribution. These retail giants dominate due to their convenience, vast product variety, and one-stop shopping experience.

US Tariff Impact on Cashew Milk Market

On April 9, the US President Donald Trump paused for 90 days, with the exception of China, the additional country-specific high import tariff rates he announced on numerous countries earlier that day, which helped to ease tensions in the cashew market. Vietnam is the largest cashew processor and was facing a prospect of a 46% import tariff rate on all its goods in the US, including cashews.

Gregg Doud, President and CEO of the National Milk Producers Federation, said the Executive Order provides more clarity on the administration’s approach to reciprocal tariffs and could be a net positive for U.S. dairy producers. The minimum 10% tariff rate remains in place, and some market players opine this still poses challenges for US cashew importers. The uncertainty is going to mainly affect the US market, no matter what the tariffs are. Some big buyers in the States are really concerned.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-cashew-milk-market/request-sample/

They are willing to buy cashews from Africa, but no one knows going forward what the tariffs will be there, a global trader said on Wednesday, 9, after the 46% tariff rate on Vietnam temporarily took effect. The 46% rate was crazy, and 10% is tough too. We are not sure how the market is going to react to this 10% rate, a Vietnamese processor said. The big problem was that Vietnam was taxed 46% and the Côte d’Ivoire only 21%. With the 10% rate, the market will adjust. Buyers will have to pay the higher price, or they will buy less, a trader commented. This dramatic change in tariffs cannot be sustained; the cashew business in the US will drop drastically. How can you think of a single rate for everything? This is just not going to work, a broker noted.

Key Takeaways

- Cashew Milk Market size is expected to be worth around USD 256.1 Mn by 2034, from USD 127.8 Mn in 2024, growing at a CAGR of 7.2%.

- Unflavored/original segment of the cashew milk market held a commanding position, securing more than a 65.2% share of the market.

- Conventional cashew milk held a dominant position in the market, accounting for over 79.3% of the total market share.

- Bottles held a commanding market share of over 67.1%.

- Supermarkets and hypermarkets held a dominant market position in the distribution of cashew milk, capturing more than a 45.3% share.

Analyst Viewpoint

The cashew milk industry is catching the eye of investors as plant-based diets gain traction, driven by health-conscious consumers and environmental concerns. Cashew milk stands out for its creamy texture and nutritional appeal, making it a strong contender in the dairy alternative space. Investment opportunities are ripe in innovative startups focusing on organic, unsweetened, or fortified cashew milk products, as well as in companies prioritizing eco-friendly packaging like biodegradable cartons or reusable glass bottles.

The rising vegan population and increasing lactose intolerance affecting adults globally are fueling demand, particularly in North America and Asia-Pacific, where consumers are willing to pay a premium for sustainable, health-focused products. However, risks loom large: high cashew nut prices and supply chain volatility, especially from key producers like Ivory Coast and Vietnam, can squeeze margins. Competition from almond, oat, and soy milk also poses a threat, as consumer preferences can shift quickly based on taste or price.

Consumer insights reveal a growing preference for cashew milk among millennials and Gen Z, who value its low cholesterol and heart-healthy fats. Social media campaigns and influencer marketing are amplifying brand visibility, but consumers are picky—they want clean labels, no added sugars, and transparent sourcing. Still, evolving standards on nutritional claims and environmental impact could raise compliance costs.

Report Scope

| Market Value (2024) | USD 127.8 Million |

| Forecast Revenue (2034) | USD 256.1 Million |

| CAGR (2025-2034) | 7.2% |

| Segments Covered | By Product Type (Unflavored/Original, Flavored, Coconut, Chocolate, Strawberry, Others), By Type (Conventional, Organic), By Packaging Туре (Cartons, Bottles, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, Others) |

| Competitive Landscape | Plenish, BalTraWed, Danone S.A., Nayagreens, ProVeg International, Campbell’s Soup Company., PureHarvest, Riverford Organic Farmers Ltd., Dream (SunOpta Inc.), Elmhurst Milked Direct LLC, Forager Project LLC, Pacific Foods of Oregon LLC (Campbell Soup Company), Plenish Cleanse Ltd. (Britvic plc), RITA Food & Drink Co. Ltd., Rude Health Foods Limited, The Hain Celestial Group Inc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145612

Key Market Segments

By Product Type

- In 2024, unflavored/original cashew milk dominated with a 65.2% market share, reflecting consumers’ love for its natural, nutty flavor. Health-focused shoppers, drawn to minimally processed, plant-based drinks with no added sugars or flavors, drive this demand. The segment’s strength signals a wider trend toward clean, simple beverage choices that align with wholesome, dairy-free lifestyles.

By Type

- Conventional cashew milk led in 2024, commanding a 79.3% market share. Its popularity stems from affordability and widespread availability compared to organic options. Efficient supply chains and mass production keep prices low, making it a go-to for consumers seeking a budget-friendly, familiar-tasting plant-based milk to incorporate into their daily diets.

By Packaging Type

- In 2024, bottled cashew milk held a 67.1% market share, favored for its convenience, recyclability, and durability. Bottles offer easy storage and portability, appealing to individuals and families alike. Their practicality and eco-friendly appeal make them a top choice for consumers balancing sustainability with the need for a user-friendly plant-based milk option.

By Distribution Channel

- Supermarkets and hypermarkets accounted for a 45.3% share of cashew milk distribution in 2024. These retail giants dominate due to their convenience, vast product variety, and one-stop shopping experience. Health-conscious consumers flock to them for easy access to cashew milk, benefiting from the ability to compare brands and meet their plant-based dietary needs.

Regional Analysis

- North America leads the cashew milk market, capturing 45.3% of global share with USD 57.7 million in revenue. This dominance stems from a strong shift toward plant-based diets, especially in the U.S. and Canada, fueled by health and wellness trends and growing awareness of lactose intolerance and dairy allergies, boosting demand for non-dairy options like cashew milk.

- The region excels in innovation, offering a diverse range of cashew milk products, from unflavored to flavored varieties. These appeal to health-conscious consumers and those prioritizing sustainable, ethical choices. Supportive government guidelines advocating reduced animal-based food consumption for health and environmental reasons further drive the preference for plant-based milk alternatives.

- Key industry players in North America enhance cashew milk’s market presence through robust marketing and distribution efforts. Their focus ensures widespread availability in supermarkets, health food stores, and online platforms, keeping cashew milk a top choice among dairy alternatives and sustaining its competitive edge.

Top Use Cases

- Beverage for Lactose-Intolerant Consumers: Cashew milk is a go-to drink for those with lactose intolerance. Its creamy texture and nutty flavor make it a tasty dairy-free option for drinking straight, blending into smoothies, or pouring over cereal, offering a digestible alternative without sacrificing taste or nutrition.

- Coffee and Tea Creamer: Cashew milk’s rich, velvety consistency makes it a popular creamer for coffee and tea. It blends smoothly, adding a subtle nutty sweetness without overpowering flavors. Baristas and home brewers love it for lattes and cappuccinos, especially in vegan cafes, where it froths well for plant-based drinks.

- Cooking and Baking Ingredients: In cooking, cashew milk shines as a versatile substitute for dairy milk. It adds creaminess to soups, sauces, and curries, enhancing flavor without cholesterol. Bakers use it in cakes, muffins, and pancakes for a moist texture, appealing to vegan and health-conscious consumers seeking nutritious recipes.

- Base for Vegan Desserts: Cashew milk is a star in vegan desserts like ice cream, puddings, and cheesecakes. Its high unsaturated fat content creates a smooth, indulgent texture. Brands are launching cashew-based frozen treats, tapping into the growing demand for plant-based sweets among millennials and Gen Z.

- Nutritional Supplement for Smoothies: Fitness enthusiasts blend cashew milk into smoothies for its vitamins, minerals, and heart-healthy fats. Often fortified with calcium and vitamin D, it boosts nutrition without added cholesterol. Its low-calorie profile suits weight-conscious consumers, making it a staple in health-focused diets and gym routines.

Recent Developments

1. Plenish

- Plenish, a UK-based plant-milk brand, expanded its product line with unsweetened cashew milk, emphasizing clean-label ingredients and sustainability. The company focuses on reducing its carbon footprint by using recyclable packaging. Plenish also partnered with major UK retailers like Sainsbury’s and Waitrose to increase accessibility. Their cashew milk is marketed as a creamy, nutrient-rich dairy alternative with no additives.

2. BaliTraWed

- BaliTraWed, known for Bali’s Best products, introduced organic cashew milk in Indonesia, targeting health-conscious consumers. The company sources locally grown cashews to support farmers and ensure sustainability. Their product is free from preservatives and artificial sweeteners, aligning with the global shift toward organic plant-based milk.

3. Danone S.A.

- Danone, through its Alpro brand, has been investing in plant-based innovations, including cashew milk blends. While Alpro primarily focuses on almond and oat milk, it has explored mixed nut milks featuring cashews. Danone’s sustainability push includes carbon-neutral production by 2025, influencing its plant-based dairy alternatives.

4. Nayagreens

- Nayagreens, an Indian startup, launched fortified cashew milk with added vitamins and minerals, catering to the growing vegan market in India. The brand emphasizes diabetes-friendly and low-calorie options, positioning cashew milk as a healthier alternative to traditional dairy.

5. ProVeg International

- ProVeg International, a food awareness NGO, promotes cashew milk as part of its plant-based advocacy. While not a producer, ProVeg collaborates with companies to improve plant-based milk accessibility in Europe and beyond, including cashew-based products. Their 2023 report highlighted cashew milk’s rising demand in foodservice sectors.

Conclusion

The global cashew milk market is on a strong growth path, driven by rising demand for plant-based, lactose-free, and nutrient-rich dairy alternatives. Fueled by health trends, veganism, and sustainability concerns. Key players like Danone, Plenish, and Nayagreens are innovating with organic, fortified, and flavored cashew milk to attract health-conscious consumers. Retail and e-commerce growth is making these products more accessible worldwide. As consumers shift toward clean-label and eco-friendly options, cashew milk presents significant opportunities for new brands, product variations, and market expansion in both developed and emerging regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)