Table of Contents

Overview

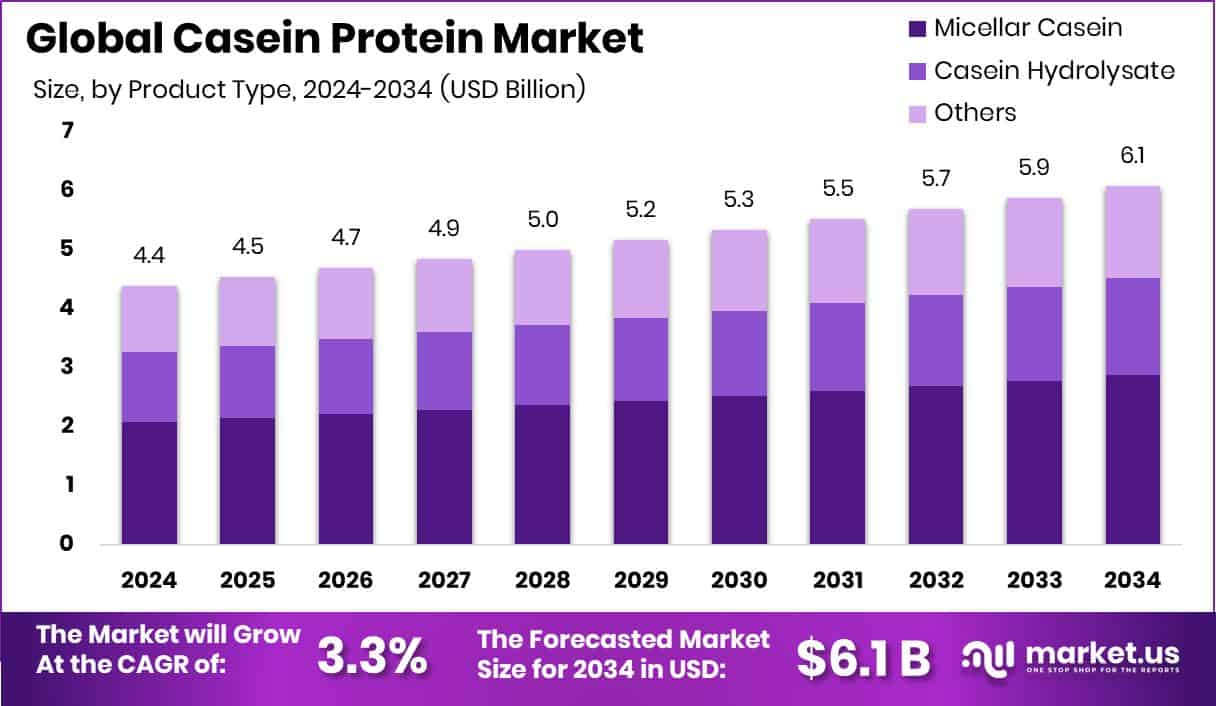

New York, NY – May 14, 2025 – The global Casein Protein Market is growing steadily, driven by increasing demand for high-protein food and supplements. In 2024, the market was valued at USD 4.4 billion and is expected to reach USD 6.1 billion by 2034, growing at a 3.3% CAGR.

In 2024, Micellar Casein led the Casein Protein Market with a 47.3% share in the product type segment. Cow milk dominated the source segment of the Casein Protein Market in 2024, holding a 72.9% share globally. Its widespread availability, high protein yield, and established processing systems make it the go-to source for manufacturers.

In 2024, the powder form captured an 84.2% share in the Casein Protein Market’s form segment. Nutritional Supplements led the application segment of the Casein Protein Market in 2024, with a 45.1% share. Casein’s slow-digesting nature makes it ideal for muscle recovery and overnight nourishment, appealing to fitness enthusiasts, bodybuilders, and health-focused consumers.

US Tariff Impact on Market

Tariffs imposed by US President Donald Trump, affecting USD 10 trillion in global equity value, equivalent to 10% of global GDP, have been in place for 90 days. These tariffs heavily impact US dairy exporters, with rates of 25% on Mexico and Canada, and 125% on China, escalating trade tensions with Beijing and pressuring the dairy sector.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/casein-protein-market/request-sample/

The Milk Producers Council notes a 4.3% drop in US dairy exports in February, totaling 463 million pounds, adjusted for the leap day. China, the third-largest market for US dairy, saw exports of 385,485 metric tons worth USD 584 million in 2024, a 29% increase over 10 years, per USDA data. However, China’s tariffs on US goods, raised to 84% from 34% last week, took effect on April 10. The National Milk Producers’ Federation warns these tariffs will significantly hurt US dairy exports to China, with the trade body still assessing the full impact.

Key Takeaways

- Global Casein Protein Market is expected to be worth around USD 6.1 billion by 2034, up from USD 4.4 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034.

- In 2024, Micellar Casein dominated by product type in the Casein Protein Market with a 47.3% share.

- Cow Milk remained the primary source, contributing a 72.9% share in the global Casein Protein Market.

- Powder form led the market in 2024, accounting for 84.2% share due to ease of use.

- Nutritional Supplements segment held a 45.1% share, showing strong demand for Casein Protein in the fitness industry.

- Asia-Pacific led the casein protein demand, capturing 48.5% market at USD 2.1 Bn.

Report Scope

| Market Value (2024) | USD 4.4 Billion |

| Forecast Revenue (2034) | USD 6.1 Billion |

| CAGR (2025-2034) | 3.3% |

| Segments Covered | By Product Type (Micellar Casein, Casein Hydrolysate, Others), By Source (Cow Milk, Sheep Milk, Others), By Form (Powder, Liquid), By Application (Nutritional Supplements, Food and Beverage, Agriculture/Animal Feed, Cosmetics, Pharmaceutical, Others) |

| Competitive Landscape | Kerry Group plc, Optimum Nutrition, Arla Foods, Fonterra Co-operative Group Limited, Lacto Japan Co., Ltd., NOW Foods, Erie Foods International, Inc., The Milky Whey, Inc., ProteinCo, Havero Hoogwegt B.V., Glanbia Nutritionals, Inc., Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147685

Key Market Segments

By Product Type Analysis

- In 2024, Micellar Casein led the Casein Protein Market with a 47.3% share in the product type segment. Its slow-digesting property ensures prolonged amino acid release, perfect for overnight muscle recovery. Popular among consumers for sustained satiety and muscle support, micellar casein’s intact structure and high bioavailability make it a top choice for protein shakes, nutritional supplements, and functional foods. Demand is driven by the trend toward clean-label, high-protein diets among athletes and health-conscious individuals.

By Source Analysis

- Cow Milk dominated the source segment of the Casein Protein Market in 2024, holding a 72.9% share globally. Its widespread availability, high protein yield, and established processing systems make it the go-to source for manufacturers. Cow milk offers a reliable amino acid profile and consistent quality, supporting its use in nutritional supplements, functional foods, and sports nutrition. Its dominance reflects consumer trust in dairy proteins, ease of sourcing, and compatibility with various production methods.

By Form Analysis

- In 2024, the powder form captured an 84.2% share in the Casein Protein Market’s form segment. Its popularity stems from excellent shelf stability, ease of transport, and versatility in applications like nutritional supplements, sports drinks, and functional foods. Powdered casein is preferred for its solubility, long storage life, and convenience in formulation and distribution. This form’s dominance highlights its efficiency in meeting protein needs and enabling customization for consumers and producers.

By Application Analysis

- Nutritional Supplements led the application segment of the Casein Protein Market in 2024, with a 45.1% share. Casein’s slow-digesting nature makes it ideal for muscle recovery and overnight nourishment, appealing to fitness enthusiasts, bodybuilders, and health-focused consumers. It’s widely used in protein powders, drinks, and bars, driven

Regional Analysis

- In 2024, Asia-Pacific led the global casein protein market, capturing a 48.5% share valued at USD 2.1 billion. This dominance is fueled by a rising focus on nutritional supplements, growing awareness of protein-rich diets, and an expanding middle class with higher disposable incomes.

- Countries like India, China, and Japan drive demand through fitness trends and increased use of sports nutrition products. North America and Europe, with mature markets and established nutritional industries, contribute steadily but trail behind Asia-Pacific. Meanwhile, Latin America and the Middle East & Africa are emerging markets, showing gradual growth in protein supplement adoption as health awareness rises, despite challenges in accessibility and awareness.

Top Use Cases

- Muscle Recovery and Sports Nutrition: Casein protein, with its slow-digesting nature, is widely used by athletes for overnight muscle recovery. It provides a steady release of amino acids, supporting muscle repair after intense workouts. Popular in protein powders and shakes, it caters to fitness enthusiasts and bodybuilders aiming for sustained muscle growth and performance.

- Nutritional Supplements for Wellness: Casein protein is a key ingredient in nutritional supplements targeting health-conscious consumers. Its ability to promote satiety and provide essential amino acids makes it ideal for weight management and general wellness. Supplements like bars and drinks use casein to support balanced diets, especially for aging populations and busy individuals.

- Functional Foods and Beverages: Casein protein enhances functional foods like protein bars, shakes, and meal replacements. Its gel-forming and water-retention properties improve texture and stability in products. With a global rise in demand for high-protein snacks, casein is increasingly used in fortified foods and beverages, catering to on-the-go consumers seeking sustained energy.

- Pharmaceutical and Clinical Nutrition: In pharmaceuticals, casein protein is used in clinical nutrition products for patients needing high-quality protein. Its slow-release properties aid in muscle maintenance for bedridden or recovering individuals. Casein is also used in formulas for infants and those with specific dietary needs, supporting growth and recovery in medical settings.

- Cosmetics and Personal Care Products: Casein protein is gaining traction in cosmetics for its skin and hair-enhancing benefits. Used in creams, lotions, and hair masks, it acts as a natural moisturizer and strengthener. The growing demand for natural ingredients in personal care products drives casein’s use, appealing to consumers seeking clean-label beauty solutions globally.

Recent Developments

1. Kerry Group plc

- Kerry Group has focused on enhancing its casein protein offerings for functional foods in 2024, emphasizing high-quality milk proteins for applications like yogurts and protein bars. Their solutions cater to the growing demand for clean-label, high-protein products, with improved solubility and stability for manufacturers. Kerry’s innovations target health-conscious consumers, particularly in the sports nutrition and wellness sectors, ensuring their casein proteins deliver nutritional benefits without compromising taste.

2. Optimum Nutrition

- Optimum Nutrition, a leader in sports nutrition, has expanded its casein protein portfolio in 2024 by introducing new slow-digesting micellar casein formulas tailored for overnight recovery. These products target athletes seeking sustained muscle repair, offering high bioavailability and clean-label options. The brand leverages its reputation for quality, focusing on powder formats that blend seamlessly into shakes.

3. Arla Foods

- In 2023, Arla Foods launched a new line of sodium caseinate-enriched beverages aimed at sports nutrition markets in Europe and Asia, strengthening its position in the casein protein sector. Additionally, their Lacprodan Micelpure, a micellar casein isolate, gained traction in 2024 for medical nutrition, addressing protein malnutrition with its high-quality nutrition and appealing taste. Arla continues to innovate with casein for functional foods, aligning with sustainability goals.

4. Fonterra Co-operative Group Limited

- Fonterra expands its Studholme site, boosting casein protein production to meet global demand for premium dairy ingredients. Their focus includes micellar casein for sports nutrition and functional foods, leveraging dairy science expertise. Fonterra’s SureProtein range, like Milk Protein Isolate, offers low-lactose, high-micellar casein options for infant and health products, emphasizing formulation flexibility.

5. Lacto Japan Co., Ltd.

- Lacto Japan has been advancing its casein protein production in 2024, focusing on the Asian market, particularly Japan and China, where demand for infant formula and sports nutrition is rising. They emphasize high-quality casein derivatives for nutritional supplements, capitalizing on Japan’s growing health-conscious consumer base.

Conclusion

The casein protein market is on a steady growth path. Consumers are turning to casein for its muscle recovery and weight management benefits, making it popular in fitness and health circles. The market is also benefiting from innovations, including plant-based alternatives, catering to vegan and vegetarian trends. Emerging economies, especially in Asia-Pacific and Latin America, present strong opportunities due to rising incomes and health awareness. As the food and supplement industries continue to expand, casein protein remains a key ingredient, offering long-term potential for manufacturers and investors.