Table of Contents

Introduction

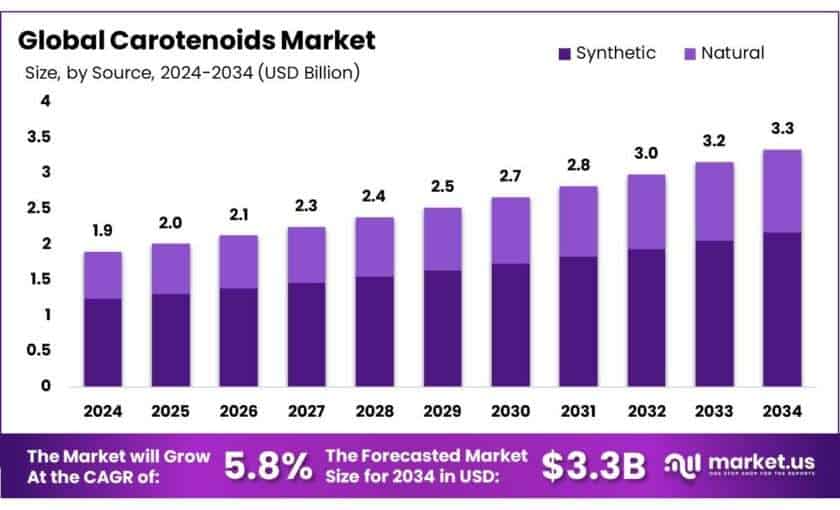

The Global Carotenoids Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 5.8%. during the forecast period from 2023 to 2033. The global carotenoids market is witnessing steady growth, driven by increasing consumer awareness of health benefits associated with these natural pigments. Carotenoids, found in fruits and vegetables, are known for their antioxidant properties and role in preventing chronic diseases.

Several factors contribute to this growth. There’s a rising demand for natural food colorants over synthetic alternatives, driven by consumer preferences for clean-label products. Additionally, the use of carotenoids in dietary supplements is gaining traction as preventive health solutions become more popular. The animal feed industry also utilizes carotenoids to enhance the coloration of poultry and fish, further boosting market demand.

Recent developments in the industry include strategic acquisitions and product launches. For instance, in June 2019, DDW The Color House acquired DuPont’s Natural Colors business to enhance its product portfolio. In May 2019, Algatech introduced AstaPure-EyeQ, a natural astaxanthin powder aimed at supporting eye and brain health.

Key Takeaways

- The global carotenoids market was valued at USD 1.9 billion in 2024.

- The global carotenoids market is projected to grow at a CAGR of 5.8% and is estimated to reach USD 3.3 billion by 2034.

- Among sources, synthetic accounted for the largest market share of 65.1%.

- Among types, beta-carotene accounted for the majority of the market share at 34.1%.

- By form, powder accounted for the largest market share of 46.1%.

- By application, color accounted for the majority of the market share at 44.2%.

- By end use, animal feed accounted for the majority of the market share at 38.1%.

- Europe is estimated as the largest market for Carotenoids with a share of 44.2% of the market share.

Get More Detailed Insights about US Tariff Impact @ https://market.us/report/global-carotenoids-market/free-sample/

Carotenoids Statistics

- Food frequency surveys indicate that daily carotenoid intake varies significantly across regions, with populations in the U.S., Europe, and China consuming between 4.7 to 17.2 mg per day. This variation reflects differing dietary habits and the availability of carotenoid-rich foods.

- According to the U.S. Institute of Medicine, 6 µg of β-carotene, 12 µg of α-carotene, or 12 µg of β-cryptoxanthin equals 1 µg of retinol, supporting the use of carotenoids in food fortification and supplements for better vitamin A intake.

- Globally, astaxanthin, β-carotene, and lutein dominate the carotenoid market, making up nearly 60% of the total value, due to their broad usage in supplements, food, and cosmetics.

- In aquaculture, particularly in Scotland’s Atlantic salmon sector, carotenoids play a critical role. The industry plans to double its economic output to £3.6 billion by 2030, emphasizing its reliance on these nutrients for quality and coloration.

- In terms of cost, synthetic carotenoids range from USD 200–2000 per kg, whereas natural carotenoids can cost between USD 350–7500 per kg. Astaxanthin is the most expensive, reaching up to USD 7500 per kg, due to its complex extraction and lower yields, limiting its competitive edge against synthetics.

- Consumer preferences are also shaping the market. A Unilever survey in 2021, involving 10,000 people across nine countries, found that 74% prioritize beauty and self-care, increasing demand for natural carotenoids in skincare.

- Additionally, Cargill notes a 12% annual growth rate in demand for non-GMO and organic foods in the U.S., driven by health-conscious consumers. Between 2012 and 2017, the share of Americans buying non-GMO products rose by 66%, signaling a strong shift toward transparency and clean-label ingredients.

US Tariff Impact Analysis

The carotenoid market is currently experiencing considerable disruptions driven by recent geopolitical developments, especially the implementation of tariffs and trade barriers. On April 3, 2025, the U.S. government introduced broad tariff measures, including a base rate of 10% on most imports globally, alongside more specific tariffs such as 54% on Chinese goods, 20% on imports from the European Union, and 26% on Indian products. Since carotenoids are largely sourced from countries like China and India, these tariffs have triggered price hikes for U.S. manufacturers and importers. This has particularly impacted industries reliant on carotenoids, including those producing nutritional supplements, cosmetics, pharmaceuticals, and functional foods. The tariffs have not only raised input costs but have also disrupted sourcing strategies, affected logistics, and weakened the efficiency of production and distribution across the carotenoid supply chain.

Beyond tariffs, other geopolitical factors are also influencing market dynamics. Economic sanctions on major producers or consumers, such as China or Russia, can create significant supply chain disruptions and increase price volatility. Additionally, stricter environmental regulations are pushing for more sustainable farming methods in carotenoid-rich crop cultivation, which may elevate production costs. Climate change further compounds the issue, as it affects crop yields and introduces uncertainty into raw material availability. The global market’s response to these overlapping geopolitical and environmental pressures will be crucial in shaping the stability and future growth of the carotenoid industry.

Economic Impact:

The carotenoids market is experiencing significant economic pressure due to fluctuating raw material costs, largely driven by global supply chain disruptions. The price of key ingredients like beta-carotene, lutein, and astaxanthin is highly sensitive to geopolitical tensions and climatic changes, which can cause production shortfalls or price surges. With the US imposing tariffs on Chinese-origin carotenoids and related components, the market has faced increased production costs, impacting profit margins.

However, the increased demand for clean-label and natural ingredients is providing some positive growth, with companies investing in more localized production and sourcing strategies to reduce exposure to price volatility. As the global economy seeks to recover from pandemic-related shocks, these price fluctuations and market disruptions are also contributing to wider inflationary pressures across the food, pharmaceuticals, and cosmetics industries.

Geographical Impact:

The geographical impact of the carotenoids market is heavily influenced by trade policies, climate conditions, and regional supply availability. Countries like the US, India, and China, which are key players in the carotenoid production and consumption market, are seeing shifts in their sourcing strategies. For instance, the US tariffs on Chinese carotenoid imports have prompted companies to explore alternatives in regions like Southeast Asia and Latin America, where production costs may be lower.

Simultaneously, certain regions that are major exporters, like Europe and South America, are investing in sustainable sourcing practices to meet increasing consumer demand for natural, clean-label ingredients. Climate change and agricultural instability in regions like Africa and South America also pose risks to carotenoid crop yields, affecting global availability and trade patterns.

Business Impact:

The business landscape for carotenoid producers is being reshaped by rising raw material costs, trade uncertainties, and increasing demand for natural ingredients. Manufacturers are shifting towards more diversified supply chains to mitigate risks associated with trade tariffs and regional political tensions. The need to comply with stricter regulations on ingredient safety and environmental impact is also prompting investments in technology and innovation, such as biotechnological methods of carotenoid extraction and production.

Companies are increasingly focusing on sustainability initiatives to align with consumer preferences for eco-friendly and ethically produced products. While the higher production costs from tariffs and supply chain disruptions have squeezed margins, the long-term outlook for businesses in the carotenoid sector remains positive due to growing demand in food, beverage, and health supplements. This shift towards natural ingredients is expected to drive new product development and market expansion in the coming years.

Analyst Viewpoint

From an investment standpoint, the carotenoids market presents a compelling opportunity, especially as global health and wellness trends gain momentum. This growth is fueled by increasing consumer demand for natural and clean-label products, as well as the rising popularity of plant-based diets. Carotenoids like beta-carotene and lutein are particularly sought after for their health benefits, including support for eye health and immune function. Investors might find promising opportunities in sectors such as dietary supplements, functional foods, and cosmetics, where the demand for natural ingredients is surging. However, it’s important to be mindful of potential risks, such as high production costs and regulatory challenges that can impact market entry and profitability.

Key Segmentation

Source Analysis: In 2024, synthetic carotenoids led the market by source, capturing a commanding 65.1% share. This dominance is mainly due to their cost-efficiency, consistent quality, and large-scale production capabilities. Synthetic variants are widely adopted across food, beverages, animal feed, and cosmetics industries, where product uniformity and stability are essential. Their production in controlled environments offers better supply stability and extended shelf life, making them an ideal choice for manufacturers prioritizing affordability and reliability.

Type Analysis: Beta-carotenoids held the top position among type segments in 2024, securing a notable 34.1% market share. Their popularity stems from excellent chemical stability, affordability, and versatile usage across food, dietary supplements, beverages, and pharmaceuticals. Known for their antioxidant properties and pro-vitamin A benefits, beta-carotenoids support immune health, eye care, and skin protection. Strong consumer awareness and ease of formulation further cement their role as the preferred carotenoid type.

Form Analysis: The powder form dominated the carotenoids market in 2024, accounting for a substantial 46.1% share. Powdered carotenoids are favored for their extended shelf life, improved solubility, and ease of integration into different applications. Their portability and storage advantages make them suitable across food, cosmetics, supplements, and feed industries. Additionally, their dosing accuracy and production efficiency make them the go-to option for manufacturers.

Application Analysis: Color application emerged as the leading segment in 2024, commanding a 44.2% market share. The growing consumer preference for clean-label and natural ingredients has fueled demand for carotenoids as safe colorants. These pigments offer vibrant hues without synthetic additives, making them ideal for food, beverages, and cosmetics. Moreover, their antioxidant benefits also enhance their use in skincare products.

End-Use Analysis: Animal feed remained the top end-use category in 2024, securing a dominant 38.1% market share. Carotenoids are extensively used in feed to enhance the pigmentation, health, and growth performance of poultry, fish, and livestock. They help improve the visual quality of products like eggs and salmon while supporting immune function. Rising demand for natural additives in the feed industry continues to drive this segment’s growth.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146482

Regional Analysis

In 2024, Europe led the global carotenoids market with a 44.2% share, driven by innovation, health-aware consumers, and supportive regulations. Countries like Germany, the Netherlands, and Denmark serve as manufacturing hubs, especially for algae-derived carotenoids, reflecting the region’s focus on sustainable and natural solutions. Europe’s advanced industrial infrastructure, paired with its strong research and development capabilities, has made it a frontrunner in carotenoid innovation.

Additionally, Europe’s emphasis on sustainability and clean-label products enhances its role in this space. In 2023, the region accounted for nearly 50% of global imports of coloring matter, reflecting its central role in the natural ingredient trade. Germany, in particular, is seeing rising interest in organic food, with demand projected to grow 4.8% by 2027, positively impacting carotenoid use in natural coloring. Also, EU regulations—such as the requirement that food products offer at least 15% of the 800 µg daily reference intake for vitamin A—support increased inclusion of beta-carotene in food products. Together, these trends affirm Europe’s leadership in driving forward the carotenoids market globally.

Recent Developments

- In January 2024 – NutraMaize secured a three-year, $460,455 National Institute of Food and Agriculture (NIFA), part of the U.S. Department of Agriculture grant to study the impact of antioxidant carotenoids in its Orange Corn on mitigating heat stress in laying hens. This project builds on previous research demonstrating the benefits of NutraMaize’s corn in improving poultry health and productivity.

- BASF SE: In 2024, BASF SE’s Nutrition & Health division, encompassing carotenoids, reported sales of €1.978 billion, a 7.4% decrease from €2.137 billion in 2023. This decline was primarily due to a fire at the isophytol plant, which disrupted the supply of precursors for vitamin A, E, and carotenoids. Despite this setback, BASF achieved a 44% increase in EBITDA before special items, reaching €814 million, by focusing on high-margin products and enhancing operational efficiency. The company continues to invest in sustainable carotenoid solutions, leveraging its microencapsulation technology to ensure product stability and performance across various applications.

- Royal DSM: In 2023, Royal DSM merged with Firmenich to form DSM-Firmenich, strengthening its position in the carotenoids market. DSM-Firmenich focuses on natural and sustainable carotenoid production, catering to the growing demand in dietary supplements, food, and personal care products. The company’s commitment to innovation and sustainability positions it as a key player in delivering high-quality carotenoid solutions globally.

- Givaudan: In 2024, Givaudan’s Taste & Wellbeing division, which includes carotenoids, reported sales of CHF 3,752 million, up from CHF 3,603 million in 2023. The division’s EBITDA increased to CHF 780 million in 2024, compared to CHF 704 million in 2023, reflecting a focus on natural ingredients and health-oriented products. The EBITDA margin improved to 20.8% in 2024 from 19.5% in 2023, driven by strong demand in snacks, beverages, and dairy segments. Givaudan continues to invest in sustainable solutions to meet consumer preferences for natural and health-benefiting ingredients.

Conclusion

In conclusion, the global carotenoids market growth is driven by increasing consumer awareness of the health benefits of carotenoids, such as their antioxidant properties and support for eye health. The rising demand for natural and clean-label products in the food, beverage, and cosmetics industries further fuels this market expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)