Table of Contents

Overview

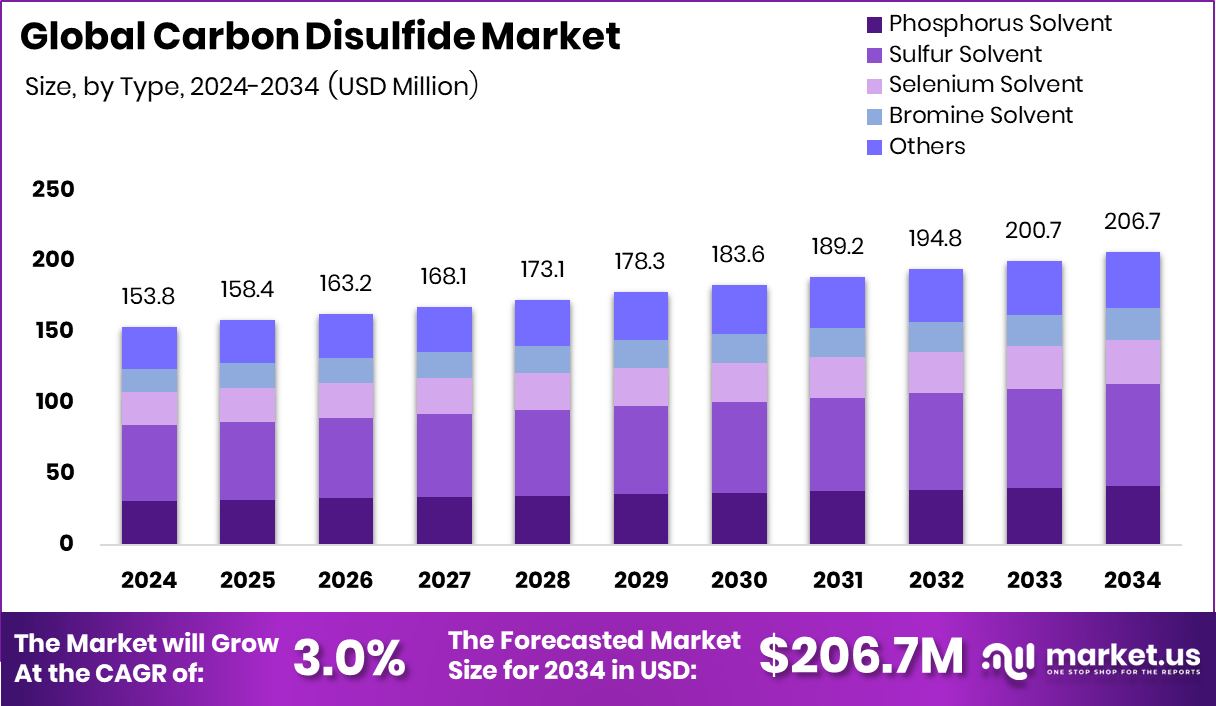

New York, NY – Nov 07, 2025 – The global Carbon Disulfide (CS₂) market is projected to reach USD 206.7 million by 2034, rising from USD 153.8 million in 2024 at a 3.0% CAGR. Asia Pacific, holding 44.9%, drives demand through its strong textile and chemical industries.

CS₂—a volatile, colorless liquid—acts as a key intermediate in viscose rayon, cellophane, rubber chemicals, and mining reagents. The rising use of regenerated cellulose fibers such as viscose and lyocell in apparel and home textiles is spurring growth, supported by expanding sulfur and carbon feedstock capacity. Parallelly, increased funding in fragrance and beauty-tech ventures highlights downstream momentum: Homecourt (US$8 M), Fraganote (US$1 M), Nirmalaya (US$0.8 M), Perfume Lounge (US$0.25 M), and Proven (US$12.2 M) signal growth in specialty chemicals linked to CS₂ derivatives.

Demand also stems from its role in producing xanthates for mining flotation and dithiocarbamates for rubber and agrochemicals. Expanding mining and tyre industries in developing regions further support consumption. Future opportunities lie in shifting towards sustainable and high-performance derivatives for advanced fibers, mining reagents, and rubber additives, aligning CS₂ with evolving specialty chemical platforms and eco-oriented industrial trends.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-carbon-disulfide-market/request-sample/

Key Takeaways

- The Global Carbon Disulfide Market is expected to be worth around USD 206.7 million by 2034, up from USD 153.8 million in 2024, and is projected to grow at a CAGR of 3.0% from 2025 to 2034.

- In 2024, sulfur solvent led the carbon disulfide market, securing a 34.9% share with broad industrial applications.

- By purity, the pure segment dominated the carbon disulfide market, capturing a 76.3% share across major manufacturing sectors.

- Within applications, rubber held a significant 23.4% share in the carbon disulfide market, supporting tire and elastomer production.

- In terms of end-use, the chemical and pharmaceutical industries commanded a 34.7% share of the carbon disulfide market globally.

- The Asia Pacific market value reached approximately USD 69.0 million, reflecting strong industrial growth.

➤ Directly purchase a copy of the report—https://market.us/purchase-report/?report_id=163955

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 153.8 Million |

| Forecast Revenue (2034) | USD 206.7 Million |

| CAGR (2025-2034) | 3.0% |

| Segments Covered | By Type (Sulfur Solvent, Phosphorus Solvent, Selenium Solvent, Bromine Solvent, Others), By Purity (Pure, Impure), By Application (Rubber, Cleaning Carbon Nanotubes, Rayon, Fibers, Perfumes, Cellophane and Packaging, Others), By End-use (Chemical and Pharmaceutical, Transportation, Personal Care and Cosmetic, Food and Beverages, Others) |

| Competitive Landscape | Akzo Nobel N.V., Merck KGaA, GFS Chemicals Inc., PPG Industries, Inc., Alfa Aesar, Univar Solutions Inc., Jiangsu Jinshan Chemical Co. Ltd., Arkema, Shikoku Chemicals Corporation, Zhuzhou Jinyuan Chemical Industry Co., Ltd., Shanghai Baijin Chemical Group Co., Ltd., Jiaonian Ruixing Chemical, Tedia |

Key Market Segments

By Type Analysis

In 2024, sulfur solvent dominated the carbon disulfide market by type, with a 34.9% share. Its leadership stemmed from extensive use in industrial synthesis, particularly for producing viscose fibers, cellophane films, and rubber additives. The solvent’s ability to effectively dissolve sulfur and phosphorus compounds made it essential across multiple chemical processes.

The growth of the textile and rubber industries further reinforced its prominence, while rising investments in fragrance and specialty chemical sectors indirectly supported demand. As these industries increasingly relied on sulfur-based intermediates, Sulfur Solvent maintained its critical role in the global carbon disulfide market landscape.

By Purity Analysis

In 2024, the Pure segment led the Carbon Disulfide Market by Purity, securing a 76.3% share. This dominance stemmed from its crucial role in industries demanding high chemical purity, including pharmaceuticals, specialty chemicals, and textiles. The pure grade’s consistent composition and minimal impurities make it ideal for producing viscose rayon and cellophane, ensuring reliable process performance and uniform product quality.

Rising demand for premium chemical formulations and advanced solvent standards further boosted its prominence. Moreover, continuous improvements in purification technologies and the growing industrial shift toward high-grade inputs solidified the Pure segment’s strong position in 2024.

By Application Analysis

In 2024, the rubber segment dominated the carbon disulfide market by application, holding a 23.4% share. This strong position was driven by its essential use in producing rubber accelerators, vulcanization agents, and performance additives that enhance elasticity, strength, and durability. Carbon disulfide’s high chemical compatibility makes it indispensable in manufacturing tires, seals, and industrial rubber goods.

The steady growth of the automotive and construction industries further boosted demand for superior rubber materials. Moreover, advancements in sulfur-based rubber processing and the development of more efficient formulations reinforced the segment’s prominence, allowing the rubber segment to retain a strong and influential presence in the global market landscape in 2024.

By End-use Analysis

In 2024, the chemical and pharmaceutical segment led the carbon disulfide market by end-use, accounting for a 34.7% share. This dominance was attributed to carbon disulfide’s essential role as a chemical intermediate in manufacturing active pharmaceutical ingredients, agrochemicals, and specialty solvents. Its strong reactivity with organic and inorganic compounds makes it indispensable for fine chemical synthesis and advanced drug formulation.

Rising demand for high-purity intermediates and innovative medicines further drove its use in pharmaceutical applications. Moreover, continued investments in chemical production capacity and process enhancement reinforced the segment’s position, enabling the chemical and pharmaceutical category to retain its leadership within the global carbon disulfide market in 2024.

Regional Analysis

In 2024, Asia Pacific dominated the global carbon disulfide market with a 44.9% share, valued at about USD 69.0 million. The region’s leadership was fueled by rapid industrial growth in China, India, and Southeast Asia, where expanding textile, rubber, and chemical industries drove substantial consumption.

Rising viscose rayon and specialty chemical production further boosted regional demand. North America maintained steady progress, supported by its robust chemical and pharmaceutical sectors, while Europe saw moderate growth due to strict environmental regulations and increased use of high-purity carbon disulfide.

Latin America and the Middle East & Africa displayed emerging potential, driven by industrial expansion and rising rubber and solvent applications. Overall, Asia Pacific remained the dominant force, supported by its strong manufacturing base, cost advantages, and growing demand from downstream industries, solidifying its position as the leading regional market for carbon disulfide in 2024.

Top Use Cases

- Viscose rayon & cellophane production: CS₂ is used in converting cellulose into viscose (rayon) fibers and into cellophane films. In the process, the cellulose is treated with CS₂ and caustic soda to form a xanthate, then precipitated into fibers.

- Rubber/tire chemicals: CS₂ serves as a key intermediate in making vulcanization agents and performance additives for rubber—helping improve elasticity and strength in tires and industrial rubber goods.

- Mining/flotation reagents: CS₂ is part of the chemical route to xanthates and other organosulfur compounds, which are widely used in froth flotation to extract metals (e.g., copper, gold) from their ores.

- Solvent for non-polar substances: As a solvent, CS₂ dissolves things that many other liquids struggle with: fats, waxes, sulfur, phosphorus compounds, resins, and rubber. This makes it useful in specialist chemical manufacturing.

- Intermediate for specialty chemicals/agrochemicals: CS₂ is used as a building block in producing certain agrochemicals (soil fumigants, pesticides) and other specialty chemical intermediates, especially those involving sulfur chemistry.

- Fumigant/pest control in storage: Historically, CS₂ has been used to fumigate stored grain, warehouses, and ships to control insects and larvae—though many of these uses have been scaled back due to safety concerns.

Recent Developments

- In October 2024, Merck KGaA completed the acquisition of the investigational bispecific antibody candidate “CN201” from Curon Biopharmaceutical, expanding its pipeline in B-cell malignancies and autoimmune diseases.

- In October 2024, PPG announced an agreement to sell its U.S. and Canadian architectural coatings business to American Industrial Partners (AIP). This business includes well-known brands and retail stores, and the move is part of PPG’s strategy to focus more on its core specialty and industrial coatings operations

- In May 2024, Akzo Nobel announced the closure of three manufacturing sites in Groot-Ammers (Netherlands), Cork (Ireland), and Lusaka (Zambia). Production from these sites is to be transferred to other regional locations as part of a multi-year efficiency plan.

Conclusion

The Carbon Disulfide market continues to evolve with expanding industrial applications and regional growth. Its use in producing viscose fibers, rubber accelerators, and specialty solvents highlights its importance in modern manufacturing. Growing activity in textiles, pharmaceuticals, and chemical synthesis supports stable demand. Moreover, increased investment in sustainable production technologies and high-purity intermediates enhances its long-term potential.

As industries shift toward environmentally safer chemical practices and advanced sulfur-based compounds, carbon disulfide remains a critical building block. With ongoing innovations in specialty chemicals and downstream applications, the market is positioned for steady transformation towar

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)