Table of Contents

- Introduction

- Editor’s Choice

- Global Car Rental Market Overview

- Number of Users of Car Rentals Worldwide

- Car Rental Bookings by Brand

- Comparison of Car Rental Companies by Number of Cars in Service and Locations

- Rental Car Pricing Statistics

- The Best Time to Book a Rental Car

- Car Rental Statistics – By Region

- Demographics of Car Rental Owners Statistics

- The Impact of COVID-19 on Car Rental Services Statistics

- Impact of Car-sharing Services

- Recent Developments

- Conclusion

- FAQs

Introduction

Car Rental Statistics: Car rental services are crucial in the transportation industry, meeting the diverse needs of tourists and business travelers alike.

Customers have a range of choices, from international chains to online platforms, offering vehicles from economy to luxury models.

Booking can be done online or directly with agencies, requiring essential documentation like identification and a driver’s license.

Pricing varies based on factors such as vehicle type and rental duration, with extra services available for additional fees.

Insurance options help manage financial risks, while return procedures involve meeting fuel and cleanliness standards.

Technological innovations like mobile apps and vehicle tracking are reshaping the industry, with a growing emphasis on sustainability through electric and hybrid fleets.

Editor’s Choice

- In 2023, the global car rental market revenue stood at $133 billion.

- Projections for 2025 and beyond indicate that offline channels will continue to dominate, with market shares of 70% in 2025.

- Enterprise Holdings Inc. leads with a market share of 15%

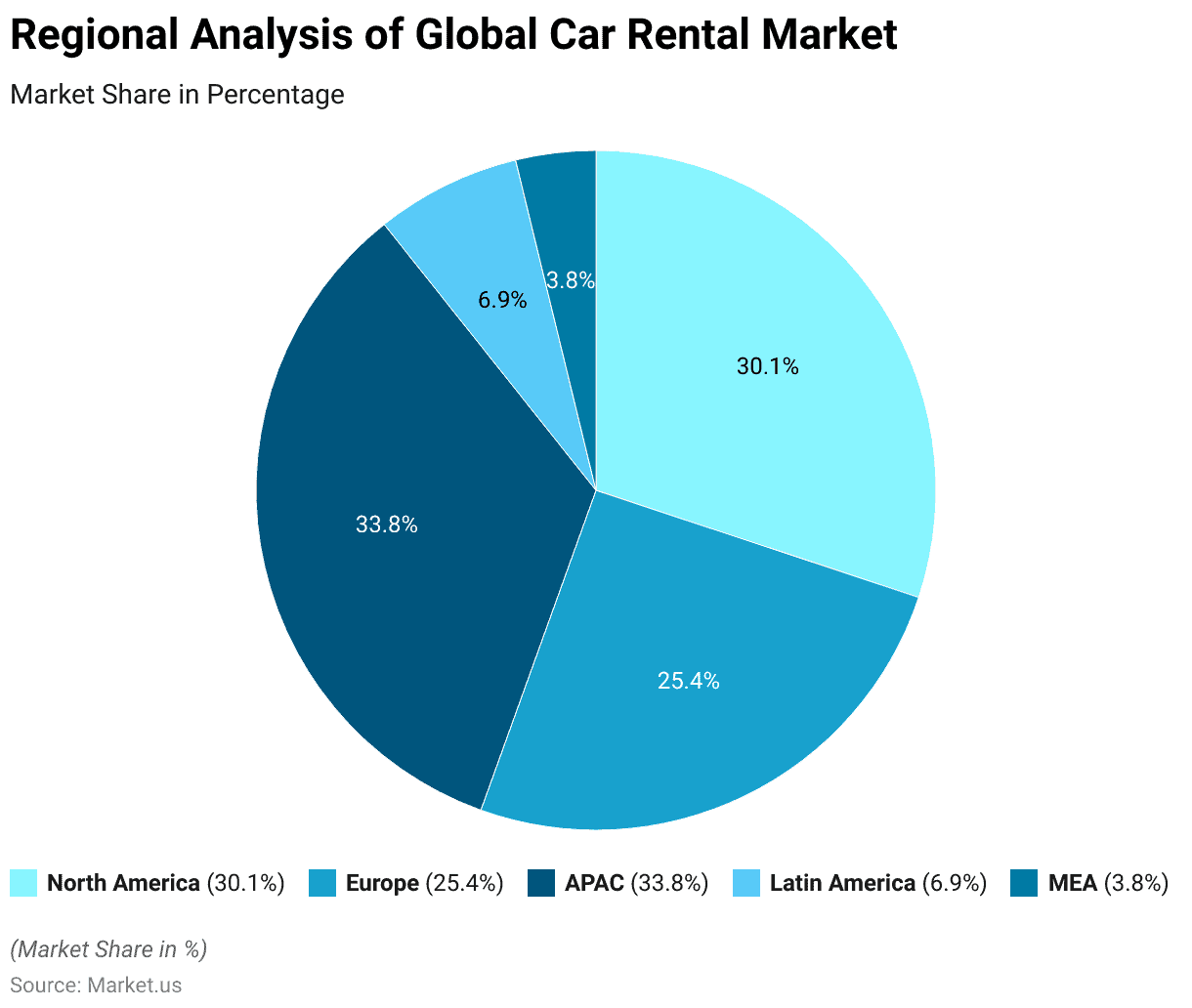

- The global car rental market exhibits varied regional market shares, with the Asia-Pacific (APAC) region leading at 33.8%.

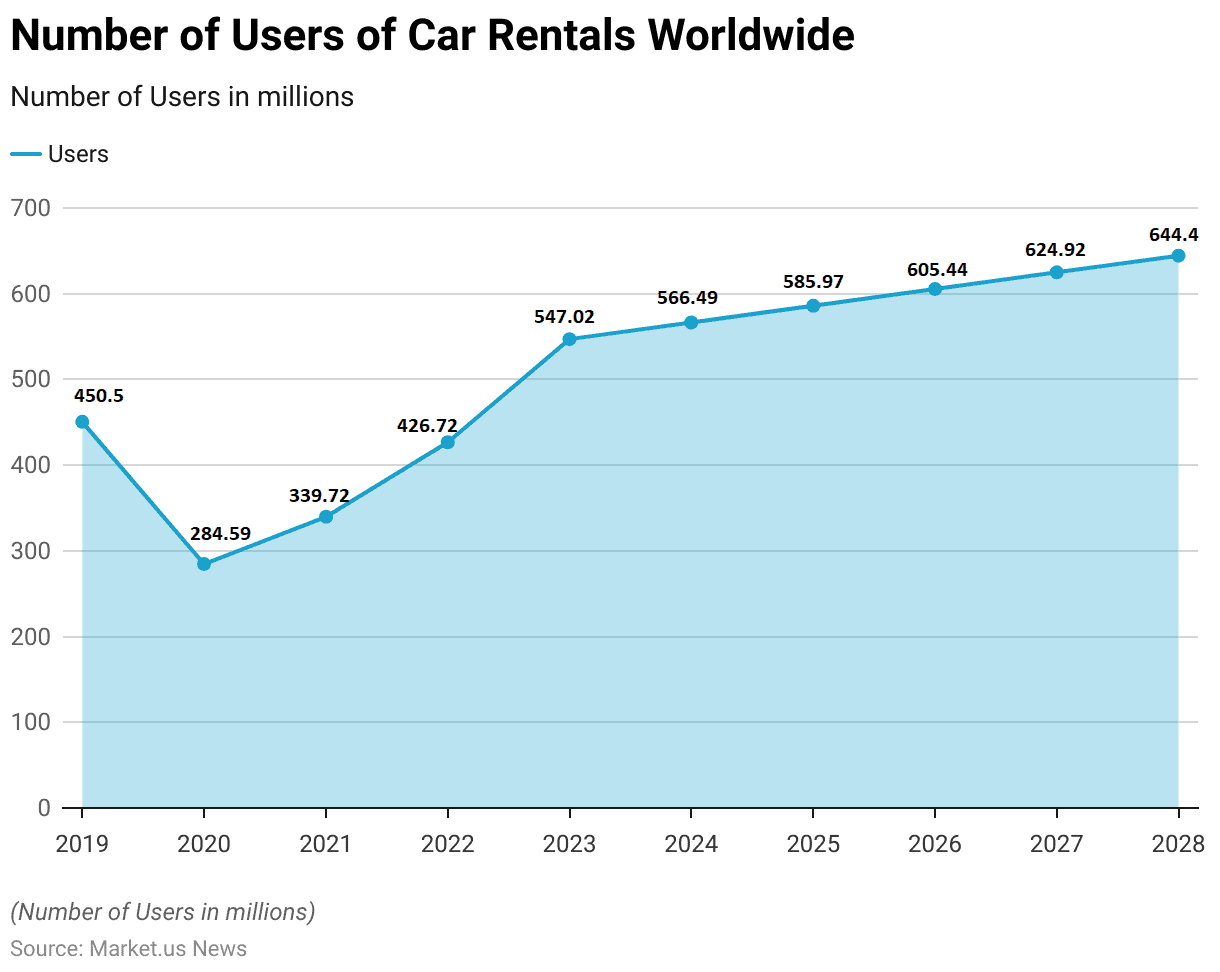

- The number of car rental users worldwide is expected to expand to 644.4 million by 2028.

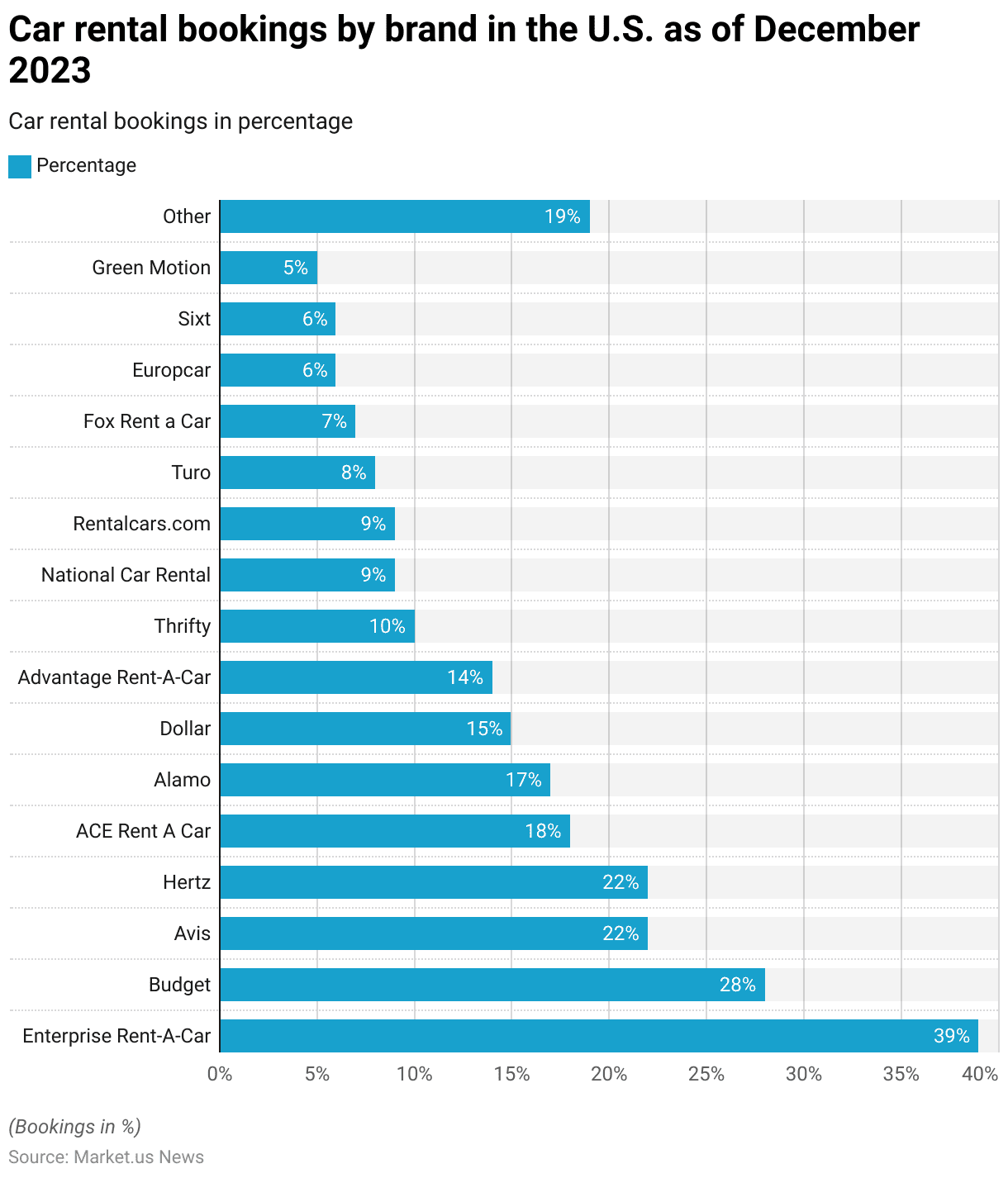

- As of December 2023, the U.S. car rental market is dominated by Enterprise Rent-A-Car, which holds a significant 39% share of bookings.

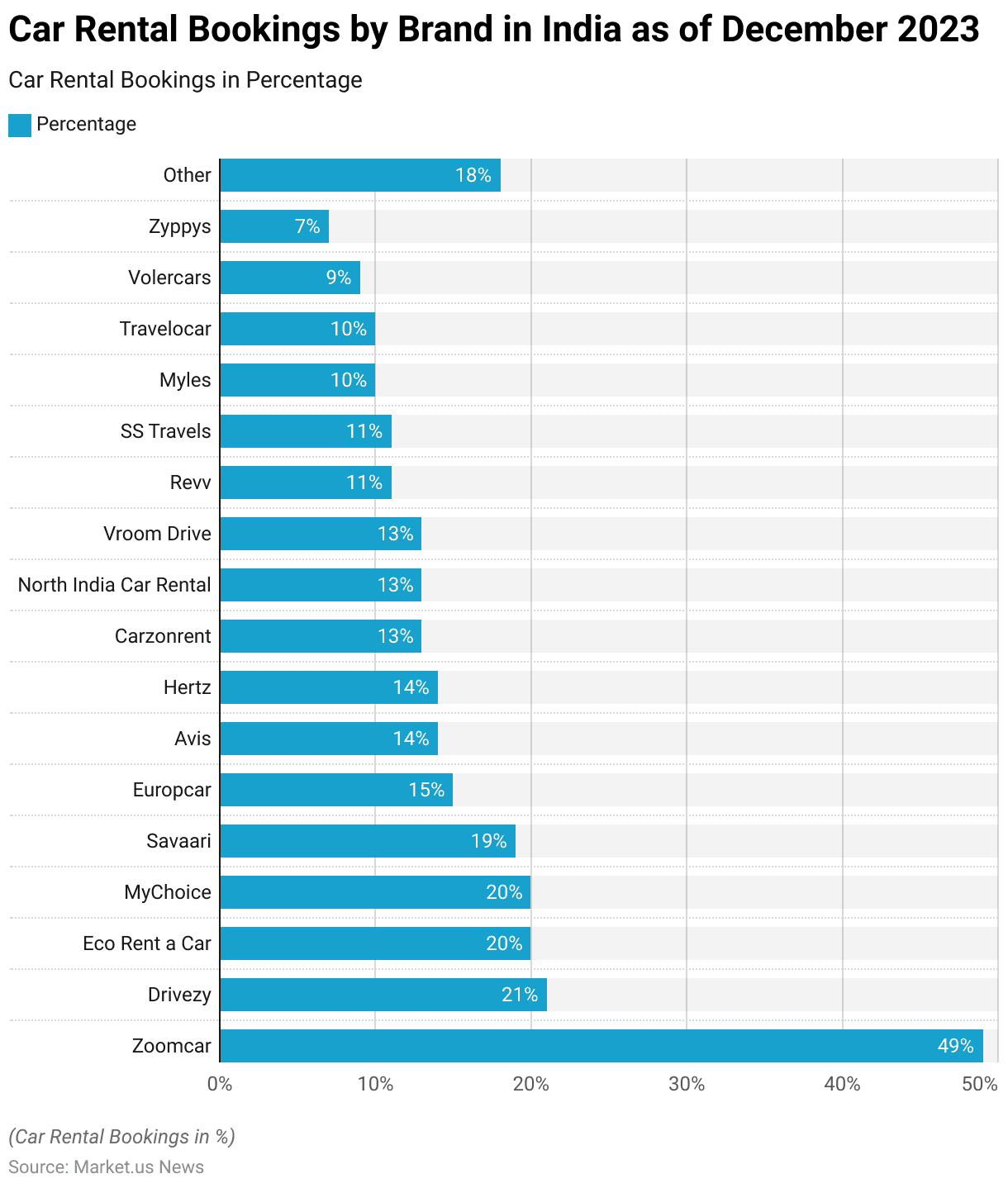

- As of December 2023, Zoomcar leads the car rental market in India with a commanding 49% share of bookings.

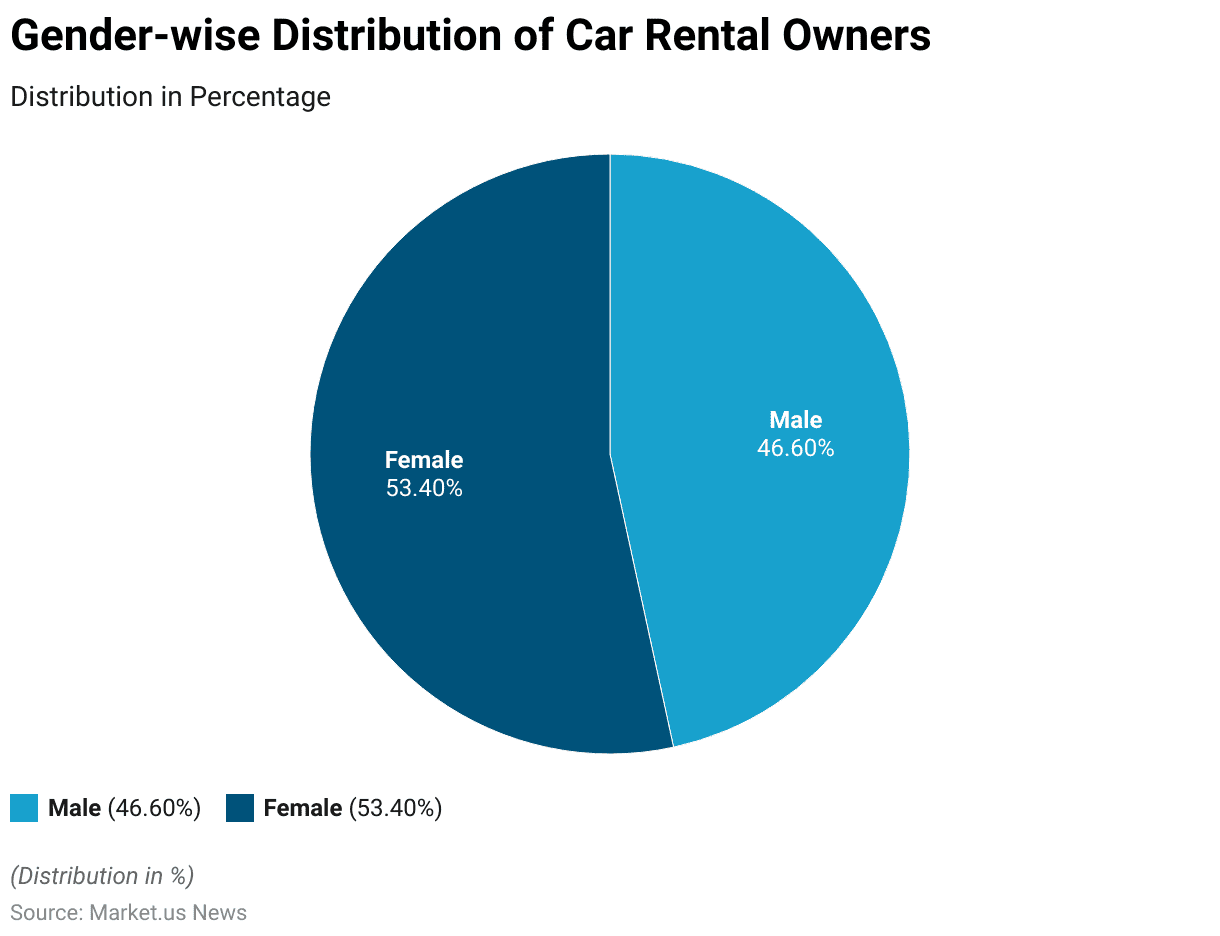

- The demographics of car rental owners reveal a slight majority of female owners, accounting for 53.40% of the total.

Global Car Rental Market Overview

Global Car Rental Market Size Statistics

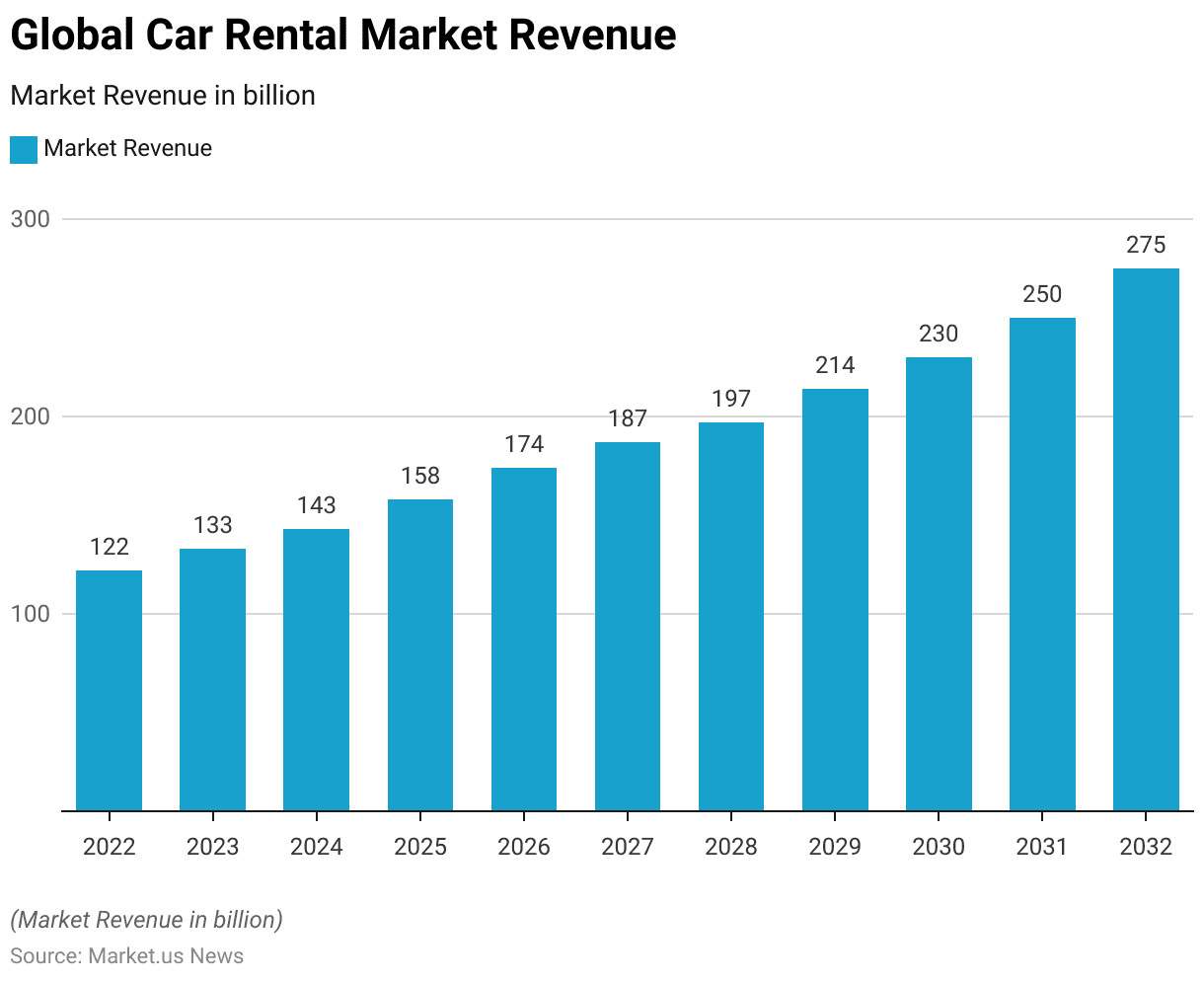

- The global car rental market has demonstrated significant growth from 2022 to 2032 at a CAGR of 8.70%.

- In 2022, the market revenue stood at $122 billion. This figure increased to $133 billion in 2023 and is projected to continue its upward trajectory, reaching $143 billion in 2024.

- The revenue is expected to grow steadily, hitting $158 billion by 2025 and $174 billion by 2026.

- By 2027, the market is anticipated to generate $187 billion, with further growth leading to $197 billion in 2028.

- This trend is expected to continue, with revenues reaching $214 billion in 2029 and $230 billion in 2030.

- By 2031, the market is projected to achieve $250 billion, culminating in a substantial $275 billion by 2032.

- This consistent increase reflects the expanding demand and robust growth potential within the global car rental industry.

(Source: market.us)

Global Car Rental Market Share – By Distribution Channel Statistics

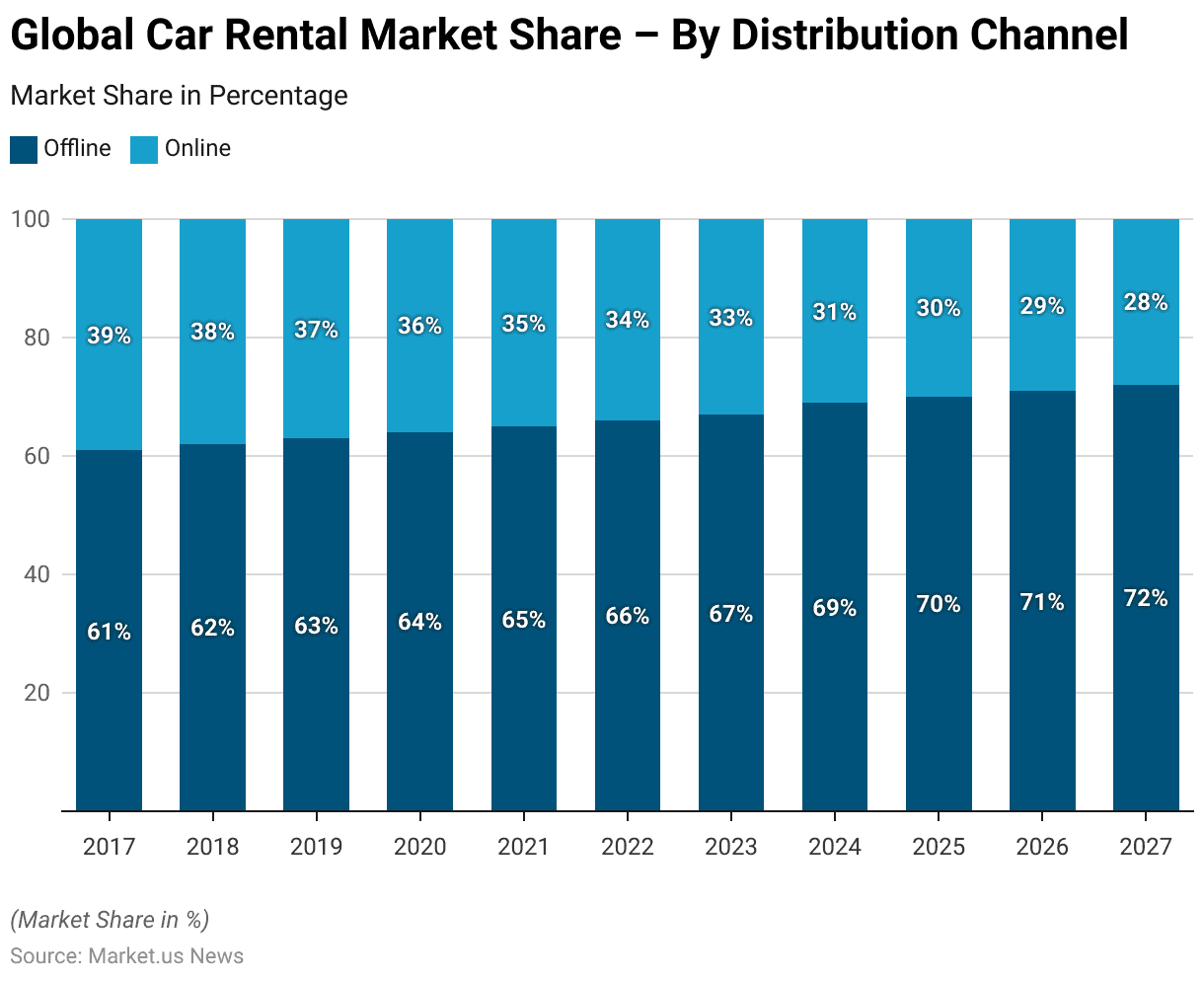

- The global car rental market has shown a clear trend in its distribution channels from 2017 to 2027, with a growing preference for offline channels over online.

- In 2017, the market share for offline channels was 61%, compared to 39% for online channels. This trend continued, with offline channels increasing to 62% in 2018 and 63% in 2019.

- By 2020, offline channels accounted for 64%, and this share rose steadily to 65% in 2021 and 66% in 2022.

- The trend persisted, with offline channels capturing 67% of the market in 2023 and 69% in 2024.

- Projections for 2025 and beyond indicate that offline channels will continue to dominate, with market shares of 70% in 2025, 71% in 2026, and 72% in 2027.

- Consequently, online channels have seen a gradual decline in market share, decreasing from 39% in 2017 to an anticipated 28% by 2027, reflecting the sustained preference for offline booking methods in the car rental industry.

(Source: Statista)

Competitive Landscape of the Global Car Rental Market Statistics

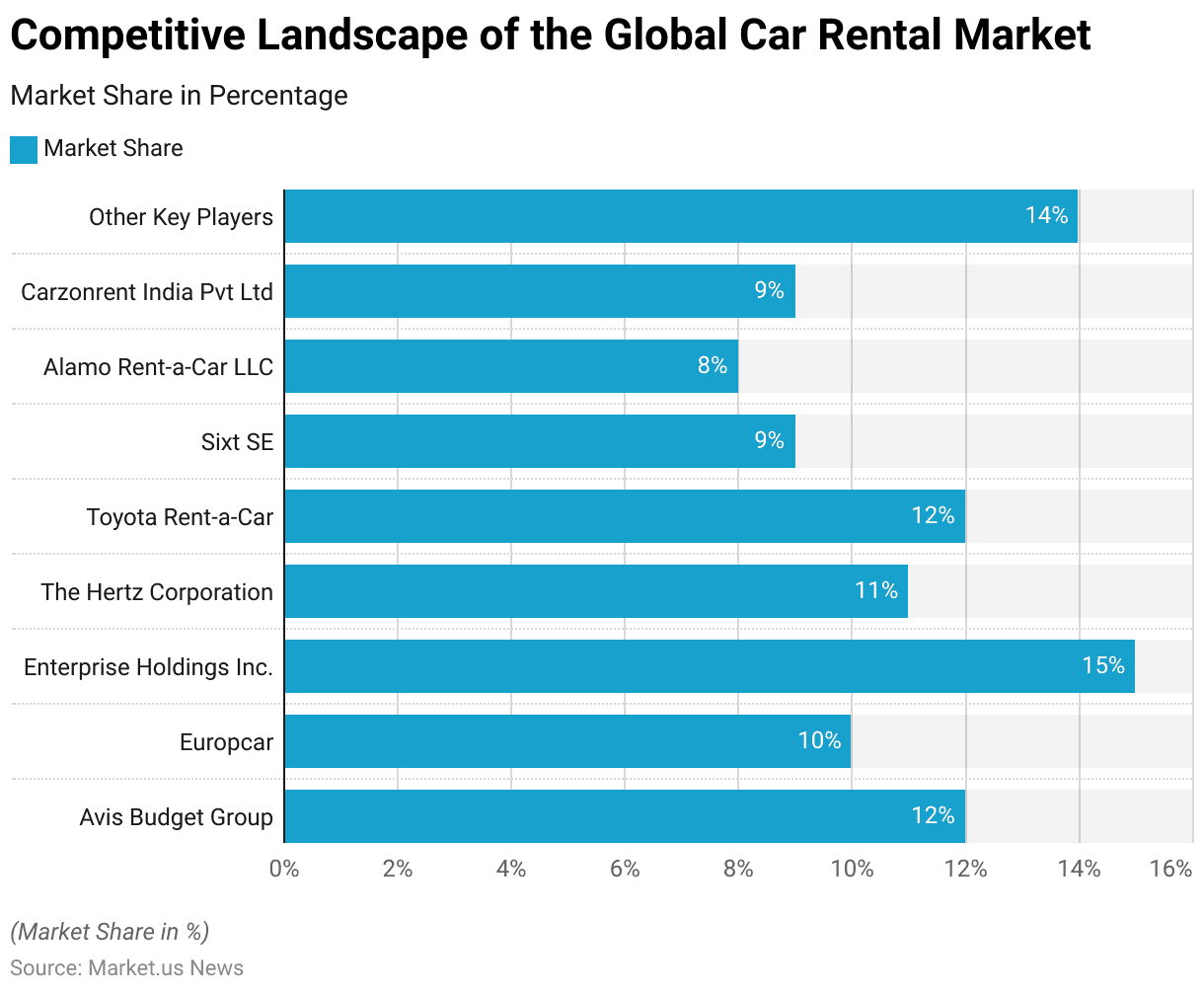

- The global car rental market is characterized by a diverse distribution of market shares among leading companies.

- Enterprise Holdings Inc. leads with a market share of 15%, followed by Avis Budget Group and Toyota Rent-a-Car, each holding 12%.

- The Hertz Corporation commands an 11% share, while Europcar and Sixt SE account for 10% and 9% of the market, respectively.

- Alamo Rent-a-Car LLC holds an 8% share, and Carzonrent India Pvt Ltd also captures 9% of the market.

- The remaining 14% of the market is shared by other key players, highlighting the competitive and fragmented nature of the car rental industry.

(Source: market.us)

Regional Analysis of the Global Car Rental Market Statistics

- The global car rental market exhibits varied regional market shares, with the Asia-Pacific (APAC) region leading at 33.8%.

- North America follows closely, holding a 30.1% share of the market. Europe accounts for 25.4% of the market share, demonstrating significant participation.

- Latin America and the Middle East & Africa (MEA) regions hold smaller portions, with market shares of 6.9% and 3.8%, respectively.

- This distribution underscores the dominance of APAC and North America in the global car rental market, with Europe also playing a substantial role.

(Source: market.us)

Number of Users of Car Rentals Worldwide

- The number of car rental users worldwide has experienced significant fluctuations and growth from 2019 to 2028.

- In 2019, the global user base was 450.5 million.

- However, in 2020, the number of users sharply declined to 284.59 million, likely due to the impact of the COVID-19 pandemic.

- Recovery began in 2021, with the number of users rising to 339.72 million.

- By 2022, the user base had rebounded to 426.72 million. This upward trend continued, reaching 547.02 million users in 2023.

- Projections indicate that the number of users will continue to grow, reaching 566.49 million in 2024, 585.97 million in 2025, and 605.44 million in 2026.

- The user base is expected to further expand to 624.92 million in 2027 and 644.4 million by 2028, reflecting a robust recovery and sustained growth in the global car rental market.

(Source: Statista)

Car Rental Bookings by Brand

United States

- As of December 2023, the U.S. car rental market is dominated by Enterprise Rent-A-Car, which holds a significant 39% share of bookings.

- Budget and Avis follow with 28% and 22%, respectively, while Hertz also captures 22% of the market.

- ACE Rent-A-Car accounts for 18% of bookings, and Alamo holds a 17% share.

- Dollar and Advantage Rent-A-Car have 15% and 14% of the market, respectively.

- Thrifty and National Car Rental each command 10% and 9% of bookings, respectively, with Rentalcars.com also at 9%.

- Turo, a peer-to-peer car rental service, accounts for 8% of bookings, while Fox Rent a Car has a 7% share.

- Europcar and Sixt each hold a 6% share, and Green Motion accounts for 5%.

- Other brands collectively represent 19% of the market, highlighting the competitive landscape and diverse options available in the U.S. car rental industry.

(Source: Statista)

India

- As of December 2023, Zoomcar leads the car rental market in India with a commanding 49% share of bookings.

- Drivezy follows with 21%, and both Eco Rent a Car and MyChoice each capture 20% of the market.

- Savaari holds a 19% share, while Europcar accounts for 15%. Avis and Hertz each have a 14% share, and Carzonrent, North India Car Rental, and Vroom Drive each account for 13% of bookings.

- Revv and SS Travel each hold 11% of the market, with Myles and Travelocar each capturing 10%.

- Volercars and Zyppys account for 9% and 7% of bookings, respectively.

- Other brands collectively represent 18% of the market, reflecting a competitive and diverse car rental industry in India.

(Source: Statista)

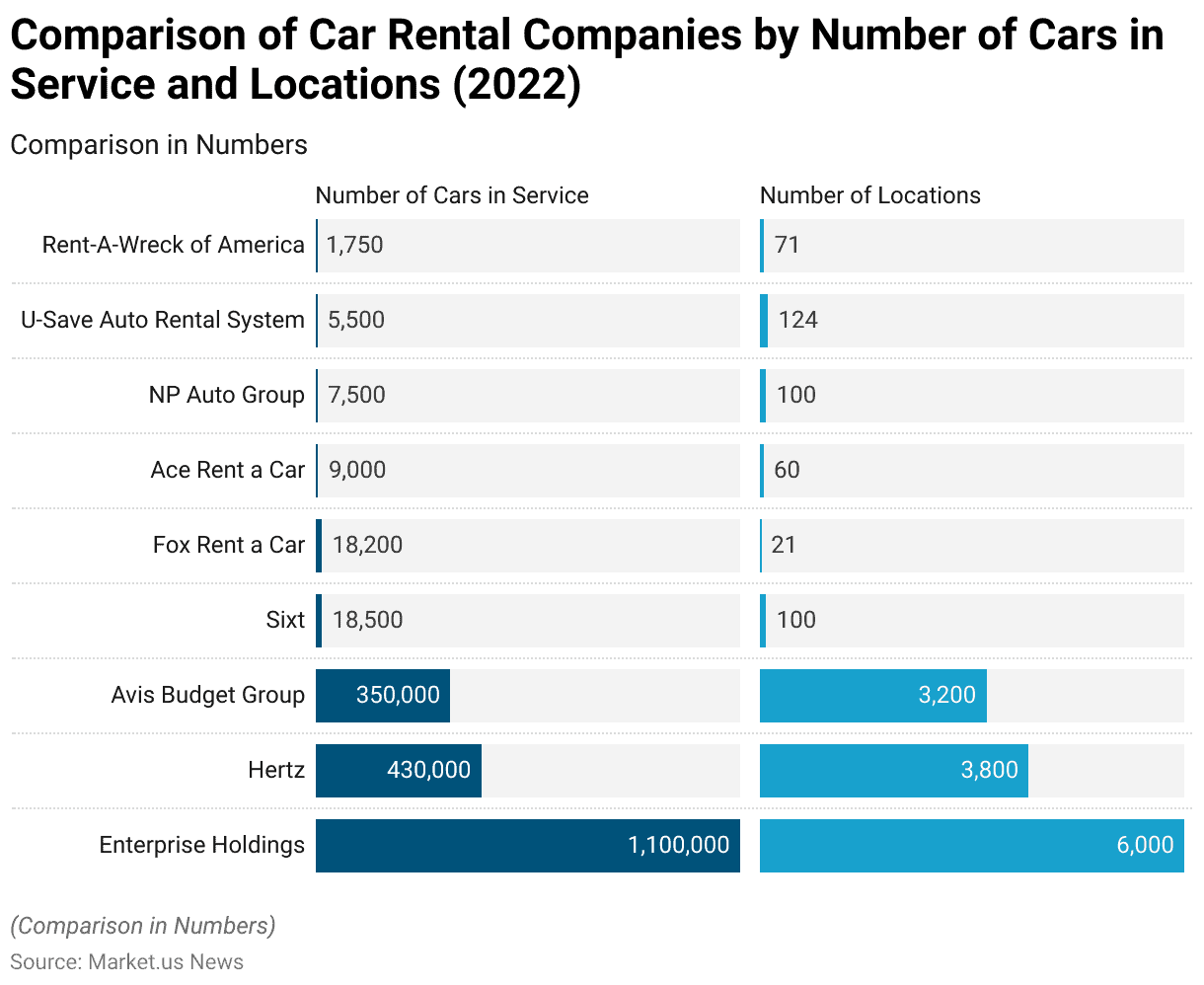

Comparison of Car Rental Companies by Number of Cars in Service and Locations

- As of 2022, Enterprise Holdings leads the car rental industry with the highest number of cars in service, totaling 1.1 million across approximately 6,000 locations.

- Hertz follows with 430,000 cars in service and operations spread across 3,800 locations.

- The Avis Budget Group operates 350,000 rental cars at 3,200 different locations.

- Other notable companies include Sixt, which has 18,500 cars and 100 locations, and Fox Rent a Car, which has 18,200 cars and 21 locations.

- Ace Rent a Car operates 9,000 cars across 60 locations, while NP Auto Group has 7,500 cars in 100 locations.

- U-Save Auto Rental System manages 5,500 cars at 124 locations, and Rent-A-Wreck of America has 1,750 cars across 71 locations.

- This data highlights the varying scales of operations among leading car rental companies.

(Source: ZIPPIA)

Rental Car Pricing Statistics

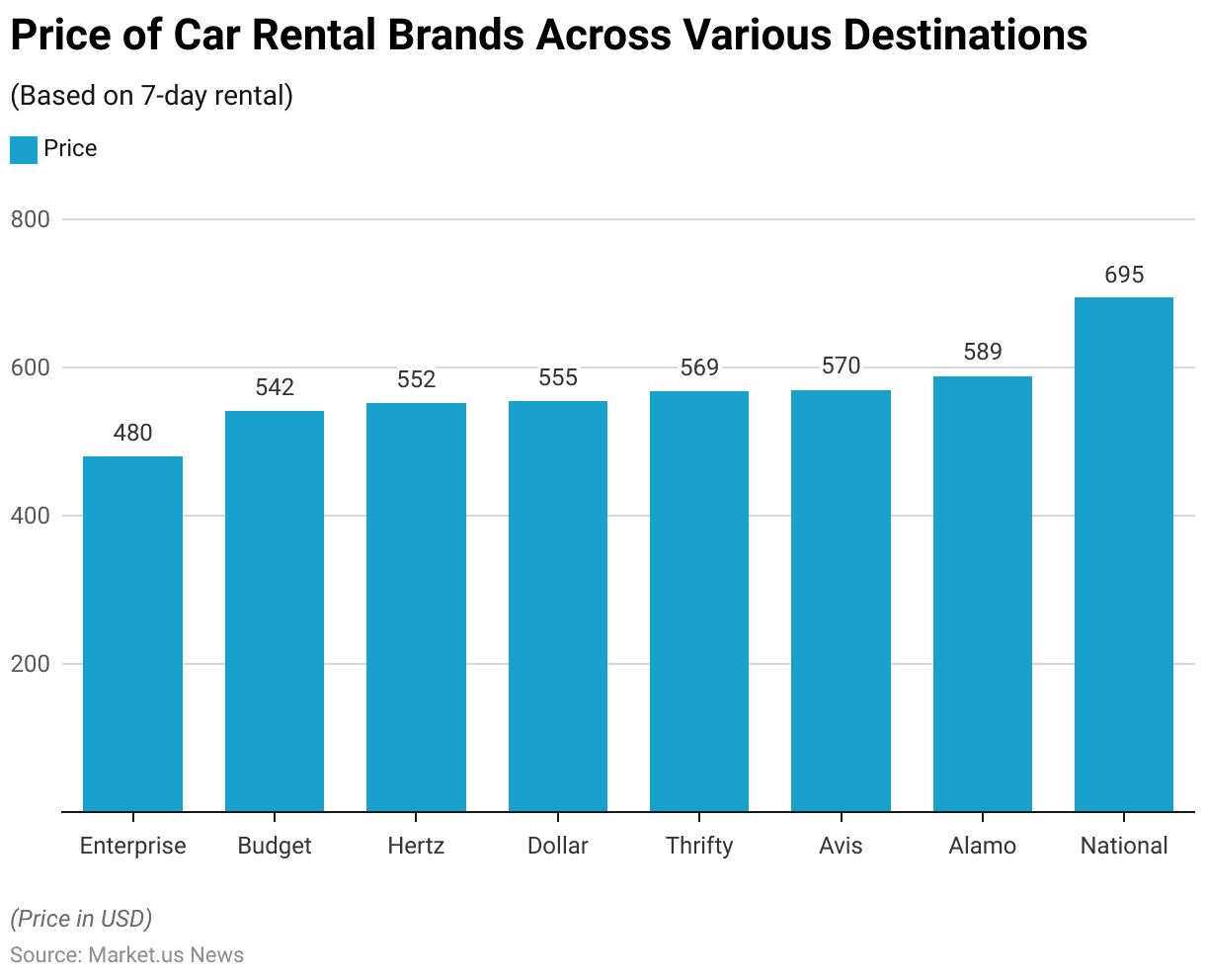

Price of Car Rental Brands Across Various Destinations

- As of the latest data, the price of car rentals for seven days varies significantly across different brands.

- Enterprise offers a competitive rate of $480, making it one of the more affordable options.

- The budget follows with a price of $542, while Hertz and Dollar rentals are slightly higher, priced at $552 and $555, respectively.

- Thrifty’s rental rate is $569, closely followed by Avis at $570.

- Alamo presents a higher price point at $589, and National is the most expensive option, with a seven-day rental costing $695.

- These price variations reflect the diverse pricing strategies and market positioning of each brand within the car rental industry.

(Source: nerdwallet)

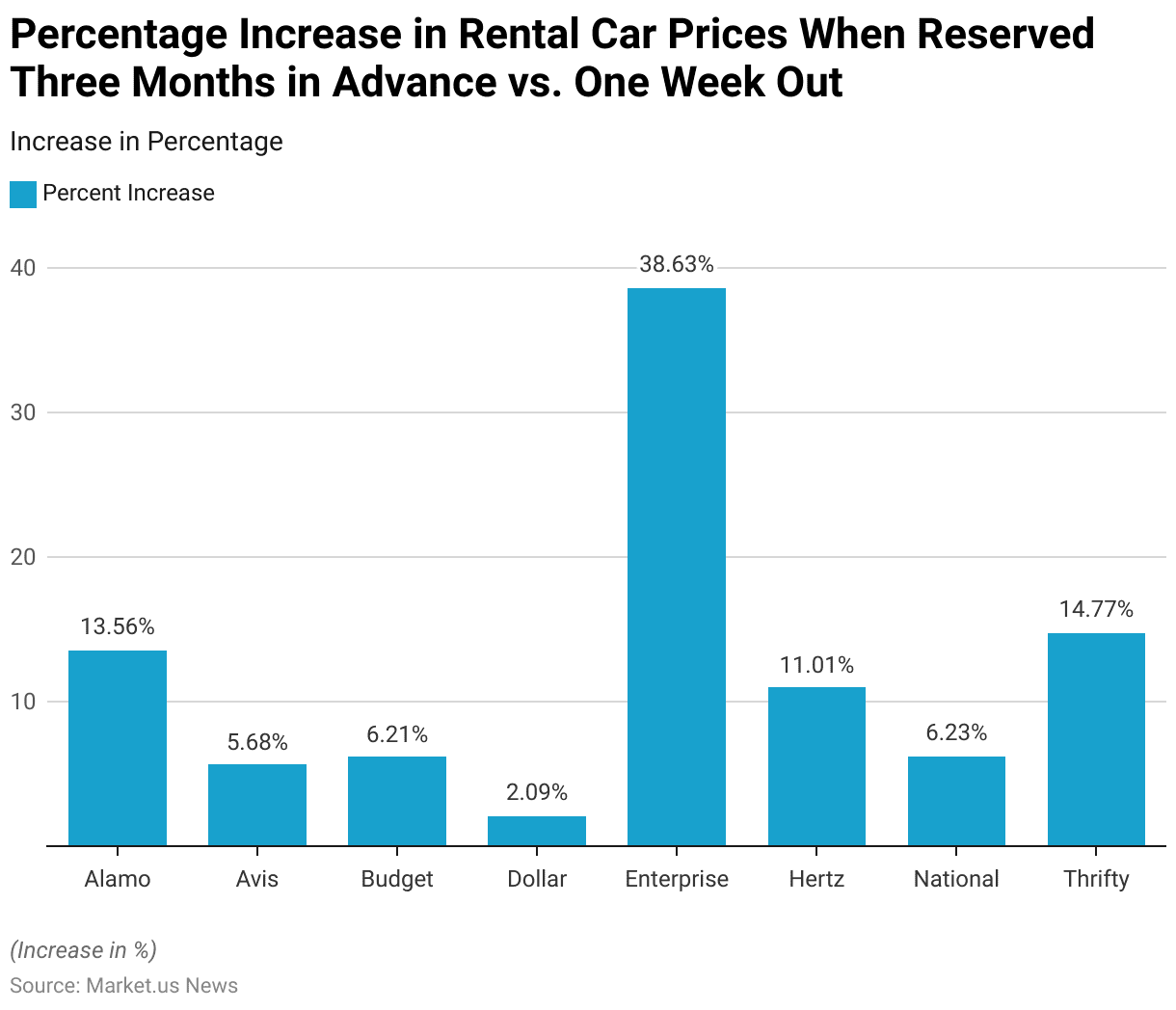

Percentage Increase in Rental Car Prices

- When reserving a rental car three months in advance compared to one week out, the price differences vary across different companies.

- Enterprise shows the highest increase, with customers paying 38.63% more for early reservations.

- Thrifty follows with a 14.77% increase, and Alamo’s prices rise by 13.56%.

- Hertz customers will pay 11.01% more, while National sees a 6.23% increase.

- Budget and Avis have similar increases of 6.21% and 5.68%, respectively.

- The dollar exhibits the smallest increase, with prices rising by only 2.09%.

- These variations highlight the diverse pricing strategies among rental car companies for early bookings.

(Source: nerdwallet)

The Best Time to Book a Rental Car

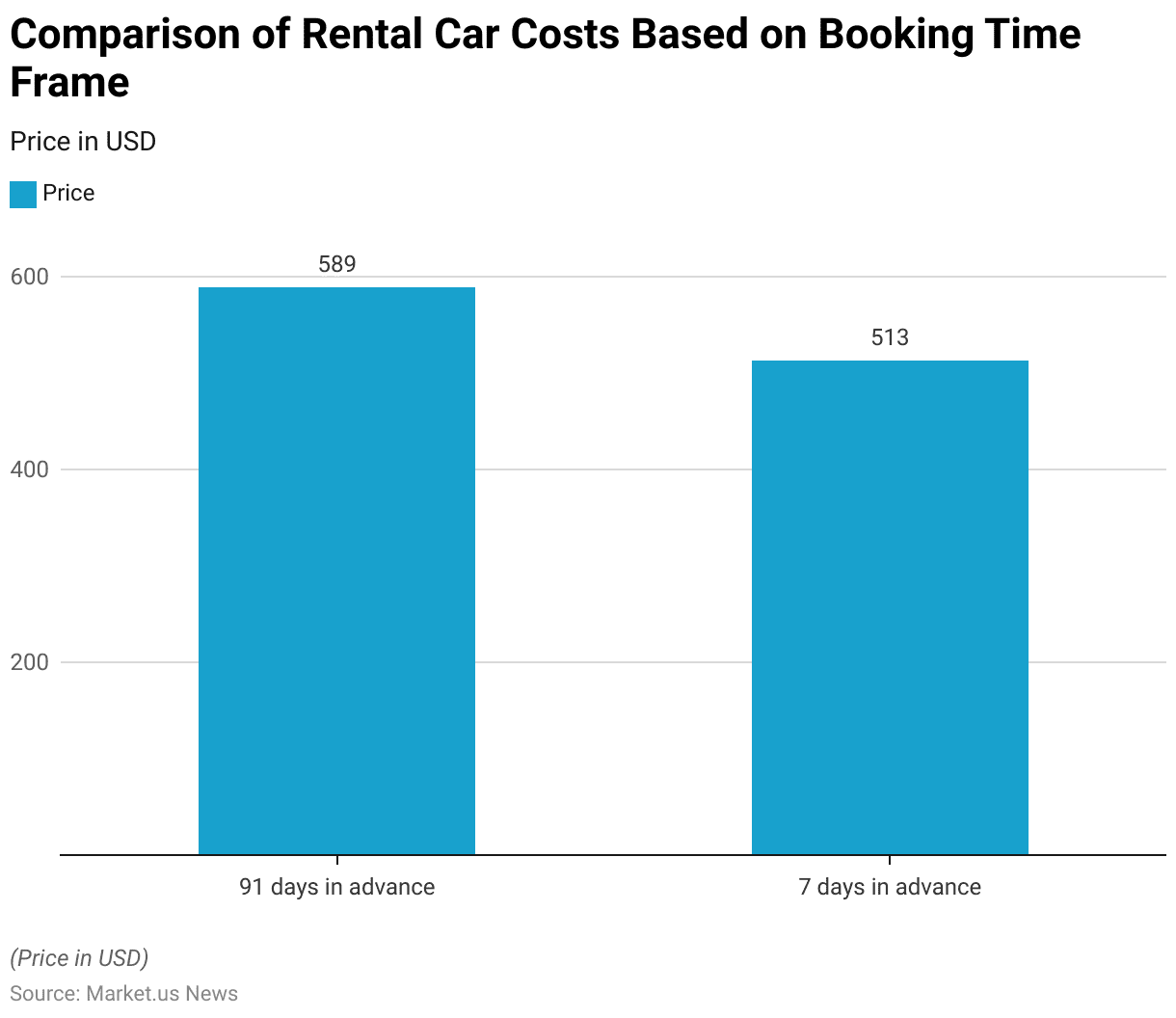

Rental car cost by booking time frame

- The cost of renting a car for seven days varies depending on the booking time frame.

- When booking 91 days in advance, the average price is $589. In contrast, booking just seven days in advance results in a lower average cost of $513.

- This indicates that booking well in advance typically results in higher rental prices compared to last-minute bookings.

(Source: nerdwallet)

Car Rental Statistics – By Region

Asia

- The projected data indicates that the Asian car rental sector is poised for substantial growth, with an estimated increase of approximately 348.9 million users by 2027.

- Online sales are anticipated to play a significant role, accounting for 68% of the industry’s revenue by the same year.

- Forecasts suggest a robust compound annual growth rate (CAGR) of 6.08%, resulting in a market value of approximately USD 51.71 billion by 2027.

- On average, each user is expected to contribute USD 141.40 in revenue.

- In 2023, the sector is projected to generate USD 40.84 billion in revenue. User penetration, currently at 6.4% as of 2023, is expected to rise to 7.5% by 2027.

(Source: Statista)

Europe

- The projected user penetration for 2023 stands at 6.4%, with an anticipated increase to 7.5% by 2027.

- By 2027, the total number of users in the car rental industry is estimated to reach 63.4 million.

- Online sales are expected to dominate the European market, accounting for 72% of the car rental segment by 2027.

- The average revenue per user is projected at USD 279.60.

- In 2023, the European car rental market is forecasted to reach USD 15.11 billion.

- Additionally, the annual growth rate is anticipated to be CAGR 5.46%, leading to a market value of $18.69 billion by 2027.

(Source: Statista)

Africa

- By 2023, the expected car rental revenue in Africa is USD 3.57 billion, with an average revenue per user of USD 53.90.

- Online sales are forecasted to contribute 56% of the total revenue by 2027.

- Projections for the African car rental sector indicate a user base of 91 million by 2027, with user penetration set to increase from 5.3% in 2023 to 6.6% by 2027.

- Additionally, revenue is anticipated to grow annually at a rate of 8.47%, reaching $4.94 billion by 2027.

(Source: Statista)

Americas

- In 2023, the anticipated revenue in the American car rental industry was USD 38.50 billion, with projections indicating a rise to 108.50 million users by 2027.

- User penetration is forecasted to increase from 9.8% in 2023 to 10.4% by 2027, with an average revenue per user expected to be USD 0.39K.

- By 2027, online sales are predicted to account for 77% of the car rental segment’s revenue.

- The American car rental market is expected to experience a growth rate of CAGR 2.44%, reaching USD 42.40 billion by 2027.

(Source: Statista)

Demographics of Car Rental Owners Statistics

By Gender

- The demographics of car rental owners reveal a slight majority of female owners, accounting for 53.40% of the total.

- Male owners comprise 46.60% of the car rental ownership demographic.

- This data indicates a balanced gender distribution, with a marginally higher representation of females among car rental owners.

(Reference: ZIPPIA)

By Race/ Ethnicity

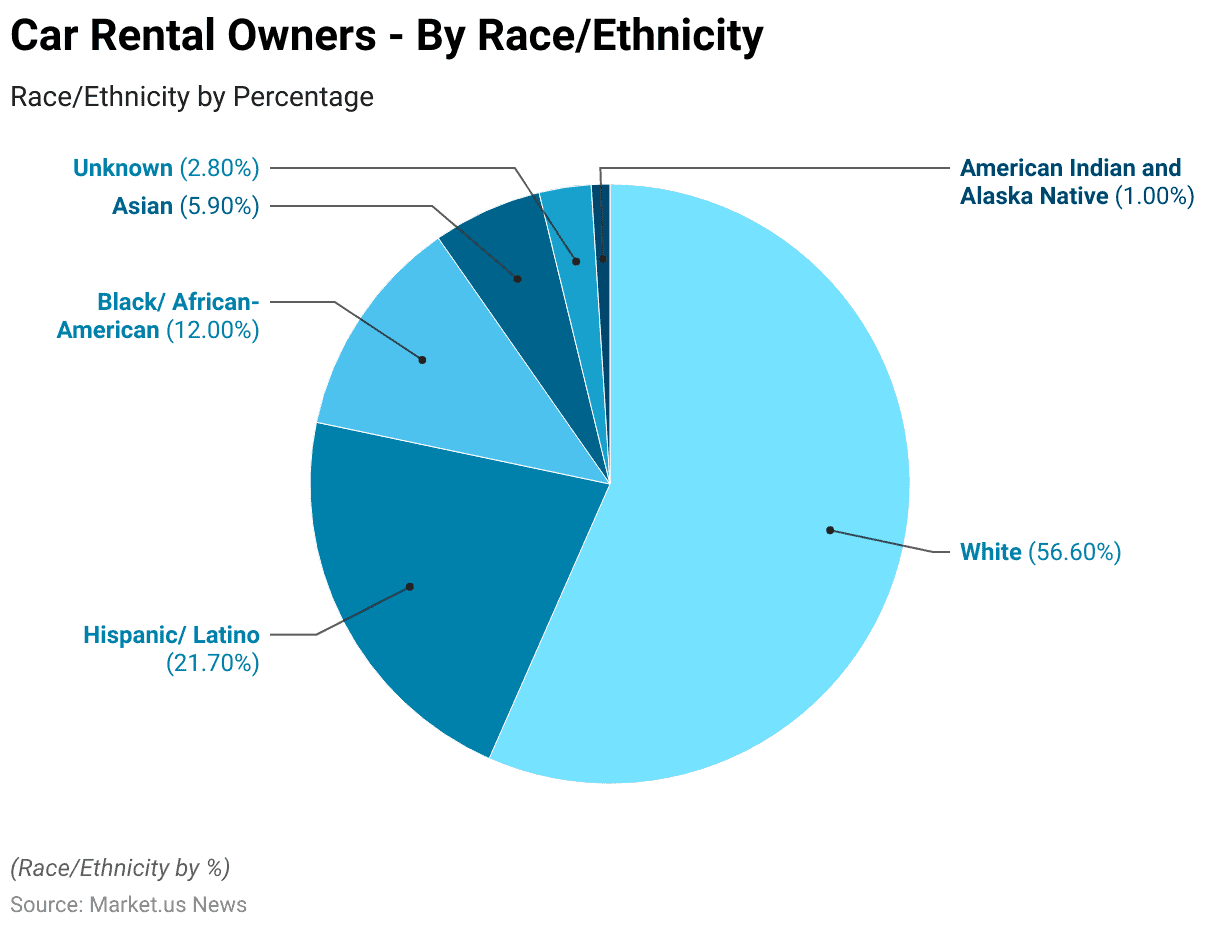

- The demographics of car rental owners by race and ethnicity show that the majority are White, representing 56.60% of the total.

- Hispanic/Latino owners account for 21.70%, while Black/African-American owners make up 12%.

- Asian owners constitute 5.90% of the demographic.

- Additionally, 2.80% of car rental owners fall under the “Unknown” category, and 1% are American Indian and Alaska Native.

- This data highlights the racial and ethnic diversity among car rental owners.

(Source: ZIPPIA)

The Impact of COVID-19 on Car Rental Services Statistics

- The car rental industry underwent significant upheaval due to the COVID-19 pandemic, witnessing a substantial drop in revenues by approximately 30% between 2019 and 2020 in the United States.

- This downturn prompted major players to downsize their workforce and offload a significant portion of their vehicle fleets, with up to 770,000 cars sold, representing one-third of their rental inventory. Additionally, approximately 40,000 jobs were cut within the industry.

- Notably, Hertz, a prominent player, sought refuge in Chapter 11 bankruptcy for its U.S. operations on May 22, 2020.

- However, by June 30, 2021, the company successfully navigated through its bankruptcy proceedings and emerged restructured.

- As travel restrictions eased and consumers resumed traveling, car rental companies faced challenges meeting the renewed demand due to the lingering effects of the pandemic and a semiconductor chip shortage. This shortage significantly constrained their ability to replenish their vehicle fleets.

- The confluence of heightened customer demand for rental vehicles and limited supply post-pandemic led to a notable surge in rental prices.

- Average daily rental rates soared from $76 in 2019 to $90 in 2022.

(Source: Hertz)

Impact of Car-sharing Services

- Car rental firms are promoting car-sharing as an alternative to ride-hailing services like Uber.

- Car-sharing allows consumers to rent vehicles for short periods, typically at hourly rates ranging from $5 to $15. Some services, like Turo, operate on a peer-to-peer model, enabling car owners to rent out their vehicles.

- Car-sharing is praised for its affordability compared to traditional rentals and ride-hailing. Services like Zipcar may offer additional perks, such as dedicated parking spaces. However, drawbacks include insurance issues, as some policies exclude coverage for car-sharing.

- Major rental companies like Enterprise and Hertz have integrated car-sharing into their offerings. Hertz reported a significant growth in car-sharing volume during the third quarter of 2023.

- Competitors like Zipcar and Getaround focus exclusively on car-sharing services, omitting long-term rentals.

(Source: Mobokey, New York City Department of Transportation)

Recent Developments

Acquisitions and Mergers:

- Green Motion, a UK-based car rental company, acquired U-Save Car & Truck Rental. This acquisition expands Green Motion’s reach to over 650 locations in 60 countries, enhancing its global service offerings.

- Avis Budget Group partnered with Albatha Automotive Group to integrate Budget Rent a Car and Payless Car Rental into Albatha’s mobility services. This partnership will broaden Avis Budget’s service portfolio, including self-drive and chauffeur-driven options.

New Product Launches:

- MakeMyTrip, an online travel agency, entered the car rental market by acquiring Savaari, an Indian intercity car rental company. This acquisition, valued at USD 10 million, marks MakeMyTrip’s expansion into the car rental sector.

Funding:

- IndusGo, a leading self-drive car rental service in South India, raised INR 200 crore (approximately USD 24 million) from its parent company, Indus Motors. This funding will support its expansion into Bengaluru and Hyderabad.

Market Trends and Innovations:

- There is a growing preference for electric vehicles (EVs) among car rental customers, with over 70% of Americans showing interest in renting EVs as a way to experience the technology before purchasing.

Conclusion

Car Rental Statistics – The car rental market has shown robust growth, characterized by leading companies like Enterprise Holdings, Hertz, and Avis Budget Group with extensive fleets and locations.

Demographically, there is a balanced gender distribution and diverse racial composition among car rental owners.

Trends indicate a preference for offline bookings, though online channels remain significant. Cost analysis reveals that last-minute bookings are generally more economical than early reservations.

Regionally, the Asia-Pacific, North America, and Europe dominate the market. Overall, the industry is dynamic, adapting to consumer preferences and technological advancements, enhancing its growth and efficiency.

FAQs

Typically, renters must be at least 21 years old to rent a car. However, this age requirement may vary depending on the rental company and location. Additionally, younger drivers under 25 may face additional fees or restrictions.

You’ll typically need a valid driver’s license, a credit card in the renter’s name for payment and security deposit purposes, and sometimes additional identification like a passport or government-issued ID. International renters may need an International Driving Permit (IDP) along with their domestic license.

Some car rental companies accept debit cards, but policies vary. Debit card usage may be subject to additional requirements such as a credit check, proof of insurance, or a larger deposit.

Basic insurance coverage is often included in the rental price, typically covering liability and collision damage. However, it’s advisable to check the terms and conditions carefully, as there may be exclusions or optional coverage available for purchase.

Many rental companies allow additional drivers to be added to the rental agreement for a fee, provided they meet age and licensing requirements. The primary renter is usually responsible for any damages caused by additional drivers.