Table of Contents

Overview

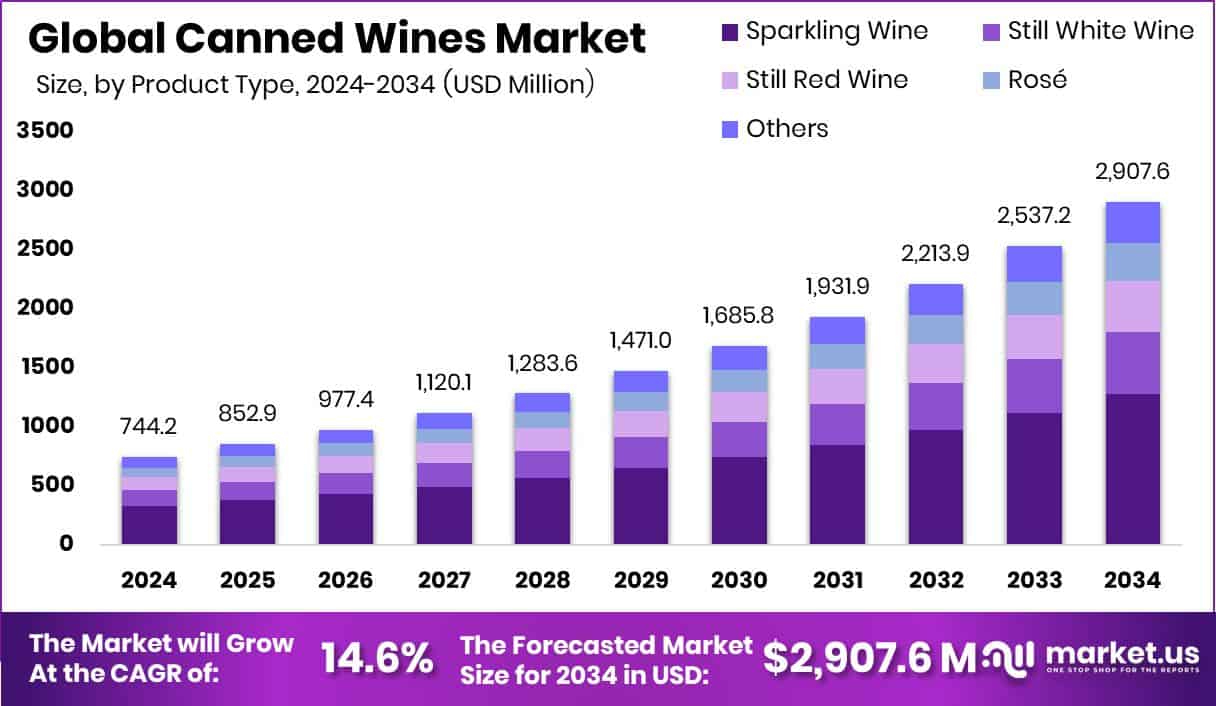

New York, NY – Aug 6, 2025 – The global canned wines market is projected to reach approximately USD 2,907.6 million by 2034, rising from USD 744.2 million in 2024. This growth represents a robust CAGR of 14.6% between 2025 and 2034. North America holds a leading share of 45.20%, driven by increasing consumer demand for convenient and portable wine options across diverse age groups.

The canned wines market includes the production, distribution, and sale of wine packaged in cans, covering a range of types such as red, white, sparkling, and still wines. The market has seen notable growth due to evolving consumer preferences favoring convenience and eco-friendly packaging solutions.

In FY 2021, global canned wine imports reached $7.5 billion and were projected to grow to $7.7 billion in FY 2022. Italy and France were the top contributors, each accounting for $2.5 billion worth of imports. Further supporting market expansion, Colorado allocated $250,000 through Senate Bill 21-248 to improve wine processing infrastructure, indicating strong regional investment potential.

Key drivers of market growth include rising demand for sustainable and lightweight packaging. Cans offer advantages like reduced weight, decreased breakage risk, and better recyclability factors that appeal to environmentally aware consumers. Their portability also supports new use occasions and consumption patterns.

Millennials and Gen Z are major contributors to this trend, drawn to the laid-back, accessible image of canned wine. Their preference for casual, on-the-go drinking experiences especially at informal or outdoor events continues to fuel market momentum.

Key Takeaways

- The global canned wines market is projected to reach approximately USD 2,907.6 million by 2034, growing from USD 744.2 million in 2024, with a strong CAGR of 14.6% between 2025 and 2034.

- Sparkling wine accounts for 44.20% of the market, reflecting its broad appeal among consumers worldwide.

- The 250 ml (8.4 oz) can size leads the market with a 56.30% share, driven by its convenience and popularity as a single-serving option.

- Hypermarkets and supermarkets dominate distribution channels with a 38.40% share, supported by high customer footfall and strong shelf visibility.

- North America recorded a market value of USD 336.3 million, highlighting the region’s strong and growing demand for canned wine products.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/canned-wines-market/free-sample/

Report Scope

| Market Value (2024) | USD 744.2 Million |

| Forecast Revenue (2034) | USD 2,907.6 Million |

| CAGR (2025-2034) | 14.6% |

| Segments Covered | By Product Type (Sparkling Wine, Still White Wine, Still Red Wine, Rosé, Others), By Package Size (250 ml (8.4 oz), 375 ml (12.7 oz), 187 ml (6.3 oz)), By Sales Channel (Hypermarket/supermarket, Wine Shops and Specialty Stores, Club Stores, Liquor Stores, Online Retail, Others) |

| Competitive Landscape | Archer Roose Wines, Babe Wine, Canned Wine Co., E. & J. Gallo Winery, House Wine, JOIY Wine, Lila Wines, Maker Wine Company, Ramona, Sans Wine Co., SUNTORY HOLDINGS LIMITED, The Infinite Monkey Theorem, Underwood |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144749

Key Market Segments

- By Product Type Analysis

Sparkling canned wines lead the market, accounting for 44.20% of global consumer preference in 2024. This strong position is driven by increasing demand for light, refreshing alcoholic beverages, particularly among millennials and Gen Z consumers.

Sparkling wines, known for their effervescent and festive nature, are gaining popularity in ready-to-drink formats. The canned version enhances their appeal by offering portability, portion control, and eco-friendly packaging. These products are increasingly favored for casual, outdoor, and on-the-go occasions, expanding their usage beyond traditional events.

Innovative flavors and premium options are further boosting interest in this category, especially on retail shelves. Aluminum cans, being highly recyclable, also appeal to environmentally conscious buyers. While red and white canned wines remain significant, sparkling variants outperform due to their celebratory image and social media-friendly presentation.

This category is especially popular in regions where alcohol consumption patterns are evolving and disposable incomes are rising. The growth of sparkling canned wine reflects changing consumer behaviors, prioritizing convenience, experience, and occasion-based choices.

- By Package Size Analysis

The 250 ml (8.4 oz) can size dominated the market in 2024, capturing a 56.30% share in the package size segment. This format has become the preferred choice for consumers seeking convenience, portability, and a perfectly portioned single serving.

The 250 ml size caters to the growing trend of mindful alcohol consumption, offering a balanced amount without waste. It’s particularly well-suited for outdoor, on-the-go, and casual settings such as picnics, concerts, or festivals.

This format also stands out due to its easy-to-chill and ready-to-drink nature, making it ideal for immediate consumption. Younger consumers, in particular, are driving its popularity as it aligns with their preference for lifestyle-friendly and sustainable packaging.

Retailers favor this size due to its compatibility with standard display formats and efficient storage. Moreover, its lightweight and recyclable nature enhances its eco-friendly appeal, making it a win for both consumers and brands.

- By Sales Channel Analysis

In 2024, hypermarkets and supermarkets led the canned wines market in terms of sales channel, holding a 38.40% share. Their dominance is attributed to product variety, strong in-store marketing, and the convenience of one-stop shopping.

Consumers often turn to these retail formats for reliable product quality, diverse options, and promotional deals. Strategic shelf placement, attractive displays, and discounts drive both regular purchases and impulse buying behavior.

This channel also helps new brands gain visibility, offering a platform for sampling and in-store promotions. Many supermarkets conduct wine tastings or seasonal campaigns, increasing consumer engagement and boosting sales.

The high footfall in these stores, coupled with the trust they command, continues to position them as key players in canned wine distribution even as online retail grows. Their accessibility and broad appeal make them essential to the market’s growth trajectory.

Regional Analysis

In 2024, North America dominated the global canned wines market, capturing a 45.20% share valued at USD 336.3 million. This leadership is fueled by rising demand for convenient alcoholic beverages, especially among millennials and consumers seeking portable options for outdoor and casual occasions.

Europe holds the second-largest share, supported by shifting consumer preferences and growing interest in sustainable packaging in countries like the UK, Germany, and France. The region’s openness to alternative formats and premium wine offerings also contributes to market expansion.

The Asia Pacific region is showing strong growth potential, driven by rapid urbanization, a growing middle class, and increasing exposure to Western consumption habits. Markets such as Japan, South Korea, and Australia are at the forefront of this trend.

In the Middle East & Africa, the market remains niche but is gaining momentum in premium urban segments, particularly among affluent consumers seeking novel beverage options.

Latin America is experiencing steady growth, especially in culturally rich wine markets like Brazil and Argentina, where younger consumers are increasingly receptive to new, convenient wine packaging formats. Across regions, evolving lifestyles and the popularity of single-serve alcoholic beverages continue to drive global demand.

Top Use Cases

- Outdoor Events & Festivals:

- Canned wines offer a perfect solution for open-air events lightweight, unbreakable packaging avoids glass restrictions, while single-serving cans simplify portion control. Attendees can enjoy sparkling or still wine safely, effortlessly chilled, without waste a use case widely adopted at music festivals, beaches, and sporting events.

2. At‑Home Single Serve & Portion Control:

- Cans in 187-250 ml sizes suit consumers seeking just one glass without opening a full bottle, reducing waste and allowing variety. Millennials and Gen Z especially appreciate this moderation-friendly format for winding down evenings or tasting different varietals without commitment to a full bottle.

3. On‑the‑Go & Travel Consumption:

- Due to their portability and durable construction, canned wines are ideal for journeys camping, hiking, park picnics or travel and eliminate concerns around breakage or glass ban restrictions. They fit easily in coolers, backpacks, and beach bags, enhancing convenience and availability in new consumption occasions.

4. Retail & Impulse Purchase Strategy:

- Supermarkets, hypermarkets, and convenience stores leverage canned wine’s vibrant packaging and single‑serve appeal to drive impulse purchases. Front-of-shop displays, shelf placement near ready‑to‑drink drinks, and sampling support trial and conversion especially among casual and first‑time wine buyers.

5. Premium & Flavored Innovation Launches:

- Winemakers are introducing premium and flavored canned wines such as sparkling spritzers, fruit-infused variants, and fortified styles to attract adventurous, eco-conscious consumers. The format supports brand storytelling, creative packaging, and limited‑edition releases, appealing to customers seeking novelty and convenient premium experiences.

Recent Developments

- Babe Wine:

Babe Wine, once a quickly expanding canned rosé brand under AB InBev, has seen discontinuation by mid‑2023 as AB InBev streamlined its portfolio. Retailers were notified that no further supplies would be issued, signaling the brand’s exit from mainstream availability despite earlier UK expansion. No new official canned wine developments have been announced since. - Canned Wine Co.:

In November 2024, Canned Wine Co. won the Sustainable Supplier Award at Footprint Media’s sustainability awards. The brand also partnered with Every Can Counts to promote can recycling across the UK retail and on‑premise channels. Earlier in 2023, they acquired UK rival Copper Crew, consolidating their presence in premium canned formats and international markets. - E. & J. Gallo Winery:

In June 2023, E. & J. Gallo acquired the premium canned wine and spritzer brand Bev, adding nine varietals including Rosé, Blanc, and ‘Brite’ to their portfolio. Bev, a woman‑founded brand with progressive positioning, continues under its founder’s guidance and benefits from Gallo’s distribution muscle. The move followed two years of Bev having been exclusively distributed in the U.S. by Gallo. - Underwood:

In April 2024, Underwood celebrated its 10‑year anniversary of canned wine leadership, highlighting its sustainability goals: about 95% less energy use, full recyclability, and reduced waste. The brand emphasized its accessible, environmentally conscious positioning with campaigns like “#PINKIESDOWN” to encourage casual enjoyment. They’ve also expanded canned offerings including rosé bubbles, red & white packs, and LGBTQ+ pride editions.

Conclusion

The canned wines market is experiencing strong growth, driven by shifting consumer preferences toward convenience, portability, and sustainability. Sparkling wines lead in popularity, reflecting a broader trend toward refreshing and celebratory beverages in ready-to-drink formats. Single-serve packaging, especially in 250 ml sizes, aligns with growing demand for portion control and on-the-go consumption. Hypermarkets and supermarkets continue to dominate as key sales channels, offering visibility and product variety. Regionally, North America maintains a leadership position due to high adoption among millennials and outdoor lifestyle trends, while Europe and Asia Pacific show increasing potential.

Leading brands are innovating with premium offerings, flavor infusions, and recyclable packaging to meet evolving customer expectations. Strategic acquisitions, sustainability commitments, and expanded retail presence are shaping the competitive landscape. As lifestyle habits shift and eco-consciousness rises, the market is poised for continued expansion, offering significant opportunities for both established players and emerging brands in the alcoholic beverages sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)