Table of Contents

Overview

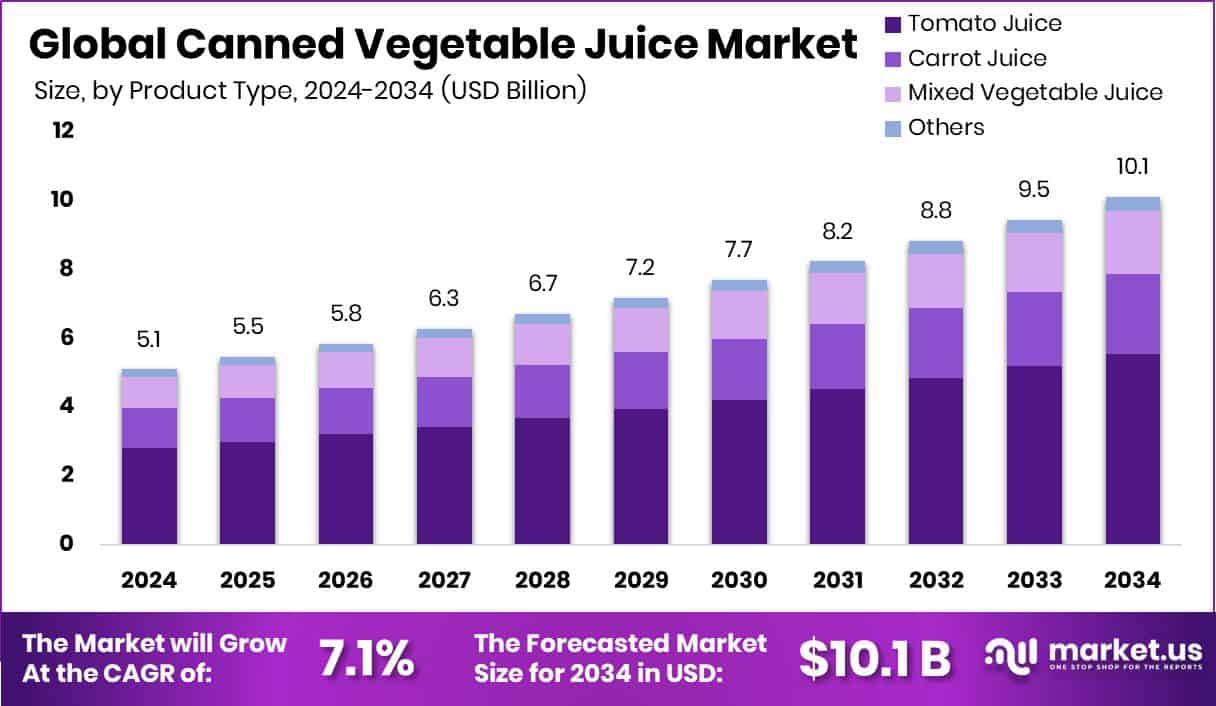

New York, NY – June 23, 2025 – Global Canned Vegetable Juice Market is expected to be worth around USD 10.1 billion by 2034, up from USD 5.1 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

Canned Vegetable Juice is a processed beverage made from the juice of vegetables like tomatoes, carrots, beets, celery, and spinach, preserved in metal cans for extended shelf life without refrigeration until opened. The market involves production, distribution, and sale through retail, supermarkets, and food service channels. Growing health awareness, plant-based diets, and the popularity of functional foods are key growth drivers.

Urban, hectic lifestyles have increased demand for quick, nutritious, and convenient drink options. These juices offer low-calorie, nutrient-rich solutions and are especially useful in areas with unreliable refrigeration. Consumers also favor natural, clean-label products without added sugars or preservatives. The market is further influenced by the trend of on-the-go consumption.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-canned-vegetable-juice-market/request-sample/

Lockyer Valley Foods has secured $50 million in Series A funding to boost the fruit and vegetable processing industry, underlining investment interest and growth potential in this sector. Overall, canned vegetable juice is positioned as a practical choice for health-conscious consumers.

Key Takeaways

- Global Canned Vegetable Juice Market is expected to be worth around USD 10.1 billion by 2034, up from USD 5.1 billion in 2024, and grow at a CAGR of 7.1% from 2025 to 2034.

- Tomato juice dominates the canned vegetable juice market, accounting for 54.9% of total product share.

- Conventional variants lead the canned vegetable juice market, holding a strong 83.3% market segment dominance.

- Supermarkets and hypermarkets contribute 46.2% to canned vegetable juice sales, making them the primary distribution channel.

- The Asia-Pacific reached a market value of USD 2.4 billion this year.

Report Scope

| Market Value (2024) | USD 5.1 Billion |

| Forecast Revenue (2034) | USD 10.1 Billion |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Product Type (Tomato Juice, Carrot Juice, Mixed Vegetable Juice, Others), By Nature (Conventional, Organic), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Others) |

| Competitive Landscape | Campbell Soup Company, The Kraft Heinz Company, Del Monte Foods, Inc., PepsiCo, Inc., Ocean Spray Cranberries, Inc., Nestla, Dole Food Company, Inc., Welch Foods Inc., Coca-Cola Company |

➤ Directly purchase a copy of the report— https://market.us/purchase-report/?report_id=150916

Key Market Segments

By Product Type Analysis

In 2024, Tomato Juice held a dominant 54.9% share in the By Product Type segment of the Canned Vegetable Juice Market. Its popularity stems from being a familiar, versatile, and nutrient-rich beverage, rich in vitamins A, C, and lycopene, a powerful antioxidant. Health-conscious consumers favor it for its heart health and detox benefits. Its mild flavor and adaptability to spices make it appealing across various cultures.

Tomato juice is widely used both as a refreshing drink and a culinary ingredient. Its shelf stability, multiple packaging options, and functional health perceptions further enhance its appeal. These factors—convenience, health value, and consumer trust—drive its continued leadership in the canned vegetable juice market.

By Nature Analysis

In 2024, conventional products held an 83.3% share in the By Nature segment of the Canned Vegetable Juice Market, reflecting their widespread availability, affordability, and consumer accessibility. Mass production using standard agricultural practices ensures a consistent supply and competitive pricing, appealing to a broad audience. Strong distribution through retail chains, supermarkets, and convenience stores supports this dominance. Consumers favor conventional juices, especially tomato-based blends, for their convenience, long shelf life, and variety.

Their practicality suits both households and institutions that purchase in bulk. Additionally, well-established production infrastructure allows manufacturers to scale efficiently. Despite growing interest in natural beverages, the affordability and familiar taste of conventional juices maintain their leading position in the market.

By Distribution Channel Analysis

In 2024, Supermarkets/Hypermarkets led the By Distribution Channel segment of the Canned Vegetable Juice Market with a 46.2% share. This dominance is driven by their wide product selection, strong visibility, and consumer trust. These retail formats offer a convenient one-stop shopping experience, allowing customers to inspect, compare, and purchase products easily. Strategic shelf placement, promotions, discounts, bundle deals, and loyalty programs further boost sales and impulse purchases.

Their accessibility in urban and suburban areas enhances their appeal. Supermarkets/hypermarkets also support both individual and bulk purchases, aligning with typical canned juice consumption. Strong partnerships with manufacturers ensure consistent supply and competitive pricing, reinforcing their leading role in the distribution of canned vegetable juices.

Regional Analysis

In 2024, the Asia-Pacific region led the canned vegetable juice market with a dominant 47.9% share, generating approximately USD 2.4 billion in revenue. This growth is driven by a large population, increasing urbanization, and rising health consciousness. The region’s expanding supermarket presence and growing demand for convenient, nutritious beverages have further fueled market performance.

North America remains a significant market due to its established juice consumption culture and mature retail infrastructure. Although specific figures are not provided, continued interest in flavor innovation and functional beverages supports regional demand.

Europe maintains steady growth, driven by health trends and regulatory support for fortified drinks. Consumers in Western and Central Europe particularly favor tomato- and carrot-based juices, ensuring consistent market expansion.

Latin America shows promising growth potential, supported by rising disposable incomes and a shift toward ready-to-drink diets. The Middle East & Africa region also presents emerging opportunities, especially in urban areas where convenience, long shelf life, and ease of storage drive demand for canned vegetable juices.

Top Use Cases

- Boosting Immune Health: Canned tomato or mixed veggie juice delivers a rich dose of vitamins A, C, potassium, and antioxidants like lycopene, supporting heart health and immunity. It’s a convenient way to get key nutrients quickly, without the prep time of fresh produce.

- Flavor Base for Cooking & Sauces: Use canned vegetable juice to enrich soups, sauces, or chili. It adds depth and nutrition with minimal effort. It can even stretch tomato sauce or replace broth. This is a cost-effective way to boost flavor and value in recipes.

- Marinades and BBQ Enhancer: Mix veggie juice with spices and vinegar to make a tasty meat marinade or brush it on BBQ foods. The juice adds moisture, tanginess, and nutrients to grilled dishes while keeping prep simple.

- Shelf-Stable Nutritional Punch: Canned vegetable juice stays fresh long-term and is often more affordable than fresh produce. It ensures a ready supply of nutrients during off-seasons or busy days. Its convenience and price make it ideal for families and busy consumers.

Recent Developments

- In June 2025, Campbell’s introduced a powdered V8 Energy Drink Mix, a new on-the-go version of their vegetable and fruit–based energy drink, with three fruit-forward flavors.

- In June 2025, The Kraft Heinz Company pledged to eliminate all artificial FD&C colors from its U.S. products by the end of 2027. The company will stop launching any new products containing synthetic dyes immediately and gradually replace remaining ones with natural alternatives

- In May 2025, Del Monte announced that nine of its JOYBA® Bubble Tea drinks received Upcycled Certified® status, part of an effort to reduce food waste. These drinks reclaim by-products like vegetable syrup, echoing earlier achievements where their green bean cans gained certification in 2021.

- In February 2025, Ocean Spray launched its first-ever dessert-style juice: Strawberry Shortcake. With flavors like strawberry jam, graham crackers, and whipped cream, this novelty cranberry blend is sold exclusively at Walmart.

- In August 2024, Welch’s introduced a new Zero Sugar juice line in both refrigerated (Passion Fruit and Grape) and shelf-stable (Tropical Punch, Strawberry, and Concord Grape) formats. This move aimed to offer healthier, full-flavor options.

Conclusion

The canned vegetable juice market is experiencing steady growth, driven by increasing health awareness, busy lifestyles, and the demand for convenient, nutritious beverages. Products like tomato juice lead the segment due to their familiarity, health benefits, and versatility. Conventional variants dominate because of their affordability and wide availability, while supermarkets and hypermarkets remain the primary distribution channels, offering accessibility and product variety.

Regionally, Asia-Pacific leads the market, supported by urbanization and changing dietary habits. Overall, canned vegetable juice is well-positioned as a practical, shelf-stable option that caters to health-conscious consumers seeking easy, ready-to-drink solutions in a fast-paced world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)