Table of Contents

Overview

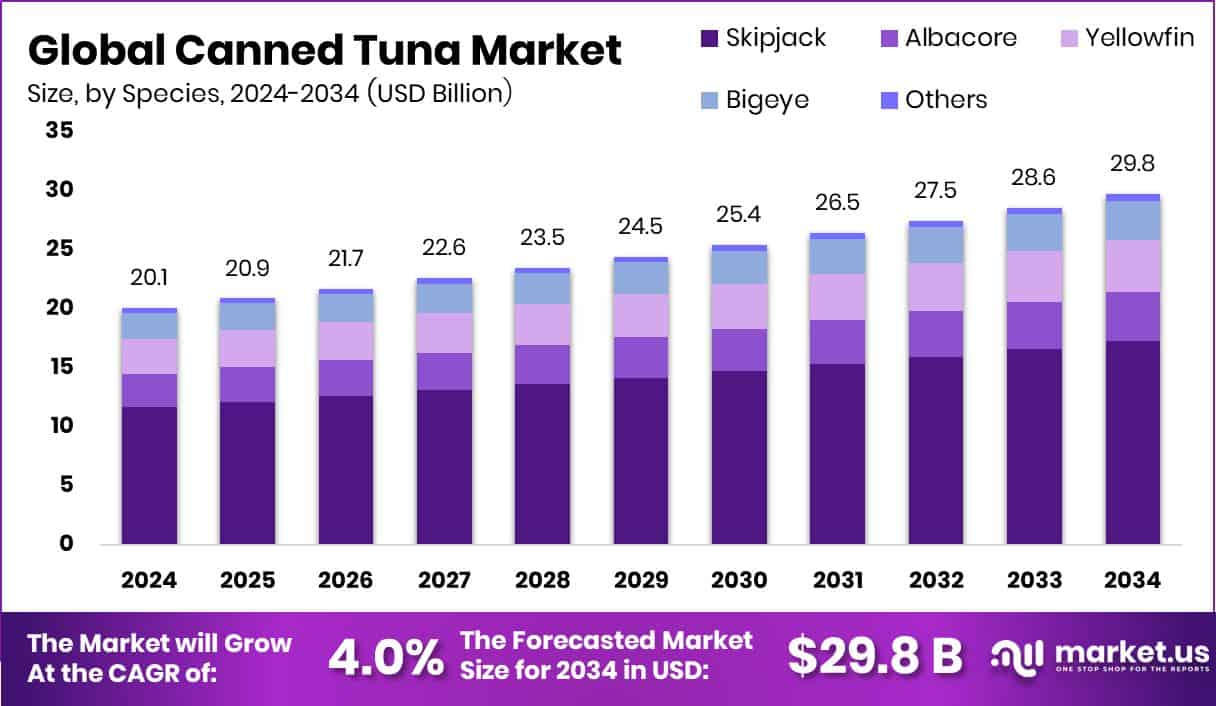

New York, NY – Sep 03, 2025 – The global canned tuna market is poised for steady growth, projected to reach nearly USD 29.8 billion by 2034, rising from USD 20.1 billion in 2024 at a CAGR of 4.0% from 2025 to 2034. Europe leads with a 40.20% share, reflecting strong regional demand. Canned tuna, a convenient and shelf-stable food made from pre-cooked tuna preserved in oil, water, or brine, is widely used in salads, sandwiches, and other dishes. It remains a household staple due to its versatility and nutritional value, being rich in protein, omega-3 fatty acids, and essential vitamins and minerals.

The market consists of various product forms such as chunk, flaked, and solid tuna, meeting different consumer preferences. One of the key drivers of growth is the increasing emphasis on health and wellness. As consumers seek convenient yet nutritious food options, canned tuna stands out as a high-protein, low-calorie solution that fits well into modern dietary habits. Its practicality and ease of storage further contribute to its popularity among diverse consumer segments, including working professionals and health-conscious individuals.

Looking ahead, the canned tuna market offers promising opportunities, especially in areas like innovation and sustainability. Consumer demand is rising for organic and responsibly sourced seafood, encouraging companies to adopt environmentally friendly practices and improve transparency. Brands that invest in sustainable fishing methods, ethical sourcing, and traceable supply chains are expected to gain a competitive edge by appealing to eco-aware customers who value both nutrition and environmental responsibility.

Key Takeaways

- The global canned tuna market is projected to grow from USD 20.1 billion in 2024 to approximately USD 29.8 billion by 2034, with a steady CAGR of 4.0% between 2025 and 2034.

- Skipjack tuna leads the market by species, contributing a dominant 58.40% share.

- Among product types, canned light tuna is the top consumer choice, making up 69.20% of the market.

- Water and brine are the most commonly used preservation mediums, together accounting for 68.30% of the market.

- Flaked tuna holds the largest share by shape, representing 52.40% of total sales.

- Europe remains a key regional market, generating USD 8.0 billion in revenue and holding 40.20% of the global market share.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-canned-tuna-market/free-sample/

Report Scope

| Market Value (2024) | USD 20.1 Billion |

| Forecast Revenue (2034) | USD 29.8 Billion |

| CAGR (2025-2034) | 4.0% |

| Segments Covered | By Species (Skipjack, Albacore, Yellowfin, Bigeye, Others), By Type (Canned White Tuna, Canned Light Tuna), By Preservation Method (Water and Brine, Oil), By Shape (Flakes, Chunks, Fillets, Others) |

| Competitive Landscape | A.E.C. Canning Company Limited, American Tuna Inc., Aneka Tuna Indonesia, Bolton Foods, Bumble Bee Foods LLC, Century Pacific Food Inc., Crown Prince Inc., Dongwon Enterprise Co., Ltd., Frinsa del Noroeste S.A., Golden Prize Canning Co. Ltd., Grupo Albacora SA, Grupo Calvo, Ocean’s, Sea Value PLC, Simplot Australia Pty Ltd, StarKist Co., Thai Union Group PLC, Wild Planet Foods Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145025

Key Market Segments

1. By Species Analysis

- Skipjack tuna leads the canned tuna market, holding a dominant share due to its wide availability, affordability, and mild flavor. Its firm texture and versatility make it ideal for various dishes, from salads to main meals. Skipjack is also favored for its health benefits, being rich in omega-3 fatty acids and having lower mercury content compared to other species. This makes it especially appealing to health-conscious consumers, including those with dietary sensitivities. As demand for nutritious, accessible seafood continues to rise, Skipjack’s strong presence in the market is expected to remain steady, supported by sustainable sourcing and consumer trust.

2. By Type Analysis

- Canned light tuna is the most preferred type, accounting for a significant portion of market demand. Sourced primarily from Skipjack or Yellowfin tuna, it offers a lean and healthy protein option that fits well with low calorie diets. Consumers across various age groups and lifestyles favor light tuna for its mild flavor and nutritional profile, especially those looking for convenient and healthy meal options. Its adaptability in everyday recipes like salads, wraps, or pasta dishes adds to its popularity. As health and convenience remain key priorities, canned light tuna is likely to maintain its strong foothold in the global market.

3. By Preservation Method Analysis

- Water and brine are the leading preservation methods in the canned tuna market, reflecting a clear consumer shift toward cleaner, healthier food choices. These preservation styles help retain tuna’s natural taste and nutrients while avoiding the added calories and fats found in oil-based alternatives. This makes them especially attractive to consumers focused on weight management or heart health. The simple, low-processed nature of tuna in water or brine also resonates with the clean-eating trend, driving its widespread adoption. With growing awareness of healthy eating, this preservation method is expected to remain the go-to choice for many consumers worldwide.

4. By Shape Analysis

- Flaked tuna is the most popular shape format in the canned tuna market, largely due to its convenience and ease of use. It’s especially favored for its ability to blend effortlessly into a wide variety of dishes, such as sandwiches, casseroles, and salads. The flaked form also absorbs sauces and seasonings more effectively, offering a flavorful and consistent eating experience. Its soft, ready-to-use texture appeals to both home cooks and food service providers, making it a reliable choice for quick meals and bulk preparation. This functional versatility ensures its continued dominance in the market across consumer segments.

Regional Analysis

- In 2024, Europe emerged as the leading region in the global canned tuna market, capturing 40.20% of the total market share with a value of USD 8.0 billion. This dominance is supported by a strong demand for convenient, healthy protein sources and the widespread consumption of ready-to-eat seafood across Western Europe. The region’s focus on sustainability and preference for high-quality food products also contribute to its continued leadership.

- North America remains an important market, driven by consistent demand for low-fat, high-protein foods among health-focused consumers and busy professionals seeking quick, nutritious meal solutions. Meanwhile, the Asia Pacific region is experiencing steady growth fueled by urbanization, evolving dietary habits, and a rising preference for Western-style meals.

- In other regions, moderate growth is seen in the Middle East & Africa, thanks to expanding retail distribution and greater awareness of affordable protein-rich foods. Latin America is gradually developing as well, supported by increasing local consumption and improvements in retail infrastructure. Despite growing interest in emerging markets, Europe continues to lead the canned tuna sector in both value and volume, underpinned by economic stability, high consumer purchasing power, and strong demand for sustainable seafood products.

Top Use Cases

- Retailers and Supermarkets: Use market data to plan product assortment, stocking both popular light tuna and pouch formats to meet demand from health-conscious, busy shoppers. Leverage insights like sustainability certifications to create appealing in‑store displays and private label options that drive loyalty and compete with major brands.

- Foodservice & Meal Kit Providers: Tap into canned tuna’s convenience and long shelf life for ready-to-eat meal kits, sandwiches, and salads. Understanding preferences for forms like flaked or flavored tuna helps design appealing, nutritious products that cater to fast-paced consumer lifestyles in catering or quick-service restaurant channels.

- Product Innovators & Brand Managers: Use trend data such as rising demand for flavored and eco-friendly options—to guide R&D. Launch products like organic, flavored, or sustainably sourced tuna in novel packaging (e.g., pouches) to stand out in the market and attract modern, health-conscious shoppers.

- Supply Chain & Sustainability Teams: Apply insights on eco-friendly sourcing and tech adoption to adopt traceability systems, AI-based vessel tracking, or improved packaging processes. This helps ensure compliance, reduce carbon footprint, and enhance brand positioning among environmentally concerned consumers.

- E‑commerce & Direct-to-Consumer (DTC) Platforms: Use online shopping trends to expand reach through digital channels. Offer subscription packs or premium bundles featuring flavored or gourmet tuna, emphasizing convenience and quality. Leverage analytics to personalize recommendations and boost customer retention.

Recent Developments

1. A.E.C. Canning Company Limited

- No publicly available updates or fresh developments related directly to A.E.C. Canning Company Limited were located from government or official company sources. Their online presence remains limited, and recent announcements or expansions—especially in the canned tuna segment cannot be confirmed at this time. Further insights may require direct outreach to the company or review of specialized trade publications for small or regional manufacturers.

2. American Tuna Inc.

- American Tuna Inc. recently appointed Josh as their new General Manager, bringing over 15 years of leadership from sustainable butchery and premium food brands. This leadership change reflects their ongoing commitment to enhancing operational excellence in sustainably sourced, traceable canned tuna offerings. Their website continues to promote transparency, sustainable pole-and-line sourcing, and third-party auditing to uphold product integrity and consumer trust.

3. Aneka Tuna Indonesia (PT. Aneka Tuna Indonesia)

- PT. Aneka Tuna Indonesia, operating under the SunBell brand, continues its long-standing production of canned tuna using technologies developed in partnership with Itochu and Hagoromo Foods. While no new developments were reported, the company maintains a global footprint—supplying markets in Japan, Europe, the Middle East, Australia, and more—anchored by quality and sustainability values like “Safe, Clean, Prime Product Quality, Legal, Authentic.”

4. Bolton Foods (Bolton Group)

- Bolton Foods, part of the broader Bolton Group seafood portfolio, has seen continued prominence following early 2020s growth in canned seafood sales across Europe during the pandemic. The group has sustained its leadership through strategic acquisitions like Tri Marine, expansion of brands such as Rio Mare (including organic MSC-certified tuna), and commitment to more sustainable sourcing policies introduced in recent years.

5. Bumble Bee Foods LLC

- Bumble Bee Foods is facing increasing legal scrutiny over labor practices in its tuna supply chain. In March 2025, Indonesian fishermen filed a lawsuit under the U.S. Trafficking Victims Protection Act, claiming forced labor aboard vessels supplying Bumble Bee. In June 2025, Bumble Bee responded by asking the court to dismiss the case on legal grounds. The company continues to maintain its innocence and uphold traceability efforts, despite mounting external pressure.

Conclusion

The global canned tuna market is showing stable growth, driven by rising demand for convenient, high-protein, and affordable food options. The dominance of skipjack tuna, light tuna varieties, and water or brine preservation methods reflects a clear consumer shift toward healthier eating habits. Europe leads the market due to strong purchasing power and preference for sustainable seafood, while Asia Pacific and Latin America are witnessing emerging demand due to urbanization and changing diets.

Companies like American Tuna and Bolton Foods are emphasizing traceability and sustainability, while legal challenges faced by firms like Bumble Bee Foods highlight growing concerns around ethical sourcing. Moving forward, health awareness, innovation in product offerings, and transparency in supply chains will remain crucial to market expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)