Table of Contents

Introduction

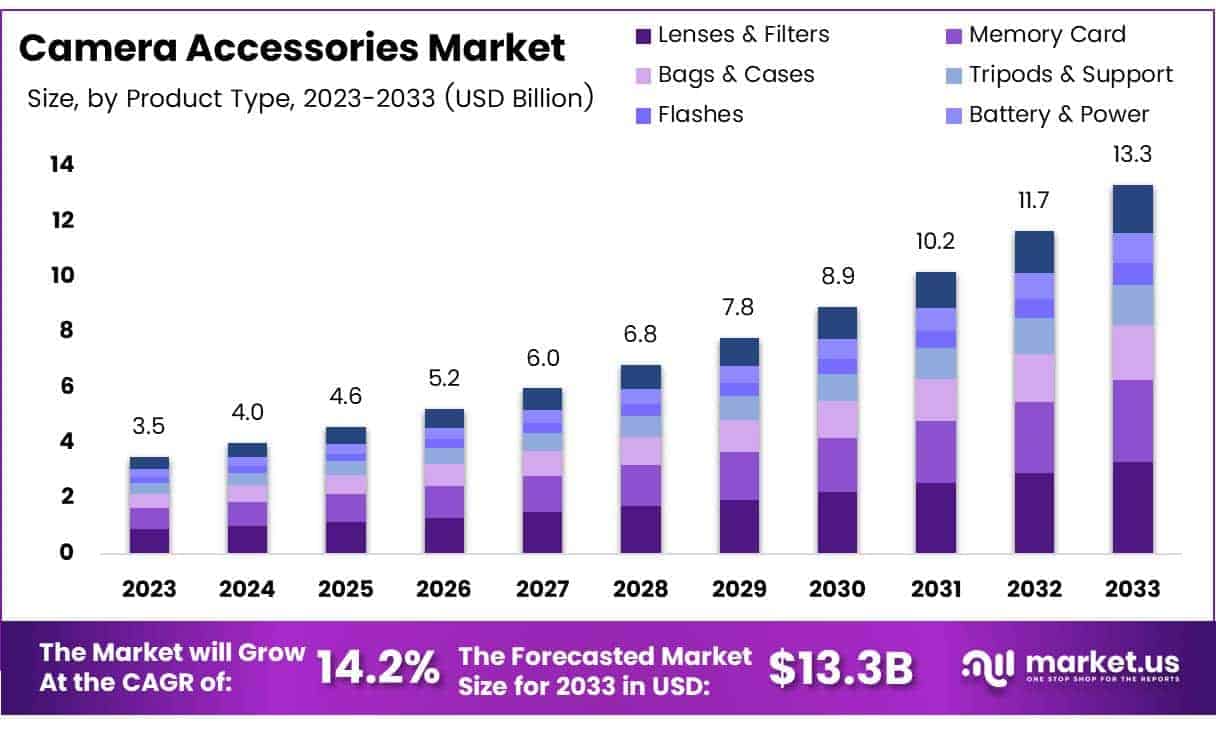

New York, NY – March 18 , 2025 – The Global Camera Accessories Market is anticipated to expand from USD 3.5 billion in 2023 to around USD 13.3 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 14.2% during the forecast period from 2024 to 2033.

Camera accessories encompass a broad range of supplementary equipment designed to enhance the functionality and performance of cameras. This category includes items such as lenses, tripods, bags, memory cards, flash units, and battery packs. The camera accessories market refers to the economic environment surrounding the production, distribution, and sale of these items, catering to both professional photographers and hobbyists seeking to augment their photography experience.

The growth of the camera accessories market can be attributed to several factors. Technological advancements in photography equipment drive the need for compatible accessories that enhance photographic quality and functionality. The increasing popularity of photography as a hobby and profession, fueled by social media platforms and digital marketing, also contributes to rising demand. Additionally, the trend towards high-quality visual content across media channels stimulates continuous investment in camera gear and accessories.

Demand in the camera accessories market is sustained by both emerging and established markets. Consumers in emerging markets are gradually adopting more sophisticated photography practices, contributing to new sales channels, while professional users in developed markets continue to invest in high-end accessories to maintain competitive edge and quality.

Opportunities within the camera accessories market are vast. The shift towards mirrorless cameras, for example, opens new avenues for accessories tailored to these devices. Moreover, the integration of smart technology into camera accessories, such as app-controlled features or accessories enhancing VR and AR experiences, presents significant growth potential. As the market evolves, companies that innovate to meet changing consumer preferences and technological trends are likely to capture greater market share and achieve sustained growth.

Key Takeaways

- The Global Camera Accessories Market is projected to expand from USD 3.5 billion in 2023 to USD 13.3 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 14.2%.

- Lenses & Filters accounted for 25% of the market share in 2023, propelled by increasing demands for enhanced image quality among photography enthusiasts and professionals.

- Folding Cartons dominated the packaging sector within the camera accessories market, attributed to their cost-effectiveness and versatile design capabilities, which enhance product visibility and attractiveness.

- Electronic Stores emerged as the leading sales channel in 2023, providing a wide array of camera accessories that cater to both professional photographers and hobbyists.

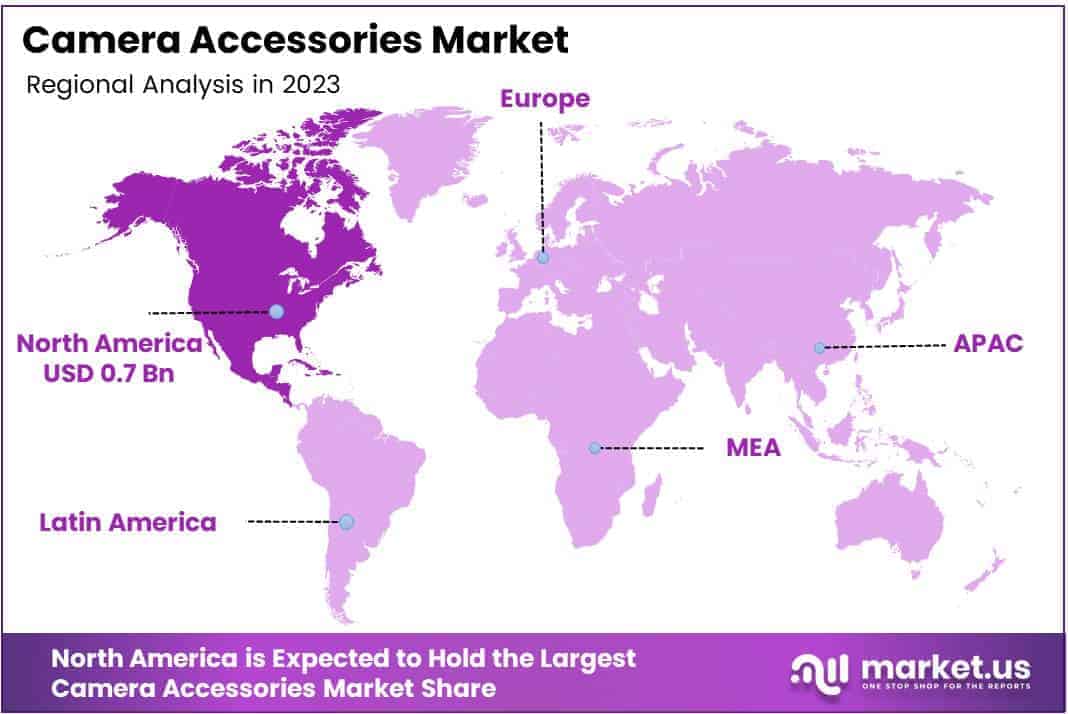

- In 2023, North America captured 22% of the global market, equivalent to USD 0.77 billion, driven primarily by the widespread adoption of advanced photographic equipment in the region.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 3.5 Billion |

| Forecast Revenue (2033) | USD 13.3 Billion |

| CAGR (2024-2033) | 14.2% |

| Segments Covered | By Product Type (Lenses & Filters, Memory Card, Flashes, Bags & Cases, Battery & Power, Tripods & Support, Other), By Packaging Type (Folding Cartons, Trays, Clear View Boxes, Clamshells, Blister Packs, Pouches & Bags), By Price Range (Premium, Mid, Low), By Sales Channel (Electronic Stores, Franchise Outlets, Exclusive Stores, Retail Outlets, E-commerce, Other) |

| Competitive Landscape | Canon Inc., Nikon Corporation, Panasonic Corporation, Sony Corporation, Olympus Corporation, GoPro, Inc., CASIO COMPUTER CO, Fujifilm Holdings Corporation, Leica Camera AG, Samsung GSG, CP-PLUS, Ricoh Imaging Americas Corporation, Vitec Imaging Solutions Spa, Peak Design, RED |

Emerging Trends

- Increased Consumer Awareness: Enhanced understanding of photographic lighting techniques is driving the demand for specialized lighting equipment like ring lights and softboxes.

- Technological Advancements: Continuous innovations, particularly in high-speed memory cards and stabilization tools, cater to advanced photography and videography needs.

- Rise of Content Creation: The growing trend of social media and content creation is significantly influencing the market, with increased demand for accessories that aid in producing high-quality visuals.

- 360-Degree Cameras: There is growing interest in accessories for 360-degree cameras, largely for creating immersive experiences in virtual reality and real estate.

- Digitization and Online Sales: The shift towards digital platforms and the growing preference for online purchases are reshaping distribution channels.

Top Use Cases

- Professional Photography: High-quality lenses, tripods, and lighting equipment remain crucial for commercial photography, including advertising and fashion.

- Hobbyist Photography: Amateurs and hobbyists are investing in mid-range accessories to enhance their photography skills, driven by the ease of sharing on social media.

- Travel and Adventure Photography: Durable and portable accessories like travel tripods and waterproof cases are essential for outdoor and adventure photography.

- Videography: The expanding creator economy is boosting the demand for videography accessories like gimbals and microphones.

- Educational Use: Schools and educational institutions are incorporating more photography into their curricula, requiring basic camera accessories.

Major Challenges

- Competition from Smartphones: The improving quality of smartphone cameras is challenging the demand for traditional camera accessories.

- Economic Fluctuations: Changes in economic conditions can affect consumer spending on non-essential items like camera accessories.

- Market Saturation: High competition among manufacturers may pressure prices and margins.

- Technological Compatibility: Keeping up with rapidly evolving camera technology can be a challenge for accessory manufacturers.

- Environmental Concerns: Increasing consumer preference for sustainable products is pushing companies to innovate with eco-friendly materials.

Top Opportunities

- Innovative Product Development: There is significant potential for growth through the development of accessories that enhance the functionality of advanced camera systems.

- Expansion in Emerging Markets: Asia Pacific and Latin America show promise due to rising disposable incomes and a growing interest in photography and videography.

- E-commerce Growth: Increasing online sales provide opportunities for reaching a broader customer base with targeted marketing and promotions.

- Specialized Accessories for Niches: Targeting niche markets like sports and wildlife photography with specialized products can lead to growth.

- Integration with Mobile Technology: Developing accessories that complement or enhance the use of mobile devices for photography and videography could capture a new customer segment.

Key Player Analysis

In 2024, the global camera accessories market is witnessing a diversified range of contributions from leading players, each enhancing their competitive edges through innovative product offerings and strategic market positioning.

Canon Inc. continues to dominate with its robust portfolio of lenses and photographic accessories, leveraging its longstanding reputation for quality to drive market growth. Nikon Corporation closely competes, focusing on high-performance optical components that appeal to professional photographers. Panasonic Corporation is carving out a niche with accessories optimized for video, reflecting the rising demand for multimedia capabilities.

Sony Corporation is notable for integrating cutting-edge technology into its accessories, enhancing connectivity and automation features that appeal to tech-savvy consumers. Olympus Corporation remains a strong contender by focusing on compact, ergonomic designs that complement their camera systems, especially in medical and scientific photography.

GoPro, Inc. stands out in the action camera segment, continuously innovating with mounts and housing accessories that support rugged and versatile use. CASIO COMPUTER CO., Ltd. caters to casual photographers with affordable, user-friendly accessories that enhance photographic experiences.

Fujifilm Holdings Corporation capitalizes on the retro appeal of its camera lines with matching accessories that are both functional and aesthetic. Leica Camera AG maintains its premium niche with meticulously crafted accessories that promise durability and precision.

Samsung GSG is pushing the envelope in digital imaging with smart accessories that integrate seamlessly with mobile devices, reflecting the convergence of mobile technology and photography. CP-PLUS focuses on enhancing photographic capabilities in security and surveillance, offering specialized accessories that support robust functionality.

Ricoh Imaging Americas Corporation continues to innovate in the field of rugged and outdoor photography, with accessories designed to withstand extreme conditions. Vitec Imaging Solutions Spa offers professional-grade accessories that enhance the functionality and usability of cameras in live production and broadcasting.

Peak Design is gaining traction with its innovative carrying solutions, which are highly appreciated by mobile photographers for their adaptability and sleek design. RED, known for cinema-grade cameras, provides professional filmmakers with high-quality accessories that enhance film production quality.

Top Key Players

- Canon Inc.

- Nikon Corporation

- Panasonic Corporation

- Sony Corporation

- Olympus Corporation

- GoPro, Inc.

- CASIO COMPUTER CO

- Fujifilm Holdings Corporation

- Leica Camera AG

- Samsung GSG

- CP-PLUS

- Ricoh Imaging Americas Corporation

- Vitec Imaging Solutions Spa

- Peak Design

- RED

Regional Analysis

North America Leads the Camera Accessories Market with the Largest Market Share of 22% in 2024

In 2024, the camera accessories market in North America is projected to dominate with a significant market share of 22%, valuing at USD 0.77 billion. This region’s leadership in the market can be attributed to several factors including advanced technological adoption, high consumer spending on electronics, and a strong presence of leading market players that drive innovation and distribution. The robust growth in North America is further supported by the increasing popularity of photography as a hobby and profession, coupled with rising investments in camera technologies and accessories designed to enhance photographic quality and experience.

The market dynamics in North America are indicative of a mature and highly competitive market environment where consumers demand high-quality, innovative products that offer convenience and advanced features. This regional dominance is expected to continue as market players invest heavily in R&D to innovate and capture consumer interest in a rapidly evolving technological landscape.

Recent Developments

- In 2023, FUJIFILM North America Corporation introduced two new tilt-shift lenses tailored for its GFX System mirrorless digital cameras: the FUJINON GF30mmF5.6 T/S and the FUJINON GF110mmF5.6 T/S Macro. These lenses, compatible with the GFX System’s 55mm large-format sensor, are ideal for professional photographers who require precise adjustments for parallax, distortion, and focus.

- On June 10, 2024, Canon unveiled the RF35mm f/1.4L VCM, a prime lens for the RF mount and the debut model to incorporate Canon’s Voice Coil Motor (VCM) AF system. This lens combines the legacy of Canon’s 35mm f/1.4L with advanced features to provide exceptional performance in both video and still photography, making it a standout choice for content creators.

- On February 26, 2024, Sony India launched the Alpha 9 III, a pioneering camera featuring the world’s first full-frame global shutter image sensor. This sensor allows the camera to capture images at a burst rate of up to 120 fps without distortion or blackout. Equipped with Sony’s latest autofocus technology, the Alpha 9 III sets a new standard in professional photography.

- On July 10, 2024, Panasonic Life Solutions India released the LUMIX S9, the most compact and lightweight full-frame mirrorless camera in its LUMIX S Series, tailored for the Indian market. The camera features a 24.2-megapixel CMOS sensor and advanced image stabilization, enhancing its versatility for content creators across various shooting conditions.

- In April 2024, Nikon Corporation announced its acquisition of RED.com, LLC, making RED a wholly owned subsidiary. This acquisition marks a significant expansion of Nikon’s capabilities in digital cinema technology, with RED’s leadership team, including Jarred Land and James Jannard, playing key advisory roles.

- On September 26, 2024, Tamron Co., Ltd. introduced the 90mm F/2.8 Di III MACRO VXD lens, a 1:1 macro lens compatible with Sony E-mount and Nikon Z mount cameras. Scheduled for release on October 24, 2024, this lens promises exceptional close-up performance for professional and enthusiast photographers alike.

Conclusion

The camera accessories market is poised for significant growth, driven by continuous technological advancements and an expanding base of photography enthusiasts and professionals globally. The increasing demand for high-quality visual content across various media channels further boosts the market. As the industry adapts to changing consumer preferences and technological innovations, opportunities abound for companies that innovate and strategically position their products. The rise of mirrorless cameras and the integration of smart technology into camera accessories highlight the market’s dynamic nature, promising substantial development and transformation in the coming years. This evolving landscape presents a fertile ground for strategic investments and innovative product development to meet the sophisticated needs of modern consumers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)