Table of Contents

Overview

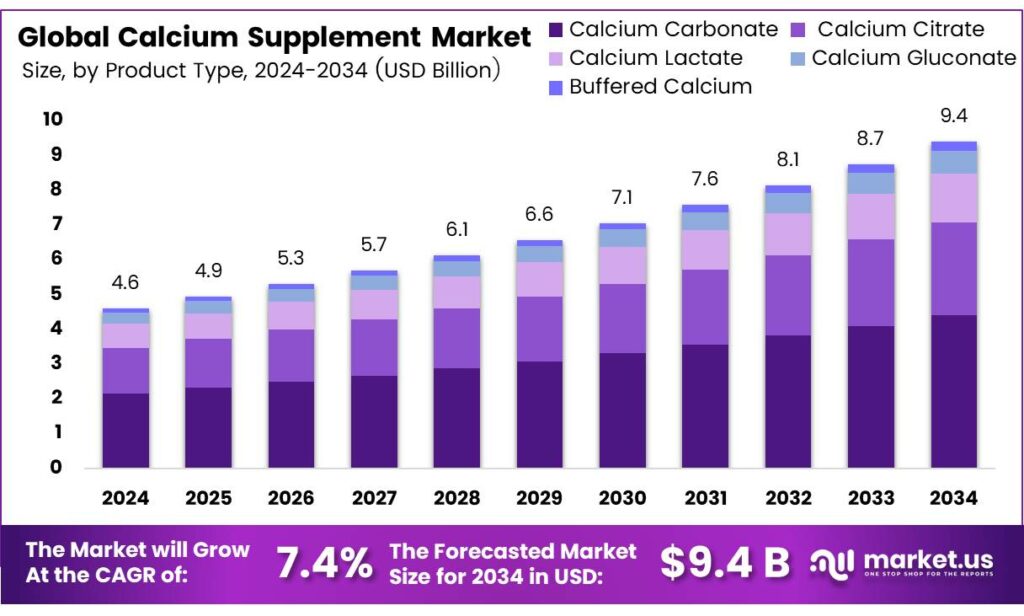

New York, NY – September 19, 2025 – The Global Calcium Supplement Market is projected to reach around USD 9.4 billion by 2034, growing from USD 4.6 billion in 2024 at a CAGR of 7.4% between 2025 and 2034. This growth is being driven by rising awareness of bone health, aging populations, and dietary gaps that make supplementation an essential choice for many individuals.

Calcium plays a central role in maintaining strong bones and overall health throughout life. While a balanced diet remains the best source of calcium, supplements are often used when food intake does not meet the body’s needs. Before choosing a supplement, it is important to understand the body’s calcium requirements, the benefits and risks of supplementation, and the different types of products available.

Daily calcium requirements vary based on age and gender. Men between 19 and 70 years generally need 1,000 mg per day, while men aged 71 and older should increase their intake to 1,200 mg. For women, the recommended intake is also 1,000 mg per day between ages 19 and 50, rising to 1,200 mg after the age of 51. To prevent health issues from overconsumption, the upper daily intake limit has been set at 2,500 mg for adults aged 19 to 50 and 2,000 mg for those 51 and older.

Calcium supplements come in several forms, with each compound offering different levels of elemental calcium—the portion actually absorbed by the body. Calcium carbonate, containing 40% elemental calcium, is one of the most cost-effective and widely used options. Calcium citrate (21% elemental calcium) is also popular due to its high absorption rate, while other forms, such as calcium gluconate (9%) and calcium lactate (13%), are available in specialized products.

Many supplements are fortified with additional nutrients like vitamin D or magnesium, which support calcium absorption and provide added health benefits. Checking the ingredient list is therefore essential, particularly for individuals with specific dietary needs or health conditions. Understanding the amount of elemental calcium is equally important for proper dosing.

Key Takeaways

- The Global Calcium Supplement Market is expected to reach USD 9.4 billion by 2034 from USD 4.6 billion in 2024, growing at a 7.4% CAGR.

- Calcium Carbonate held a 46.9% market share in 2024 due to high elemental calcium and cost-effectiveness.

- Tablets dominated with a 58.2% share in 2024, favored for ease of use and accurate dosing.

- Pharmacies led distribution with a 39.4% share in 2024, trusted for reliable supplement guidance.

- Asia-Pacific accounted for 38.8% of market revenue (USD 1.7 billion) in 2024, driven by health awareness and demographics.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-calcium-supplement-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.6 Billion |

| Forecast Revenue (2034) | USD 9.4 Billion |

| CAGR (2025-2034) | 7.4% |

| Segments Covered | By Product Type (Calcium Carbonate, Calcium Citrate, Calcium Lactate, Calcium Gluconate, Buffered Calcium), By Formulation Type (Tablets, Powders, Syrup), By Distribution Channel (Pharmacies, Online Retail, Supermarkets and Hypermarkets, Health and Wellness Store, Others) |

| Competitive Landscape | Pfizer (Caltrate), AandZ Pharmaceutical, Amway (Nutrilite), Nature Made, GSK, GNC Holdings Inc, Bio Island, Nature’s Bounty |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156825

Key Market Segments

By Product Type

Calcium Carbonate Commands 46.9% Market Share

In 2024, calcium carbonate solidified its leading position in the global calcium supplement market, holding a 46.9% share. Its dominance is driven by its high elemental calcium content, offering a cost-effective option for both manufacturers and consumers. Available in tablets, chewables, and powders, calcium carbonate appeals to a wide range of age groups. Its affordability makes it a preferred choice in both developing and developed regions.

Increased awareness of bone health and osteoporosis prevention, particularly among aging populations, further boosts its demand. As calcium carbonate is best absorbed with food, it aligns well with consumer dietary habits, supporting its widespread use. With growing emphasis on preventive healthcare and daily calcium intake recommendations, demand is expected to remain strong.

By Formulation Type

Tablets Hold 58.2% Market Share

Tablets led the calcium supplement market in 2024, capturing a 58.2% share. Their popularity stems from ease of use, precise dosing, and widespread consumer trust. Cost-efficient to produce and distribute, tablets are widely available in pharmacies, supermarkets, and online platforms.

They are particularly favored for their convenience and consistent calcium delivery, supporting bone and joint health. Rising awareness of osteoporosis, especially among women over 50, has driven tablet demand. Their compact, travel-friendly nature and standardized formulation make them a top choice among healthcare professionals and consumers. Tablets are expected to maintain their dominance in 2025, particularly in regions with low dietary calcium intake.

By Distribution Channel

Pharmacies Lead with 39.4% Share

Pharmacies dominated the calcium supplement market in 2024, accounting for a 39.4% share. Their strong position is due to consumer trust in pharmacists for guidance on dosage, product selection, and safe supplement use. Pharmacies are a go-to channel for older adults and those with bone health concerns, offering both branded and generic options.

The rising prevalence of osteoporosis and calcium deficiencies has driven consumers to seek professional advice, reinforcing pharmacies’ role. Their accessibility and credibility, especially in rural and semi-urban areas where online platforms are less prevalent, ensure continued dominance. Pharmacies remain a vital distribution channel as consumers prioritize safety and authenticity.

Regional Analysis

Asia-Pacific Leads with 38.8% Share, USD 1.7 Billion

The Asia-Pacific (APAC) region held a leading 38.8% share of the global calcium supplement market, generating approximately USD 1.7 billion in revenue. This dominance is driven by a rapidly aging population in countries like China, Japan, and India, and increasing demand for bone health products. Rising disposable incomes in emerging economies such as India, Indonesia, and Vietnam have fueled spending on preventive healthcare.

Growing health awareness, supported by government campaigns addressing nutritional deficiencies, has further boosted demand. A cultural preference for dietary supplements, combined with a robust distribution network of pharmacies, e-commerce, and direct-selling channels, ensures high accessibility and sustains APAC’s market leadership.

Top Use Cases

- Bone Health Support: Calcium supplements are widely used to strengthen bones and prevent conditions like osteoporosis, especially in older adults. They help maintain bone density, reducing the risk of fractures. Taken daily, they support skeletal health, particularly for women post-menopause and elderly individuals with low dietary calcium intake.

- Dental Health Maintenance: Calcium supplements promote strong teeth by supporting enamel and dentin health. They are popular among people with calcium-deficient diets, helping prevent tooth decay and gum issues. Regular use ensures teeth remain resilient, especially for children and adults prone to dental problems.

- Muscle Function Enhancement: Calcium supplements aid muscle contraction and relaxation, benefiting active individuals and athletes. They help prevent cramps and support smooth muscle function. People with low calcium levels use them to improve physical performance and reduce muscle fatigue during exercise.

- Cardiovascular Health Support: Calcium supplements may contribute to heart health by aiding proper blood vessel function and heart muscle activity. They are used by individuals at risk of calcium deficiency to support overall cardiovascular wellness, ensuring steady heart rhythms and healthy blood pressure levels.

- Pregnancy and Lactation Support: Pregnant and breastfeeding women use calcium supplements to meet increased calcium needs for fetal bone development and maternal health. They help prevent bone loss in mothers and ensure healthy growth in babies, making them a key part of prenatal care routines.

Recent Developments

1. Pfizer (Caltrate)

Pfizer’s primary recent development is the strategic spin-off and merger of its Upjohn division, which included Caltrate, with Mylan to form Viatris. This move has refocused Pfizer on innovative medicines, while Viatris now manages the Caltrate brand. The focus for Caltrate under Viatris remains on maintaining its market position with trusted bone health formulas, though major new product innovations have been limited post-transaction.

2. AandZ Pharmaceutical

AandZ Pharmaceutical focuses on manufacturing high-quality, cost-effective supplements, including various calcium carbonate and citrate forms. A key development is their expansion in B2B and private-label manufacturing, supplying calcium and other ingredients to other brands. They emphasize stringent quality control and GMP certification to meet growing market demand for reliable contract manufacturing, rather than consumer-facing brand innovation.

3. Amway (Nutrilite)

Nutrilite by Amway emphasizes traceability and plant-based nutrition. Their development focus is on the Nutrilite Cal Mag D product, which sources calcium from algae (Algas calcareas). Recent initiatives highlight their sustainable sourcing practices and the brand’s Seed to Supplement promise, using traceability technology to show consumers the origin and purity of the natural calcium used in their supplements.

4. Nature Made

Nature Made, a Pharmavite brand, continues to lead with consumer education and third-party verification. A significant development is their extensive use of the USP Verified Mark on products like Calcium With D3, assuring potency and purity. They focus on research-backed formulations and digital campaigns to educate on bone health, reinforcing their position as a trusted, science-backed pharmacist-recommended brand in the calcium supplement space.

5. GSK

GSK Consumer Healthcare, which included Caltrate competitor Os-Cal, was recently demerged and merged with Pfizer’s consumer health business to form a new standalone company, Haleon. This major corporate shift means legacy GSK calcium products are now under Haleon’s portfolio. The focus is on integrating brands and supply chains, with product-specific innovations taking a backseat to the large-scale business integration.

Conclusion

Calcium supplements play a vital role in addressing diverse health needs, from strengthening bones and teeth to supporting muscle and heart function. Their widespread use across age groups, especially among women, the elderly, and pregnant individuals, highlights their importance in preventive healthcare. As awareness of nutritional deficiencies grows, demand for calcium supplements is expected to rise, driven by their accessibility and health benefits.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)