Table of Contents

Overview

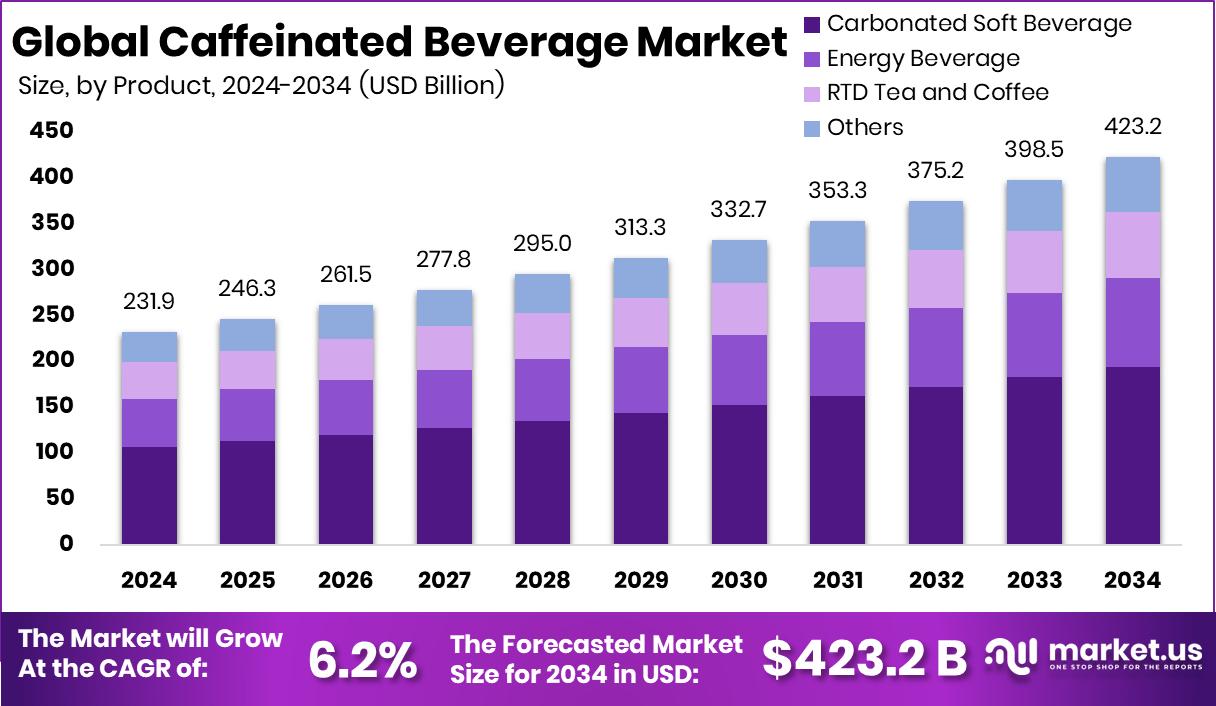

New York, NY – October 07, 2025 – The Global Caffeinated Beverage Market is projected to reach USD 423.2 billion by 2034, rising from USD 231.9 billion in 2024, at a CAGR of 6.2% from 2025 to 2034. North America led the global market with a 34.8% share, generating USD 80.7 billion in revenue from caffeinated beverages.

Caffeinated beverages include drinks like coffee, tea, energy drinks, and sodas, each containing caffeine, a natural stimulant derived from coffee beans, tea leaves, or cacao. These beverages not only offer energy and alertness but have also become deeply rooted in cultural and social traditions across many regions, serving as part of everyday routines.

The market’s growth is fueled by changing lifestyles, increasing demand for instant energy solutions, and widespread product availability. Investments and startup funding are enhancing innovation and expansion. For instance, Artha Venture Fund invested ₹1.25 crore in Haazri, a tea startup, while Chai Kings secured $3 million to scale its retail presence, reflecting strong investor confidence in the beverage sector.

In addition, ethical sourcing and community-based production models are gaining attention. Croft Beverages, for example, raised $125,000 in pre-seed funding to support small tea farmers, aligning with consumer preferences for transparency and sustainability. On the industrial side, Ontario’s $33.4 million investment in Mississauga manufacturing is strengthening local supply chains and boosting production efficiency.

Rising disposable incomes, urbanization, and a growing youth demographic continue to energize this market. With increasing product diversification and innovative caffeine alternatives, the caffeinated beverage industry is poised for steady, sustainable global expansion.

Key Takeaways

- The Global Caffeinated Beverage Market is expected to be worth around USD 423.2 billion by 2034, up from USD 231.9 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, Carbonated Soft Beverages captured a 45.8% share in the Caffeinated Beverage Market globally.

- Supermarkets and hypermarkets led distribution with a 37.2% share, making them dominant channels for the Caffeinated Beverage Market.

- Strong consumer demand in North America drove caffeinated beverage sales to 34.8%, totaling USD 80.7 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/caffeinated-beverage-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 231.9 Billion |

| Forecast Revenue (2034) | USD 423.2 Billion |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Product (Carbonated Soft Beverage, Energy Beverage, RTD Tea and Coffee, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, Online Retail, Specialty Store, Others) |

| Competitive Landscape | Dr Pepper Snapple Group, Monster Beverage Corporation, PepsiCo, Inc., Red Bull GmbH, 5-hour ENERGY, Rockstar, Inc., The Coca-Cola Company, Starbucks Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158365

Key Market Segments

By Product Analysis

In 2024, Carbonated Soft Beverages led the caffeinated beverage market, capturing a 45.8% share in the product segment. Their popularity stems from refreshing, fizzy flavors and convenient, ready-to-drink formats that appeal to a wide audience. Affordable and widely available in urban and rural areas, these drinks are driven by youth trends and café culture. Ongoing innovations in flavors and expanded production facilities ensure carbonated soft beverages maintain strong consumer loyalty and continue to drive market growth.

By Distribution Channel Analysis

In 2024, supermarkets and hypermarkets dominated the caffeinated beverage market’s distribution channel segment with a 37.2% share. Their success comes from offering diverse products, appealing discounts, and the convenience of one-stop shopping. These outlets enhance product visibility through strategic placement and seasonal promotions, boosting sales. With urbanization and the growth of large retail chains in both developed and emerging markets, supermarkets and hypermarkets remain the top channel for caffeinated beverage distribution.

Regional Analysis

In 2024, North America dominated the caffeinated beverage market, holding a 34.8% share valued at USD 80.7 billion. This leadership stems from robust demand for carbonated soft drinks and energy beverages, fueled by high disposable incomes, a well-developed retail infrastructure, and an entrenched caffeine consumption culture, especially among working professionals and younger consumers.

Europe shows consistent growth, with health-conscious consumers favoring tea and coffee-based caffeinated drinks. The Asia Pacific region offers substantial growth opportunities, driven by rapid urbanization and a young demographic embracing modern beverage trends.

In the Middle East & Africa and Latin America, the market is expanding due to increasing awareness of functional beverages and improved access through growing supermarket and hypermarket networks. North America, however, maintains its leading position through a strong consumer base, prominent brand presence, and continuous product innovation.

Top Use Cases

- Morning Boost: Many people start their day with a cup of coffee or tea to shake off sleepiness and feel more awake. The caffeine helps kickstart the brain, making it easier to tackle daily tasks like getting ready for work or school. This simple habit improves focus and energy levels right from the morning routine, supporting a productive start without needing extra stimulants.

- Alertness at Work: Professionals often sip caffeinated drinks during office hours to stay sharp and handle meetings or deadlines. It enhances concentration and quick thinking, reducing the mid-day slump. This use case fits busy lifestyles where mental clarity is key, helping users maintain high performance throughout demanding workdays.

- Fitness Enhancement: Athletes and gym-goers drink energy beverages before workouts to boost stamina and endurance. Caffeine stimulates the body to burn fat for fuel and delays fatigue, allowing longer and more intense exercise sessions. It’s a popular choice for those aiming to improve physical results in sports or daily fitness activities.

- Social Enjoyment: Friends gather at cafes for coffee chats, turning caffeinated drinks into a fun social ritual. The mild buzz adds to lively conversations and relaxation without alcohol. This everyday application strengthens bonds and creates enjoyable moments, blending taste with a subtle energy lift in casual settings.

- Study Aid: Students use caffeinated sodas or teas while cramming for exams to heighten memory recall and reaction times. It fights drowsiness during late-night sessions, aiding better retention of information. This practical tool supports academic success by keeping young minds engaged and alert during intense learning periods.

Recent Developments

1. Dr Pepper Snapple Group (Keurig Dr Pepper)

Keurig Dr Pepper is aggressively expanding its energy portfolio. A key recent development is the successful national launch of Celsius Energy, which it now owns and distributes in the U.S. This move, alongside the growth of its existing brands like Core Power and the partnership with Nutrabolt (C4 Energy), strategically positions KDP to capture significant market share in the high-growth energy drink category, directly competing with Monster and Red Bull.

2. Monster Beverage Corporation

Monster continues to innovate with new product lines and strategic extensions. Recent developments include the launch of Monster Juice Monarch, a papaya and orange juice flavor, and the expansion of its alcohol segment with The Beast Unleashed, a flavored malt beverage. Furthermore, Monster is focusing on its “premium” coffee line with launches like Java Monster Farmer’s Oats, an oatmeal cookie flavor, catering to diverse consumer taste preferences across multiple beverage categories.

3. PepsiCo, Inc.

PepsiCo is heavily investing in its energy and functional beverage portfolio. A major recent move is the complete rebranding and reformulation of its Mtn Dew Energy line with new flavors and zero-sugar options to better compete. Simultaneously, the company is expanding its Rockstar Energy brand with focused innovations like the “Recovery” series with electrolytes. PepsiCo is also leveraging its partnership with Bang Energy to distribute and potentially acquire the brand.

4. Red Bull GmbH

Red Bull’s recent developments focus on brand experiences and strategic flavor innovation. The company continues to host global events like the Red Bull Cliff Diving World Series to reinforce its “gives you wings” image. In products, it has expanded its flavor portfolio with offerings like Red Bull Juneberry and the summer edition Red Bull Amber Edition, which is a raspberry and apricot flavor. This maintains its premium positioning while attracting new consumers.

5. 5-hour ENERGY

5-hour ENERGY continues to focus on innovation within the shot format while expanding into new categories. Recent developments include the launch of 5-hour ENERGY Extra Strength for a more potent boost and the introduction of 5-hour ENERGY Heat, a caffeinated energy shot with capsaicin for a “thermogenic” experience. The brand is also targeting the hydration space with its new 5-hour ENERGY Hydration line, which includes electrolytes and B vitamins.

Conclusion

The Caffeinated Beverage market thrives on shifting consumer tastes toward healthier, natural options like low-sugar energy drinks and functional blends with added wellness benefits. As lifestyles grow busier, demand rises for convenient, innovative products that offer quick boosts while aligning with wellness trends. Companies innovating in sustainable sourcing and personalized flavors will lead this evolving landscape, capturing loyal fans seeking both refreshment and vitality in daily routines.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)