Table of Contents

Overview

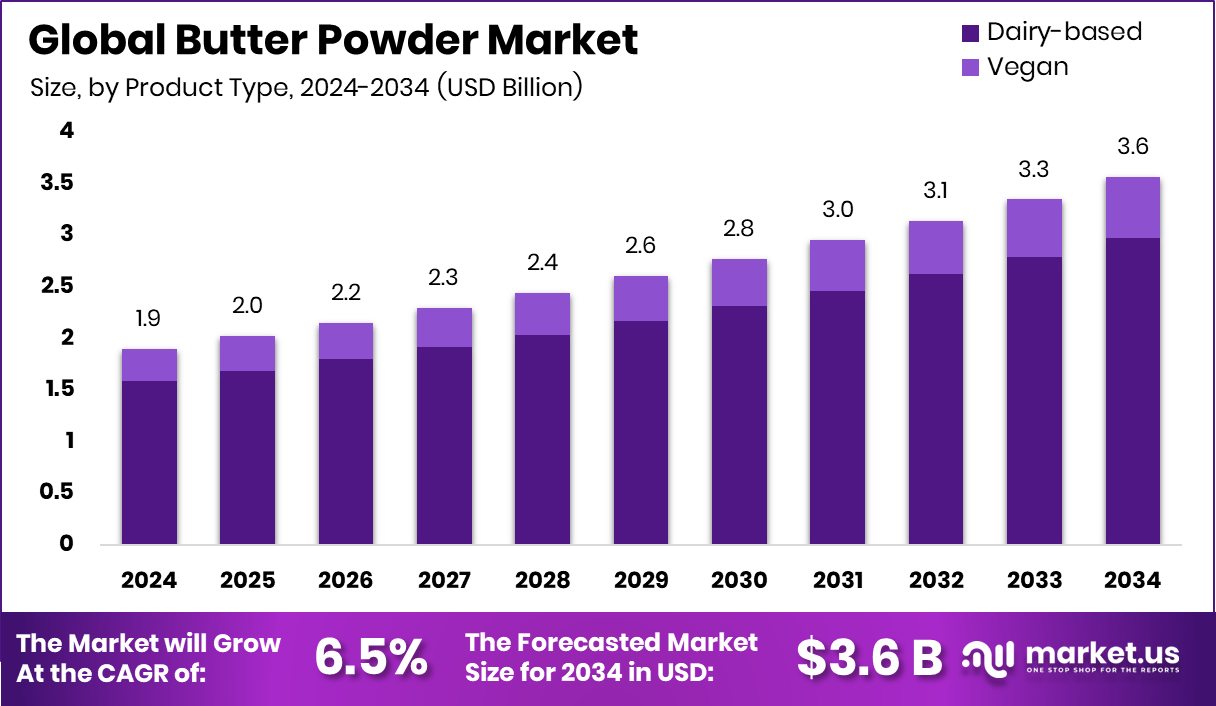

New York, NY – August 12, 2025 – The Global Butter Powder Market is projected to reach USD 3.6 billion by 2034, rising from USD 1.9 billion in 2024, with a CAGR of 6.5% from 2025 to 2034. North America leads the market with a 46.2% share, driven by strong demand from the food processing industry.

Butter powder is a dehydrated version of traditional butter, produced by removing moisture often through spray drying, while retaining its natural flavor and fat content. This process results in a fine, yellowish powder that offers a long shelf life, easy storage, and simplified transportation compared to regular butter. It can be reconstituted with water or incorporated directly into recipes, making it highly valued in bakery mixes, snacks, ready-to-eat meals, and food manufacturing.

The market encompasses global production, trade, and use of powdered butter across bakery, dairy, convenience food, and processed food sectors. It is especially beneficial for manufacturers seeking stable butter ingredients without refrigeration. Growth is being fueled by rising demand for long-lasting dairy products, expanding packaged food varieties, and the convenience of dry ingredients for consistent taste and texture.

Butter powder’s popularity is surging in bakery and confectionery applications, pancake and sauce mixes, snack coatings, and large-scale catering, where its solubility and smooth rehydration provide efficiency and quality. Additionally, innovations such as plant-based and zero-waste butter alternatives are shaping future market opportunities.

Key Takeaways

- The Global Butter Powder Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- In 2024, dairy-based butter powder led the market with 83.4% due to its wide industrial usage.

- Conventional butter powder captured 78.1% of the market in 2024, dominating due to cost-effectiveness.

- Baked goods accounted for 32.8% of butter powder use, reflecting high usage in mixes and pastries.

- North America recorded a market value of USD 0.8 billion in 2024 alone.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-butter-powder-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.9 Billion |

| Forecast Revenue (2034) | USD 3.6 Billion |

| CAGR (2025-2034) | 6.5% |

| Segments Covered | By Product Type (Dairy-based, Vegan), By Nature (Organic, Conventional), By Application (Baked Goods, Dairy Products, Dry Beverage Mix, Confectionery, Snack Food, Breakfast Cereals, Dietary Supplements, Sports Nutrition, Others) |

| Competitive Landscape | Agropur Dairy Cooperative, Arla Foods amba, Dairy Farmers of America, Inc., Fonterra Co-operative Group Limited, Garden of Life, Glanbia plc, Kraft Heinz Company, Lactalis Group, Laita, Land O’Lakes, Inc., Nestlé S.A. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154134

Key Market Segments

By Product Type Analysis

In 2024, dairy-based butter powder led the market with an 83.4% share, reflecting its strong acceptance in food sectors where authentic butter flavor, natural fat content, and a rich mouthfeel are essential. This variant closely replicates the taste of fresh butter while offering a longer shelf life and easier storage.

Baking, processed food, and instant meal manufacturers favor dairy-based butter powder for its reliability in dry formulations and its stability under high-heat processing, where fresh butter may not be suitable. Its dominance is expected to continue as large-scale food producers seek consistent, high-quality dairy ingredients.

By Nature Analysis

The conventional butter powder segment captured a 78.1% share in 2024, driven by its affordability, wide availability, and dependable performance across varied food applications such as baking mixes, sauces, ready meals, and dairy blends. It remains the preferred choice for large-scale manufacturers and institutional buyers prioritizing cost efficiency and supply chain stability. Conventional variants offer long shelf life without compromising flavor or texture, making them a practical choice for mass production.

By Application Analysis

Baked goods accounted for 32.8% of the butter powder market in 2024, underscoring their critical role in bakery products such as bread, cakes, cookies, pastries, and dry mixes. Butter powder’s ability to blend seamlessly with dry ingredients, deliver rich flavor, and extend shelf stability makes it a preferred choice for commercial bakeries and packaged food producers. Its powder form simplifies dosing, reduces waste, and eliminates the need for refrigeration, supporting large-scale production and wide distribution.

Regional Analysis

North America dominated the global butter powder market in 2024 with a 46.2% share, valued at USD 0.8 billion. This leadership is fueled by high consumption of processed and packaged foods, coupled with a robust food processing industry that values shelf-stable dairy ingredients.

The region benefits from advanced production infrastructure, strong supply chain networks, and a preference for convenient, long-lasting products. North America’s role as both a key producer and consumer solidifies its position as the central hub for butter powder in the global market.

Top Use Cases

- Bakery Products: Butter powder is widely used in bread, cakes, cookies, and pastries because it blends easily with dry ingredients and delivers the rich flavor of butter without refrigeration. Its long shelf life and consistent quality make it a top choice for industrial bakeries producing large volumes of goods.

- Instant and Ready-to-Eat Meals: In convenience foods like pasta, soups, and instant mashed potatoes, butter powder offers the taste and fat content of butter while simplifying storage and transportation. It helps maintain flavor consistency across batches and eliminates the need for cold-chain logistics in large-scale meal production.

- Snack Coatings: Butter powder is often used in popcorn, chips, and nut coatings to provide a buttery taste with minimal preparation. Its dry form allows even distribution, making it easier for manufacturers to achieve consistent flavor while avoiding the mess and spoilage risks associated with fresh butter.

- Sauce and Seasoning Mixes: In powdered sauces, gravies, and spice blends, butter powder adds depth of flavor and creaminess without adding moisture. This ensures the product remains stable during storage while rehydrating quickly during cooking, making it a reliable choice for both retail and foodservice seasoning products.

- Institutional and Catering Services: Large-scale catering operations and institutional kitchens use butter powder for its ease of storage, portion control, and ability to maintain quality over time. It supports high-volume cooking where refrigeration space is limited and consistent flavor is essential for customer satisfaction.

Recent Developments

1. Agropur Dairy Cooperative

Agropur has expanded its butter powder offerings to meet rising demand in the bakery and convenience food sectors. Their latest product features improved solubility and extended shelf life, catering to industrial clients. Agropur emphasizes sustainable sourcing and clean-label ingredients.

2. Arla Foods amba

Arla Foods introduced a new organic butter powder under its “Arla Foods Ingredients” line, targeting health-conscious consumers. The product is rich in healthy fats and free from additives. Arla is also investing in R&D for lactose-free butter powder variants.

3. Dairy Farmers of America, Inc. (DFA)

DFA launched a high-protein butter powder for sports nutrition and functional foods. Their product enhances flavor and texture in protein shakes and snacks. DFA is collaborating with food manufacturers to innovate in the dairy ingredients space.

4. Fonterra Co-operative Group Limited

Fonterra’s “NZMP Butter Powder” now includes a heat-stable variant for processed foods and confectionery. The company is focusing on sustainable production and has reduced carbon emissions in its butter powder processing plants.

5. Garden of Life

While primarily known for plant-based products, Garden of Life has introduced a grass-fed organic butter powder as part of its “Raw Organic” line. The product is non-GMO and designed for keto and paleo diets.

Conclusion

The Butter Powder Market is growing steadily as demand for long-lasting, easy-to-use dairy ingredients rises across bakery, snacks, ready meals, and catering. Its extended shelf life, consistent taste, and storage convenience make it a valuable alternative to fresh butter in large-scale food production. With evolving consumer trends and expanding packaged food markets, butter powder is set to remain an essential ingredient in global food manufacturing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)