Table of Contents

Overview

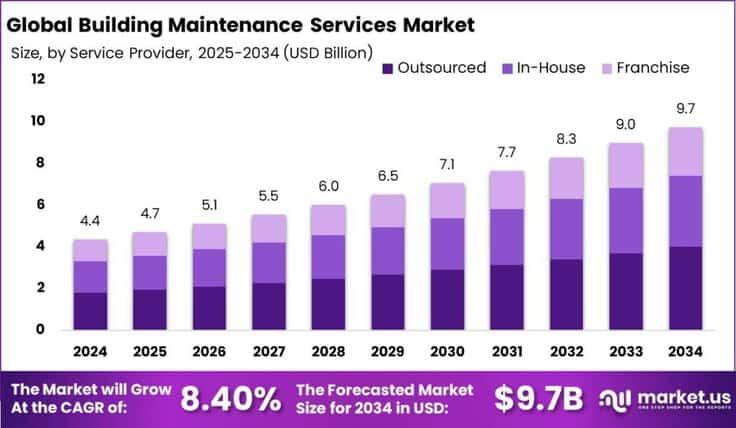

New York, NY – Aug 11, 2025 – The global Building Maintenance Services Market is projected to grow from USD 4.35 billion in 2024 to approximately USD 9.7 billion by 2034, registering a compound annual growth rate (CAGR) of 8.40% during the forecast period from 2025 to 2034. In 2024, North America led the market, accounting for over 34% of the global share and generating around USD 1.4 billion in revenue.

Building Maintenance Services involve a comprehensive range of activities designed to ensure the optimal functionality, safety, and efficiency of buildings and their surroundings. These services include routine cleaning, repairs, HVAC maintenance, electrical and plumbing work, landscaping, and pest control. The primary goal is to prevent structural degradation while creating a safe, efficient, and visually appealing environment for occupants.

The demand for building maintenance services has significantly increased due to the growing emphasis on sustainability and energy efficiency. Property owners and facility managers are taking a more proactive approach to building upkeep, aiming to extend the life of their assets and comply with increasingly stringent environmental standards.

Several key factors are fueling the market’s growth. Rising awareness about sustainable practices and the need to improve energy performance are driving demand for services that enhance building efficiency. Additionally, aging infrastructure, particularly in urban settings, requires ongoing maintenance to ensure safety and operational reliability.

A notable trend contributing to market expansion is the increasing tendency of businesses and residential complexes to outsource maintenance services. This allows them to concentrate on core functions while relying on specialized providers for facility upkeep. Furthermore, advancements in building technologies have increased the complexity of modern systems, boosting the need for skilled maintenance professionals.

Technological integration is reshaping the industry, with smart technologies and IoT playing a pivotal role. These innovations enable predictive maintenance, allowing for early detection and resolution of potential issues, thereby reducing downtime and improving operational efficiency.

Opportunities for market growth also lie in the adoption of eco-friendly cleaning products and sustainable practices, as clients increasingly prioritize environmentally responsible services. Additionally, services that address occupant wellness such as enhanced indoor air quality and optimized natural lighting are gaining traction.

As building regulations and tenant expectations evolve, the demand for high standards in cleanliness, functionality, and public health compliance continues to rise. Combined with the increasing sophistication of building systems, this creates strong momentum for the continued growth of the Building Maintenance Services market.

Key Takeaways

- The global Building Maintenance Services market is projected to grow from USD 4.35 billion in 2024 to approximately USD 9.7 billion by 2034, registering a CAGR of 8.40% during the forecast period (2025-2034).

- In 2024, the Interior Building Cleaning segment led the market, accounting for over 22% of the total share.

- The Commercial Building segment emerged as the dominant end-user category in 2024, capturing more than 34% of the market.

- Facility Management Companies held the leading position among service providers, commanding over 40% of the market share in 2024.

- The Outsourced Services segment accounted for the largest share of the market in 2024, contributing more than 41%.

- North America led the global market in 2024, securing over 34% of the total market share and generating approximately USD 1.4 billion in revenue.

- The U.S. Building Maintenance Services market alone was valued at USD 1.4 billion in 2024 and is expected to grow at a CAGR of 5.3%.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/building-maintenance-services-market/free-sample/

Report Scope

| Market Value (2024) | USD 4.3 Bn |

| Forecast Revenue (2034) | USD 9.7 Bn |

| CAGR (2025-2034) | 8.40% |

| Segments Covered | By Type (Landscaping, Interior Building Cleaning, Pest Control, Exterior Building Cleaning, Street & Parking Lot Cleaning, Maintenance, Swimming Pool Cleaning, HVAC Maintenance, Elevator Maintenance, Security Services, Others), By Application (Residential Building, Commercial Building, Hotels and Resorts, Healthcare, Education, Others), By End-User (Facility Management Companies, Property Owners/Managers, Government Organizations, Outsourced Service Providers, Others), By Service Provider (In-House, Outsourced, Franchise) |

| Competitive Landscape | Akrobat Pte Ltd., Alimak Group, Andrew Engineering., FBA Gomyl, Heightsafe Systems Limited, Jomy, NSS Group, Power Climber, Sky Rider Equipment Inc, Workplace Access Safety, Zarafa Group Ltd, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144564

Key Market Segments

Type Analysis

In 2024, the Interior Building Cleaning segment emerged as the leading category in the Building Maintenance Services market, accounting for over 22% of the total share. This strong performance is largely driven by the increasing trend of outsourcing cleaning services, as businesses and residential complexes look to streamline operations by relying on external professionals. This approach allows organizations to focus on core activities while ensuring high-quality cleanliness standards are maintained.

Technological innovation has played a significant role in boosting this segment. The adoption of automated cleaning tools, environmentally friendly cleaning agents, and advanced scheduling software has enhanced both efficiency and service quality, making professional cleaning services more appealing than traditional in-house options.

Additionally, stricter hygiene and safety regulations across various industries have led to a rise in demand for professional-grade cleaning services. Companies are increasingly investing in interior maintenance to meet compliance standards, reinforcing this segment’s growth.

Application Analysis

In 2024, the Commercial Building segment dominated the Building Maintenance Services market, securing over 34% of the total share. This leadership position is driven by the complexity and volume of maintenance needs in commercial environments, including offices, retail spaces, and business centers.

Commercial facilities require consistent upkeep to maintain property value, ensure occupant safety, and uphold brand image. The segment benefits from stricter compliance requirements, as these properties are subject to more rigorous building codes compared to residential structures.

The high frequency of required services ranging from HVAC and electrical system maintenance to cleaning and landscaping further contributes to this segment’s prominence. Moreover, growing emphasis on energy efficiency and sustainable practices is prompting commercial property owners to invest in ongoing maintenance, boosting market demand.

End-User Analysis

The Facility Management Companies segment held the largest market share in 2024, accounting for over 40% of the Building Maintenance Services market. These companies offer an integrated suite of services covering everything from routine upkeep to emergency repair, making them a preferred choice across sectors.

Their use of advanced technologies, such as building automation systems, enhances operational efficiency while minimizing energy costs. This tech-driven approach, combined with industry expertise, enables them to deliver high-quality, cost-effective maintenance solutions.

Facility management providers also offer flexible, scalable services that can be customized for different building types and sizes. Their ability to adapt to the unique needs of both residential and commercial clients gives them a competitive advantage.

As buildings increasingly incorporate smart technologies and become more complex, demand for expert maintenance is expected to grow further solidifying the dominant role of facility management companies in the market.

Service Provider Analysis

In 2024, the Outsourced Services segment led the Building Maintenance Services market, accounting for more than 41% of the total share. This dominance stems from the numerous advantages outsourcing offers over in-house or franchised solutions.

Outsourced providers offer greater flexibility and scalability, allowing businesses to tailor services based on specific needs or seasonal demands. This dynamic approach helps organizations avoid unnecessary overhead and respond quickly to changing requirements.

These providers also invest in specialized training and cutting-edge technologies, including smart building systems, to enhance energy efficiency and overall service performance. Their focus on innovation and expertise boosts client satisfaction and operational outcomes.

Another key factor driving this segment’s growth is its strong alignment with regulatory compliance. Outsourcing firms are well-versed in complex health, safety, and environmental standards, reducing liability for clients and ensuring adherence to all legal obligations making them a preferred choice in the market.

Regional Analysis

In 2024, North America dominated the global Building Maintenance Services Market, accounting for over 34% of total revenue, which amounted to approximately USD 1.4 billion. This leading position is primarily supported by the region’s well-established economic infrastructure and the high density of commercial and industrial facilities that require ongoing maintenance.

The region’s strict regulatory standards for building safety and environmental sustainability further boost demand for professional maintenance services. Companies are compelled to comply with evolving safety and environmental codes, which increases reliance on specialized service providers capable of meeting these requirements.

North America also benefits from the presence of major industry players, who drive innovation, offer a broad range of services, and intensify market competition. This dynamic encourages continuous improvement and service expansion across the region.

Looking ahead, North America is expected to maintain its dominant position, fueled by technological advancements, increasing investments in smart and sustainable buildings, and rising recognition of the role of facility management in optimizing operational efficiency and building longevity. These trends are expected to sustain strong growth in demand for professional building maintenance services.

Top Use Cases

1. Proactive Equipment Monitoring:

Building managers use smart sensors and IoT systems to constantly check HVAC, lighting, and energy systems. These tools alert providers to issues early before major breakdowns reducing downtime and cutting repair costs. Predictive maintenance helps maintain smooth building operations, boosts occupant comfort, and extends equipment lifespan.

2. Outsourced Cleaning & Janitorial Services:

Organizations offices, residential towers, shopping malls hire specialized firms to manage cleaning and sanitation tasks. Outsourcing lets clients avoid hiring in-house staff, ensures consistent quality, and supports compliance with health and safety regulations. It also allows building owners to redirect resources toward core operational objectives.

3. Regulatory Compliance & Safety Audits:

Service providers regularly inspect fire alarms, plumbing, elevators, and electrical systems to ensure buildings meet evolving building codes and safety standards. This use case is critical in regulated markets, as compliance avoids penalties, protects occupants, and enhances the property’s reputation through professional upkeep.

4. Landscaping & Exterior Upkeep:

Specialist maintenance firms are engaged to manage outdoor spaces lawns, gardens, sidewalks, parking lots to preserve aesthetics and safety. Regular landscaping, pressure washing, and surface repairs improve curb appeal, reduce trip hazards, and support tenant satisfaction while maintaining property value.

5. Specialized Repair & Technical Maintenance:

Facility managers schedule expert technicians to handle mechanical, electrical, and plumbing (MEP) systems that require advanced skills. Tasks include fixing HVAC faults, restoring water systems, or repairing electrical panels. These services ensure smooth technical operations, cut service disruptions, and preserve system efficiency over time.

6. Integrated Facility Management Solutions:

Large commercial buildings and campuses engage full-service providers to manage all maintenance from cleaning and repairs to energy systems and security in one contract. This integrated approach streamlines vendor management, enhances coordination across services, and delivers consistent service quality while optimizing operational costs.

Recent Developments

- Akrobat Pte Ltd (Singapore):

- Akrobat, a Singapore-based specialist in fall prevention and facade access systems, continues to strengthen its reputation for height‑safety solutions. Licensed by the Singapore Building and Construction Authority, Akrobat provides full-range FM and conservancy services, and has supported major landmarks like Marina Bay Sands and Resorts World Sentosa. Their BMU (Building Maintenance Unit) systems enable safe access for complex building facades, supporting cleaning, inspections, and maintenance in high‑rise developments.

2. Alimak Group:

- Alimak recently entered a five-year exclusive partnership with Skyline Robotics to develop AI-enabled automated Building Maintenance Units (BMUs) for facade access. This initiative aims to address labour constraints and complex design demands in high-rise maintenance. Alimak is also investing in scaffold transportation systems (STS 300), reinforcing its commitment to innovative, technology-driven facade-access solutions.

3.Andrew Engineering:

- Andrew Engineering, headquartered in Heidelberg, Australia, specializes in designing custom mechanical services equipment such as HVAC, comfort cooling, kitchen ventilation systems, and dehumidifiers for buildings. Though traditionally focused on industrial and rail sectors, they continue supporting building services with energy-efficient mechanical installations and maintenance solutions across Australia and select export markets.

4.FBA Gomyl:

- FBA Gomyl, a leading provider of Building Maintenance Units in the Philippines, has been lauded for revolutionizing high-rise façade maintenance. The company designs and manufactures bespoke BMU systems (cradles and gondolas) tailored for skyscrapers, significantly improving safety and efficiency in window cleaning, inspections, and exterior repairs in dense urban environments.

5. Heightsafe Systems Limited (UK):

- Heightsafe continues advancing its work-at-height solutions by promoting safe and comprehensive BMU operations. Their services include building restoration, masonry repairs, high-level painting, and cladding maintenance all supported via rope access and suspended cradles. Their messaging highlights the elimination of access risks and reinforces compliance with UK safety standards.

6. Jomy SA (Belgium):

- Jomy, a long-established designer of custom aluminum safety systems, provides facade access ladders, evacuation routes, and BMUs. They recently promoted fixed and retractable ladder systems compliant with EU EN 353‑1 standards and highlighted solar-panel maintenance ramps as a growing focus. They offer reliable yearly maintenance contracts to ensure safety installations remain operational and compliant.

7. NSS Group (UK):

- Nationwide Specialist Services (NSS), now part of Premier Technical Services Group (PTSG), continues as a UK leader in external building maintenance offering window and technical cleaning, testing, and platform hire. They operate a self-performed, 24/7 rapid-response model across multiple sectors. The acquisition by PTSG further enhances their scale and ability to deliver integrated FM services across the UK.

8. Power Climber (Global):

- Power Climber remains at the forefront of suspended access and BMU solutions for facility maintenance worldwide. They offer custom-engineered access systems for high-rise renovations, historic restorations, industrial facilities, power plants, and other infrastructure environments. Their training services ensure technicians worldwide can safely operate and maintain these systems.

Conclusion

The Building Maintenance Services Market is witnessing steady growth due to increasing demand for consistent upkeep across commercial, industrial, and residential properties. The market is supported by a rising focus on energy efficiency, sustainability, and regulatory compliance, which encourages property owners to adopt professional maintenance services.

The integration of smart technologies, such as IoT-based predictive systems, is improving operational efficiency and reducing downtime. Outsourcing remains a preferred approach due to its flexibility and cost-effectiveness. Key segments, including interior cleaning, HVAC maintenance, and facade access services, are experiencing strong demand.

Growth is further reinforced by aging infrastructure, urban development, and the need for adherence to safety standards. Regions with dense commercial activity and strict regulatory environments continue to lead the market. Facility management companies and outsourced service providers dominate the competitive landscape, leveraging innovation and scalability to address evolving building needs. The market outlook remains positive, shaped by modernization and evolving customer expectations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)