Table of Contents

Overview

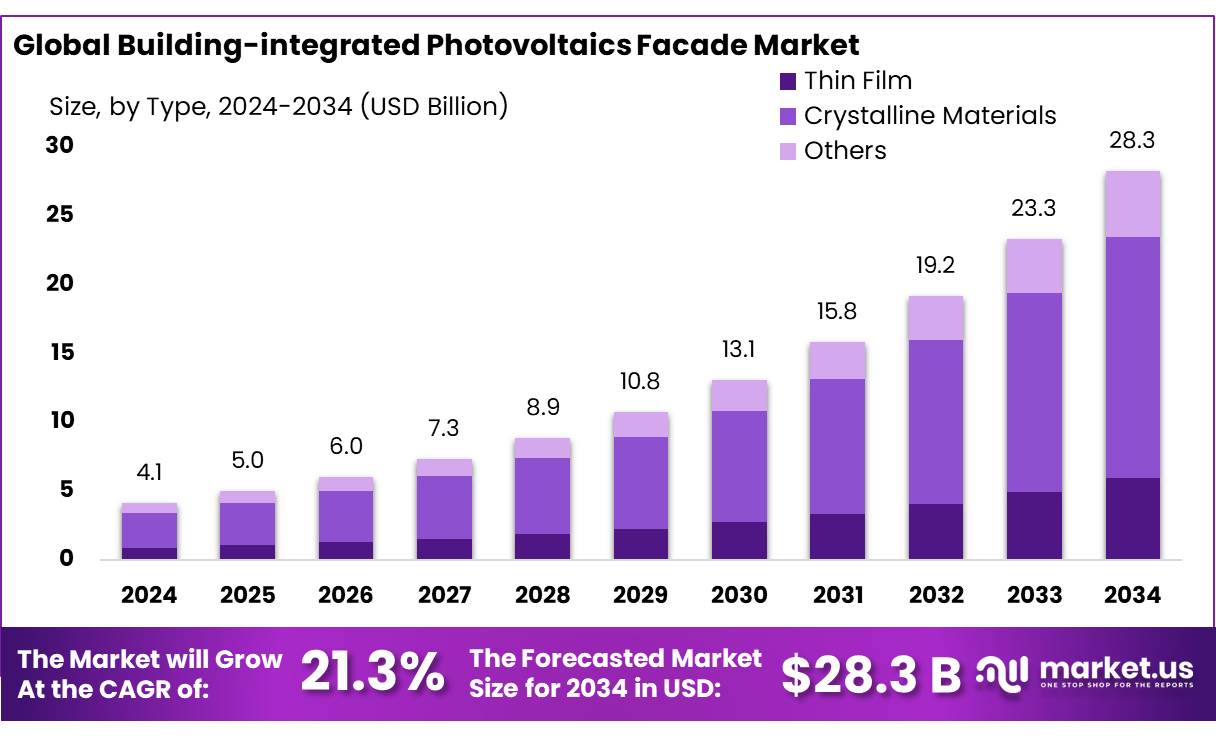

New York, NY – August 21, 2025 – The Global Building-Integrated Photovoltaics (BIPV) Facade Market is projected to grow significantly, reaching an estimated USD 28.3 billion by 2034, up from USD 4.1 billion in 2024, with a robust CAGR of 21.3% during the 2025–2034 forecast period. In 2024, Europe led the market, commanding a 41.9% share and generating USD 1.7 billion in revenue.

BIPV systems are revolutionizing sustainable architecture by embedding photovoltaic technology into building components such as facades, roofs, and windows. Unlike conventional solar panels, BIPV serves as both a structural element and a renewable energy source, enhancing building aesthetics while boosting energy efficiency. This aligns with global efforts toward decarbonization and energy self-sufficiency.

Government policies are key drivers of BIPV adoption. In the U.S., the Inflation Reduction Act of 2022 offers a 30% refundable Investment Tax Credit (ITC) for clean energy projects, including BIPV systems. In Europe, the REPowerEU plan targets expanding solar photovoltaic capacity to over 320 GW by 2025 and nearly 600 GW, fostering greater BIPV integration in buildings.

Key Takeaways

- Building-integrated Photovoltaics Facade Market size is expected to be worth around USD 28.3 Billion by 2034, from USD 4.1 Billion in 2024, growing at a CAGR of 21.3%.

- Crystalline Materials held a dominant market position, capturing more than a 62.1% share in the Building-integrated Photovoltaics (BIPV) Facade market.

- Glass held a dominant market position, capturing more than a 43.8% share in the Building-integrated Photovoltaics (BIPV) Facade market.

- New Construction held a dominant market position, capturing more than a 71.2% share in the Building-integrated Photovoltaics (BIPV) Facade market.

- Commercial Buildings held a dominant market position, capturing more than a 34.7% share in the Building-integrated Photovoltaics (BIPV) Facade market.

- Europe emerged as the dominant region in the Building‑integrated Photovoltaics (BIPV) facade market, capturing a leading 41.9 % share and generating revenue of around USD 1.7 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/building-integrated-photovoltaics-facade-market/request-sample/

Report Scope

| Market Value (2024) | USD 4.1 Billion |

| Forecast Revenue (2034) | USD 28.3 Billion |

| CAGR (2025-2034) | 21.3% |

| Segments Covered | By Type (Thin Film, Crystalline Materials, Others), By Material (Glass, Polymer, Ceramic, Metal, Composite), By Installation Type (New Construction, Retrofit), By Application (Commercial Buildings, Residential Buildings, Industrial Buildings, Educational Institutions, Healthcare Facilities) |

| Competitive Landscape | AGC Inc., AVANCIS GmbH, Ertex Solar, Hanergy Thin Film Power Group Europe, Hanwha Q CELLS, Heliatek GmbH, JinkoSolar, LG Electronics, Onyx Solar Group LLC., Polysolar |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154895

Key Market Segments

By Type Analysis

Crystalline Materials commanded a 62.1% share of the BIPV Facade market in 2024, driven by their superior energy conversion efficiency, durability, and compatibility with standard construction practices. Monocrystalline and polycrystalline silicon are widely used in commercial and institutional building facades, where consistent energy output and architectural uniformity are essential.

The segment benefits from a mature supply chain and established manufacturing processes, enabling large-scale adoption. Government incentives favoring efficient, long-lasting solar technologies further bolster crystalline materials’ dominance.

By Material Analysis

In 2024, Glass captured a 43.8% share of the BIPV Facade market, driven by its transparency, aesthetic appeal, and structural strength. Glass-based solar facades are favored in modern architecture for their ability to allow natural light while generating electricity, making them ideal for curtain walls, skylights, and expansive facades.

Their durability, fire resistance, and compatibility with thin-film solar cells make glass a top choice for commercial and institutional projects. Advancements in double and triple-glazed photovoltaic glass panels in 2025 enhance insulation and energy efficiency, aligning with green building certifications and urban sustainability goals, ensuring glass remains a leading material.

By Installation Type Analysis

New Construction accounted for a 71.2% share of the BIPV Facade market in 2024, fueled by the growing emphasis on energy-efficient building designs from the outset. Incorporating BIPV facades during the planning phase allows architects and developers to meet stringent green building codes, reduce operational costs, and increase property value.

Unlike retrofitting, new construction enables seamless integration of photovoltaic materials, offering greater design flexibility and performance. In 2025, this trend persists as net-zero building mandates and solar-ready construction incentives grow, particularly in commercial offices, educational institutions, and high-rise residential projects.

By Application Analysis

Commercial Buildings held a 34.7% share of the BIPV Facade market in 2024, driven by businesses’ focus on energy efficiency, cost reduction, and sustainability goals. Office buildings, retail centers, airports, and hotels adopt BIPV facades to generate clean energy while maintaining modern aesthetics.

Their large surface areas and high energy consumption make commercial properties ideal for solar integration, offering attractive returns on investment. In 2025, the segment’s growth is fueled by corporate sustainability targets, national energy policies, and certifications like LEED, positioning commercial buildings as a key driver for BIPV facade adoption.

Regional Analysis

In 2024, Europe led the global Building-Integrated Photovoltaics (BIPV) Facade market, securing a 41.9% share and generating approximately USD 1.7 billion in revenue. This dominant position is driven by the European Green Deal’s robust policy framework, which emphasizes energy-efficient construction and advanced sustainability standards, making BIPV solutions highly attractive to architects, developers, and policymakers.

Europe’s leadership is bolstered by its strong regulatory environment, cultural commitment to sustainability, and well-developed supply chains for photovoltaic integration. These factors create a dynamic ecosystem for BIPV facades, positioning Europe ahead of other regions like Asia-Pacific and North America. As these competing markets expand, Europe’s structural advantages are expected to sustain its market dominance shortly.

Top Use Cases

- Commercial Office Buildings: BIPV facades in office towers generate clean energy, reducing electricity costs. They blend with modern glass designs, enhancing aesthetics while meeting sustainability goals. Large surface areas maximize energy output, supporting corporate green initiatives and certifications like LEED, making them ideal for urban business districts.

- Residential High-Rises: BIPV facades in apartment complexes provide renewable energy for shared facilities. They offer insulation and noise reduction, improving resident comfort. Customizable designs ensure aesthetic appeal, while energy savings attract eco-conscious buyers, aligning with net-zero building trends in urban residential projects.

- Educational Institutions: Schools and universities use BIPV facades to power classrooms and labs. They reduce operational costs and support sustainability education. Semi-transparent panels allow natural light, creating bright learning spaces while generating electricity, making them a practical choice for campus modernization.

- Healthcare Facilities: Hospitals integrate BIPV facades to lower energy expenses and ensure reliable power for critical systems. The panels provide thermal insulation, reducing cooling costs. Their sleek design enhances building aesthetics, supporting green healthcare initiatives while meeting strict energy efficiency regulations.

- Public Infrastructure: BIPV facades on train stations and airports generate on-site power, reducing reliance on the grid. They enhance modern architectural designs and provide shading, improving passenger comfort. These installations align with government sustainability goals, making public buildings energy-efficient landmarks.

Recent Developments

1. AGC Inc.

AGC Inc. is advancing BIPV facades with its high-performance, multi-functional glass. A key development is their “Fineo” vacuum glass integrated with thin-film PV cells. This technology combines exceptional thermal insulation (U-value ≤ 0.5 W/m²K) with power generation, making it ideal for energy-saving building envelopes in both new constructions and renovations.

2. AVANCIS GmbH

AVANCIS GmbH, a SK Group company, specializes in CIGS (Copper Indium Gallium Selenide) thin-film technology. Their recent focus for facades is on the aesthetic and functional versatility of their solar modules. They produce modules in various sizes, colors (including black, silver, and bronze), and transparencies to meet architectural design requirements.

3. Ertex Solar

Ertex Solar, an Austrian specialist, focuses on custom-made, aesthetically driven BIPV facade elements. Their recent work emphasizes integrating PV into a wider range of materials beyond standard glass, including custom colors, patterns, and logos printed directly onto the modules to blend seamlessly with the building’s design. They have developed solutions where the solar cells are virtually invisible, creating monochromatic and uniform solar surfaces.

4. Hanergy Thin Film Power Group Europe

Hanergy promotes its lightweight, flexible, and robust thin-film solar panels based on GaAs (Gallium Arsenide) technology for facades. A recent highlight is their ability to create curved and semi-transparent BIPV facade solutions with a high conversion efficiency. Their modules are particularly suited for retrofitting projects on existing buildings due to their light weight and adaptability to different substrates.

5. Hanwha Q CELLS

Hanwha Q CELLS leverages its mass production capabilities for crystalline silicon technology in the BIPV market. Their recent developments include the Q.PEAK DUO BLK-G10+ module, which, while primarily for rooftops, is also used in facade applications. Its all-black aesthetic, with a black frame and uniform cell surface, offers an architecturally clean look for building integration.

Conclusion

The Building-Integrated Photovoltaics (BIPV) Facade market is poised for strong growth, driven by demand for sustainable, energy-efficient buildings. These systems combine aesthetics with functionality, offering energy savings, insulation, and reduced carbon footprints. Supported by government incentives and urban green building trends, BIPV facades are becoming a cornerstone for eco-friendly architecture across commercial, residential, and public sectors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)