Table of Contents

Overview

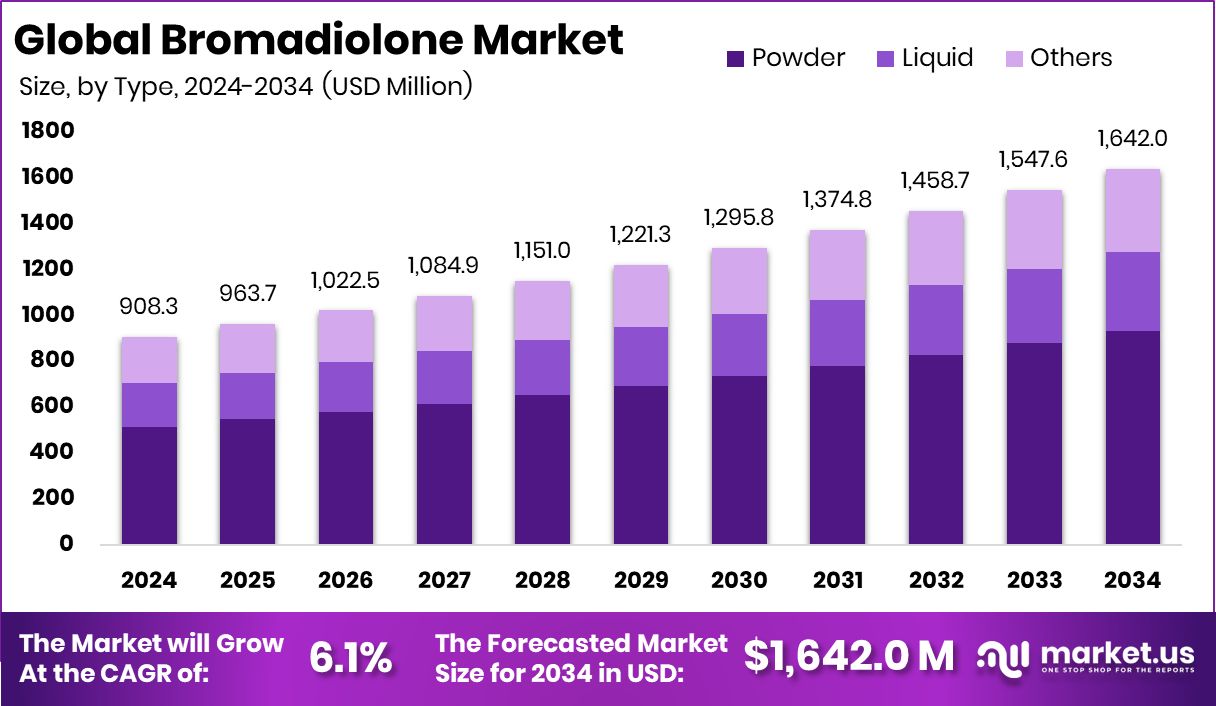

New York, NY – October 03, 2025 – The Global Bromadiolone Market is projected to reach USD 1,642.0 million by 2034, rising from USD 908.3 million in 2024, at a CAGR of 6.1% between 2025 and 2034. The Asia-Pacific region leads the market, accounting for 43.9% of revenues in 2024, valued at USD 398.7 million.

Bromadiolone is a second-generation anticoagulant rodenticide designed to control rats and mice in agricultural fields, warehouses, and residential spaces. It prevents blood clotting, causing internal bleeding in rodents, and is highly effective even in minimal doses. Its widespread use is linked to safeguarding stored grains, food hygiene, crop yields, and infrastructure from rodent damage.

The Bromadiolone market encompasses global production, trade, and application across agriculture, food storage, and public health programs. Rising urbanization, rodent-related losses in cities, and food safety concerns are driving adoption. Governments and municipalities also integrate bromadiolone into pest management programs to curb rodent-borne diseases. Growing agricultural output and the urgent need to reduce post-harvest losses are fueling demand.

Farmers and food processors increasingly rely on rodenticides like bromadiolone to protect stored commodities, reinforcing food security. An important growth opportunity lies in government-backed integrated pest management (IPM) initiatives. For instance, India’s Department of Agriculture implemented a National Plan on Rodent Pest Management under the Strengthening and Modernization of Pest Management Approach, with funding of ₹6.7972 crore (Rs. 679.72 lakh) during the XI Plan.

This program promotes awareness, training, and technical support, providing a structured platform for rodenticide adoption. By aligning with IPM strategies and environmental safety regulations, bromadiolone manufacturers can expand their reach with innovative, safer formulations, further strengthening market growth during outbreak-prone seasons.

Key Takeaways

- The Global Bromadiolone Market is expected to be worth around USD 1,642.0 million by 2034, up from USD 908.3 million in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- Powder dominates the Bromadiolone Market with 56.8%, driven by ease of handling and application.

- Mother Liquor leads the Bromadiolone Market at 47.9%, reflecting its strong industrial utility.

- Strong agricultural dependency drives the Asia-Pacific Bromadiolone Market, holding a 43.9% share worth USD 398.7 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-bromadiolone-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 908.3 Million |

| Forecast Revenue (2034) | USD 1,642.0 Million |

| CAGR (2025-2034) | 6.1% |

| Segments Covered | By Type (Powder, Liquid, Others), By Application (Mother Liquor, Pellets or Bait Blocks, Other) |

| Competitive Landscape | PelGar International, Liphatech Inc., BASF SE, Syngenta Crop Protection AG, Rentokil Initial Plc, Liphatech Inc., Neogen Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157963

Key Market Segments

By Type Analysis

Powder leads the Bromadiolone Market, commanding a 56.8% share in 2024. Its dominance stems from its ease of use and adaptability across agricultural, commercial, and residential pest control environments. Powder formulations excel in covering expansive areas and ensuring rapid rodent uptake, particularly in storage facilities and grain warehouses.

The segment’s growth is fueled by its cost-effectiveness and extended shelf life compared to liquid alternatives. Farmers and pest control professionals favor powder for its seamless integration with baits, enhancing efficacy in infestation control. As demand for efficient rodent control solutions rises, powder maintains its market leadership.

By Application Analysis

Mother Liquor dominates the Bromadiolone Market’s application segment, holding a 47.9% share in 2024. Its leading position is driven by its essential role as an intermediate in producing high-purity, consistent bromadiolone formulations. Widely utilized in industrial processing, mother liquor ensures precision and reliability in large-scale rodenticide manufacturing.

Its prominence is bolstered by growing adoption in chemical plants and large facilities prioritizing efficiency and cost optimization. The ability to deliver stable yields and uniform end products solidifies mother liquor’s position as the top application in the bromadiolone market.

Regional Analysis

The Asia-Pacific region dominated the Bromadiolone Market, securing a 43.9% share with a market value of USD 398.7 million. This leadership is driven by dense urban populations, expanding grain storage infrastructure, and heightened rodent pressure linked to frequent monsoons, all of which amplify the demand for effective rodent control solutions.

North America holds a significant position in the market, supported by well-established professional pest-management networks and widespread adoption of integrated pest management (IPM). Steady demand from food processing and logistics hubs sustains the region’s growth, though increasing regulatory scrutiny is shifting focus toward enhanced product stewardship and training standards without limiting essential applications.

Europe’s market is characterized by disciplined, compliance-driven adoption, shaped by stringent anticoagulant regulations. These guidelines promote safer baiting practices, digital monitoring, and precise application in agricultural and municipal sanitation settings, ensuring effective yet controlled use of bromadiolone.

The Middle East & Africa region presents emerging opportunities, fueled by government investments in food-security initiatives, cold-chain expansion, and warehouse modernization. These efforts, aimed at reducing post-harvest losses, are driving the adoption of structured rodent-control protocols in ports and silos.

Latin America’s demand for bromadiolone is propelled by its extensive grain corridors, sugar and horticulture supply chains, and growing storage capacity. This increases the need for reliable rodent control solutions around mills, terminals, and distribution centers to safeguard critical agricultural infrastructure.

Top Use Cases

- Urban Pest Management: Bromadiolone serves as an effective bait for controlling rats and mice in city homes and buildings. Homeowners and pest pros use it in safe stations to stop rodents from spreading germs and damaging wires or food. Its strong action works fast on tough pests, helping keep urban spots clean and healthy without much hassle.

- Agricultural Field Protection: Farmers apply bromadiolone baits to guard crops from rodent harm in fields and storage areas. It targets pests that eat grains and veggies, cutting losses and boosting yields. Easy to place near plants, it fits into farm routines for better pest defense and steady harvests.

- Warehouse and Storage Control: In food warehouses, bromadiolone blocks or pellets help wipe out mice and rats that spoil goods. Pros set it in tough stations to avoid contamination and meet safety rules. This keeps supplies safe from chew marks and waste, ensuring smooth operations and quality stock.

- Industrial Facility Use: Factories and transport hubs rely on bromadiolone for rodent-free zones to protect machines and products. It tackles hidden nests in walls or vehicles, preventing downtime from bites or dirt. Safe handling makes it a go-to for big sites needing reliable, quick pest fixes.

- Food Processing Safeguard: Bromadiolone aids in keeping processing plants clear of rodents that carry illness to food lines. Baits in sealed spots stop entry and breeding, upholding hygiene standards. This supports safe production and trust in packaged goods without interrupting workflows.

Recent Developments

1. PelGar International

PelGar continues to expand its range of professional-use Bromadiolone formulations, emphasizing high-performance baits and pellets. Recent developments focus on improving palatability and weather resistance for challenging environments. The company actively promotes its products for agricultural and urban rodent control programs, supported by technical guidance for effective application. Their strategy reinforces Bromadiolone as a key tool in integrated pest management.

2. Liphatech Inc.

Liphatech, a key manufacturer, has been innovating with its Generation brand Bromadiolone baits. A significant recent development is the introduction of new extruded bait formulations designed for superior acceptance and efficacy. They focus on creating durable, weather-resistant products for professional pest management. Liphatech also emphasizes stewardship and training to ensure responsible use of its anticoagulant rodenticides in compliance with evolving regulatory standards.

3. BASF SE

BASF has been strategically realigning its rodenticide portfolio. A major recent development was the divestment of its Bromadiolone-based rodent control business to Syngenta. This move was part of BASF’s broader strategy to focus on its core agricultural solutions. Consequently, BASF is no longer directly involved in the development or marketing of Bromadiolone products, with existing lines now integrated into Syngenta’s portfolio.

4. Syngenta Crop Protection AG

Following its acquisition of BASF’s rodent control business, Syngenta has significantly bolstered its Bromadiolone portfolio. Recent developments include integrating products like Talon and Storm into its brand, expanding solutions for professional pest managers. Syngenta is focusing on stewardship programs, promoting responsible use and resistance management. This acquisition solidifies their position in the professional rodenticide market, offering a more comprehensive range of control options.

5. Rentokil Initial Plc

As a leading service provider, Rentokil’s recent developments with Bromadiolone focus on its application within integrated pest management (IPM). The company emphasizes its intelligent monitoring system, PestConnect, to detect rodent activity before deploying Bromadiolone baits strategically and only when necessary. This targeted, data-driven approach aims to maximize efficacy while minimizing product usage, aligning with regulatory pressures and sustainability goals for responsible rodent control.

Conclusion

Bromadiolone stands out as a key player in the rodent control scene, offering strong defense against pests in homes, farms, and industries. Its reliable performance drives steady demand amid rising urban growth and crop needs, though shifts toward greener options and tighter rules push makers to innovate safer forms. Overall, it holds solid promise for pest pros seeking effective tools.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)