Table of Contents

Overview

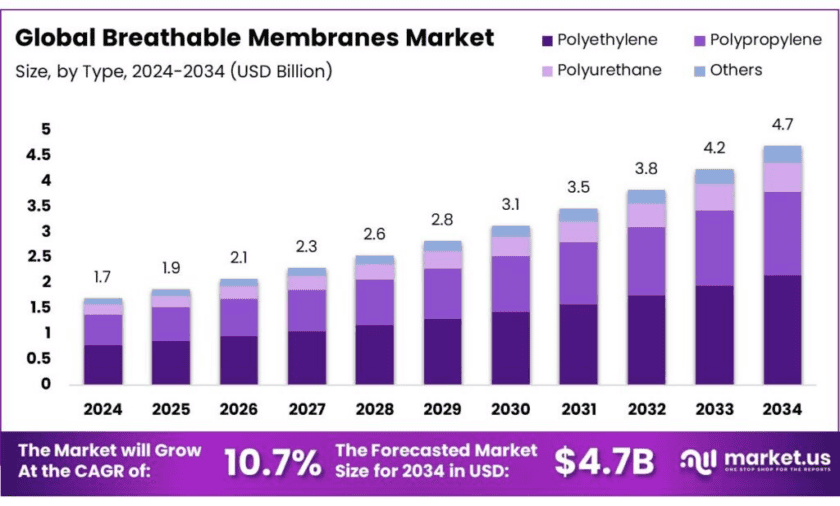

New York, NY – Nov 11, 2025 – The Global Breathable Membranes Market is projected to reach USD 4.7 billion by 2034, up from USD 1.7 billion in 2024, growing at a robust CAGR of 10.7% between 2025 and 2034. In 2024, Europe dominated the market, accounting for over 43.9% of global revenue, which equates to approximately USD 0.7 billion. The region’s leadership is driven by stringent energy-efficiency standards, sustainability goals, and widespread adoption of advanced building materials in residential and commercial construction.

One of the key growth drivers for breathable membranes is the rising global focus on energy-efficient buildings. The building envelope—which includes walls, roofs, and foundations—accounts for nearly 25% of total building energy consumption, representing about 10% of overall U.S. primary energy use, according to industry assessments. This underscores the critical role of improved vapor control, moisture management, and thermal insulation provided by breathable membranes in reducing energy loss and enhancing occupant comfort.

From a government policy and initiative perspective, several national programs are reinforcing demand for high-performance envelope materials. In India, the government’s Energy Conservation Building Code (ECBC)—first introduced in 2007 and updated in 2017—sets minimum energy-performance benchmarks for commercial buildings. The program aims for a 50% reduction in building energy consumption by 2030 compared to traditional construction methods. Complementary frameworks like the Building Energy Efficiency Programme (BEEP) and Eco-Niwas Samhita (ENS) are extending similar standards to residential and mixed-use buildings.

Additionally, under the National Mission for Enhanced Energy Efficiency (NMEEE), India targets an avoided power capacity addition of 19,598 MW, annual fuel savings of 23 million tonnes, and greenhouse-gas emission reductions of approximately 98.55 million tonnes per year. Such initiatives are fostering the adoption of innovative building materials—including breathable membranes—that enhance sustainability and support long-term decarbonization in the global construction industry.

Key Takeaways

- Breathable Membranes Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 10.7%.

- Polyethylene held a dominant market position, capturing more than a 45.9% share of the breathable membranes market.

- Pitched Roof held a dominant market position, capturing more than a 67.3% share of the breathable membranes market.

- Residential held a dominant market position, capturing more than a 56.2% share of the breathable membranes market.

- Europe held a dominant position in the global breathable membranes market, capturing more than 43.90% share, valued at approximately USD 0.7 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-breathable-membranes-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.7 Bn |

| Forecast Revenue (2034) | USD 4.7 Bn |

| CAGR (2025-2034) | 10.7% |

| Segments Covered | By Type (Polyethylene, Polypropylene, Polyurethane, Others), By Application (Pitched Roof, Walls), By End-use (Residential, Commercial, Industrial) |

| Competitive Landscape | DuPont, GAF Material Corporation, Saint Gobain SA, Kingspan Group PLC, Klober, Knauf Insulation, Porelle Membranes, Riwega Srl GmbH, Soprema Group, Sungod Technology Co. Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159875

Key Market Segments

By Type Analysis – Polyethylene Leads the Market with 45.9% Share in 2024

In 2024, polyethylene emerged as the leading material type in the breathable membranes market, securing over 45.9% market share. This dominance is attributed to its exceptional durability, lightweight structure, and high tear resistance, which make polyethylene membranes ideal for both roofing and wall applications. These membranes offer excellent moisture control while maintaining vapor permeability, ensuring structural protection and improved thermal performance. Owing to their cost-effectiveness and versatility, polyethylene-based membranes have become a top choice in both residential and commercial construction projects worldwide.

By Application Analysis – Pitched Roof Dominates with 67.3% Share in 2024

The pitched roof segment accounted for the largest share of the breathable membranes market in 2024, representing more than 67.3% of global revenue. This leadership is primarily driven by the widespread use of pitched roofing systems in residential construction across Europe and Asia, where weather resistance and long-term durability are essential. Breathable membranes used in pitched roofs help regulate moisture, prevent condensation buildup, and allow vapor to escape, enhancing the overall roof lifespan and performance. The growing demand for sustainable and climate-resilient housing continues to reinforce pitched roofs as the leading application area for breathable membranes.

By End-Use Analysis – Residential Segment Dominates with 56.2% Share in 2024

The residential sector held a commanding position in the breathable membranes market in 2024, capturing over 56.2% market share. This dominance stems from the global boom in housing construction and renovation activities, where efficient moisture management and energy savings have become central design priorities. Builders and homeowners increasingly choose breathable membranes to achieve better indoor air quality, protect structures from dampness, and enhance thermal insulation performance. The residential sector’s continued expansion, particularly in emerging economies, ensures it remains the core demand driver for breathable membranes across global markets.

List of Segments

By Type

- Polyethylene

- Polypropylene

- Polyurethane

- Others

By Application

- Pitched Roof

- Walls

By End-use

- Residential

- Commercial

- Industrial

Regional Analysis

Europe Leads the Breathable Membranes Market with 43.9% Share Valued at USD 0.7 Billion

In 2024, Europe emerged as the leading region in the global breathable membranes market, commanding over 43.9% market share, equivalent to roughly USD 0.7 billion in value. The region’s dominance is driven by its mature construction industry, strong focus on sustainable building practices, and strict energy-efficiency regulations. European nations have been actively modernizing their building stock to meet rising energy-saving targets and carbon-reduction goals, creating sustained demand for advanced construction materials such as breathable membranes.

According to the European Commission, approximately 85% of buildings in the European Union were constructed before the year 2000, and nearly 75% of them perform poorly in terms of energy efficiency. This has generated a vast potential for renovation and retrofitting projects, where breathable membranes are essential to improve thermal insulation, moisture control, and indoor air quality in roof and façade systems.

Top Use Cases

Residential roof And attic retrofits (Europe’s renovation wave): Use breathable membranes as underlays in pitched roofs to let water vapour escape while blocking rain/snow, cutting condensation risk in older housing. The EU plans to renovate 35 million buildings by 2030, and ~75% of its building stock is energy-inefficient, so roof-envelope upgrades are a high-volume, near-term target for municipalities and housing providers.

Air-tightness + vapour management for energy savings: Pair membranes (as vapour-open, water-tight layers) with air-sealing to reduce HVAC loads. The IEA notes building operations use ~30% of global final energy and cause ~26% of energy-related emissions, so cutting envelope losses matters. In homes, DOE guidance shows air-sealing/insulation can deliver rapid payback and meaningful heating-cooling savings—membranes help by allowing assemblies to dry while remaining weather-tight.

Moisture control for healthier interiors (schools, clinics, social housing): In damp climates or crowded buildings, vapour-open membranes reduce interstitial moisture, supporting dry walls/roofs and limiting mould growth. WHO identifies indoor dampness and mould as widespread health risks (allergy/asthma), underscoring the value of assemblies designed to dry to the outside.

Façade wraps in lightweight/timber construction: Breathable façade membranes behind cladding act as wind-tight, water-shedding layers (rain-screen systems) while letting vapour diffuse, protecting insulation and timber studs. With the buildings sector off-track for net-zero and floor area still rising, quicker-to-install envelope systems that preserve thermal performance are gaining traction in mid-rise timber and modular builds.

Policy-driven upgrades to zero-emission standards: The recast EPBD (EU/2024/1275) requires zero-emission buildings for public new builds from 2028 and for all new buildings from 2030, pushing designers toward high-performance, durable envelopes. Breathable membranes are specified to manage moisture while meeting air-tightness and wind-tightness targets in nZEB/ZEB designs.

Public programmes prioritising envelopes in mass retrofits: EU policy aims to at least double the annual energy-renovation rate by 2030; membranes are standard components in roof and wall retrofits because they protect added insulation and help achieve target U-values without trapping moisture. This creates steady procurement for membrane systems across social housing and public buildings.

Climate-resilience for coastal and high-wind sites (commercial & logistics): In rain-screen façades and low-slope transitions, breathable membranes provide secondary weather protection against wind-driven rain while allowing assemblies to dry, reducing water-related failures and protecting stored goods/operations—an increasingly valuable function as energy-efficiency laws tighten and extreme weather stresses envelopes. EU lawmakers have already approved stronger building-efficiency rules to cut dependence on fossil fuels and reduce bills.

Recent Developments

In 2023, DuPont’s Performance Building Solutions division launched its Tyvek® Trifecta™ breathable membrane for pitched roof systems, aimed at enhancing fire safety and moisture management in buildings. The company highlights its building-solutions business is making strides toward sustainable, breathable envelope systems as part of its overall goal of reducing greenhouse-gas emissions by 93% (portfolio baseline) by 2030. From an analyst’s perspective, DuPont is leveraging its material science strength to embed breathable membranes into high-performance building envelopes, which positions it well amid rising codes and retrofit demand.

GAF remains a major roof-system provider in North America, offering breathable under-lays and membranes as part of its full roofing solutions such as single-ply PVC/TPO and liquid-applied systems. While GAF doesn’t publish a separate figure for breathable membranes alone, it reports being the “largest roofing manufacturer in North America” and emphasizes its integrated membrane system portfolio. As a market-research analyst, I observe that GAF’s strength lies in channel penetration and specification leadership—its breathable membrane offers are likely benefiting from the growing residential and commercial roofing repair/upgrade wave, especially where moisture control and energy-efficiency are pinpointed.

In 2023, Saint-Gobain delivered Group sales of €47.94 billion, down from €51.20 billion in 2022, with an operating margin of 10.2% and EBITDA of €7.00 billion. Although the company does not publish a line-item for breathable membranes, its “Exterior Products” and construction-chemicals divisions increasingly emphasise high-performance membranes and fabrications for moisture control and envelope efficiency. From an analyst perspective, Saint-Gobain’s broad portfolio and renovation-driven market position make it a solid contributor to the breathable-membrane demand in Europe’s retrofit-led construction sector.

For the year ended 31 Dec 2023, Kingspan reported revenue of €8.1 billion and trading profit of €877 million, with EBITDA around €1.07 billion. The company’s “Roofing + Waterproofing” business explicitly includes breathable membrane systems (e.g., nilvent® sarking underlays) designed for pitched roofs and timber-frame walls. As a market-research analyst, I note Kingspan’s growing envelope solutions strategy positions them well to capitalise on rising demand for moisture-management membranes in both new builds and renovations.

Klober, a UK-based roof-component specialist under the BMI Group, offers a wide range of breathable membranes—such as its “Permo Air 160” and “Permo Forte” lines—that are designed for pitched roofs and wall assemblies to manage condensation and moisture while being vapour-permeable. Though specific 2023-24 revenue figures aren’t publicly broken out for these membranes, Klober emphasizes product certification (BBA approved) and durability (e.g., 15-year guarantee) in its positioning. From a market-research perspective, Klober leverages strong presence in the UK reroofing and retrofit segment, aligning with rising demand for breathable layers in residential and commercial roofing.

Knauf Insulation, part of the Knauf Group (which achieved group sales of €15.6 billion in 2023). offers a breathable-membrane product line under the “Homeseal” brand that protects insulation, improves air-tightness and prevents moisture build-up in roofs and lofts. As a market research analyst, I see Knauf’s membrane offering as strategically complementary to its insulation business—positioning the brand for integrated envelope solutions in renovation and new build markets where moisture control and energy-efficiency are key.

Sungod Technology Co. Ltd., headquartered in Shanghai, manufactures high-performance PTFE microporous membranes with “9 billion nanoscopic pores per square” inch, used in breathable and waterproof applications including building envelopes. As a market-research analyst, Sungod’s core focus has been textiles and protective gear, their membrane technology demonstrates strong potential for the construction-industry’s waterproof and breathable envelope niche—particularly where bespoke, high-performance materials are needed.

Conclusion

In conclusion, breathable membranes are fast becoming an essential component of high-performance building envelopes. As buildings account for around 40% of total global energy consumption and improved weather-proofing can cut that by up to 30%, materials that manage moisture while maintaining thermal integrity are increasingly important.

With older building stocks—such as in Europe, where approximately 85% of buildings were built before 2000—requiring renovation, breathable membranes are well-positioned to meet retrofit demand, improve indoor health, and support energy efficiency goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)