Table of Contents

Overview

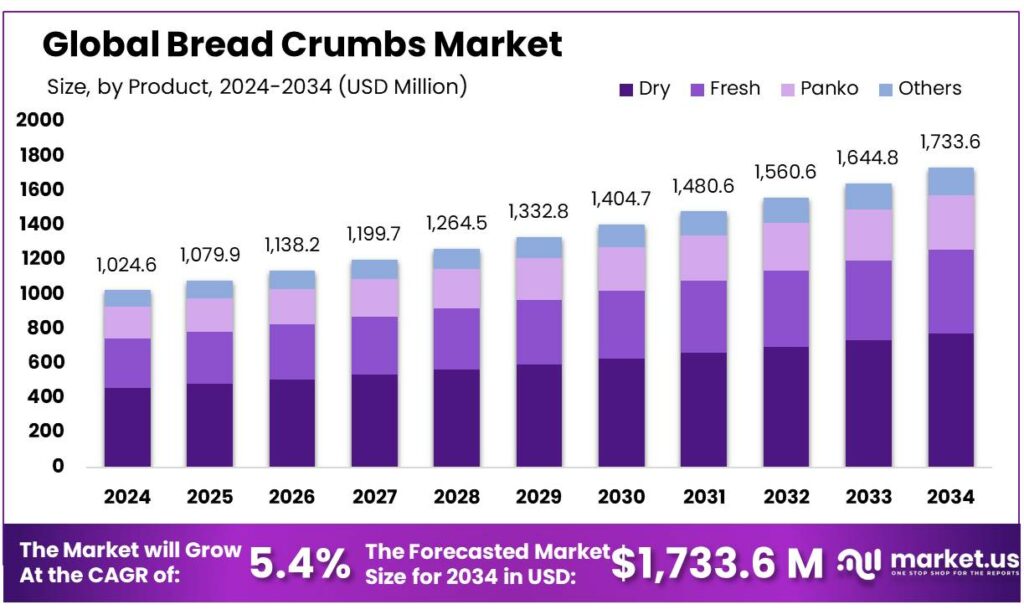

New York, NY – September 30, 2025 – The Global Bread Crumbs Market is projected to reach USD 1,733.6 million by 2034, rising from USD 1,024.6 million in 2024, at a steady CAGR of 5.4% between 2025 and 2034. In 2024, the Asia Pacific region led the market with a commanding 43.7% share, generating USD 447.7 million in revenue.

The bread crumbs sector operates at the intersection of wheat milling, bakery processing, and value-added food coatings. Its supply chain remains closely linked to global grain production. According to the FAO, worldwide wheat output is expected to reach 787 million tonnes in 2024, ensuring consistent flour availability for crumb manufacturers. Additionally, the USDA ERS highlights stable per-capita flour availability, reflecting sustained demand for wheat-based products that feed into crumbs used in snacks, frozen meats, and ready-to-eat meals.

In Europe, regulatory measures also shape industry practices. The EU Regulation enforces strict benchmarks to mitigate acrylamide levels in bakery products, pushing manufacturers to optimize recipes and production conditions. Meanwhile, in the U.S., the FDA’s revised voluntary sodium reduction goals aim for a 20% reduction in population-level intake. This has encouraged crumb producers, particularly those supplying quick-service restaurants and private labels, to reformulate seasonings and base products with lower sodium levels.

Sustainability and waste-to-value models are increasingly significant. The UNEP Food Waste Index 2024 reported that 1.05 billion tonnes of food were wasted in 2022, averaging 132 kg per capita. With households accounting for 60% of this waste, crumb makers are leveraging surplus bread streams, transforming them into industrial crumbs and rusk meal. This not only reduces disposal costs but also supplies essential inputs for breaded proteins and vegetables.

Government support programs further enhance industry growth, especially in emerging markets. India’s PM Formalisation of Micro Food Processing Enterprises (PMFME) scheme offers credit-linked subsidies—typically on a 60:40 Centre–State cost share (and 90:10 in Northeastern and Himalayan states). With a target of supporting 200,000 micro-units, including bakeries and crumb processors, the initiative underwrites investments in ovens, dryers, grinders, sievers, and packaging that align with national quality standards.

Key Takeaways

- Bread Crumbs Market size is expected to be worth around USD 1733.6 Million by 2034, from USD 1024.6 Million in 2024, growing at a CAGR of 5.4%.

- Dry held a dominant market position, capturing more than a 44.8% share in the global bread crumbs market.

- Unflavored held a dominant market position, capturing more than a 56.4% share in the global bread crumbs market.

- Frozen Food Items held a dominant market position, capturing more than a 49.2% share in the global bread crumbs market.

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 49.1% share of the global bread crumbs market.

- Asia Pacific held a dominant position in the global bread crumbs market, capturing a substantial 43.7% market share, valued at approximately USD 447.7 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/bread-crumbs-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1024.6 Million |

| Forecast Revenue (2034) | USD 1733.6 Million |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Product (Dry, Fresh, Panko, Others), By Seasoning (Unflavored, Italian, French, Cheese, Paprika, Garlic), By End-use (Frozen Food Items, Dessert, Fresh Food Items, Pet Treats, Others), By Distribution Channel (Hypermarkets/Supermarkets, Wholesale Stores, Online, Others) |

| Competitive Landscape | Kikkoman Corporation, Gonnella Baking Company, DeLallo, 4C Foods, Vigo Importing Co, General Mills, Edward & Sons Trading Co., Aleia’s Gluten Free Foods Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157263

Key Market Segments

By Product Type

Dry bread crumbs led the global market in 2024, commanding a 44.8% share. Their dominance is driven by a long shelf life, ease of storage, and versatility in culinary applications. Preferred by both commercial and household kitchens, dry bread crumbs offer a crunchy texture and extended usability compared to fresh or semi-dry variants. Their integration into the growing frozen and ready-to-cook food sectors, along with suitability for export due to stability, ensures continued leadership as convenience food demand rises.

By Seasoning

Unflavored bread crumbs held a 56.4% market share in 2024, favored for their neutrality and flexibility. Widely used in household cooking and food processing, they serve as a versatile base for coating, binding, or thickening in dishes like cutlets, patties, and soups. Food manufacturers value their adaptability to diverse flavor profiles, especially in frozen and ready-meal applications. The clean-label appeal of unflavored crumbs, free from added sodium or artificial flavors, aligns with health-conscious consumer trends, reinforcing their market dominance.

By End-Use

Frozen food items captured a 49.2% share of the bread crumbs market in 2024, fueled by the rising popularity of convenient, ready-to-cook products like nuggets, fish sticks, and breaded vegetables. Bread crumbs enhance texture, appearance, and moisture retention in frozen meals, appealing to both quick-service restaurants and home consumers. Innovations in crumb variants that retain crunch after reheating further boost their adoption, solidifying this segment’s role in market growth.

By Distribution Channel

Hypermarkets and supermarkets dominated with a 49.1% share in 2024, driven by their wide product selection, prominent shelf displays, and promotional offers. These retail channels cater to diverse consumer needs with both private-label and premium bread crumb options, encouraging impulse buys in bakery and snack aisles. Their expansion into tier-2 and tier-3 cities globally enhances accessibility, strengthening their position as the primary distribution channel for bread crumbs.

Regional Analysis

Asia Pacific led the global bread crumbs market in 2024, holding a 43.7% share valued at approximately USD 447.7 million. The region’s prominence is driven by a cultural preference for fried and breaded foods in countries like Japan, China, South Korea, India, and Southeast Asia. Japan, a key player, exported over 8,200 metric tons of panko-style bread crumbs in 2023, per JETRO, reflecting its innovation and global reach. In India, the growth of quick-service restaurants, frozen food brands, and snack manufacturers, coupled with urbanization and demand for convenient foods like cutlets and nuggets, continues to drive bread crumb consumption.

Top Use Cases

- Coating for Fried Meats and Poultry: Bread crumbs shine as a go-to coating for frying chicken cutlets, schnitzel, or nuggets, giving a golden, crunchy outside that locks in juicy flavors inside. Home cooks and busy restaurants love how they add texture without much effort, fitting perfectly into quick meal prep trends where crispy bites make everyday dinners feel special and satisfying.

- Enhancing Frozen Ready Meals: In the world of grab-and-go frozen foods like fish sticks or veggie patties, bread crumbs create that irresistible crisp layer even after reheating. They help seal in taste and moisture, making these convenient options a hit for families on the move, boosting appeal in supermarkets where easy, tasty meals drive steady sales.

- Binding Agent in Meat Dishes: Bread crumbs act as a smart binder in meatballs, burgers, or loaves, holding everything together for a tender yet firm bite. This simple trick saves time for food makers and home chefs alike, turning basic ingredients into hearty favorites that align with the rising demand for affordable, flavorful proteins in daily cooking.

- Topping for Baked Casseroles: Sprinkled over cheesy casseroles or gratins, bread crumbs deliver a buttery crunch that elevates comfort foods to crowd-pleasers. They’re a staple in home baking and restaurant sides, adding visual pop and texture that keeps diners coming back, especially as cozy, shareable dishes gain traction in casual dining scenes.

- Coating for Seafood Delights: For tempura shrimp or breaded fish fillets, bread crumbs provide a light, airy shell that highlights fresh ocean flavors without overpowering them. This use thrives in global cuisines, from Asian-inspired bites to Western pub fare, supporting growth in seafood snacks where crispiness meets health-focused eating habits.

Recent Developments

1. Kikkoman Corporation

Kikkoman has leveraged its brand strength in soy sauce to expand its Panko bread crumb line. Recent developments include the introduction of Gluten-Free Panko, catering to the growing demand for allergen-free products. Their strategy focuses on marketing Panko as a premium, versatile ingredient for home cooks, emphasizing its lighter, crispier texture compared to traditional breadcrumbs. This innovation helps them compete in the specialized premium crumb segment.

2. Gonnella Baking Company

As a major bakery, Gonnella’s primary development is a focus on sustainability and circularity within its bread crumb operations. They have enhanced their production process to convert day-old bread and bakery waste into various bread crumb products. This reduces food waste and offers a cost-effective supply. They primarily supply foodservice and industrial clients, emphasizing consistent quality and a reliable supply chain for their dry breadcrumbs and stuffings.

3. DeLallo

DeLallo has focused on authentic Italian positioning for its bread crumbs. A key development is the introduction of Italian-Style Panko, blending traditional Italian seasonings with the light, airy texture of Japanese-style crumbs. Their marketing emphasizes the use of simple, non-GMO ingredients without artificial additives, directly targeting home cooks seeking an authentic Italian cooking experience. This aligns with their overall brand strategy of offering premium imported and specialty foods.

4. 4C Foods

4C has aggressively expanded its Carb-Conscious and Keto-Friendly product lines. A significant recent development is the launch of new zero-sugar and ultra-low-carb bread crumb alternatives, such as those made with almond flour or pork rinds. They target the health-conscious consumer by clearly labeling net carbs and promoting their products as ideal for specific diets like Keto and Atkins, capitalizing on current food trends.

5. Vigo Importing Co

Vigo has maintained its classic, seasoned bread crumb offerings but has recently invested in packaging updates and e-commerce optimization. Their development focuses on strengthening their presence in the Latin American and Caribbean food aisles, where their seasoned crumbs are a staple for dishes like empanadas and alcapurrias. Efforts include refreshed packaging designs and ensuring product availability through online retailers to reach a broader diaspora market.

Conclusion

Bread Crumbs evolving from a humble kitchen staple into a powerhouse ingredient shaping modern food trends. With busy lifestyles fueling demand for quick, crunchy enhancements in everything from home-cooked favorites to factory-fresh snacks, their versatility keeps them at the heart of global cuisines. Health shifts toward cleaner, gluten-free options, and the boom in plant-based meals opens fresh doors for innovation, while sustainable sourcing promises a greener future.