Table of Contents

Introduction

The Global boutique fitness studio market is projected to reach approximately USD 80.4 billion by 2034, rising from an estimated value of USD 40.1 billion in 2024. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 7.2% during the forecast period from 2025 to 2034.

A Boutique Fitness Studio is a specialized gym or wellness center that provides a focused, personalized experience, often emphasizing specific workout disciplines such as yoga, Pilates, HIIT, barre, or cycling, in a small group setting. These studios prioritize community engagement, expert-led instruction, and curated ambiance, differentiating themselves from traditional big-box gyms. The Boutique Fitness Studio Market refers to the global industry encompassing these specialized fitness centers, including their infrastructure, services, digital integration, and member engagement strategies.

The growth of this market is being propelled by rising health awareness, increased consumer willingness to spend on premium wellness services, and the expanding urban millennial population seeking personalized fitness experiences. A significant demand shift is being observed as consumers favor immersive, results-driven workouts over generic fitness routines. Moreover, the rise of hybrid fitness models, which blend in-person classes with digital fitness platforms, has further amplified the appeal of boutique studios, especially among tech-savvy and convenience-driven consumers.

The market is also witnessing strong traction from corporate wellness initiatives, wherein companies invest in boutique studio partnerships to improve employee well-being. Geographically, urban areas in North America, Europe, and parts of Asia-Pacific are emerging as high-potential zones, driven by dense populations and increasing disposable incomes. Opportunities exist in franchise expansion, wearable fitness technology integration, and on-demand workout content, which can drive customer retention and create additional revenue streams. As the global emphasis on mental and physical health strengthens, the boutique gym market is expected to expand further, underpinned by evolving consumer preferences for quality, customization, and holistic wellness solutions.

Key Takeaways

- The global boutique fitness studio market was valued at USD 40.1 billion in 2024 and is projected to reach USD 80.4 billion by 2034, expanding at a CAGR of 7.20% over the forecast period.

- Yoga studios accounted for the largest share (32.3%) of the type segment in 2024. This dominance can be attributed to the increasing global focus on mental well-being, mindfulness, and flexibility training.

- Within the service offering segment, group classes held the leading position with a 40.2% share in 2024, driven by the rising preference for socially engaging and motivational fitness environments.

- North America emerged as the dominant regional market in 2024, supported by a well-established fitness culture, high consumer spending on wellness, and the proliferation of boutique studio chains across urban centers.

Delve into Sector-Wise Impact Assessments of US Trade Tariffs at https://market.us/report/boutique-fitness-studio-market/request-sample/

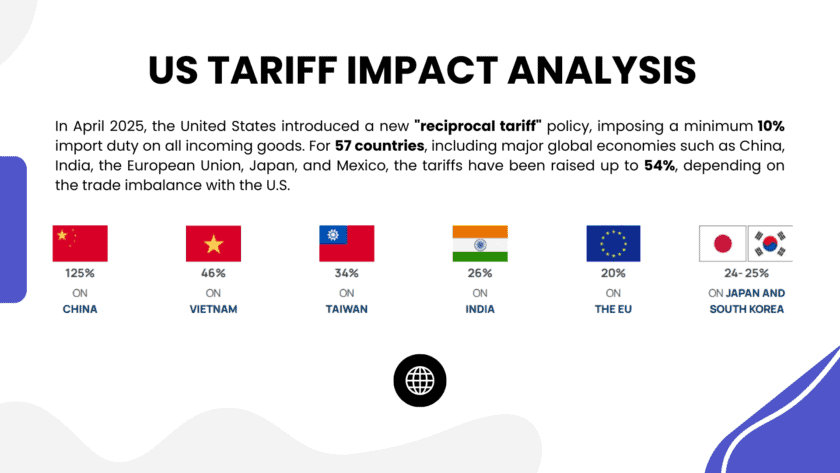

Impact of US Tariffs on Boutique Fitness Studios

📈 Economic Implications

- Elevated Retail Prices: Tariffs on imported apparel and fitness equipment are leading to increased costs for boutique studios. For instance, a 145% tariff could necessitate a price increase from $50 to $79 to maintain profitability, as highlighted by Steven Borrelli, founder of Cuts Clothing . This escalation in retail prices may dampen consumer spending, particularly among price-sensitive clientele.

- Consumer Spending Constraints: The cumulative effect of tariffs, inflation, and economic uncertainty is contributing to a cautious consumer outlook. Companies like Lululemon have reported stagnant sales and declining foot traffic in U.S. stores, attributing these trends to diminished consumer confidence .

🏋️♂️ Supply Chain and Operational Challenges

- Disruption in Equipment Supply: Boutique fitness studios reliant on imported equipment are encountering supply chain disruptions due to tariffs. These challenges are exacerbated by the global nature of fitness equipment manufacturing, with significant portions of production occurring in countries like China and Vietnam .

- Strategic Shifts in Sourcing: In response to tariff-induced cost increases, some U.S. brands are considering reshoring manufacturing to domestic facilities. This transition aims to mitigate tariff impacts but necessitates substantial investment in infrastructure and time to establish competitive manufacturing capabilities .

🔍 Strategic Considerations for Boutique Studios

- Diversification of Supply Sources: Exploring alternative suppliers from countries with lower tariff rates can help mitigate cost increases.

- Enhanced Consumer Engagement: Developing loyalty programs and personalized services can strengthen customer retention despite economic challenges.

- Operational Efficiency: Investing in technology and training to improve service delivery can offset increased costs and enhance competitiveness.

- Advocacy and Policy Engagement: Collaborating with industry associations to advocate for tariff exemptions or reductions can benefit the broader fitness sector.

Emerging Trends

- Community-Centric Fitness: Approximately 85% of boutique fitness customers prioritize community and social interaction when selecting a studio. This underscores a shift towards fitness environments that foster social connections and a sense of belonging.

- Digital Integration: A significant 88% of boutique fitness customers utilize social media platforms to discover and book classes, highlighting the importance of digital presence and engagement in attracting clientele.

- Specialized Offerings: Around 73% of boutique fitness studios focus on a specific type of training, such as yoga, Pilates, or high-intensity interval training (HIIT), catering to niche markets and specialized fitness goals.

- Premium Pricing Models: Boutique fitness studios often charge higher membership fees, with averages ranging from $90 to $200 per month, reflecting the value placed on specialized classes and personalized experiences.

- Demographic Targeting: The majority of boutique fitness customers are aged between 18-44 years, with 72% being female, indicating targeted marketing and program development towards this demographic.

Top Use Cases

- Group Fitness Classes: Group sessions, including yoga, Pilates, and cycling, constitute approximately 70% of boutique fitness studio activities, emphasizing the popularity of communal workout experiences.

- Personalized Training Programs: Studios offer tailored fitness plans, with 81% of customers valuing personalized workout experiences, enhancing engagement and satisfaction.

- Flexible Scheduling: Boutique studios provide varied class times, accommodating diverse schedules and increasing accessibility for clients.

- Wellness Integration: Incorporation of wellness services, such as nutrition counseling and mindfulness sessions, addresses holistic health needs.

- Technology-Enhanced Workouts: Utilization of wearable technology and fitness apps facilitates progress tracking and personalized feedback, enriching the client experience.

Major Challenges

- High Operational Costs: Premium locations and specialized equipment contribute to elevated operational expenses, impacting profitability.

- Market Saturation: The proliferation of boutique studios increases competition, necessitating differentiation strategies to attract and retain clients.

- Retention Rates: Maintaining customer loyalty is challenging, with average yearly retention rates around 67%, requiring continuous engagement efforts.

- Diversity and Inclusion: The industry faces criticism for lack of diversity, with high membership fees and location choices contributing to limited inclusivity.

- Economic Sensitivity: Premium pricing models may deter potential clients during economic downturns, affecting membership numbers and revenue.

Top Opportunities

- Pansion into Underserved Markets: Targeting areas with limited boutique fitness options can capture new customer segments and drive growth.

- Corporate Partnerships: Collaborations with businesses to offer employee wellness programs can expand client bases and revenue streams.

- Virtual Class Offerings: Developing online classes can reach a broader audience, providing flexibility and convenience for clients.

- Customized Membership Plans: Offering varied membership tiers can cater to different financial capabilities, enhancing accessibility.

- Sustainable Practices: Implementing eco-friendly operations can appeal to environmentally conscious consumers, differentiating studios in the market.

Key Player Analysis

The Global Boutique Fitness Studio Market is being shaped by a diverse range of key players, each contributing uniquely to its growth. Orangetheory Fitness remains a dominant force, with its high-intensity interval training (HIIT) model attracting a broad audience seeking results-driven workouts. Similarly, F45 Training’s global expansion continues to capitalize on its functional training approach, which appeals to fitness enthusiasts looking for a community-centered environment.

SoulCycle maintains its status as a leader in indoor cycling, known for its cult-like following and immersive experiences. Barry’s Bootcamp, offering a hybrid of strength training and cardio, consistently attracts high-end clients looking for luxury fitness services. Other notable players such as Pure Barre, with its low-impact toning workouts, and CrossFit, LLC, known for its intense and competitive workout culture, continue to grow their niche markets. Meanwhile, emerging brands like Solidcore and Row House are tapping into the demand for targeted strength and rowing workouts. Together, these players represent the diverse spectrum of boutique fitness offerings, positioning themselves to thrive in an increasingly competitive market.

Top Companies in the Market

- Orangetheory Fitness

- F45 Training

- SoulCycle

- Barry’s Bootcamp

- Pure Barre

- CrossFit, LLC

- CorePower Yoga

- Solidcore

- Row House

- Club Pilates

- CycleBar

- 9Round

- SLT (Strengthen Lengthen Tone)

- The Bar Method

- Rumble Boxing

Gain Complete Access To In-depth Market Insights By Securing Your Full Report Today. https://market.us/purchase-report/?report_id=138609

Recent Developments

- In 2024, Viva Leisure has announced a strategic investment in Boutique Fitness Studios (BFS), which holds the master franchise rights for Xponential Fitness brands, including Club Pilates, Rumble Boxing, StretchLab, and CycleBar in Australia and New Zealand. This move is part of Viva Leisure’s strategy to expand its presence in the fast-growing boutique fitness sector across the two countries.

- In 2024, Hydrow, a leading manufacturer of at-home rowing machines, made headlines by acquiring a majority stake in Speede Fitness, an AI-driven strength training company. This acquisition aligns with Hydrow’s mission to enhance its fitness offerings and expand into new areas of strength training, all while marking a significant leadership change with the departure of their CEO.

- In 2024, EGYM, a global fitness technology provider, has strengthened its position in the U.S. wellness market by acquiring FitReserve, a prominent U.S.-based network of fitness studios and gyms. This acquisition further solidifies EGYM’s commitment to expanding its corporate wellness platform, Wellpass, within the U.S. market, offering more options for corporate clients seeking holistic wellness solutions.

- In 2024, FitLab Inc. continued to disrupt the fitness industry by acquiring Assault Fitness, a renowned fitness equipment manufacturer, and RPM Training, a leader in performance equipment and apparel. These acquisitions allow FitLab to expand its portfolio, offering a comprehensive suite of products that combine boutique studio experiences, mass participation events, and high-quality fitness equipment.

- On October 25th, 2024, Urban Gym Group (UGG) announced its acquisition of Sparring Partners Holdings, the owners of Gymbox, a disruptive fitness brand in London. The acquisition marks a new chapter for Gymbox as it prepares for expanded growth, while the leadership team exits, having played a pivotal role in building the brand over the past two decades.

- On October 28, 2024, World Gym International, a well-established global fitness brand, was acquired by World Fitness Services, Ltd (WFS), the parent company of World Gym Taiwan. WFS, which operates 130 World Gym centers in Taiwan, has expressed its commitment to maintaining the brand’s legacy while expanding its reach internationally.

- On April 2, 2024, Orangetheory Fitness, a leader in heart-rate-based interval training, announced its merger with Self Esteem Brands, a prominent player in the health and personal care sector. This merger creates the largest portfolio of wellness brands, positioning the combined entity to dominate the global $5.6 trillion wellness market.

Conclusion

The boutique fitness studio market is experiencing significant growth, driven by increasing consumer demand for personalized and community-focused wellness experiences. This trend is evident across various regions, with independent gyms and specialized fitness centers gaining popularity in urban areas. Additionally, the rise of women-only gyms highlights a shift towards creating inclusive and supportive environments for specific demographics. The integration of digital platforms and hybrid fitness models has further expanded the reach of boutique studios, allowing them to cater to a broader audience. Despite challenges such as high operational costs and market saturation, the industry’s emphasis on innovation, community engagement, and wellness integration positions it well for continued expansion in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)