Table of Contents

Overview

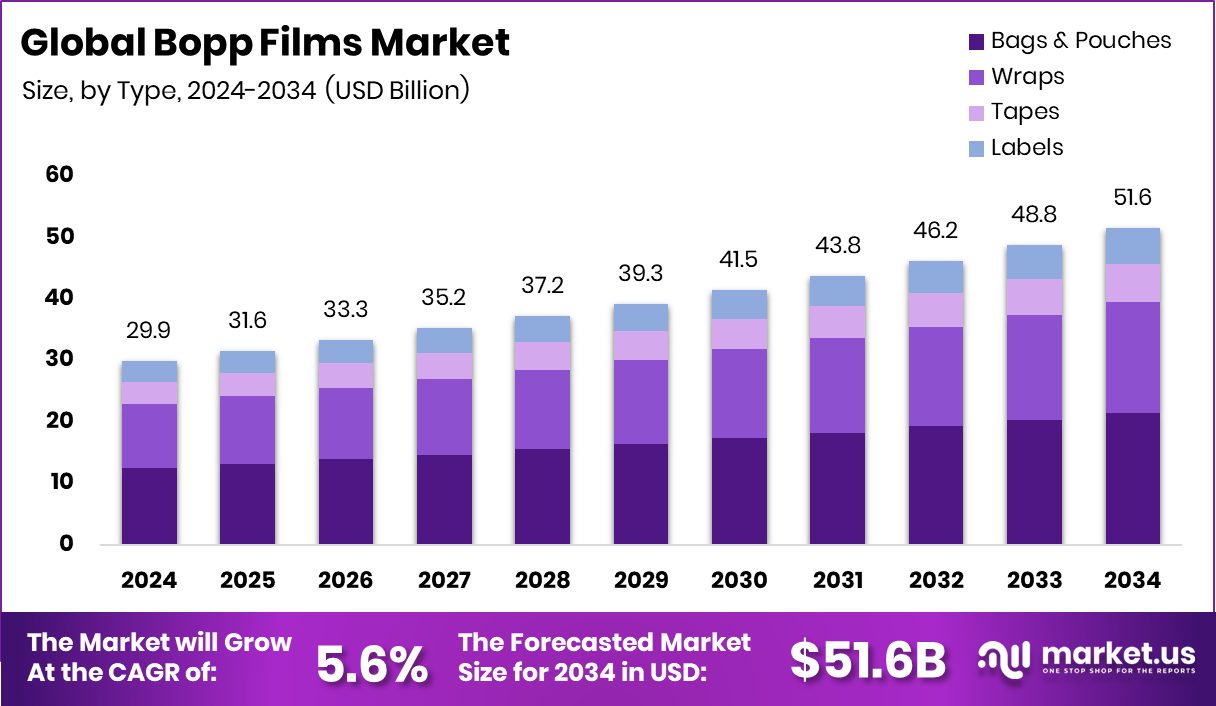

New York, NY – Nov 13, 2025 – The global BOPP films market is moving steadily toward stronger growth as demand for flexible, recyclable, and lightweight packaging rises across food, personal care, and e-commerce sectors. Expected to reach USD 51.6 billion by 2034, up from USD 29.9 billion in 2024, the market expands at a 5.6% CAGR, with Asia Pacific holding a dominant 39.60% share due to its fast-growing manufacturing and packaging industries. BOPP films—formed by stretching polypropylene in two directions—offer clarity, tensile strength, moisture resistance, and excellent printability, making them a popular material for sealing, labeling, and product protection.

Growth is strongly linked to the global shift toward packaged foods and the expanding online retail ecosystem, where freshness, shelf appeal, and cost efficiency are critical. Their lightweight profile also supports lower transport emissions, which aligns with sustainability expectations.

Increasing pressure to reduce single-use plastics is accelerating innovation in recyclable BOPP film formats. This industry direction is reinforced by broader environmental funding, such as UKRI’s £3.2 million initiative to manage plastic waste, Zouk’s $1.5 million raise for vegan accessories, and the €9 million phone-pouch sustainability project. These investments underscore the global momentum toward eco-friendly materials, thereby strengthening the long-term prospects for BOPP films.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-bopp-films-market/request-sample/

Key Takeaways

- The Global Bopp Films Market is expected to be worth around USD 51.6 billion by 2034, up from USD 29.9 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- The BOPP Films Market sees strong dominance in bags and pouches, capturing a 40.4% share.

- The 15–30 micron thickness segment leads the BOPP Films Market, accounting for 49.7% of the market share.

- The tenter process drives the BOPP Films Market production, holding a commanding 89.3% share globally.

- Food packaging applications dominate the BOPP Films Market, representing a substantial 48.8% of total demand.

- The Asia Pacific market value reached an impressive USD 11.8 billion in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164746

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 29.9 Billion |

| Forecast Revenue (2034) | USD 51.6 Billion |

| CAGR (2025-2034) | 5.6% |

| Segments Covered | By Type (Bags and Pouches, Wraps, Tapes, Labels), By Thickness (Below 15 Microns, 15-30 Microns, 30-45 Microns, More Than 45 Microns), By Production Process (Tenter, Tubular), By Application (Food, Beverage, Personal Care, Pharmaceutical, Electrical and Electronics, Others) |

| Competitive Landscape | Cosmo Films Limited, Taghleef Industries, CCL Industries, Jindal Poly Films, Sibur Holdings, Zhejiang Kinlead Innovative Materials, Inteplast Group, Uflex Ltd., Polinas, Polibak, Toray Industries |

Key Market Segments

By Type Analysis

In 2024, bags and pouches held a dominant 40.4% share in the By Type segment of the BOPP Films Market, reflecting their strong acceptance across major packaging industries. Their leadership comes from the growing use of flexible, durable solutions in food, beverage, and personal care products, where protection, clarity, and visual appeal are essential. BOPP-based bags and pouches offer excellent transparency, moisture resistance, and tensile strength, helping brands maintain product freshness while improving shelf presentation.

This segment also gains momentum from rising consumer demand for lightweight, resealable, and recyclable packaging options. These preferences align well with the characteristics of BOPP film, thereby boosting adoption across both retail and e-commerce. As manufacturers work to enhance packaging efficiency and reduce production costs, BOPP bags and pouches continue to stand out as a practical, sustainable, and cost-effective choice. Their consistent advantages reinforce their leadership in the global BOPP films market.

By Thickness Analysis

In 2024, the 15–30 Microns category led the By Thickness segment of the BOPP Films Market with a 49.7% share, reflecting its strong suitability for modern packaging needs. This thickness range is favored because it offers an effective balance of flexibility, durability, and cost efficiency. Films in this segment deliver clear visibility, strong tensile performance, and reliable moisture and oxygen barrier protection, making them ideal for food packaging, labels, and lamination applications.

Their lightweight design contributes to material savings and smoother production processes, which benefits both manufacturers and brand owners seeking high-output efficiency. As industries increasingly value durable and sustainable packaging formats that can withstand transportation and storage conditions, the 15–30 micron range continues to gain preference. Its combination of practicality, performance, and affordability reinforces its leadership in the global BOPP films market.

By Production Process Analysis

In 2024, the tenter process dominated the by-production process segment of the BOPP films market with an exceptionally strong 89.3% share. This method remains the industry’s preferred choice because it delivers films with outstanding dimensional stability, consistent thickness, and excellent optical clarity. Through controlled stretching in both the machine and transverse directions, the tenter process enhances mechanical strength and barrier performance, making the films suitable for demanding packaging environments.

Its high production efficiency further supports large-scale manufacturing, enabling companies to produce reliable, uniform, and high-quality films for packaging, labeling, and lamination. As packaging needs evolve toward greater precision, durability, and cost-effectiveness, the tenter process continues to set the benchmark. Its proven capability to meet diverse performance requirements ensures its ongoing leadership within the global BOPP films market.

By Application Analysis

In 2024, the food segment dominated the By Application category of the BOPP Films Market with a 48.8% share, highlighting its central role in global packaging demand. The segment leads due to the widespread use of BOPP films for snacks, confectionery, bakery products, and ready-to-eat meals, where maintaining freshness and visual appeal is essential. These films provide strong moisture protection, excellent clarity, and reliable sealing qualities, helping extend shelf life and improve overall product presentation.

Their lightweight, recyclable design also supports sustainability goals as manufacturers work to reduce material waste without compromising performance. With consumers increasingly seeking convenient, attractive, and protective packaging, the food industry continues to rely heavily on BOPP films. This consistent demand reinforces the segment’s leadership and strengthens its influence on the overall growth of the BOPP films market.

Regional Analysis

In 2024, Asia Pacific led the global BOPP Films Market with a 39.60% share, valued at USD 11.8 billion, maintaining its position as the strongest regional contributor. This dominance stems from its large manufacturing base, fast-growing food and beverage sectors, and rising adoption of flexible packaging across China, India, and Southeast Asia. Urbanization and a shift toward lightweight, convenient packaging formats continue to reinforce the region’s consumption.

North America recorded steady growth supported by advanced packaging technologies and a strong emphasis on recyclable materials in the U.S. and Canada. Europe also sustained solid demand for premium and high-clarity films, encouraged by strict environmental policies and a rising preference for sustainable solutions.

Markets in the Middle East & Africa and Latin America are gradually expanding, driven by growing retail networks and industrial packaging needs. Together, these dynamics confirm Asia Pacific as the central growth hub of the BOPP Films Market in 2024.

Top Use Cases

- Flexible food pouches: BOPP films are widely used to make bags and pouches for snacks, confectionery, and bakery items because they keep out moisture and gases, preserve freshness, and offer a clear display of the product. Their durability and glossy look attract consumers while protecting contents in transit.

- Labels for bottles and containers: BOPP acts as an excellent film for labels on food jars, cosmetics, or industrial containers. It resists water, oil, and chemicals better than paper, and its clarity enables high-quality prints and strong brand visuals.

- Self-adhesive tape backing: The biaxial orientation of BOPP film gives high tensile strength and good bonding for pressure-sensitive tapes. These tapes are used in packaging and sealing applications where moisture resistance and durability matter.

- Industrial laminated film overlays: BOPP can be laminated onto paper, foil, or board to add gloss, barrier protection, and printability. Such laminated boards are used in the packaging of bakery items, confectionery, and dry foods needing extra strength and visual appeal.

- Heavy-duty woven sacks and storage bags: When BOPP film is laminated over woven polypropylene, you get robust sacks for grains, fertilizers, or building materials that resist tears, moisture, and pests—ideal for industrial or agricultural use.

- Overwraps and promotional clear films: BOPP films are used as tight overwraps around cartons, bottles, or gift packs owing to their high clarity, gloss, and heat-sealability. They protect products from dust and handling damage while supporting a premium look and branding.

Recent Developments

- In April 2025, Ti presented its “reDESIGN™” consulting service at Ipack-Ima in Milan. This helps brands redesign packaging structures—especially replacing multilayer films with more sustainable BOPP or mono-material solutions—while keeping film performance intact.

- In August 2024, Cosmo First announced seven new specialty films for the U.S. market (for signage, label, lamination applications), including high-shrink label films, heat-resistant laminate film, and primer-coated label films.

Conclusion

The BOPP Films Market continues to strengthen as industries move toward flexible, durable, and sustainable packaging solutions. Its versatility, strong sealing ability, and clarity make it suitable for food, personal care, labels, and industrial applications. Growing focus on recyclable materials and lightweight packaging further supports its long-term relevance.

With expanding use across retail, e-commerce, and manufacturing, BOPP films remain a dependable choice for brands aiming to improve product protection, visual appeal, and efficiency. The market’s future outlook stays positive as innovation in film properties and eco-friendly formats encourages wider adoption across global packaging systems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)