Table of Contents

Overview

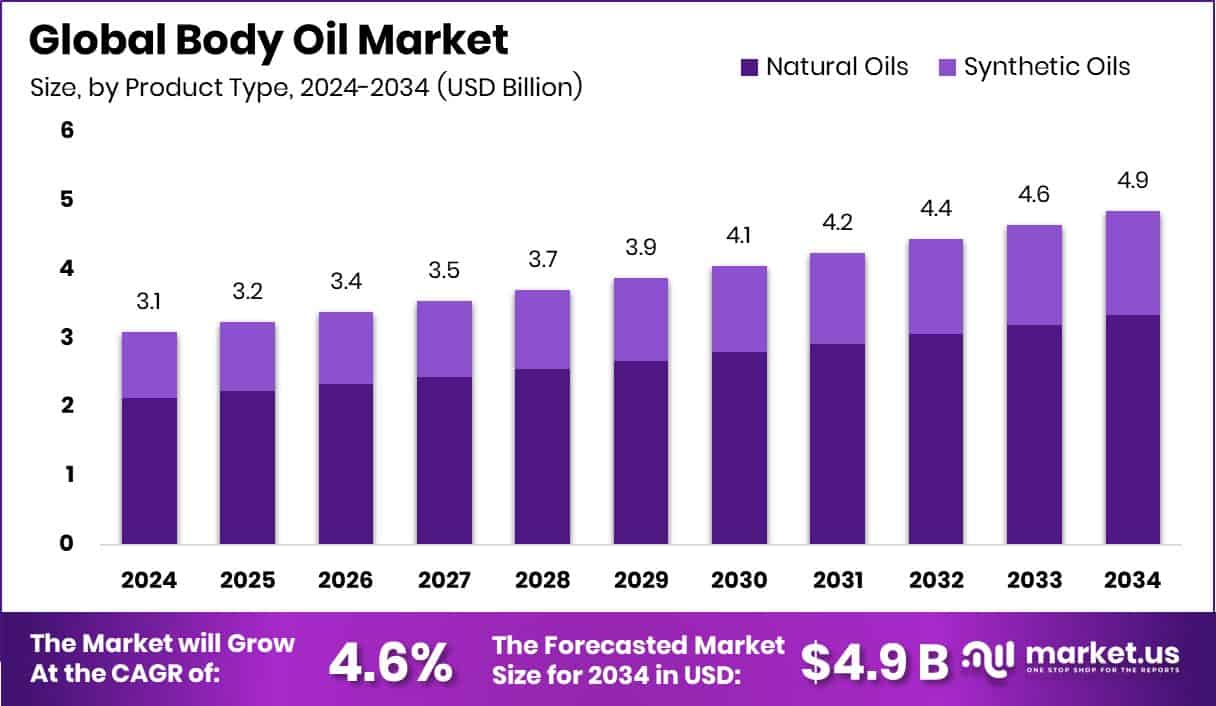

New York, NY – May 14, 2025 – The Global Body Oil Market is growing fast, driven by increasing demand for skincare and wellness products. In 2024, the market was valued at USD 3.1 billion and is expected to reach USD 4.9 billion by 2034, growing at a steady rate of 4.6% per year.

In 2024, Natural Oils commanded a 68.9% share in the body oil product type segment, solidifying their dominance in the market. This strong preference reflects a surge in consumer demand for plant-based, organic skincare options over synthetic alternatives. Liquid formulations led the body oil market in 2024, capturing a 72.7% share in the product form segment.

Spa and Wellness Centers held a 56.4% share in the body oil application segment in 2024, underscoring their pivotal role in the market. Supermarkets and Hypermarkets accounted for a 44.8% share of the body oil distribution channel segment in 2024, reflecting their dominance as a retail powerhouse.

Key Takeaways

- Global Body Oil Market is expected to be worth around USD 4.9 billion by 2034, up from USD 3.1 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- In 2024, Natural Oils held a 68.9% share in the Body Oil Market by Product Type.

- Liquid form dominated the Body Oil Market with a 72.7% share in the Product Form segment.

- Spa and Wellness Centers accounted for 56.4% application share in the Body Oil Market.

- Supermarkets/Hypermarkets led distribution with a 44.8% market share in the Body Oil segment.

- North America generated USD 1.2 Bn in body oil sales during 2024.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-body-oil-market/request-sample/

Analyst Viewpoint

The Body Oil Market is an attractive space for investors, with steady growth driven by consumer demand for natural, sustainable skincare solutions. Investment opportunities lie in brands focusing on organic and plant-based oils like jojoba and argan, which align with the clean beauty trend.

Smaller companies innovating with eco-friendly packaging or multifunctional oils for hair and skin are also gaining traction, offering high-growth potential for early investors. However, risks include intense competition from lotions and creams, volatile raw material prices, and the challenge of differentiating in a crowded market. Investors should prioritize companies with strong supply chains and clear sustainability commitments to mitigate these risks.

Technological advancements, like cold-pressing techniques and the integration of vitamins or essential oils, are enhancing product appeal, though high production costs can strain margins. The regulatory environment is tightening, particularly in the EU, where strict ingredient safety and labeling standards demand compliance, potentially delaying product launches.

Report Scope

| Market Value (2024) | USD 3.1 Billion |

| Forecast Revenue (2034) | USD 4.9 Billion |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Product Type (Natural Oils, Synthetic Oils), By Product Form (Spray, Liquid), By Application (Spa and Wellness Centers, Medical Therapeutics, Others), By Distribution Channels (Supermarkets/Hypermarkets, Brand Stores, Pharmacy Stores, Online Platforms, Other Distribution Channels) |

| Competitive Landscape | Unilever plc, The Procter & Gamble Company, Avon Products, Inc., L’Occitane Groupe S.A., Aveda Corporation, Clarins, KAO USA Inc., Desert Essence, Chanel Limited, MOROCCANOIL, INC., Forte Organics Ltd, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147737

Key Market Segments

By Product Type Analysis

- In 2024, Natural Oils commanded a 68.9% share in the body oil product type segment, solidifying their dominance in the market. This strong preference reflects a surge in consumer demand for plant-based, organic skincare options over synthetic alternatives. Oils like almond, coconut, and jojoba are prized for their nourishing, antioxidant-packed, and chemical-free qualities, resonating with wellness-focused buyers who prioritize ingredient transparency.

By Product Form Analysis

- Liquid formulations led the body oil market in 2024, capturing a 72.7% share in the product form segment. Their popularity stems from their smooth, fast-absorbing texture and versatility, making them ideal for daily moisturizing, massages, and aromatherapy. Liquid oils are easy to apply, often packaged in convenient pump bottles or droppers, enhancing hygiene and user experience.

By Application Analysis

- Spa and Wellness Centers held a 56.4% share in the body oil application segment in 2024, underscoring their pivotal role in the market. Body oils are integral to massage therapies, skincare treatments, and relaxation-focused services, delivering nourishment and therapeutic benefits. The segment’s strength is driven by the wellness industry’s focus on sensory experiences and premium care, amplified by post-pandemic demand for self-care and rejuvenation.

By Distribution Channels Analysis

- Supermarkets and Hypermarkets accounted for a 44.8% share of the body oil distribution channel segment in 2024, reflecting their dominance as a retail powerhouse. Their widespread presence, high customer traffic, and ability to offer a diverse range of products—from budget to premium oils—make them a go-to for skincare shoppers. In-store promotions, product displays, and the option to physically assess products drive impulse and routine purchases.

Regional Analysis

- North America led the Body Oil Market in 2024, capturing a 41.8% global share and generating USD 1.2 billion in revenue. This dominance stems from heightened consumer awareness of skincare benefits, a robust retail network, and the rising popularity of natural and therapeutic body oils in wellness routines.

- Europe maintained strong demand, fueled by widespread adoption of premium and organic body care products, particularly in markets like Germany and France. The Asia Pacific region is experiencing rapid growth, driven by increasing disposable incomes and a growing preference for beauty and personal care among younger demographics.

- The Middle East & Africa is steadily emerging as key market, with body oils gaining traction in traditional beauty rituals and wellness tourism destinations. Latin America shows promising potential, supported by local production and a cultural affinity for oil-based skincare solutions.

Top Use Cases

- Daily Skin Moisturization: Body oils like coconut and almond hydrate dry skin, offering long-lasting moisture. Their lightweight, non-greasy formulas suit daily use, appealing to consumers seeking natural alternatives to lotions. Popular in North America, where skincare awareness is high, they cater to busy lifestyles with quick application and deep nourishment.

- Massage Therapy in Spas: Spa and wellness centers use body oils for relaxation and therapeutic massages. Oils infused with essential oils like lavender enhance sensory experiences, promoting stress relief and skin health. Their smooth texture ensures easy glide, making them a staple in professional wellness settings.

- Aromatherapy Applications: Body oils blended with essential oils are widely used in aromatherapy to boost mood and relaxation. Consumers apply them during meditation or self-care routines, valuing their calming scents. This use case is growing in Europe, where holistic wellness trends drive demand for natural, aromatic products.

- Hair and Scalp Nourishment: Oils like argan and jojoba are applied to hair and scalp to reduce frizz, add shine, and combat dryness. Their nutrient-rich profiles strengthen hair, appealing to consumers seeking multifunctional products. This use case is prominent in Asia Pacific, where beauty routines increasingly include oil-based haircare solutions.

- Post-Bath Hydration Ritual: Body oils are popular post-shower to lock in moisture and protect the skin barrier. Their fast-absorbing nature suits consumers who prioritize quick, effective skincare. This ritual is gaining traction in Latin America, where oil-based products align with cultural preferences for hydrated, glowing skin.

Recent Developments

1. Unilever plc

- Unilever has expanded its Vaseline and Dove body oil ranges with sustainable formulations. The new Vaseline Gluta-Hya Serum Spray combines hyaluronic acid and glutathione for hydration. Dove’s Nourishing Secrets line now includes a lightweight argan oil-infused body oil. Unilever emphasizes eco-friendly packaging and vegan ingredients.

2. The Procter & Gamble Company

- P&G’s Olay launched Collagen Peptide Body Oil, targeting skin elasticity and hydration. Their Native brand introduced a coconut & jojoba body oil with 100% natural fragrances. P&G is also focusing on refillable body oil bottles to reduce plastic waste.

3. Avon Products, Inc.

- Avon’s Skin So Soft line now features a CBD-infused body oil for muscle relaxation and moisturization. They also introduced a 24K Gold Body Oil for luxury skincare, emphasizing anti-aging benefits.

4. L’Occitane Groupe S.A.

- L’Occitane’s Almond Supple Skin Oil has been reformulated with 100% natural origin ingredients, now available in a recyclable bottle. They also launched a lavender-infused body oil for stress relief and deep hydration.

5. Aveda Corporation

- Aveda introduced Botanical Repair Strengthening Body Oil, infused with argan and marula oils to repair dry skin. The product is part of their 100% vegan and sustainable initiative, packaged in post-consumer recycled materials.

Conclusion

The Body Oil Market is growing as brands focus on natural ingredients, sustainability, and multi-benefit formulas. Companies like Unilever (Vaseline, Dove) and P&G (Olay) are launching hyaluronic acid, collagen, and peptide-infused oils for better hydration and anti-aging effects. Avon and L’Occitane are tapping into luxury and wellness trends with CBD and gold-infused oils, while Aveda emphasizes vegan, eco-friendly products.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)