Table of Contents

Introduction

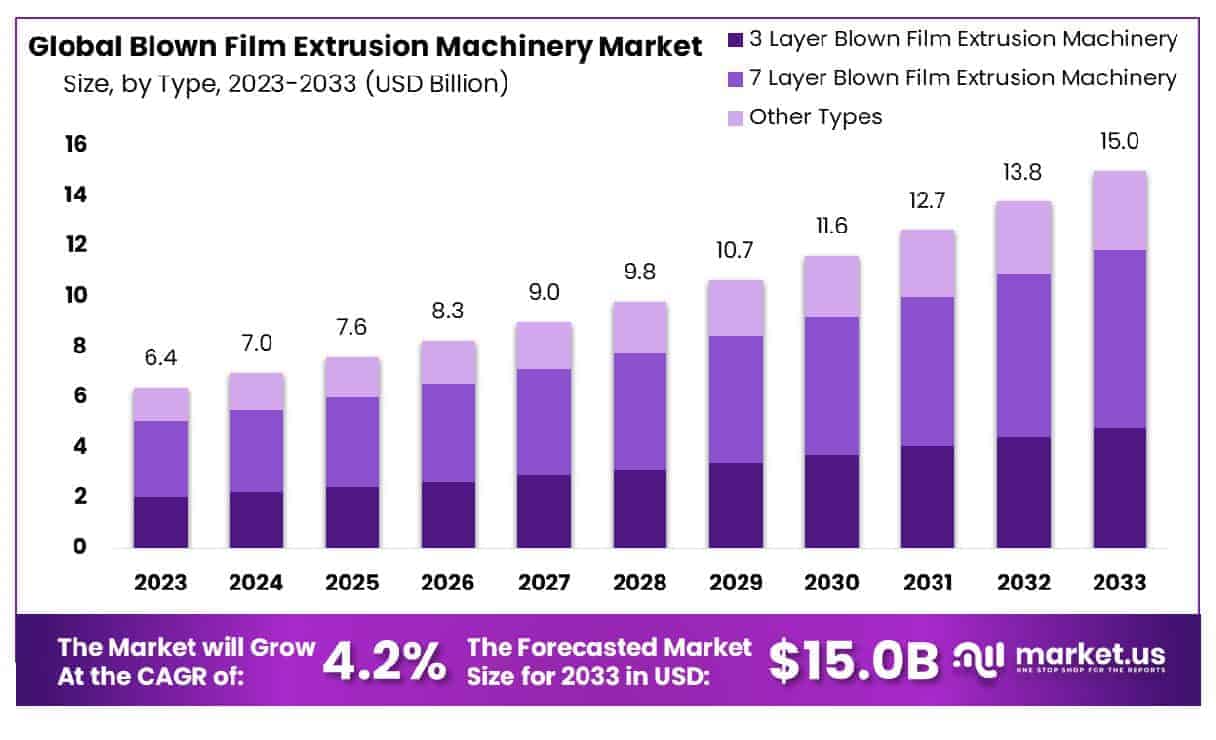

The Global Blown Film Extrusion Machinery Market is projected to reach a value of approximately USD 15.0 billion by 2033, up from USD 6.4 billion in 2023, reflecting a compound annual growth rate (CAGR) of 4.20% during the forecast period from 2024 to 2033.

Blown Film Extrusion Machinery refers to the equipment used to produce thin plastic films by extruding molten polymer through a die and inflating it to form a bubble, which is then cooled and flattened into a continuous film. This process is integral in manufacturing a variety of flexible packaging products, such as food and beverage packaging, agricultural films, and industrial liners.

The Blown Film Extrusion Machinery market encompasses the manufacturing, sales, and service of such equipment, driven by the increasing demand for flexible, durable, and cost-effective packaging solutions. The growth of the market can be attributed to the expanding packaging industry, particularly in emerging economies where demand for packaged goods is rising due to urbanization, changing lifestyles, and greater disposable incomes.

Furthermore, the growing emphasis on sustainable and biodegradable packaging solutions has spurred innovation within the industry, with manufacturers seeking machinery that supports the production of eco-friendly films. Increased demand for lightweight and multi-layered films, along with advancements in machine technology that offer higher energy efficiency, faster production speeds, and lower operational costs, also contribute to the market’s expansion.

Opportunities exist within the market for manufacturers to capitalize on these trends by offering specialized machinery designed for specific applications, such as food safety or medical packaging. Additionally, as industries look to optimize their supply chains and reduce material waste, the demand for advanced, customizable extrusion machinery with precise control systems is expected to drive continued growth in the coming years.

Key Takeaways

- The Global Blown Film Extrusion Machinery Market is projected to grow from USD 6.4 Billion in 2023 to USD 15.0 Billion by 2033, reflecting a CAGR of 4.20% during the forecast period (2024-2033).

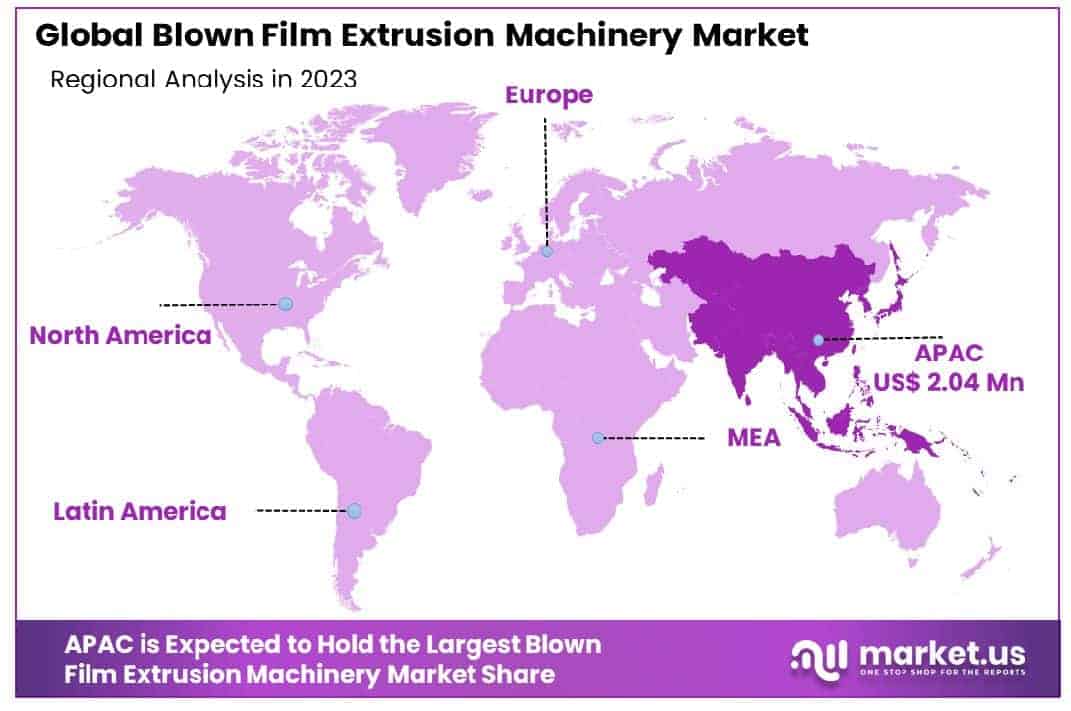

- The Asia-Pacific region leads the market, holding a 32% share of the global market.

- The 7-layer blown film extrusion machinery holds the largest market share at 47%.

- Industrial packaging accounts for 37% of the market’s application share.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 6.4 Billion |

| Forecast Revenue (2033) | USD 15.0 Billion |

| CAGR (2024-2033) | 4.20% |

| Segments Covered | By Type(3 Layer Blown Film Extrusion Machinery, 7 Layer Blown Film Extrusion Machinery, Other Types), By Application(Industrial Packaging, Food & Beverages, Consumer Goods, Pharmaceuticals, Other Applications) |

| Competitive Landscape | Davis-Standard, Windsor Machines Inc., Fong Kee International Machinery Co. Ltd., Alpha Marathon Film Extrusion Technologies Inc., POLYSTAR MACHINERY CO. LTD., Kung Hsing Plastic Machinery Co. Ltd., Plasco Engineering Inc., Chyi Yang Industrial Co. Ltd., Vikrant Industries, GAP Italy, Other Key Players |

Emerging Trends

- Shift Toward Sustainability: There is an increasing trend toward producing eco-friendly films, with a growing emphasis on biodegradable and recyclable packaging solutions. This shift is prompting manufacturers to innovate in machinery that supports the production of such materials.

- Automation Integration: Advanced automation technologies are being integrated into extrusion machinery, offering improved production efficiency, reduced labor costs, and greater precision in the extrusion process.

- Smart Manufacturing: The adoption of smart technology, including IoT and AI, is enhancing the control and monitoring of extrusion processes. These technologies allow real-time data analytics, predictive maintenance, and process optimization.

- Multi-Layer Films: The demand for multi-layer blown films, which offer enhanced barrier properties and better performance for packaging, is growing. This has prompted manufacturers to develop more advanced machinery capable of producing complex multi-layer films.

- Energy Efficiency: With rising energy costs, there is an increased focus on developing energy-efficient machinery. Newer models are being designed to reduce energy consumption while maintaining high output quality and speed.

Top Use Cases

- Packaging for Food & Beverages: Blown films are widely used in the packaging of food and beverages, particularly for their durability and ability to preserve freshness and extend shelf life.

- Agricultural Films: These films are used to protect crops, especially in the form of mulch films and greenhouse covers, helping in the controlled growth of crops.

- Medical Packaging: Blown films are also crucial for medical packaging applications where hygiene and protection from external contaminants are essential.

- Industrial Packaging: Used for packaging heavy-duty items, such as chemicals, fertilizers, and construction materials, blown films provide protection against moisture, dust, and other contaminants.

- Retail & Consumer Goods: Blown films are used in retail environments for packaging products like clothing, toys, and other consumer goods, where transparency and durability are key.

Major Challenges

- High Initial Investment: The capital cost of setting up blown film extrusion machinery can be significant, especially for small to mid-sized businesses.

- Raw Material Cost Fluctuations: The volatility in the prices of polymer resins used in film production can impact profit margins and overall production costs.

- Technological Complexity: The advancement in machinery technology requires a higher level of technical expertise and training, which can be a barrier for certain manufacturers.

- Environmental Impact of Non-Biodegradable Films: While there is a strong push for sustainability, non-biodegradable plastics continue to dominate the market, leading to growing concerns regarding environmental pollution.

- Maintenance and Downtime: High-performance machinery requires regular maintenance to ensure smooth operation, and unplanned downtime can disrupt production and increase operational costs.

Top Opportunities

- Growth in Packaging Demand: With the expanding global packaging industry, especially in emerging markets, there is a continuous demand for new and advanced blown film extrusion machinery.

- Innovation in Eco-Friendly Materials: Manufacturers can capitalize on the growing demand for sustainable, recyclable, and biodegradable packaging by developing machinery that supports such production.

- Adoption of Advanced Materials: The increased use of specialized polymers and composite materials for blown films presents opportunities for machinery developers to create machines tailored to these new materials.

- Expanding Applications in Healthcare: The healthcare sector’s need for protective and sterile packaging is growing, creating demand for advanced extrusion machinery capable of producing highly specialized films.

- Customization and Automation: There is an opportunity to develop machinery that offers greater customization for various industry needs and integrates automation for greater production efficiency and reduced costs.

Key Player Analysis

The global blown film extrusion machinery market in 2024 is characterized by a strong competitive landscape, with several key players driving innovation and market growth. Davis-Standard, known for its advanced extrusion solutions, continues to maintain a strong market presence through technological leadership and product diversification. Windsor Machines Inc. has positioned itself as a key player by offering cost-effective and efficient machinery solutions tailored to various industry needs.

Fong Kee International Machinery Co. Ltd. holds a significant share, driven by its robust manufacturing capabilities and global reach. Alpha Marathon Film Extrusion Technologies Inc. is recognized for its specialized machinery offerings, focusing on the film extrusion segment with high-quality solutions. Other notable players such as POLYSTAR MACHINERY CO. LTD., Kung Hsing Plastic Machinery Co. Ltd., and Plasco Engineering Inc. continue to drive competitive pricing strategies, while Chyi Yang Industrial Co. Ltd. and Vikrant Industries contribute through innovative product features and operational efficiency. These key players are expected to play a crucial role in shaping market dynamics in 2024.

Top Market Key Players

- Davis-Standard

- Windsor Machines Inc.

- Fong Kee International Machinery Co. Ltd.

- Alpha Marathon Film Extrusion Technologies Inc.

- POLYSTAR MACHINERY CO. LTD.

- Kung Hsing Plastic Machinery Co. Ltd.

- Plasco Engineering Inc.

- Chyi Yang Industrial Co. Ltd.

- Vikrant Industries

- GAP Italy

- Other Key Players

Regional Analysis

Asia-Pacific Region: Dominating the Blown Film Extrusion Machinery Market with 32% Market Share in 2024

The Asia-Pacific region holds a dominant position in the global blown film extrusion machinery market, accounting for 32% of the total market share in 2024, with a market value of USD 2.04 million. This substantial share can be attributed to the region’s robust manufacturing sector, particularly in countries such as China, India, and Japan, which are leading producers of plastic films. The demand for blown film extrusion machinery in this region is driven by the growing packaging industry, especially in food, consumer goods, and pharmaceuticals.

The rapid industrialization and expansion of the e-commerce sector further support the demand for packaging solutions. Additionally, the increasing focus on sustainable and biodegradable plastic films, combined with a growing preference for flexible packaging, is expected to drive the adoption of advanced extrusion technologies in the region. As a result, the Asia-Pacific market is anticipated to continue leading the market, with strong growth prospects in the coming years.

Recent Developments

- In 2024, Rajoo Engineers introduced the Proex series, a five-layer POD blown film line capable of producing films at an impressive 900 kg/hr, with a thickness of 22 microns and a 2,800-mm layflat width. The line is powered by Relex 4.0 extruders, known for their energy efficiency and high yield, offering up to 30% more output. Featuring the CSD 4.0 die, this system provides flexible film thicknesses ranging from 20 to 200 microns while maintaining superior quality and strength. The technology ensures high productivity, wide film dimensions, and energy-efficient operations.

- On September 12, 2023, Smurfit Kappa and WestRock confirmed their agreement to merge, forming Smurfit WestRock, a global leader in sustainable packaging. This strategic merger combines Smurfit Kappa, a prominent FTSE 100 company, and WestRock, an S&P 500 company, aligning their capabilities to drive innovation and sustainability in packaging solutions.

- In 2024, Kiefel showcased its KMD 90.1 Premium machine and sustainable packaging solutions at NPE 2024. At the event in Orlando, Florida, Kiefel demonstrated advanced packaging technologies, including the SPEEDFORMER KMD 90.1 Premium machine, which manufactures 100% post-consumer recycled PET lids, and the NATUREFORMER KFT Lab, producing eco-friendly natural fiber-based bowls.

- In 2024, Davis-Standard, LLC completed its acquisition of Extrusion Technology Group (ETG), marking a significant milestone for the company in expanding its expertise in extrusion and converting technologies. This merger enhances Davis-Standard’s position as a global leader in providing innovative and efficient manufacturing solutions.

Conclusion

the Blown Film Extrusion Machinery market is poised for steady growth, driven by the increasing demand for flexible, cost-effective, and sustainable packaging solutions. With advancements in machine technology, particularly in energy efficiency, automation, and multi-layer film production, the market is adapting to evolving industry needs, such as those in food packaging, medical supplies, and agriculture. The rise of eco-friendly materials and the expansion of packaging sectors in emerging economies further support the market’s expansion. However, challenges such as high initial investments, fluctuating raw material costs, and environmental concerns related to non-biodegradable films remain key hurdles. As manufacturers continue to innovate and tailor machinery to specific applications, the market is expected to benefit from both regional growth, especially in Asia-Pacific, and the increasing demand for smarter, more efficient production processes.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)