Table of Contents

Introduction

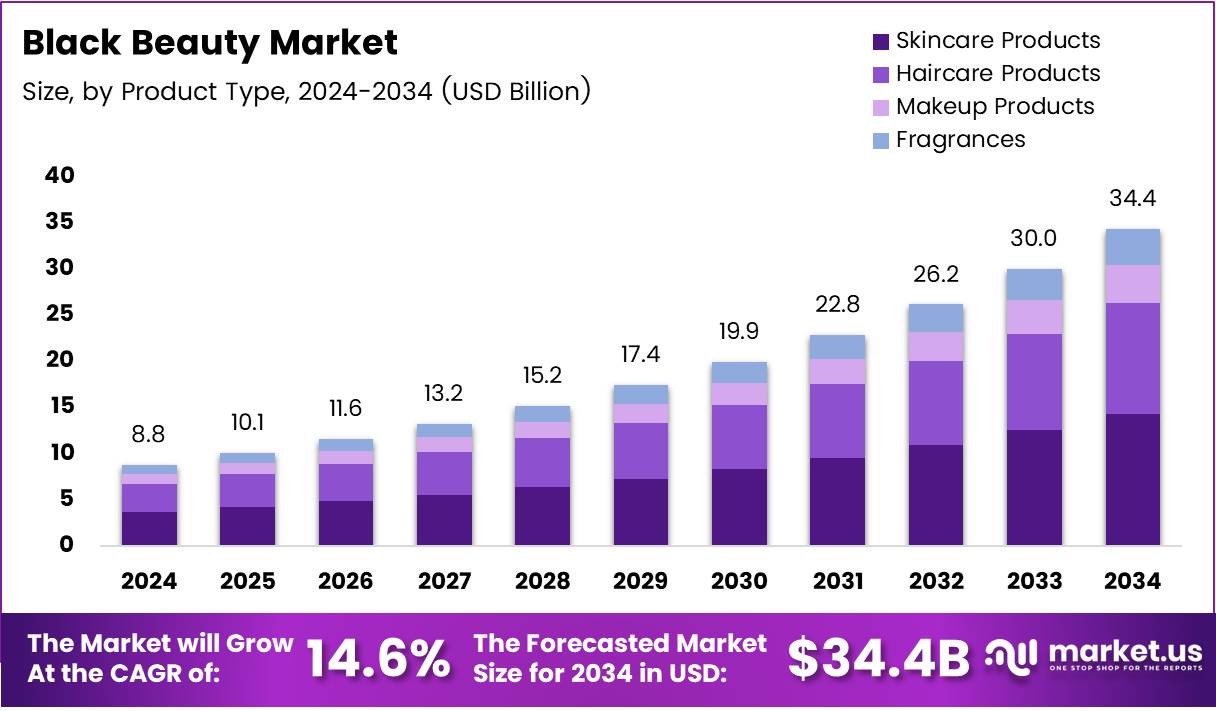

The Global Black Beauty Market is experiencing remarkable growth, expected to reach USD 34.4 Billion by 2034 from USD 8.8 Billion in 2024, expanding at a CAGR of 14.6% between 2025 and 2034. The sector continues to evolve as inclusivity, authenticity, and innovation reshape beauty standards globally.

As representation in the beauty industry grows, brands targeting Black consumers are transitioning from niche players to industry leaders. They are driving advancements in skincare, haircare, and cosmetics designed for melanin-rich skin and textured hair. This transformation reflects a broader movement toward diversity and cultural relevance in global beauty markets.

Additionally, the increasing purchasing power of Black consumers, combined with digital engagement and social media influence, is accelerating brand visibility and consumer trust. These factors collectively propel the market’s upward momentum and position it as a key growth frontier in the global beauty landscape.

Key Takeaways

- The Global Black Beauty Market is expected to reach USD 34.4 Billion by 2034, growing at a CAGR of 14.6% from 2025 to 2034.

- Skincare Products dominated the By Product Type Analysis segment in 2024, holding a 43.8% market share.

- Activated Charcoal led the By Ingredient Insights Analysis segment in 2024, with a 39.6% market share.

- Online Retail captured the largest share in the By Distribution Channel Analysis segment in 2024, with 34.8% of the market.

- North America held the largest market share in 2024, with 47.9%, valued at USD 4.2 Billion.

Market Segmentation Overview

In 2024, Skincare Products led the market with a 43.8% share, reflecting the growing need for melanin-specific care solutions. Rising consumer awareness about hyperpigmentation and uneven skin tones continues to strengthen this segment, pushing innovation in formulations and ingredients designed for darker skin tones.

Haircare Products followed closely, fueled by increasing interest in natural curls, protective hairstyles, and scalp health. Brands are focusing on clean, sulfate-free, and moisturizing formulas that support textured hair. This segment remains vital to identity and cultural expression within the Black beauty community.

Makeup Products maintained steady growth as brands expanded shade ranges and inclusive foundations. Diverse undertones and cultural representation helped strengthen consumer trust, while Fragrances carved a niche appeal with personalized, artisanal blends resonating with cultural heritage and individuality.

Activated Charcoal led the Ingredient Insights segment with a 39.6% share due to its detoxifying benefits. Black Seed Oil and Black Tea Extract also gained prominence for their hydration and antioxidant properties. Together, these natural ingredients are driving the clean beauty movement across product categories.

Online Retail dominated with a 34.8% share, signaling a shift toward e-commerce-driven beauty shopping. Consumers prefer direct-to-consumer platforms for accessibility, variety, and community engagement. Supermarkets and specialty stores also played key roles, offering both affordability and personalized shopping experiences.

Drivers

Growing Demand for Organic and Natural Beauty Products: The shift toward clean and plant-based formulations continues to shape the Black beauty industry. Consumers increasingly prioritize safety and transparency, prompting brands to eliminate harsh chemicals and focus on sustainable, non-toxic alternatives aligned with holistic wellness.

Influence of Social Media and Rising Disposable Income: Platforms like Instagram and TikTok amplify the visibility of Black-owned brands through influencer-led tutorials and reviews. With higher disposable income, consumers are investing in premium products that cater to cultural identity, authenticity, and self-expression.

Use Cases

Personalized Skincare for Melanin-Rich Skin: Brands are using technology and dermatological research to formulate products targeting hyperpigmentation, acne scars, and uneven tones. Personalized skincare routines help consumers maintain radiant, healthy complexions, enhancing loyalty to culturally inclusive brands.

Textured Haircare and Protective Styling Solutions: Innovative formulations for curls, coils, and locs support scalp health and hydration. From moisturizing masks to styling gels, these products celebrate natural beauty and empower consumers to embrace authentic hair textures with confidence.

Major Challenges

Intense Competition from Established Brands: As major global players enter the inclusive beauty space, smaller Black-owned businesses face difficulties competing with large marketing budgets and expansive distribution networks. This intensifies market saturation and challenges brand differentiation.

Limited Product Shelf Life and Retail Constraints: Organic and natural beauty products often have shorter shelf lives, limiting their retail availability. Retailers may hesitate to stock these products, affecting exposure and reducing opportunities for small-scale producers to scale efficiently.

Business Opportunities

Expansion into Emerging Markets: Regions in Africa, the Caribbean, and Latin America present strong growth potential due to rising beauty consciousness and limited access to diverse product options. Expanding into these markets can unlock significant untapped revenue streams.

Eco-Friendly and Vegan Product Development: Sustainable and cruelty-free beauty solutions resonate with ethical consumers. Black beauty brands focusing on biodegradable packaging and clean formulations can attract environmentally conscious buyers and strengthen global appeal.

Regional Analysis

North America: With a 47.9% share and valuation of USD 4.2 Billion in 2024, North America remains the dominant region. The presence of established retail infrastructure, increased awareness around product safety, and younger demographics drive market leadership across the U.S. and Canada.

Europe and Asia Pacific: Europe demonstrates rising demand for ethically sourced and inclusive products, supported by progressive regulatory frameworks. Meanwhile, Asia Pacific is rapidly expanding due to its diverse consumer base and increasing disposable incomes, offering fertile ground for inclusive and niche Black beauty brands.

Recent Developments

- In April 2024, Mented Cosmetics, a Black woman-owned beauty brand, was acquired by West Lane Capital Partners, reinforcing investment in diverse and inclusive beauty portfolios.

- In June 2025, L’Oréal acquired the British skincare brand Medik8 to strengthen its position in the premium and anti-aging skincare segments.

- In December 2024, L’Oréal Groupe acquired Korean skincare brand Dr.G, expanding its footprint in Asia’s high-growth beauty market.

Conclusion

The Global Black Beauty Market stands at the forefront of beauty innovation and inclusivity, set to reach USD 34.4 Billion by 2034. As clean beauty, personalization, and cultural authenticity gain momentum, brands that invest in transparency, representation, and sustainability will lead this transformative era of global beauty evolution.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)