Table of Contents

Overview

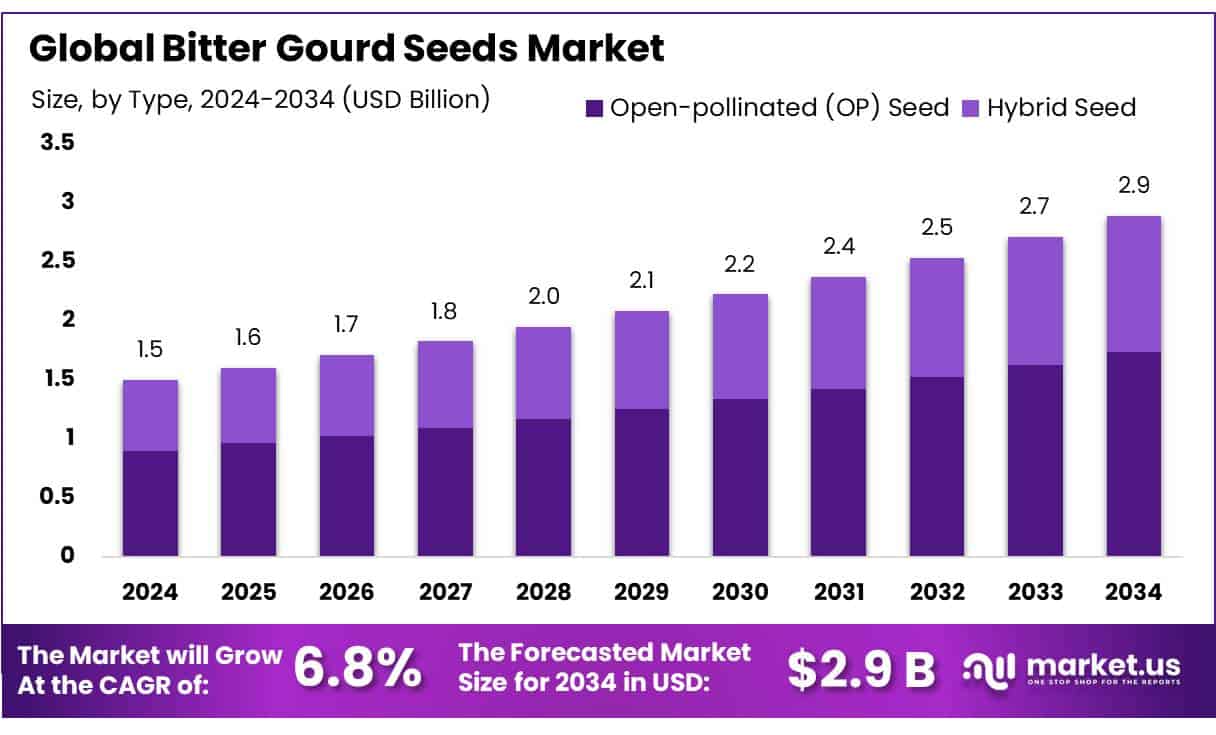

New York, NY – Oct 17, 2025 – The Global Bitter Gourd Seeds Market is projected to grow from USD 1.5 billion in 2024 to approximately USD 2.9 billion by 2034, registering a compound annual growth rate (CAGR) of 6.8% between 2025 and 2034.

Bitter gourd, also known as bitter melon, holds significant importance in both agricultural and medicinal sectors worldwide due to its notable health benefits and economic value. Bitter gourd seeds are vital for the crop’s cultivation, predominantly in Asia, Africa, and the Caribbean, serving not only in propagation but also in plant breeding and genetic research.

The global bitter gourd seeds market is witnessing steady expansion, with Asia leading in both production and consumption. In 2022, India, a key producer, cultivated bitter gourd across roughly 35,000 hectares, achieving yields of about 6.5 tonnes per hectare, as reported by the Ministry of Agriculture & Farmers Welfare. China and Thailand also rank among the major producers, employing advanced farming techniques to boost yield and quality. The market features contributions from both large agribusinesses and small-scale farmers, each playing an important role in regional economic growth.

Several factors are fueling market growth. Rising awareness of bitter gourd’s health benefits such as aiding diabetes management, enhancing immunity, and improving digestion has driven consumer demand. Additionally, advancements in seed treatment and genetics to increase yield and disease resistance are supporting market expansion.

Government initiatives in countries like India and China are further encouraging cultivation through seed subsidies, farming equipment support, and farmer training. For instance, under the National Horticulture Mission, the Indian government allocated $50 million in 2023 to promote horticultural diversity, including bitter gourd production.

Innovations in hybrid seed development are expected to create new growth opportunities. These hybrids are engineered for greater climate adaptability and disease resistance, enhancing productivity. Government-backed R&D investments are strengthening these efforts for example, in 2024, the Thai government invested about $3 million in agricultural biotechnology to improve the quality and efficiency of vegetable seed production, including bitter gourd.

Key Takeaways

- The bitter gourd seeds market is projected to grow from USD 1.5 billion in 2024 to approximately USD 2.9 billion by 2034, registering a CAGR of 6.8%.

- Open-pollinated (OP) seeds led the market, accounting for about 60.10% of the total share.

- The green bitter gourd variety dominated the segment, capturing an impressive 73.30% market share.

- Conventional farming methods prevailed, representing over 82.10% of the market share.

- Retail stores remained the leading distribution channel, holding more than 54.50% of the market.

- The Asia-Pacific (APAC) region was the market leader, with a 43.10% share, generating roughly USD 0.6 billion in value.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/bitter-gourd-seeds-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.5 Bn |

| Forecast Revenue (2034) | USD 2.9 Bn |

| CAGR (2025-2034) | 6.8% |

| Segments Covered | By Type (Open-pollinated (OP) Seed, Hybrid Seed), By Variety (Green Bitter Gourd, White Bitter Gourd), By Application (Conventional Farming, Greenhouse Farming), By Distribution Channel (Retail Stores, Online Retail, Departmental Outlets) |

| Competitive Landscape | BASF SE, Bayer AG, Urja Seeds, Unico Seeds Pvt. Ltd., Green Field Seeds, Novel Seeds Private Limited, INDO US BIO-TECH LIMITED, Chia Tai, Tan Loc Phat Seeds Company Limited, East-West Seed, Lion Seeds Co., Ltd., SUNTECH SEED CO., LTD., Pan Seeds Pvt. Ltd., Known You Seed (India) Pvt. Ltd., HajiSons, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144967

Key Market Segments

By Type

Open-Pollinated Seeds Dominate with Over 60% Share, Driven by Demand and Genetic Stability

In 2024, open-pollinated (OP) seeds accounted for a leading 60.10% share of the bitter gourd seeds market. Farmers favor OP seeds for their genetic stability, which ensures that crops retain consistent characteristics generation after generation. This reliability makes them particularly popular in regions with strong traditional farming practices and a preference for non-hybrid varieties. Their cost-effectiveness, adaptability to diverse climates, and ability to deliver stable yields further reinforce their market dominance.

By Variety

Green Bitter Gourd Leads with 73.3% Market Share on Strong Consumer Preference

The green bitter gourd variety held a commanding 73.30% market share in 2024, fueled by its widespread popularity among consumers for its distinctive taste and nutritional value. Especially favored in Asian cuisines, green bitter gourd is prized for health benefits such as blood sugar regulation and digestive support. Rising demand in both domestic and international markets driven by health-conscious diets has cemented its position as the most sought-after variety.

By Application

Conventional Farming Maintains 82.1% Share Through Proven Practices

Conventional farming methods dominated the bitter gourd seeds market in 2024, capturing 82.10% of the share. These techniques, which rely on synthetic fertilizers and pesticides, remain preferred for their proven ability to boost yields and manage pests effectively. Accessibility, cost efficiency, and the deep-rooted expertise of farmers in these practices contribute to their continued prevalence in commercial bitter gourd production.

By Distribution Channel

Retail Stores Hold 54.5% Share as Primary Distribution Hub

Retail stores led bitter gourd seed distribution in 2024 with a 54.50% share, underlining their importance in reaching both home gardeners and small-scale farmers. Offering convenient access, diverse product selections, and personalized advice, retail outlets benefit from high customer footfall and immediate product availability, making them a preferred purchasing channel.

Regional Analysis

APAC Leads the Bitter Gourd Seeds Market with 43.10% Share, Valued at USD 0.6 Billion

In 2024, the Asia-Pacific (APAC) region dominated the global bitter gourd seeds market, accounting for 43.10% of the total share and generating around USD 0.6 billion in value. This leadership is primarily attributed to the extensive cultivation and high consumption of bitter gourd in countries such as India, China, Bangladesh, Thailand, and the Philippines, where it remains a staple in both local cuisine and traditional medicine. India stands out as one of the largest producers and consumers, with vast cultivation areas in states like Uttar Pradesh, Maharashtra, and Karnataka.

Favorable agro-climatic conditions, deep-rooted cultural preferences, and consistent year-round demand have created strong growth prospects for the regional market. Rising health consciousness is further boosting consumption, supported by the promotion of bitter gourd’s anti-diabetic and digestive benefits by both public health bodies and private wellness brands.

Government support, such as India’s National Horticulture Mission (NHM) and state-led organic farming programs, is also driving market expansion. These initiatives provide subsidies for high-quality seeds, irrigation facilities, and market connectivity, strengthening demand for bitter gourd seeds across the region.

Top Use Cases

1. Product Innovation and Development:

Seed companies can explore creating value-added products like seed powders, oils, or extracts rich in antioxidants and bioactive compounds, targeting nutraceutical and functional food segments. This not only taps into health-conscious consumer demand but also transforms under-utilized seed waste into profitable, sustainable offerings.

2. Organic & Non-GMO Seed Expansion:

Growing consumer preference for natural, eco-friendly products creates opportunity to supply certified organic and non-GMO bitter gourd seeds. Companies focusing on these segments can attract premium buyers both in traditional farming zones and new markets boosting margins and brand differentiation.

3. Regional Variety Customization:

Developing seed varieties tailored to local climates, soils, and pest pressures helps farmers achieve reliable yields. This use case supports targeted R&D, enabling seed suppliers to offer region-specific solutions that improve resilience, farmer adoption, and ultimately market reach.

4. Biodiversity and Seed Conservation:

Maintaining diverse bitter gourd seed lines through seed banks or germplasm programs supports long-term genetic diversity. This safeguards the crop against future threats, enables breeding innovation, and appeals to sustainability-oriented stakeholders, including research institutions and governments.

5. Expansion into New Geographies:

With bitter gourd’s health benefits gaining recognition globally, there’s a use case for marketing seeds in untapped Western regions where urban gardening, wellness trends, and culinary curiosity are rising. Strategic promotion can open new markets and diversify demand beyond traditional areas.

6. Value-added by-product Utilization:

Beyond planting, bitter gourd seeds can be processed into powders, extracts, or oils for functional foods, cosmetics, or water purification. This creates additional income streams while aligning with %UN% sustainability goals by reducing waste and adding value from by-products.

7. Disease-Resistant and High-Yield Breeding:

Developing hybrid or improved OP varieties with stronger pest resistance and higher yields addresses farmer pain points. This use case supports investment in breeding programs that enhance productivity, reduce crop loss, and increase seed demand among commercial growers.

Recent Developments

- BASF SE :

- BASF’s brand Nunhems has introduced an innovative bitter gourd hybrid variety called US 1315, designed for India’s small spiny market segment. It offers strong plant vigor, high yield, and a quick maturity cycle (50-55 days), paired with durable spines ideal for long-distance transport. Farmers appreciate its market-favored size and quality, while traders pay 30-40% more for US 1315 produce thanks to its freshness and consistent shape.

2. East-West Seed:

- East-West Seed continues to strengthen its global role in sustainable agriculture. In 2024, the company appointed Thibaut P. Terlon as CFO to boost its financial strategy, and Franck Berger joined the Supervisory Board to bring deep seed sector experience. In June, East-West Seed also participated in the World Seed Congress, pushing for quality tropical vegetable seeds, food security, and fighting illegal seed practices through a pioneering MoU.

3. Urja Seeds:

- While specific recent developments in bitter gourd are limited, Urja Seeds continues to promote its range of both open-pollinated and hybrid bitter gourd seeds in India. Their blog highlights cultivation practices, nutritional benefits, and seed options, indicating ongoing engagement with growers and hobby gardeners.

Conclusion

The global bitter gourd seeds market is experiencing steady growth, driven by rising health awareness, technological advancements in seed breeding, and supportive government initiatives. Key players such as BASF SE (Nunhems) are introducing high-yield, disease-resistant hybrid varieties like US 1315, tailored for market demands and transport resilience. East-West Seed is enhancing its leadership through strategic appointments, global advocacy for quality seeds, and initiatives to combat counterfeit products. Companies like Urja Seeds continue to strengthen farmer engagement by offering a wide range of open-pollinated and hybrid seeds supported with cultivation guidance.

The Asia-Pacific region remains the largest market, fueled by strong consumption in India, China, and other Asian countries, favorable agro-climatic conditions, and deep cultural integration of bitter gourd into diets. Ongoing investments in R&D, organic and non-GMO seed production, and region-specific seed development are expected to expand market opportunities, ensuring consistent supply, improved yields, and better quality for both local and global markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)