Table of Contents

Overview

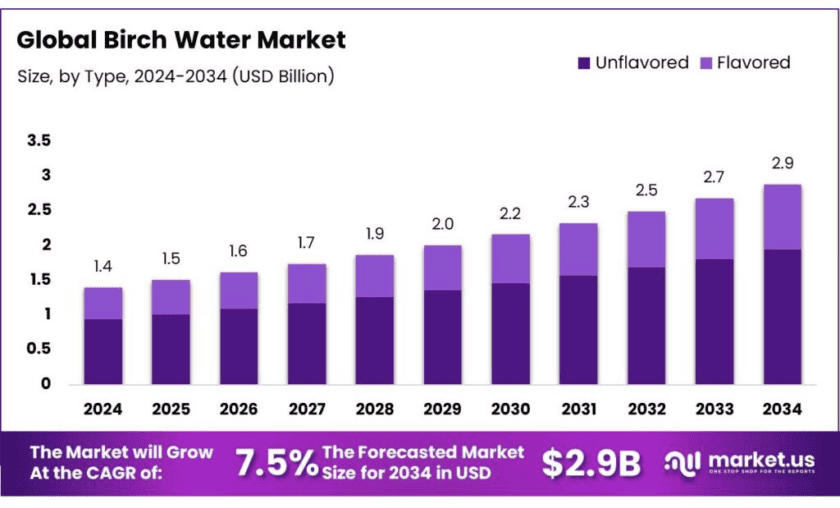

New York, NY – Nov 05, 2025 – The global birch water market is projected to reach USD 2.9 billion by 2034, growing from USD 1.4 billion in 2024 at a steady CAGR of 7.5% between 2025 and 2034. In 2024, the Asia-Pacific region led the global market, accounting for a 38.4% share and generating approximately USD 0.4 billion in revenue. Birch water, extracted from the sap of birch trees, has gained widespread popularity as a natural beverage and functional ingredient due to its detoxifying properties, hydration benefits, and rich mineral content.

In India, several government initiatives are indirectly fostering industry growth by emphasizing water conservation and sustainable water management—essential for birch water production, which depends on natural water sources. Programs such as Gujarat’s “Jal Sanchay Jan Bhagidari” initiative have constructed around 24,800 rainwater harvesting structures, strengthening regional water availability. Similarly, the Jal Jeevan Mission, with a massive ₹3.60 lakh crore budget, aims to supply 55 liters of tap water per capita per day to every rural household by 2024, ensuring sustainable water use nationwide.

Rising health consciousness among consumers continues to propel market demand for natural, sugar-free, and low-calorie beverages. According to the Food and Agriculture Organization (FAO), global consumption of natural health beverages has increased by 6% annually since 2019, underscoring a broader lifestyle shift toward healthier, eco-friendly drink options.

Key Takeaways

- Birch Water Market size is expected to be worth around USD 2.9 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.5%.

- Unflavored birch water held a dominant market position, capturing more than a 67.4% share of the global market.

- Conventional birch water held a dominant market position, capturing more than a 79.3% share.

- Beverages held a dominant market position, capturing more than a 74.6% share of the global birch water market.

- Supermarkets and hypermarkets held a dominant market position, capturing more than a 39.1% share of the global birch water market.

- Europe held the dominant market position in the global birch water sector, capturing more than 42.1% of the market share, valued at approximately USD 0.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-birch-water-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.4 Bn |

| Forecast Revenue (2034) | USD 2.9 Bn |

| CAGR (2025-2034) | 7.5% |

| Segments Covered | By Type (Unflavored, Flavored), By Nature (Conventional, Organic), By Application (Beverages, Cosmetics And Personal Care, Pharmaceuticals, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online, Others) |

| Competitive Landscape | BelSeva, Sapp, Nature on Tap, TreeVitalise, Byarozavik, Wild West, Nordic Koivu, Alaska Wild Harvest, Wild & Pure, Biotona Bio |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159403

Key Market Segments

By Type Analysis – Unflavored Birch Water Leads with 67.4% Share in 2024

In 2024, unflavored birch water dominated the global market, capturing a 67.4% share. This segment’s leadership reflects a growing consumer preference for natural, minimally processed beverages that offer health benefits without added sugars or artificial ingredients. The clean, pure taste of unflavored birch water appeals strongly to health-conscious consumers seeking hydration through plant-based and low-calorie alternatives. Its versatility also enhances demand, as it can be consumed directly or used in functional beverages such as smoothies and recovery drinks. The trend toward clean-label, additive-free products—especially among younger demographics—continues to reinforce the market position of unflavored birch water globally.

By Nature Analysis – Conventional Birch Water Dominates with 79.3% Share in 2024

The conventional birch water segment held a commanding 79.3% market share in 2024, supported by its wide availability, affordability, and consumer familiarity. Conventional variants, typically produced through large-scale commercial sourcing, are more accessible and cost-effective than organic alternatives, appealing to a broader audience. Their dominance is further strengthened by extensive retail distribution across supermarkets, convenience stores, and e-commerce platforms. As global interest in functional and hydrating beverages continues to grow, conventional birch water efficiently meets mass-market demand while maintaining consistent supply and lower production costs, solidifying its leadership in the category.

By Application Analysis – Beverages Segment Holds 74.6% Share in 2024

In 2024, the beverages segment led the global birch water market, accounting for 74.6% of total share. The surge in demand for healthy, natural, and low-calorie drinks has positioned birch water as a strong alternative to sugar-laden sodas and energy drinks. Its composition—rich in minerals, antioxidants, and electrolytes—makes it ideal for use in functional beverages such as smoothies, energy boosters, and hydration blends. Growing health awareness and the expansion of the functional beverage market have propelled birch water’s popularity, particularly in bottled and canned forms, which are increasingly visible across both retail and online sales platforms.

By Distribution Channel Analysis – Supermarkets & Hypermarkets Lead with 39.1% Share in 2024

The supermarkets and hypermarkets segment dominated birch water distribution in 2024, holding a 39.1% share of the global market. This dominance is driven by the broad reach, convenience, and strong retail infrastructure of these outlets, which make birch water widely accessible to mainstream consumers. Located in high-traffic areas, supermarkets provide the ideal platform for impulse and repeat purchases. Their ability to offer a diverse range of birch water brands and packaging sizes, from premium to value options, caters to varying consumer preferences. As global demand for natural and functional beverages rises, supermarkets and hypermarkets continue to play a central role in boosting birch water’s visibility and market penetration.

List of Segments

By Type

- Unflavored

- Flavored

- Strawberry

- Rose Chip

- Bilberry

- Apple

- Ginger

- Others

By Nature

- Conventional

- Organic

By Application

- Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Regional Analysis

In 2024, Europe dominated the global birch water market, capturing a substantial 42.1% share and generating approximately USD 0.5 billion in revenue. This strong regional performance is rooted in Europe’s centuries-old tradition of birch sap harvesting, especially in countries such as Finland, Russia, and Sweden, where birch water has long been valued for its natural hydration and health benefits.

Europe’s advantage also lies in its advanced production technologies and comprehensive retail infrastructure, ensuring wide product availability across supermarkets, health food stores, and online platforms. The growing shift toward sustainable and eco-friendly beverages has further enhanced birch water’s appeal as a natural, environmentally responsible alternative to traditional soft drinks.

Top Use Cases

Low-calorie hydration for clean-label drinks: Birch water typically delivers ~2–4 kcal/100 ml with ~0.8–1.1 g sugars/100 ml, making it a naturally low-calorie base for “better-for-you” beverages and flavored extensions. Example EU retail labels show 3 kcal/100 ml and 0.8–0.9 g carbs/100 ml—useful for meeting numeric sugar and calorie targets without artificial sweeteners. This lets brands position SKUs below common front-of-pack thresholds while keeping a simple ingredient list.

Electrolyte/mineral positioning in functional waters: Analytical studies report birch sap contains potassium ≈ 72–166 mg/L, calcium ≈ 33–85 mg/L, magnesium ≈ 7–22 mg/L, and manganese ≈ 1.5–13 mg/L (ranges vary by site and season). Such naturally occurring electrolytes support light-electrolyte claims for hydration lines or workout-adjacent products—without fortification. Further forestry/food science papers corroborate potassium as the dominant mineral in many samples.

Fermentation And specialty formulations (bases, mixers): Birch sap contains ~0.81–1.4% total saccharides (mainly glucose/fructose with some sucrose) plus organic acids (e.g., malic ~230–510 mg/L), it can serve as a mild-sugar fermentation base or as a mixer in low-sugar mocktails/RTDs. Researchers also note bioactive components (peptides, phenolic acids) that can complement “natural origins” positioning in premium lines.

Shelf-life management And cold-chain strategy: Microbiology studies show fresh birch sap is perishable; freezing for two weeks reduced microbiota counts by ~1 log in trials (without major shelf-life change post-thaw). For brands, this supports frozen or aseptic supply strategies (concentrate, then pack) to maintain quality ahead of hot-fill/aseptic RTD runs or foodservice distribution.

Transparent nutrition claims and compliance: Public nutrition references for birch sap list energy ~4.6 kcal/100 g and low sugars, supporting “low calorie” narrative when aligned to local claim rules. EU ingredient guidance and Codex frameworks underpin the regulatory pathway for simple, plant-based beverages; manufacturers should align labels with local nutrient-declaration rules using verified databases/records.

Premium provenance And seasonal SKUs: European and Nordic producers leverage provenance and seasonality for premium pricing. Composition work in Baltic/Nordic birch shows mineral patterns (e.g., potassium often >100 mg/L) that can be communicated in terroir-style stories while staying evidence-based—useful for limited releases and specialty channels.

Recent Developments

In 2024, Nature on Tap Ltd. promoted its “TAPPED” birch-water line—pure organic birch sap collected from Nordic forests and distributed in UK retail channels such as Boots and Ocado with over 250 store listings by 2017. As a market research analyst, I interpret this as Nature on Tap leveraging premium positioning and branded presence in the UK wellness-beverage segment, targeting health-conscious consumers looking for low-calorie, natural hydration alternatives sourced with forestry provenance.

In 2024, TreeVitalise remained focused on its organic birch water brand sourced from Carpathian forests and sold through key UK retailers like Holland & Barrett, offering variants such as Original, Mint and Lemon. From an analyst perspective, TreeVitalise positions itself well in the burgeoning birch-water market by offering clean-label, plant-based hydration with minimal sugar and appealing to functional-drink shoppers seeking novelty and authenticity.

In 2023, the French brand BelSeva continued producing its 100% organic birch water—labelled as “Sève de Bouleau Nature” with just 6 calories per pack and no added water or sugar. Positioned as a wellness-drink pioneer, BelSeva emphasises French forest sourcing, vegan and gluten-free credentials, and eco-friendly packaging. As a market-research analyst, I see BelSeva leveraging its niche heritage and clean-label credentials to attract European health-conscious consumers and carve out a premium segment in the growing birch water market.

In 2024, the US start-up Sapp (sometimes stylised as Säpp) marketed birch water as an organic, low-sugar alternative to coconut water, emphasising its mineral content and plant-based origin. As a market-research analyst, I believe Sapp’s focus on North American distribution, functional beverage positioning and health-forward branding places it well to gain share in the birch water category—which still remains niche in the U.S., where clean-label and novelty hydration drinks are gaining traction.

In 2023, Byarozavik emphasized its Belarus-harvested birch sap—collected each year from March to April—and bottled using a hot-fill process which claims a nine-month shelf stability. As a market-research analyst, I note that Byarozavik’s origin-story and seasonal harvesting window position it as an authentic, premium player in the birch water category, catering to consumers seeking natural, minimally processed hydration from Northern-Europe forestry traditions.

While detailed 2023/2024 RFIs are limited, Wild West is listed among key market players in global birch water reports. As a market-research analyst, I view Wild West as leveraging its branding to tap into North America’s growing functional-beverage demand—positioning birch water not just as a novelty, but as part of the wider plant-based, clean-label trend gaining traction in U.S. and Canadian wellness channels.

In 2024, Nordic Koivu marketed itself as a specialist in 100 % organic birch water harvested from Finnish forests, supplying “millions of litres per year” to food, beverage, cosmetics and pharmaceutical industries. As a market research analyst, I interpret Nordic Koivu’s strong industrial-scale readiness and organic focus as positioning it well within the birch water category—particularly for brands seeking clean-label, plant-based hydration solutions with authentic provenance.

In 2023, Alaska Wild Harvest (via its parent operation in Talkeetna, Alaska) reported harvesting upwards of 100,000 gallons of birch sap from Alaska’s boreal forest for its birch water and syrup lines. As an analyst, I see the company leveraging its wild-harvest story and U.S. origin to tap into the premium functional-beverage niche. Its emphasis on wilderness sourcing and minerals-rich birch water positions it as a U.S. player capable of capturing high-end wellness-driven demand.

In 2024, Nordic Koivu marketed itself as a Finnish specialist in 100%-natural birch water harvested from sustainably managed boreal forests, with its business profile showing 11 employees as of July 1, 2024. As a market-research analyst, I see Nordic Koivu leveraging its heritage of wild-sourced birch sap and premium positioning to meet the rising demand for clean-label, plant-based hydration in Europe’s birch water market — a region that continues to command over 40% share globally.

While precise 2023/2024 revenue figures are not publicly detailed, Biotona Bio (Belgium) is listed among the key players in the global birch water market. As a market-research analyst, I interpret Biotona Bio’s inclusion in industry overviews as recognition of its portfolio extension into birch-sap-based beverages or ingredients, aligning with its superfood brand identity and catering to health-conscious consumers seeking organic, minimally processed beverages.

Conclusion

In conclusion, birch water has carved a meaningful place in the wellness-beverage space thanks to its low calorie (~3–4 kcal/100 ml) and low sugar (~0.8–1.0 g/100 ml) profile. Its mineral-rich composition—potassium, calcium, magnesium, and trace elements—adds functional appeal.

For brands, it checks the boxes of plant-based, clean-label, minimally processed beverage formats aligned with rising consumer wellness demands. As a market-research analyst, I believe birch water is transitioning from a novelty to a growth ingredient: its natural provenance, nutritional story and versatility position it well for expansion in functional drinks, especially in regions focusing on health and sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)