Table of Contents

Overview

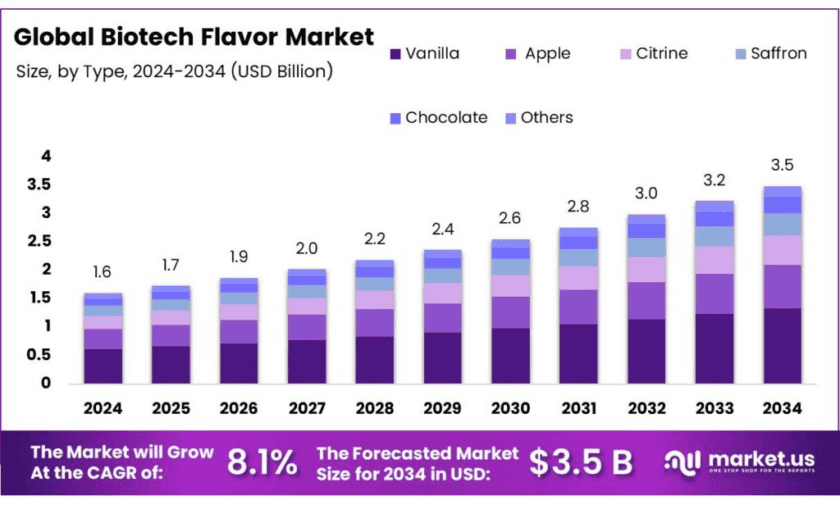

New York, NY – Nov 06, 2025 – The global biotech flavor market is projected to grow from USD 1.6 billion in 2024 to approximately USD 3.5 billion by 2034, expanding at a CAGR of 8.1% between 2025 and 2034. This market’s growth is driven by the increasing use of biotechnology in food flavoring, where fermentation, enzyme engineering, and synthetic biology enable the creation of natural, sustainable, and cost-efficient flavors.

Government support has also strengthened the biotechnology ecosystem. In India, the bioeconomy surged from USD 10 billion in 2014 to USD 165.7 billion in 2024, with a target of USD 300 billion by 2030. The Department of Biotechnology’s BioE3 policy promotes advanced biomanufacturing and bio-based industries, while BIRAC has funded over 3,000 startups and developed 750+ products, catalyzing biotech entrepreneurship and innovation.

Consumer preferences are another major force shaping this market. With rising demand for natural, clean-label, and sustainable flavors, biotech methods—especially microbial fermentation—offer a viable alternative to synthetic chemicals. In India, the food and beverage industry accounts for more than 35% of total enzyme use, highlighting a significant transition toward bio-based ingredients in food processing.

Key Takeaways

- Biotech Flavor Market size is expected to be worth around USD 3.5 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 8.1%.

- Vanilla held a dominant market position, capturing more than a 38.3% share of the global biotech flavor market.

- Liquid held a dominant market position, capturing more than a 56.8% share of the global biotech flavor market.

- Food & Beverages held a dominant market position, capturing more than a 54.2% share of the global biotech flavor market.

- North America held the largest market share in the global biotech flavor industry, capturing 42.7%, valued at approximately USD 0.6 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-biotech-flavor-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.6 Bn |

| Forecast Revenue (2034) | USD 3.5 Bn |

| CAGR (2025-2034) | 8.1% |

| Segments Covered | By Type (Vanilla, Apple, Citrine, Saffron, Chocolate, Others), By Form (Liquid, Powder, Paste), By Application (Food And Beverages, Pharmaceuticals, Nutraceuticals, Personal Care And Cosmetics, Others) |

| Competitive Landscape | Givaudan SA, Firmenich SA, Symrise AG, International Flavors & Fragrances Inc. (IFF), Takasago International Corporation, Kerry Group plc, T. Hasegawa Co., Ltd., BASF |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159423

Key Market Segments

By Type Analysis – Vanilla Leads the Biotech Flavor Market with 38.3% Share in 2024

In 2024, vanilla emerged as the dominant segment in the global biotech flavor market, accounting for a 38.3% share. This leadership is primarily due to vanilla’s wide-ranging applications across the food, beverage, cosmetics, and fragrance industries. As one of the world’s most recognized and versatile flavors, it remains an essential ingredient in ice creams, bakery goods, confectionery, and ready-to-drink beverages. The growing consumer shift toward natural and clean-label ingredients has significantly boosted demand for biotech-derived vanilla, particularly as producers move away from synthetic flavoring agents.

By Form Analysis – Liquid Biotech Flavors Dominate with 56.8% Share in 2024

In 2024, the liquid biotech flavor segment led the global market, capturing 56.8% of total share. This dominance stems from the ease of application and high versatility of liquid formats across industries, especially in food and beverages. Liquid biotech flavors are preferred for their ability to blend smoothly into formulations such as beverages, sauces, soups, and ready-to-eat meals, allowing for consistent taste and aroma. Their growing acceptance aligns with rising consumer demand for clean-label, naturally formulated products, as these flavors can be efficiently produced through fermentation and enzymatic bioprocesses.

By Application Analysis – Food & Beverages Hold 54.2% Share in 2024

In 2024, the food and beverages segment dominated the biotech flavor market, accounting for a 54.2% share. This leading position reflects the rising global preference for natural, sustainable, and clean-label flavors in everyday consumables. As consumers become more health-conscious and ingredient-aware, biotech flavors have emerged as a reliable alternative to synthetic additives, offering authentic taste, consistency, and eco-friendly sourcing. They are extensively used in snacks, dairy, confectionery, soft drinks, and plant-based foods, catering to both mainstream and niche health markets.

List of Segments

By Type

- Vanilla

- Apple

- Citrine

- Saffron

- Chocolate

- Others

By Form

- Liquid

- Powder

- Paste

By Application

- Food & Beverages

- Dairy Products

- Beverages

- Bakery & Confectionery

- Savory & Snacks

- Others

- Pharmaceuticals

- Nutraceuticals

- Personal Care & Cosmetics

- Others

Regional Analysis

In 2024, North America dominated the global biotech flavor market, capturing a significant 42.7% share and generating approximately USD 0.6 billion in revenue. This strong regional presence is fueled by advanced biotechnology infrastructure, a robust food and beverage industry, and growing consumer demand for natural, clean-label, and plant-based products. The United States remains the key contributor within the region, where innovation in biotech flavor solutions continues to expand rapidly across food manufacturing and alternative protein segments.

The surge in plant-based and vegan consumption has been a crucial driver of this trend. Biotech-derived flavors offer authentic, sustainable taste profiles that align with the clean-label movement while reducing reliance on animal ingredients. According to the Plant-Based Foods Association, the U.S. plant-based food market grew by 27% between 2020 and 2024, underscoring the region’s accelerating shift toward health-conscious, eco-friendly diets. This ongoing transformation has positioned North America as a global leader in the adoption and innovation of biotech flavor technologies.

Top Use Cases

Vanilla replacement at scale (consistent supply, clean-label): Fermentation-made vanillin lets brands meet “natural flavor” expectations when sourced from microbiological/plant materials and produced via enzymatic/microbial processes under EU rules (Reg. 1334/2008). U.S. safety frameworks (FEMA GRAS; FDA GRAS notices) also cover fermented vanillin; a 2025 FDA GRAS response (GRN 1230) flags labeling if milk-derived media proteins are present—useful for allergen-control SOPs. Result: a stable “natural-vanilla” stream for ice cream, RTD coffee, and bakery without agricultural volatility.

Citrus notes (valencene → nootkatone) with precise ppm dosing: Valencene and nootkatone—signature orange/grapefruit notes—are now produced by precision fermentation, reducing dependency on low-yield citrus peels. Academic and industry sources note nootkatone’s FEMA GRAS status (FEMA 3166) and typical beverage use around 2–6 ppm; FDA’s substance database lists it as a flavoring agent (21 CFR 172.515). These biotech routes deliver consistent organoleptics and supply for sodas, seltzers, confectionery, and perfumery.

Plant-based and “free-from” product lines (large addressable market): Biotech flavors support vegan/plant-based launches by recreating dairy, meat, and egg notes without animal inputs. The U.S. retail plant-based foods market was ~$8.1 billion in 2023; category share and adoption are tracked by GFI/PBFA and continued to evolve in 2024 (e.g., plant-based meat at 0.8–1.7% share depending on channel). This scale means better taste-matching via fermented flavors materially affects repeat rates and margin.

Regulatory labeling And “natural” claim alignment: EU and Codex frameworks define flavor categories and “natural flavoring substances”; EFSA provides scientific guidance on flavoring safety assessment. For U.S. labels, FEMA and FDA guidance (including standards for vanilla) inform proper nomenclature (e.g., “natural flavor,” “vanilla with other natural flavors”). Clear alignment lets brands keep clean-label positioning while using fermentation-derived molecules.

Supply-chain resilience, price And sustainability: Peer and trade literature highlight that microbial fermentation decouples flavor supply from climate shocks, crop disease, and seasonal yields—key for long-tail SKUs. Fermentation plants deliver uniform quality and can pivot between targets (e.g., from valencene to derivatives like nootkatone), smoothing COGS and improving scope for LTOs (limited-time offers) across beverages and confectionery.

Recent Developments

In 2024, Givaudan reported full-year sales of CHF 7,412 million, up 12.3% like-for-like and 7.2% in Swiss francs compared to 2023. Its Taste & Wellbeing division (which includes flavors) delivered strong double-digit growth, with EBITDA rising from CHF 704 million in 2023 to CHF 780 million in 2024. As a market research analyst, I see Givaudan’s investment in biotechnology and sustainable flavor production—such as its “Cultured Hub” cell-ag facility launched in 2024 —as positioning it very strongly in the biotech flavor space, combining scale, innovation and clean-label credentials.

In 2024, Firmenich (now part of dsm‑Firmenich) reported strong performance with adjusted EBITDA up 19% and adjusted free operating cash flow reaching €1,552 million, up 55% from the prior year. Firmenich’s deepening biotechnology capability—especially in flavors and aromas for plant-based foods—signals that the company is leveraging its science and scale to meet growing clean-label, natural ingredient demand via biotech-derived flavors.

In 2024, Symrise AG reported total sales of €4,998.5 million (up from €4,730.2 million in 2023) and net income of €478.2 million (versus €340.5 million a year earlier). The company’s EBITDA margin rose to 20.7% in 2024, supporting its strategic focus on flavors and functional ingredients. From a market-research analyst’s view, Symrise’s strong financials and emphasis on biotechnology for flavor creation position it well within the growing biotech-flavor segment as brands demand natural, scalable and clean-label solutions.

In 2024, IFF recorded full-year net sales of approximately US$11.48 billion, with currency-neutral growth of +6%, driven particularly by innovation in health, biosciences and flavor solutions. I see IFF’s large global footprint and investment in biotech-derived flavors and ingredients as key strengths—especially as food and beverage manufacturers transition to sustainable, high-performance flavor systems that align with clean-label and plant-based trends.

In the fiscal year ended March 31, 2024, Takasago International Corporation achieved net sales of ¥195.9 billion, up 4.9% from the previous year. Its Flavors division grew 3.4%, driven by strong beverage business in Japan and Asia. From a market-research analyst’s perspective, Takasago’s emphasis on cutting-edge flavor solutions—including biotech-based and specialty ingredients—positions it well in the rising market for sustainable and natural flavors, helping food and beverage brands respond to clean-label and plant-based consumer trends.

In 2024, Kerry Group plc reported group revenue of €8.0 billion, with continuing operations revenue at €6.9 billion, and its Taste & Nutrition segment showing volume growth of +3.4%. As a market-research analyst, I see Kerry’s broad capabilities in flavors, functional ingredients and biotechnology as strong enablers in the biotech-flavor sector: the company’s scale, innovation pipeline and focus on nutritional-profile enhancement align well with demand for bio-derived, clean-label flavor solutions across modern food and drink applications.

In the fiscal year ended September 30, 2024, T. Hasegawa reported net sales of ¥71,645 million, growing 10.4% year-on-year, and net income of ¥7,202 million. The Tokyo-based flavor and fragrance specialist is increasing its focus on biotech-enabled flavor solutions—particularly in plant-based and clean-label segments—making it well-positioned in the rising global demand for biotech flavors as food manufacturers seek scalable, sustainable taste systems.

For the business year 2024, BASF reported group sales of €65,260 million (down from €68,902 million in 2023) and an EBITDA before special items of €7,900 million. Within its Nutrition & Care segment—serving food and flavor ingredients—BASF logs sales of €6,729 million in 2024 (versus €6,858 million in 2023). BASF leveraging its biotech capabilities and scale to serve the biotech-flavor market, enabling food and beverage brands to adopt more sustainable, fermentation-derived flavor systems.

Conclusion

In conclusion, the biotech-flavor sector stands at a pivotal juncture—moving from niche innovation to mainstream adoption fueled by consumer demand for natural, clean-label, and sustainable ingredients. Innovations such as microbial fermentation and enzyme-based flavoring are delivering consistent quality, neutrally sourced profiles, and supply-chain resilience.

The path ahead hinges on scaling cost-efficient production, navigating regulatory frameworks, and leveraging biotechnological advances to deliver the next generation of flavors for plant-based foods, beverages, and personal-care formats.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)