Table of Contents

Overview

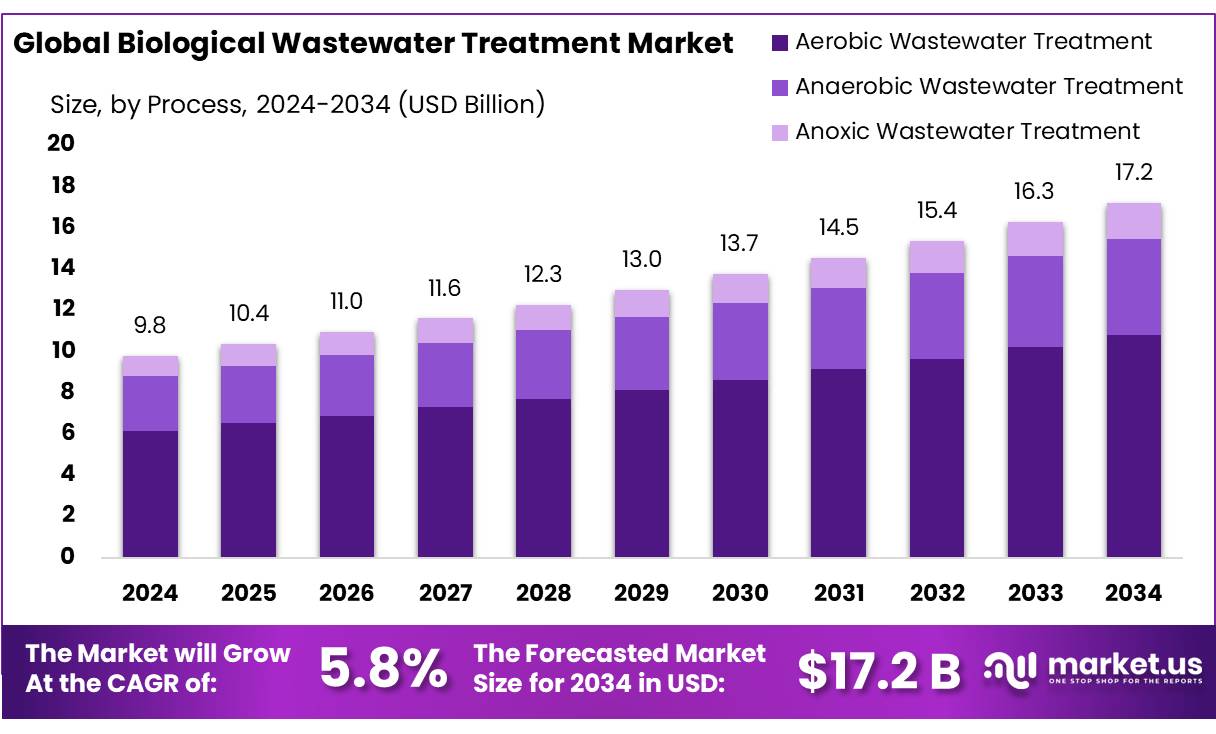

New York, NY – August 06, 2025 – The Global Biological Wastewater Treatment Market is projected to grow from USD 9.8 billion in 2024 to USD 17.2 billion by 2034, achieving a CAGR of 5.8% during the forecast period (2025–2034). In 2024, the Asia-Pacific (APAC) region led the market, accounting for a 48.2% share and generating USD 4.7 billion in revenue.

Biological wastewater treatment concentrates (BWTC), such as sludge, brine, and biosolids, are residual byproducts from biological treatment processes. These concentrates often contain high levels of organic matter, nutrients, heavy metals, and pathogens, requiring advanced treatment and disposal methods to ensure environmental safety and compliance.

The industrial sector, including chemicals, pharmaceuticals, and food processing, significantly contributes to BWTC generation due to the high organic content in their wastewater. Advanced technologies like membrane bioreactors (MBRs) are increasingly adopted for their efficiency in wastewater treatment and concentrate reduction. The MBR market, valued at USD 838.2 million in 2011, continues to grow, driven by rising demand for water reuse and resource recovery.

Global focus on sustainable water management has intensified BWTC management practices. The European Union’s Urban Waste Water Treatment Directive targets energy neutrality for wastewater treatment plants serving over 10,000 population equivalents. Similarly, the U.S. Environmental Protection Agency’s National Water Reuse Action Plan promotes enhanced water reuse, influencing BWTC handling strategies.

Government policies are crucial in addressing BWTC challenges. The U.S. EPA has allocated $6.4 million in research grants to Iowa State University and the Water Research Foundation to overcome barriers to water reuse. In China, the 14th Five-Year Plan mandates increasing the proportion of treated sewage for reuse to 25%, further driving advancements in BWTC management.

Key Takeaways

- The Biological Wastewater Treatment Market size is expected to be worth around USD 17.2 billion by 2034, from USD 9.8 billion in 2024, growing at a CAGR of 5.8%.

- Aerobic Wastewater Treatment held a dominant market position, capturing more than a 62.8% share.

- Municipal Wastewater held a dominant market position, capturing more than a 56.9% share.

- The Asia-Pacific (APAC) region emerged as the dominant force in the Biological Wastewater Treatment Market, holding a substantial 48.2% share equivalent to approximately USD 4.7 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/biological-wastewater-treatment-market/request-sample/

Report Scope

| Market Value (2024) | USD 9.8 Billion |

| Forecast Revenue (2034) | USD 17.2 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Process (Aerobic Wastewater Treatment, Anaerobic Wastewater Treatment, Anoxic Wastewater Treatment), By Type of Wastewater (Municipal Wastewater, Industrial Wastewater, Agricultural Wastewater, Stormwater and Combined Sewer Overflows) |

| Competitive Landscape | 3M, Aquatech International, Calgon Carbon Corporation, Condorchem Envitech SL, DAS Environment Expert GmbH, Dryden Aqua Ltd., Ecolab Inc., Entex Technologies, Envirocare, Huber SE, Samco Technologies Inc., Suez Water Technologies & Solutions, United Utilities Group plc, Veolia Environment SA, Xylem Inc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153417

Key Market Segments

Process Analysis

In 2024, Aerobic Wastewater Treatment commands a leading 62.8% market share, driven by its superior efficiency and widespread adoption. This dominance stems from its effectiveness in degrading organic pollutants, making it a preferred solution for municipalities and industries focused on high water quality and reuse.

Technological advancements have enhanced the sustainability of aerobic systems, further boosting their appeal. Regulatory pressures to meet stringent wastewater quality standards, especially in water-scarce regions, combined with rapid urbanization and industrial growth, ensure sustained demand for aerobic treatment. Its market leadership is expected to persist as the technology evolves to address modern water management challenges.

Wastewater Type Analysis

Municipal Wastewater holds a dominant 56.9% market share in 2024, fueled by rising urbanization and strict water quality regulations. The growing urban population has intensified the need for advanced wastewater treatment infrastructure to comply with environmental standards and support sustainable water management.

Increasing awareness of water scarcity and pollution, coupled with stringent discharge regulations, drives the adoption of advanced biological treatment technologies. The trend toward water reuse for non-potable applications, such as irrigation and industrial processes, further accelerates market growth. Municipal wastewater treatment is poised to maintain its leading share as these dynamics continue.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region leads the Biological Wastewater Treatment Market with a 48.2% share, valued at approximately USD 4.7 billion. Rapid industrialization, urban growth, and stringent environmental regulations drive significant investments in biological treatment technologies, including aerobic activated sludge systems, anaerobic digesters, and moving bed biofilm reactors (MBBRs).

Government initiatives targeting water scarcity, urban sanitation, and sustainable development goals bolster market expansion. As wastewater volumes grow, biological treatment systems provide scalable, eco-friendly solutions, solidifying APAC’s pivotal role in driving innovation and capacity growth in the global market.

Top Use Cases

- Municipal Wastewater Treatment: Biological wastewater treatment is widely used in cities to clean sewage from homes. It uses bacteria to break down organic waste, ensuring safe water for reuse or release. This method meets strict regulations, supports water recycling for non-potable uses, and handles large volumes from growing urban populations effectively.

- Industrial Effluent Treatment: Industries like food, beverage, and paper use biological treatment to manage wastewater with high organic content. Microorganisms degrade pollutants, reducing harmful substances before discharge. This cost-effective solution helps industries meet environmental standards, minimizes pollution, and supports sustainable operations by treating complex waste streams.

- Pharmaceutical Wastewater Management: Biological treatment, like activated sludge or membrane bioreactors, removes emerging pollutants from pharmaceutical wastewater. It breaks down complex compounds, reducing environmental risks. These systems are energy-efficient and help recover nutrients, making them ideal for treating drug-related waste while meeting strict regulatory requirements.

- Agricultural Runoff Treatment: Farms use biological treatment to clean runoff water with fertilizers and pesticides. Microorganisms reduce nitrogen and phosphorus levels, preventing water pollution. This method supports sustainable agriculture by ensuring cleaner water for irrigation and protecting nearby ecosystems from harmful contaminants.

- Biogas and Energy Recovery: Anaerobic biological treatment turns organic waste into biogas, a renewable energy source. Used in food processing and municipal plants, it reduces energy costs and supports sustainability. The process also stabilizes sludge, making it easier to manage while generating eco-friendly fuel for operations.

Recent Developments

1. 3M

3M has been advancing its biofiltration technologies for wastewater treatment, focusing on bio-based media that enhance microbial activity for organic pollutant removal. Their solutions integrate smart monitoring systems to optimize performance. 3M’s innovations aim to reduce energy consumption while improving effluent quality.

2. Aquatech International

Aquatech has introduced MABR (Membrane Aerated Biofilm Reactor) technology, improving energy efficiency in biological treatment. Their systems reduce aeration costs while maintaining high nutrient removal rates. Aquatech also emphasizes decentralized wastewater solutions for industrial clients.

3. Calgon Carbon Corporation

Calgon Carbon (now part of Kuraray) has enhanced its biological activated carbon (BAC) systems, combining adsorption and biodegradation for superior contaminant removal. Their recent projects focus on PFAS and micropollutant degradation using specialized microbial strains.

4. Condorchem Envitech SL

Condorchem has developed compact biofilm reactors (MBBR/IFAS) for industrial wastewater, improving nitrogen and phosphorus removal. Their systems feature low sludge production and are tailored for food, pharmaceutical, and chemical industries.

5. DAS Environment Expert GmbH

DAS has innovated in hybrid biological treatment, combining anaerobic and aerobic processes for high-load industrial effluents. Their Bio2E technology maximizes biogas recovery while ensuring compliance with stringent discharge limits.

Conclusion

Biological Wastewater Treatment is a versatile, eco-friendly solution driving sustainable water management across industries and municipalities. Its ability to treat diverse waste streams, recover energy, and support water reuse makes it vital for addressing global water scarcity and pollution challenges. As regulations tighten and urbanization grows, the market for these technologies is set to expand, fueled by innovations like membrane bioreactors and biogas recovery systems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)