Table of Contents

Overview

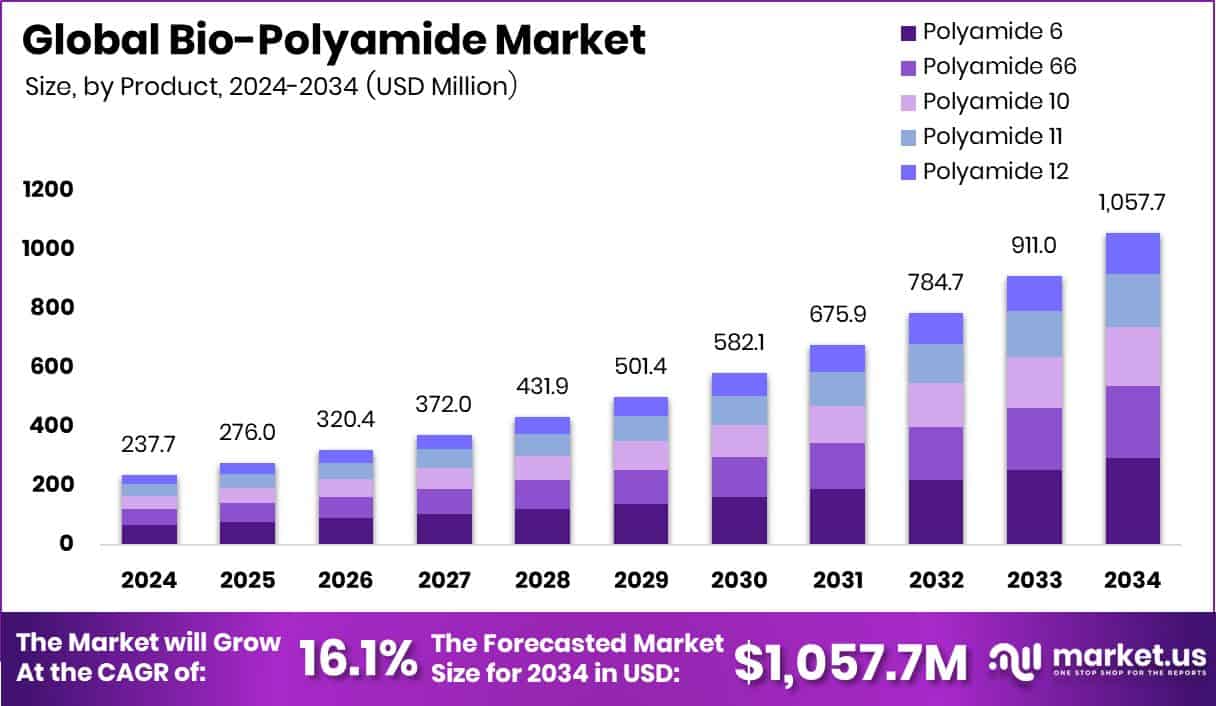

New York, NY – October 14, 2025 – The global bio-polyamide market is anticipated to reach approximately USD 1,057.7 million by 2034, rising from USD 237.7 million in 2024 and reflecting a projected CAGR of 16.1% from 2025 to 2034. Europe, already a USD 92.4 million market, is driving momentum through strong sustainability mandates.

Bio-polyamides are nylons in which one or more monomers originate from renewable, biological sources instead of fossil fuels. Their performance—strength, flexibility, and thermal resistance—mirrors conventional polyamides, but with a reduced carbon footprint. The market encompasses the full value chain: from raw materials and polymer production to distribution and end uses in textiles, automotive components, electronics, and consumer goods.

Growth is catalyzed by regulatory pressure and consumer demand for greener materials, pushing manufacturers to lower their environmental impact via molecular substitution. Technological advances in biotechnology and polymer chemistry are narrowing the cost and performance gap with traditional nylons. Rising demand is especially notable in high-performance sectors requiring durability and weight savings. Niche applications—like medical devices or barrier materials—offer additional upside.

On the funding side, the Research Council of Finland has allocated over €2 million toward green plastics and biomaterial research. Separately, Australia’s UNSW secured a USD 4.99 million grant for its plastics recycling initiative, and the engineering faculty received approximately USD 1 million to advance sustainability research. In the corporate domain, ADIA and Motilal Oswal MF acquired a 2.9% stake in Shaily Engineering Plastics (for ₹284 crore), while Capital Group purchased 1.67% (worth ₹148 crore). Another bulk deal acquired 2.76%, driving that company’s stock ~4% higher.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-bio-polyamide-market/request-sample/

Key Takeaways

- The Global Bio-Polyamide Market is expected to be worth around USD 1,057.7 million by 2034, up from USD 237.7 million in 2024, and is projected to grow at a CAGR of 16.1% from 2025 to 2034.

- In 2024, Polyamide 6 held a 27.8% share in the global Bio-Polyamide Market.

- Engineering plastics accounted for a 67.2% share in the overall bio-polyamide market during 2024.

- The automotive sector captured a 32.7% share of the global bio-polyamide market in 2024.

- The European market reached a valuation of around USD 92.4 million in 2024.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161027

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 237.7 Million |

| Forecast Revenue (2034) | USD 1,057.7 Million |

| CAGR (2025-2034) | 16.1% |

| Segments Covered | By Product (Polyamide 6, Polyamide 66, Polyamide 10, Polyamide 11, Polyamide 12), By Application (Fiber, Engineering Plastics), By End-use (Automotive, Textile, Film and Coating, Consumer Goods, Electrical and Electronics, Others) |

| Competitive Landscape | Evonik Industries AG, Huntsman International LLC, LANXESS, BASF SE, UBE Corporation, DOMO Chemicals GmbH, Arkema, Asahi Kasei Corporation, Honeywell International Inc., DSM |

Key Market Segments

By Product Analysis

In 2024, Polyamide 6 dominated the Bio-Polyamide Market’s By Product segment with a 27.8% share, highlighting its strong industrial relevance. Produced from renewable feedstocks, bio-based Polyamide 6 matches the mechanical strength, durability, and thermal stability of conventional nylon while offering a lower environmental footprint. Its high chemical resistance and lightweight nature make it ideal for automotive parts, consumer goods, and electrical components.

Growing sustainability mandates and the need to reduce petrochemical dependency have accelerated its adoption in advanced manufacturing. The segment’s growth underscores a broader market shift toward eco-friendly, high-performance polymers that balance circularity with engineering reliability, reinforcing Polyamide 6’s leadership within the bio-polyamide value chain.

By Application Analysis

In 2024, Engineering Plastics led the By Application segment of the Bio-Polyamide Market with a 67.2% share, underscoring its vital role in sustainable industrial materials. Bio-based engineering plastics, derived from renewable polyamides, are widely adopted in automotive, electronics, and industrial machinery for components demanding high durability, heat resistance, and dimensional precision.

Their ability to reduce carbon emissions while maintaining superior mechanical strength has accelerated their use as eco-friendly alternatives to petroleum-based polymers. This dominance reflects the ongoing shift toward high-performance, sustainable materials that align with global decarbonization and circular economy goals, ensuring reliable performance with a lower environmental footprint.

By End-use Analysis

In 2024, the Automotive sector dominated the By End-Use segment of the Bio-Polyamide Market, capturing a 32.7% share. This leadership stems from the rising integration of bio-based polyamides in critical vehicle components such as fuel lines, air intake manifolds, and under-the-hood parts. Automakers increasingly favor these materials for their lightweight properties, high mechanical strength, and superior heat resistance, which contribute to improved fuel efficiency and lower emissions.

Their recyclability and reduced carbon footprint also support global sustainability and regulatory targets. This strong market position highlights the automotive industry’s strategic shift toward eco-friendly, high-performance materials in modern vehicle design and production.

Regional Analysis

In 2024, Europe led the Bio-Polyamide Market with a 38.9% share, valued at USD 92.4 million, reflecting its strong commitment to sustainability and strict environmental regulations. The region’s focus on renewable polymers in automotive and industrial applications, backed by EU programs promoting bio-based materials and circular economy practices, has strengthened its leadership.

North America followed, driven by innovations in eco-friendly engineering plastics for automotive and electronics. Asia Pacific emerged as the fastest-growing region due to rising industrialization and investments in green materials.

Latin America and the Middle East & Africa are gradually expanding, supported by government initiatives encouraging sustainable manufacturing. Europe’s dominance underscores its advanced research ecosystem and early adoption of bio-based technologies, making it a key global hub for bio-polyamide innovation and commercialization.

Top Use Cases

- Automotive under-hood parts & fuel systems: Bio-polyamide is used in fuel lines, intake manifolds, and under-hood components because it resists heat and chemicals while being lighter than metals. It helps lower vehicle weight and emissions.

- Electrical & cable insulation: In wires and cables, bio-polyamides are used as jacketing or insulation layers thanks to good electrical insulation, durability, and chemical resistance.

- Toothbrush bristles/consumer goods: Some toothbrush manufacturers use bio-polyamide for bristles, replacing fossil-based nylon. It gives comparable performance and adds a sustainable angle to daily consumer items.

- 3D printing of functional parts: Bio-polyamide (for example, PA11 from renewable feedstocks) is used in additive manufacturing (powder-based 3D printing) for durable, functional parts—medical devices, connectors, or custom parts.

- Biomedical implants & devices: Because certain polyamides are biocompatible and inert, bio-versions can be used in implants or medical devices where the material should not irritate body tissue.

- High-performance textiles/e-textiles: In wearable electronics or “smart textiles,” bio-polyamide fibers can be engineered for conductivity, flexibility, or durability in garments that integrate sensors or electrodes.

Recent Developments

- In April 2025, Huntsman announced that it will unveil I-BOND® PB BIO 1025 and I-BOND® OSB BIO 1025 at LIGNA 2025. These are bio-based resins for particleboard (PB) and oriented strand board (OSB) that incorporate up to ~25% bio-based content, aiming to reduce the carbon footprint of composite wood products by up to 30% while maintaining performance.

- In February 2024, Repol (a UBE subsidiary) obtained traceability and recycled content certification for its DINALON® A2X25 MI H-4109 (a PA66 grade). UBE intends to extend certification to some PA6 grades with ≥ 30% recycled content for industrial and automotive use.

- In October 2024, Evonik made life-cycle assessment (LCA) data for more than 100 of its VESTAMID® (polyamide) and TROGAMID® (transparent polyamide) products publicly available in its High Performance Polymers plastics database. This transparency helps customers evaluate the environmental impacts of those materials.

- In October 2024, BASF introduced Ultramid® LowPCF and Ultramid® ZeroPCF variants within its polyamide 6 lineup. The LowPCF (low product carbon footprint) and ZeroPCF (net zero carbon accounting by including biogenic uptake) grades let customers choose more climate-friendly polyamides.

- In June 2022, LANXESS introduced a matrix plastic for Tepex composites based on “green” cyclohexane, with over 80 % sustainable raw materials content. The plastic is polyamide-based and part of its Scopeblue sustainable product line.

Conclusion

The Bio-Polyamide Market is evolving as industries worldwide embrace sustainable materials with strong mechanical performance and lower environmental impact. Supported by advancements in biotechnology and renewable feedstocks, bio-polyamides offer a balance of strength, flexibility, and eco-efficiency suitable for automotive, electronics, textiles, and packaging sectors.

Rising environmental awareness, corporate sustainability goals, and supportive government policies continue to encourage their adoption. The market’s future will rely on scaling production, improving cost efficiency, and expanding applications that demand durability and recyclability. Overall, bio-polyamides represent a key step toward achieving a circular and low-carbon industrial materials ecosystem.