Table of Contents

Overview

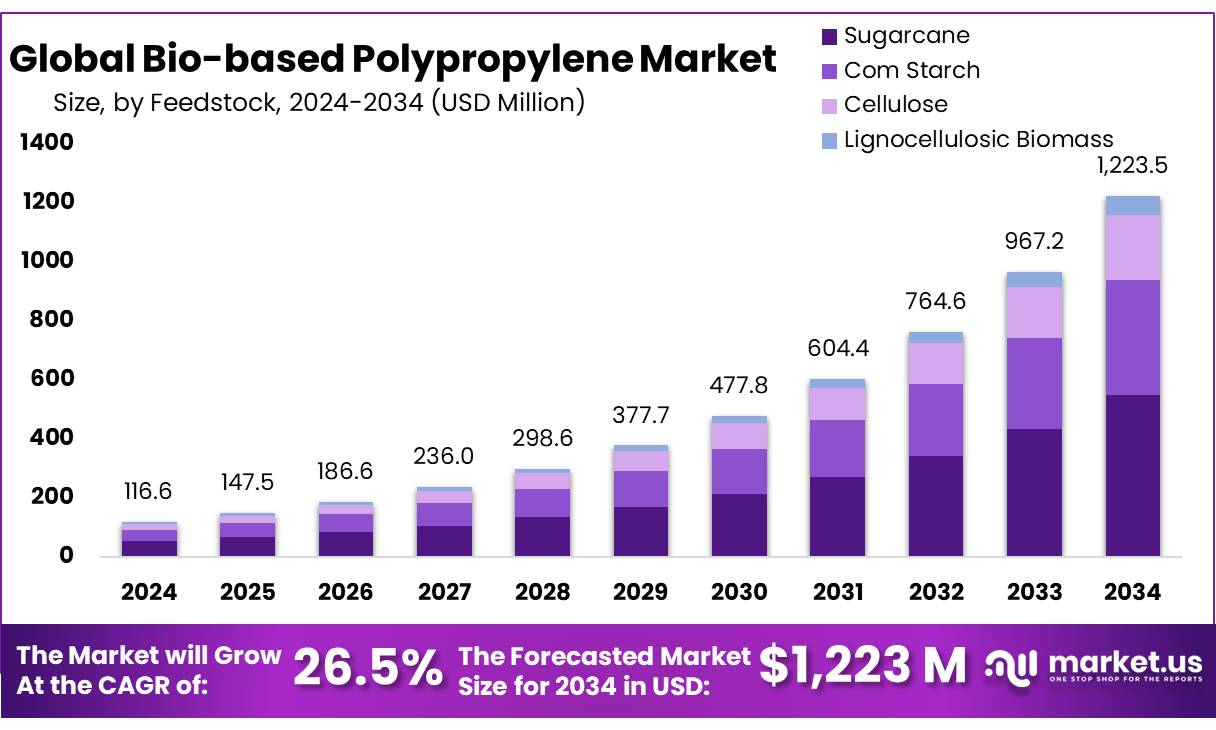

New York, NY – August 11, 2025 – The Global Bio-based Polypropylene Market is projected to reach USD 1,223.5 million by 2034, up from USD 116.6 million in 2024, with a robust CAGR of 26.5% during the 2025–2034 forecast period. In 2024, North America led the market, commanding a 43.2% share and generating USD 400 million in revenue.

Bio-based polypropylene (Bio-PP), derived from renewable sources like plant-based feedstocks, offers a sustainable alternative to conventional polypropylene. It reduces carbon emissions and reliance on fossil fuels, making it increasingly popular across industries such as packaging, automotive, and textiles. The rising demand for eco-friendly materials is fueling growth in the bio-based plastics sector, with Bio-PP emerging as a key player in advancing the circular economy.

The Bio-PP market is driven by significant investments and technological innovations. For example, Braskem, a leading biopolymer manufacturer, is exploring carbon-negative Bio-PP production in the U.S. using proprietary technology to convert bioethanol into Bio-PP. In Brazil, Braskem expanded its bio-based ethylene plant by 30%, boosting annual production capacity from 200,000 to 260,000 tons, reflecting the growing demand for sustainable solutions.

Government initiatives are accelerating Bio-PP adoption. The U.S. Department of Energy allocated USD 13.4 million to develop next-generation plastics technologies, aiming to cut energy use and emissions from single-use plastics. The USDA’s BioPreferred Program further supports biobased products through federal procurement and certification, enhancing Bio-PP market opportunities.

The Biden Administration’s “Bold Goals Report” targets over 90% of commercial polymers to be recyclable-by-design and biobased, with current biobased plastic production at 0.71%. Meanwhile, Braskem plans to evaluate a 1-million-ton carbon-negative Bio-PP production facility in the U.S., reinforcing the shift toward sustainable materials.

Key Takeaways

- Bio-based Polypropylene Market size is expected to be worth around USD 1223.5 Million by 2034, from USD 116.6 Million in 2024, growing at a CAGR of 26.5%.

- Sugarcane held a dominant market position, capturing more than a 44.8% share of the global bio-based polypropylene market.

- Melt Mass Polymerization (MMP) held a dominant market position, capturing more than a 48.3% share of the global bio-based polypropylene market.

- Sheet Extrusion held a dominant market position, capturing more than a 38.1% share of the bio‑based polypropylene market.

- Packaging held a dominant market position, capturing more than a 39.7% share of the global bio-based polypropylene market.

- North America stands as a dominant force in the global bio-based polypropylene (Bio-PP) market, holding a significant share of 43.2% in 2024, equating to approximately USD 0.4 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-bio-based-polypropylene-market/request-sample/

Report Scope

| Market Value (2024) | USD 116.6 Million |

| Forecast Revenue (2034) | USD 1223.5 Million |

| CAGR (2025-2034) | 26.5% |

| Segments Covered | By Feedstock (Sugarcane, Com Starch, Cellulose, Lignocellulosic Biomass), By Production Process (Melt Mass Polymerization (MMP), Solution Polymerization, Gas Phase Polymerization), By Extrusion Type (Sheet Extrusion, Film Extrusion, Pipe Extrusion), By End-user (Packaging, Automotive, Consumer Goods, Textile, Medical and Healthcare, Others) |

| Competitive Landscape | Braskem, LyondellBasell Industries N.V., Mitsui Chemicals, Inc., FKUR, CITRONIQ, LLC., Borealis AG., SABIC, Total Energies, Borouge, Beaulieu International Group, INEOS, ORLEN Group, Mitsubishi Chemical Group Corporation, Avient Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154088

Key Market Segments

By Feedstock Analysis

In 2024, sugarcane commanded a 44.8% share of the global bio-based polypropylene (Bio-PP) market due to its renewable nature, established agricultural systems, and compatibility with existing fermentation technologies. Sugarcane-based ethanol serves as a key feedstock for propylene production, enabling a seamless shift from conventional to bio-based polypropylene without significant equipment changes.

Its abundant availability in regions like Brazil and India ensures a reliable supply chain for large-scale production. By 2025, sugarcane is expected to maintain its dominance, bolstered by sustainability mandates and growing investments in circular economy solutions, owing to its low carbon footprint and cost-effective processing.

By Production Process Analysis

In 2024, Melt Mass Polymerization (MMP) held a 48.3% share of the global Bio-PP market, favored for producing high-quality polymers with consistent molecular weight and minimal impurities. This solvent-free, energy-efficient process aligns with sustainability goals, making it a preferred choice for manufacturers transitioning to bio-based alternatives. Its compatibility with large-scale industrial operations drives its adoption, particularly in regions focused on reducing environmental impact.

By Extrusion Type Analysis

In 2024, Sheet Extrusion captured a 38.1% share of the Bio-PP market, excelling in producing uniform sheets for applications like packaging panels, thermoformed trays, and protective liners. Its scalability and low material waste make it attractive for manufacturers prioritizing sustainability and quality. The process’s equipment aligns closely with conventional polypropylene systems, facilitating rapid adoption and production ramp-up.

By End-user Analysis

In 2024, the packaging sector held a 39.7% share of the global Bio-PP market, driven by the shift toward eco-friendly materials in food, beverage, and personal care product packaging. Bio-PP’s lightweight, durable properties and compatibility with existing molding and extrusion processes make it ideal for films, containers, and caps. Increasing pressure to reduce plastic waste further accelerates its adoption.

Regional Analysis

In 2024, North America accounted for 43.2% of the global Bio-PP market, equivalent to USD 0.4 billion, driven by strong demand in automotive, packaging, and consumer goods sectors prioritizing sustainable materials. Supportive government policies, such as U.S. Environmental Protection Agency initiatives and grants, promote eco-friendly material adoption. Advancements in production technologies and access to renewable feedstocks enhance Bio-PP’s economic feasibility in the region, solidifying its market leadership.

Top Use Cases

- Sustainable Food Packaging: Bio-based polypropylene is widely used for eco-friendly food packaging, like yogurt cups and snack wrappers. Its biodegradable nature and low carbon footprint make it ideal for brands aiming to reduce plastic waste. It offers durability and flexibility, ensuring food safety while meeting consumer demand for sustainable, recyclable packaging solutions.

- Automotive Lightweight Components: In the automotive industry, bio-based polypropylene creates lightweight parts like dashboards and door panels. Its strength and lower environmental impact help manufacturers meet emission reduction goals. The material’s compatibility with existing production processes allows easy adoption, supporting the industry’s shift toward sustainable, fuel-efficient vehicles.

- Eco-friendly Textiles: Bio-based polypropylene is used in textiles for products like sportswear and carpets. Its low carbon footprint and recyclability appeal to eco-conscious brands. The material’s durability and lightweight properties make it perfect for sustainable fabrics, reducing microfiber pollution while maintaining performance in hygiene and geotextile applications.

- Medical Device Packaging: Bio-based polypropylene is ideal for medical packaging, such as sterile containers and device trays. Its biocompatibility and recyclability ensure safety and sustainability. The material’s ability to withstand sterilization processes makes it suitable for healthcare, meeting strict regulations while reducing the environmental impact of single-use medical plastics.

- Construction Geotextiles: In construction, bio-based polypropylene is used for geotextiles in road projects and erosion control. Its strength, UV resistance, and eco-friendly profile make it a sustainable alternative to synthetic materials. The material supports durable, cost-effective solutions, aligning with green building practices and reducing the carbon footprint of infrastructure projects.

Recent Developments

1. Braskem

Braskem has advanced its bio-based polypropylene (PP) production using sugarcane ethanol, reinforcing its commitment to carbon neutrality. The company’s “I’m green” bio-based PP reduces greenhouse gas emissions by capturing CO₂ during sugarcane growth. Braskem recently partnered with global brands to expand applications in the packaging and automotive sectors. The company aims to scale production to meet rising demand for sustainable plastics.

2. LyondellBasell Industries N.V.

LyondellBasell is investing in bio-based and circular polypropylene through its CirculenRenew product line. The company recently announced collaborations with Neste to produce bio-based PP from renewable feedstocks like waste oils. This initiative supports LyondellBasell’s recycled and renewable-based polymers annually.

3. Mitsui Chemicals, Inc.

Mitsui Chemicals is developing bio-based PP using biomass-derived feedstocks as part of its sustainable polymer strategy. The company has partnered with biorefinery firms to integrate bio-naphtha into its production process. Mitsui aims to commercialize bio-PP for the automotive and packaging industries, aligning with Japan’s carbon neutrality goals.

4. FKUR

FKUR specializes in bioplastics and has been exploring bio-based polypropylene alternatives through its Terralene portfolio. The company focuses on drop-in solutions for conventional PP, using renewable raw materials. FKUR is working on enhancing the mechanical properties of bio-PP to expand its use in consumer goods and industrial applications.

5. CITRONIQ, LLC.

CITRONIQ is a startup developing bio-based and carbon-negative polypropylene using proprietary fermentation technology. The company plans to build a commercial-scale biopolymer plant, targeting industries like textiles and packaging. CITRONIQ’s approach focuses on replacing fossil-based PP with sustainable alternatives derived from plant-based feedstocks.

Conclusion

Bio-based polypropylene is transforming industries with its sustainable, versatile applications in packaging, automotive, textiles, medical, and construction sectors. Its eco-friendly properties, like biodegradability and low carbon emissions, align with global sustainability goals and regulatory pressures. As consumer demand for green materials grows, the market is set to expand rapidly, driven by technological advancements and circular economy initiatives, making it a key player in sustainable manufacturing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)