Table of Contents

Overview

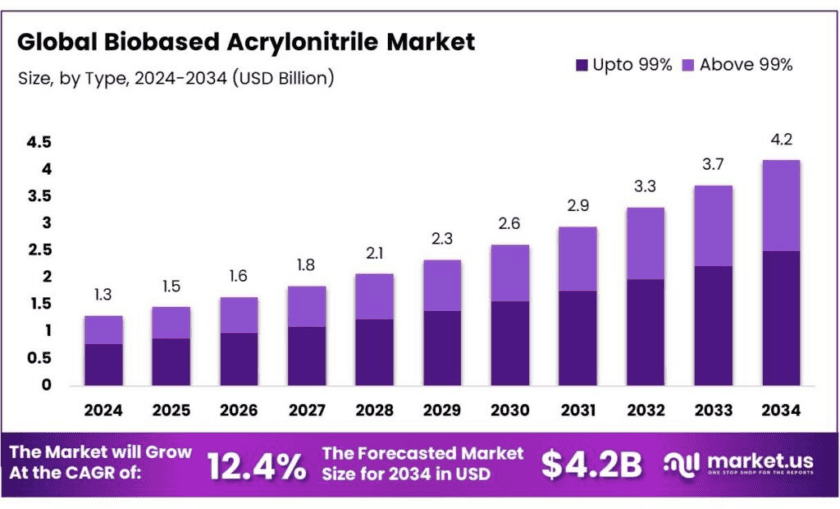

New York, NY – Oct 29, 2025 – The Global Bio-based Acrylonitrile (Bio-ACN) Market was valued at USD 1.3 billion in 2024 and is projected to reach USD 4.2 billion by 2034, growing at a CAGR of 12.4% from 2025 to 2034. In 2024, Asia Pacific dominated the market with a 35.8% share, accounting for approximately USD 0.4 billion in revenue. This strong regional presence is attributed to expanding demand from automotive, electronics, and packaging sectors that are increasingly shifting toward sustainable materials.

Bio-based acrylonitrile is produced from renewable biomass sources such as glycerol, sugars, and agricultural residues, instead of petrochemical feedstocks like propylene. It serves as a crucial raw material for ABS, SAN, polyacrylonitrile fibers, nitrile rubber, and carbon fiber precursors, offering lower environmental impact. Companies such as Ascend Performance Materials have advanced production of bio-circular acrylonitrile derived from used cooking oil, achieving a 25% reduction in carbon footprint compared to conventional methods.

The industrial landscape remains at the pilot and demonstration scale, supported by government initiatives. The U.S. Department of Energy (DOE) has funded projects converting glycerol into bio-ACN, including a USD 2.5 million grant awarded in December 2022 to Trillium Renewable Chemicals for constructing a demonstration plant.

Market growth is further propelled by global decarbonization efforts, sustainability mandates, and advances in biotechnology. Notably, INEOS Nitriles launched its bio-based acrylonitrile brand INVIREO™, which achieves up to a 90% reduction in carbon emissions compared to fossil-based acrylonitrile, highlighting the industry’s transition toward circular and low-carbon chemical production.

Key Takeaways

- Biobased Acrylonitrile Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 12.4%.

- Upto 99% held a dominant market position, capturing more than a 59.7% share of the global biobased acrylonitrile market.

- Bio-Based Acrylonitrile Butadiene Styrene held a dominant market position, capturing more than a 46.9% share of the global biobased acrylonitrile market.

- Automotive held a dominant market position, capturing more than a 39.5% share of the global biobased acrylonitrile market.

- Asia Pacific region held a dominant position in the global bio-based acrylonitrile market, capturing more than a 35.8% share, valued at approximately USD 0.4 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/biobased-acrylonitrile-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.3 Bn |

| Forecast Revenue (2034) | USD 4.2 Bn |

| CAGR (2025-2034) | 12.4% |

| Segments Covered | By Type (Upto 99%, Above 99%), By Product Type (Bio-Based Acrylonitrile Butadiene Styrene, Bio-Based Styrene Acrylonitrile, Bio-Based Acrylonitrile Styrene Acrylate, Others), By Application (Automotive, Electronics, Construction, Packaging, Others) |

| Competitive Landscape | INEOS Group Limited, Asahi Kasei Corporation, ECONITRILE, SABIC, Ascend Performance Materials LLC, Sinopec Group, Mitsubishi Chemical Corporation, LG Chem Ltd., Toray Industries Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160941

Key Market Segments

By Type Analysis – Upto 99% Biobased Acrylonitrile dominates with 59.7% share in 2024 due to high purity demand across industries

In 2024, Upto 99% Biobased Acrylonitrile held a dominant market position, capturing more than a 59.7% share of the global market. This segment’s leadership is supported by rising demand for high-purity materials in critical industries such as automotive, electronics, and packaging, where consistency and stability are essential. Upto 99% purity levels ensure superior chemical reactivity and reduced impurity levels, enhancing efficiency in polymer production and specialty chemical processes. With industries increasingly adopting sustainable and high-quality raw materials, the segment saw strong momentum in 2024 and is expected to expand further in 2025 as manufacturers aim for greener, performance-driven feedstocks.

By Product Type Analysis – Bio-Based Acrylonitrile Butadiene Styrene leads with 46.9% share in 2024 driven by versatile industrial applications

In 2024, Bio-Based Acrylonitrile Butadiene Styrene (ABS) dominated the market, accounting for more than a 46.9% share of global biobased acrylonitrile consumption. The product’s strong performance is attributed to its unique combination of toughness, flexibility, and chemical resistance, making it ideal for applications in automotive interiors, electronic casings, and consumer products. The shift toward sustainable and renewable polymers has further strengthened bio-based ABS adoption, as industries aim to replace fossil-based plastics with eco-friendly alternatives. With expanding applications in high-performance plastics, the demand for bio-based ABS continued to rise in 2024 and is projected to grow steadily through 2025.

By Application Analysis – Automotive leads with 39.5% share in 2024 driven by demand for lightweight and durable components

In 2024, the Automotive sector emerged as the leading application area, capturing more than a 39.5% share of the global biobased acrylonitrile market. The adoption of bio-based materials in this sector was driven by the growing need for lightweight, durable, and chemical-resistant components, including fuel systems, interior fittings, and structural parts. Automakers are increasingly integrating bio-based acrylonitrile to meet sustainability goals, improve fuel efficiency, and reduce carbon emissions. The growing production of electric and hybrid vehicles further accelerated demand in 2024, and this momentum is expected to continue into 2025, cementing the automotive industry as a major driver of market growth.

List of Segments

By Type

- Upto 99%

- Above 99%

By Product Type

- Bio-Based Acrylonitrile Butadiene Styrene

- Bio-Based Styrene Acrylonitrile

- Bio-Based Acrylonitrile Styrene Acrylate

- Others

By Application

- Automotive

- Electronics

- Construction

- Packaging

- Others

Regional Analysis

Asia Pacific dominates with 35.8% share in 2024, valued at USD 0.4 billion, supported by industrial expansion and green policies

In 2024, the Asia Pacific region emerged as the leading market for bio-based acrylonitrile, capturing a 35.8% share and generating revenues of approximately USD 0.4 billion. The region’s strong position is primarily supported by rapid industrialization, an expanding manufacturing base, and increasing adoption of sustainable technologies. Nations such as China, Japan, South Korea, and India have become major contributors, actively investing in renewable chemical production and promoting eco-friendly industrial practices through policy support and R&D initiatives.

The automotive industry across Asia Pacific accounted for a significant portion of demand in 2024, as manufacturers increasingly utilized lightweight and high-performance bio-based materials to improve fuel efficiency and reduce emissions. Similarly, the electronics sector has accelerated its transition toward sustainable and biodegradable components, driving consistent consumption of bio-based acrylonitrile in advanced polymer applications.

Top Use Cases

Carbon-fibre composites for lightweight transport: Bio-based acrylonitrile is used to make carbon-fibre precursors which in turn go into lightweight structures for automotive, aerospace and sporting goods. For example, INEOS Nitriles reports its product “Invireo™ bio-based acrylonitrile” reduces carbon footprint by ≈ 90 % compared to conventional fossil-based ACN. This means manufacturers can claim major sustainability gains while still meeting mechanical performance needs. In practice, a vehicle maker replacing a steel panel with a carbon-fibre variant (fed by bio-ACN) might reduce weight by 30-40 % and thereby cut fuel use/CO₂. So in effect bio-ACN enables both product innovation and environmental benefit.

Specialty resins and plastics (ABS, SAN, NBR): Conventional acrylonitrile is a key monomer in thermoplastics such as Acrylonitrile butadiene styrene (ABS), Styrene acrylonitrile resin (SAN) and Nitrile butadiene rubber (NBR). Bio-ACN provides a “drop-in” alternative: same chemical base, but sourced from renewable feedstocks. According to Trillium Renewable Chemicals, its “bio-ACN™” process using glycerol feedstock yields ~70 % lower carbon footprint versus petroleum-derived ACN. That means manufacturers of plastic housings, automotive trim, fuel and oil-resistant hoses can transition to more sustainable raw materials without redesigning the polymer system.

Water treatment and purification: ACN is also used as a precursor in surfactants, polymer membranes and other materials employed in water purification systems (serving millions of households globally). Bio-ACN thus offers a path to reduce embedded emissions in essential infrastructure. INEOS similarly mentions water purification as one of the sectors benefiting from its bio-ACN feedstock. For example, if a filtration membrane producer shifts 100 tonnes of conventional ACN to bio-ACN, the associated GHG emission savings (assuming ~90 % reduction) may amount to tens of tonnes of CO₂-equivalent.

Packaging, electronics and consumer goods: Bio-ACN feeds into acrylic fibres, moulded plastics and rigid foams used in packaging, electronics casing, and consumer appliances. A research note by the National Renewable Energy Laboratory (NREL) shows that renewable ACN production enables the same end-uses (fibres, containers) but using biomass-derived feedstocks. Given rising consumer awareness of sustainable materials and corporate commitments, bio-ACN enables brands to market “renewable-based plastic” claims and meet policy or regulatory targets for lower-carbon content polymers.

Circular and low-carbon supply chain positioning: Finally, bio-ACN enables companies to build circularity and low-carbon credentials. For example, the AnQore product “Econitrile” is produced from non-fossil propylene and ammonia, and reports a life-cycle assessment (LCA) footprint less than 40 % of regular fossil ACN. For brands and polymer producers, this means the ability to trace feedstock back to certified sustainable sources (e.g., ISCC+), build chain-of-custody claims, and align with government initiatives on green chemicals or bio-economy.

Recent Developments

In April 2024 INEOS Nitriles officially launched its bio-based acrylonitrile product named INVIREO™, marking the first commercial sales of this kind and claiming a 90 % reduction in carbon footprint versus conventional acrylonitrile. The 2024 milestone highlights INEOS’s shift from fossil-based feedstocks to a certified mass-balance route (ISCC +), reinforcing its role as the world’s largest acrylonitrile producer across Europe, USA and Asia.

Asahi Kasei advanced its sustainable acrylonitrile strategy by acquiring ISCC PLUS certification in December 2023 for its acrylonitrile (AN) products, enabling biomass-derived raw materials and mass-balance accounting. Earlier in 2022 the company announced a plan to begin biomass-propylene based AN production through its subsidiary in Asia, marking a commitment to lower-carbon chemical supply chains.

In April 2024 INEOS Nitriles started global sales of its INVIREO™ bio-based acrylonitrile, delivering up to 90 % lower CO₂ emissions than conventional ACN. The company uses ISCC Plus-certified, mass-balance feedstocks and supplies major sectors such as carbon fiber, plastics, and water purification. With annual chemical revenues above USD 60 billion, INEOS has positioned INVIREO as a flagship low-carbon product that aligns with EU Green Deal targets and helps customers decarbonize composite and polymer value chains.

In December 2023 Asahi Kasei received ISCC PLUS certification for its acrylonitrile products, enabling the use of biomass-derived propylene through mass-balance methodology. This certification supports its plan to commercialize low-carbon, bio-based AN at its Japanese and Thai plants. With consolidated net sales of JPY 2.86 trillion in FY 2023, the company integrates bio-ACN into its sustainable-chemicals roadmap to serve automotive, electronics, and textile markets.

Ascend Performance Materials LLC: In December 2024, Ascend announced it produced acrylonitrile from bio-derived feedstock such as used cooking oil using its ISCC-Plus mass-balance method, achieving a 25 % lower product carbon footprint compared to fossil routes. Then in May 2025 the company began producing high-purity acrylonitrile at its Chocolate Bayou plant in Texas, supporting advanced end-uses like aerospace and renewable energy.

In 2024 Sinopec reported chemical-segment sales of USD 58.1 billion, placing it among the world’s largest chemical companies. Although direct public data on bio-based acrylonitrile is limited, Sinopec’s major petrochemical expansions — including a 1.2 million t-per-year ethylene cracker in Tianjin and a refining/PDH complex in Zhenhai — signal its commitment to downstream value chains that include acrylonitrile derivatives.

In 2024 Mitsubishi Chemical announced it will shut the production of some acrylonitrile (AN) and AN-derivative capacity at its Hiroshima plant (90 000 t/yr for AN) by July 2024. This move reflects a shift away from older fossil-based AN manufacturing toward more profitable or strategic segments. For analysts, this suggests Mitsubishi may reduce exposure to traditional AN markets and possibly increase focus on higher-value, sustainable polymer blends or composites.

As of April 2024 LG Chem became the first Korean chemical company to secure ISCC PLUS certification for 61 eco-friendly products (including ABS resins derived via biomass-balance). Although not explicitly a bio-ACN announcement, LG Chem’s strategy signals readiness to develop renewable styrenics/ABS systems—which use acrylonitrile base monomers—and thus sets the stage for bio-based AN feedstocks in future. Analysts view this as a foundational move into circular/renewable chains in engineering plastics.

In February 2024, Toray announced that four of its Japanese plants obtained ISCC PLUS certification, enabling the use of bio-based feedstocks via mass-balance in polymer production—including materials that derive from acrylonitrile-based systems. According to its FY 2023 report, the company recorded net sales of ¥2,464.6 billion (≈ USD 17.0 billion) and core operating income of ¥102.6 billion. From an analyst perspective, this certification marks a foundational step toward integrating bio-ACN feedstocks into its advanced-materials chain, positioning Toray for growth in circular and low-carbon chemistry even though explicit bio-ACN volumes are yet to be disclosed.

Conclusion

In conclusion, bio-based acrylonitrile stands out as a meaningful bridge between high-performance materials and sustainability imperatives. These numbers reflect not only rising demand for lower-carbon alternatives, but also increasing commitment across industries—from automotive to electronics—to integrate renewable feedstocks and reduce fossil-based-chemical dependency. What’s more, scientific work confirms the technical viability: for instance, a recent study evaluated bio-production of acrylonitrile from renewable propylene and found compelling environmental gains.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)