Table of Contents

Overview

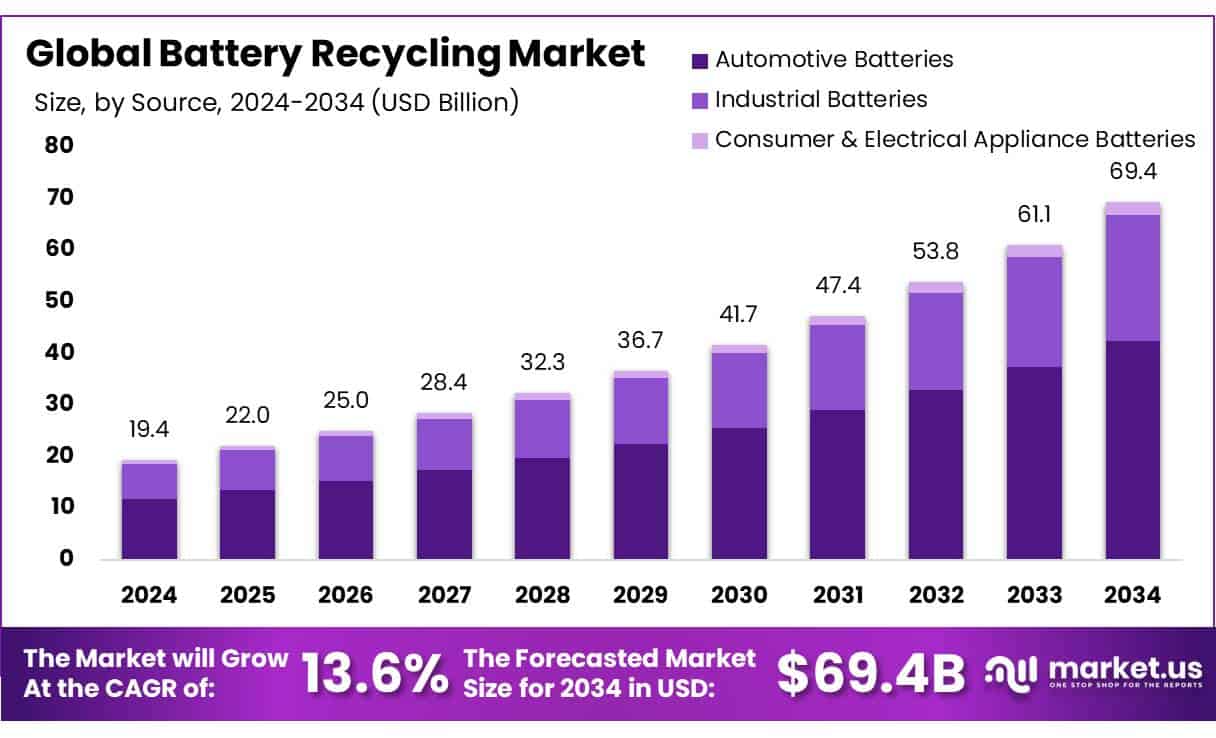

The global battery recycling market is projected to reach USD 69.4 billion by 2034, up from USD 19.4 billion in 2024, registering a strong CAGR of 13.6% during the forecast period from 2025 to 2034. This growth is driven by the rising demand for sustainable recycling solutions, particularly for recovering valuable materials and minimizing environmental harm.

Consumer electronics represent a major force behind this trend, accounting for 50% of global lithium-ion battery use and consuming 39% of all cobalt in these batteries. This has heightened the need for efficient recycling technologies to recover critical raw materials like cobalt and lithium. By source, automotive batteries held the largest market share in 2024, contributing 61.2% to global revenues.

In terms of battery chemistry, lead-acid batteries remained the dominant type, accounting for 72.1% of the market in 2024. Their dominance stems from extensive use in ICE vehicles, their cost-effectiveness, and the well-established infrastructure supporting their recycling. Based on technology, pyrometallurgy led the market with a 56.2% share in 2024.

Regarding end-use, material extraction emerged as the largest segment, holding 48.2% of the market share in 2024. This is primarily due to growing demand for raw materials—particularly lithium, nickel, and cobalt—used in manufacturing new batteries. Regionally, Asia Pacific dominated the battery recycling market in 2024, capturing 39.4% of the total share.

Key Takeaways

- The global battery recycling market was valued at USD 19.4 billion in 2024.

- The global battery recycling market is projected to grow at a CAGR of 13.6 % and is estimated to reach USD 69.4 billion by 2034.

- Among sources, automotive batteries accounted for the largest market share of 61.2%.

- Among battery chemistry, lead-acid accounted for the majority of the market share at 72.1%.

- By technology, pyrometallurgy accounted for the largest market share of 56.2%.

- By end-use, material extraction accounted for the majority of the market share at 48.2%.

- Asia-Pacific is estimated as the largest market for battery recycling with a share of 39.4% of the market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-battery-recycling-market/free-sample/

Report Scope

| Market Value (2024) | USD 19.4 Billion |

| Forecast Revenue (2034) | USD 69.4 Billion |

| CAGR (2025-2034) | 13.6% |

| Segments Covered | By Source (Automotive Batteries, (Passenger Cars, Light & Heavy Commercial, Others (2 & 3 Wheelers), Industrial Batteries, Consumer & Electrical Appliance Batteries), By Battery Chemistry (Lithium-ion, (Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Others), Lead-acid, Nickel-based, Flow Batteries, Others), By Technology (Pyrometallurgy, Hydrometallurgy, Mechanical Separation), By End-use (Material Extraction, Disposal, Reuse, Repackaging and Second Life) |

| Competitive Landscape | BASF SE, Accurec Recycling GmbH, Fortum, Glencore, Umicore, Exide Industries Ltd, Gravita India Ltd., Li-Cycle, RecycLiCo Battery Materials, Tata Chemicals Ltd., American Battery Technology Company, Cirba Solutions, Gopher Resource LLC, East Penn Manufacturing, Aqua Metals, Eco-Bat Technologies, Ganfeng Lithium Group Co., Ltd., Lithion Recycling Inc., EnerSys, Redwood Materials, Inc., Element Resources LLC, Contemporary Amperex Technology Co. Limited, Stena Recycling, REDUX Recycling GmbH, Other Key Players. |

Key Market Segments

By Source

- Automotive Batteries

- Passenger Cars

- Light & Heavy Commercial

- Others (2 & 3 Wheelers)

- Industrial Batteries

- Consumer & Electrical Appliance Batteries

By Battery Chemistry

- Lithium-ion

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Others

- Lead-acid

- Nickel based

- Flow Batteries

- Others

By Technology

- Pyrometallurgy

- Hydrometallurgy

- Mechanical Separation

By End-Use

- Material Extraction

- Disposal

- Reuse, Repackaging & Second Life

Regional Analysis

In 2024, the Asia Pacific region led the global battery recycling market, capturing 39.4% of the total market share. This dominance was primarily driven by the rapid adoption of electric vehicles (EVs) across key countries such as China, Japan, and South Korea, alongside increasingly stringent environmental regulations. As EV usage continues to expand, the challenge of managing end-of-life batteries has intensified, creating a growing demand for advanced recycling systems capable of recovering critical raw materials like lithium, cobalt, and nickel.

Governments across the region have played a central role in accelerating market development by enforcing strict environmental policies and promoting responsible recycling practices. These policies include regulatory frameworks that require manufacturers to adopt sustainable battery recycling technologies and ensure proper handling, collection, and processing of used batteries—particularly lithium-ion variants used in EVs and energy storage.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=146339

Drivers

Rising Adoption of Electric Vehicles (EVs): The global battery recycling market is being significantly driven by the growing adoption of electric vehicles (EVs). As governments set ambitious net-zero emission goals and technological advancements in EVs continue, the demand for these vehicles is surging. Consequently, the volume of end-of-life lithium-ion batteries is increasing, highlighting the urgent need for scalable recycling solutions.

For instance, over 30 million EVs were expected to be on European roads by 2020, and this number continues to rise, leading to more used batteries needing recycling. EV batteries contain toxic materials like lithium, cobalt, and nickel, and recycling helps prevent environmental pollution while recovering these valuable materials. The International Energy Agency (IEA) projects that demand for sustainable lithium-ion batteries will grow from 400 GWh in 2035 to 1300 GWh by 2040, boosting the global battery recycling market. Recycling these batteries reduces energy consumption by 5-30% and lowers particulate matter by 17%, contributing to improved air quality and sustainable practices.

Governments worldwide are further supporting battery recycling through evolving regulations. For example, in Europe, the Battery Regulation mandates ambitious recovery targets, including recovering 50% of lithium from old batteries by 2027 and 80% by 2031. Similarly, the Inflation Reduction Act of 2022 in the U.S. offers tax credits for recycled battery materials. These regulations not only ensure that EV producers take responsibility for recycling but also make it financially attractive to invest in advanced recycling technologies. The EU’s recent Battery Regulations (2023) require tracking carbon footprints and implementing digital battery passports by 2027, creating more transparent and efficient recycling systems.

Restraints

High Recycling Costs: A significant barrier to the growth of the battery recycling market is the high cost of recycling, particularly for batteries with complex chemistries. The costs associated with collection, transportation, and processing, coupled with the need for advanced technology, make the recycling process economically challenging. Additionally, the fluctuating market prices of recovered materials further affect the profitability of recycling operations. Regulatory compliance adds to the operational costs, especially in regions where recycling infrastructure is still in development. These high costs limit the expansion of recycling operations, slowing down market growth.

Opportunities

Technological innovations in battery recycling represent a major opportunity for the market. Emerging technologies such as direct recycling, biotechnology-based recycling, and blockchain for material traceability are improving scalability, operational efficiency, and environmental impact. These advancements are crucial in handling the increasing volume of batteries across various sectors, particularly with the rise in electric vehicle adoption.

According to the IEA, recycling and reuse efforts could significantly reduce primary supply requirements for minerals between 2030 and 2040, making battery recycling more economically viable. The development of sustainable methods, such as green solvents and energy-efficient technologies, supports global sustainability goals, driving further demand in the market. As of 2025, approximately 3.4 million end-of-life EV batteries, totaling 953 GWh, are expected to be discarded, yet these batteries can still be used in secondary applications like stationary storage.

Trends

Growth of Second-Life Battery Application: The rise in second-life battery applications is significantly reshaping the global battery recycling market. These repurposed batteries are being used in energy storage solutions, such as storing renewable energy, providing backup power, and stabilizing the electricity grid. Additionally, they are being used in less demanding EV applications like electric bicycles and scooters. This trend helps reduce the demand for new lithium-ion materials, promoting a circular economy and extending battery life.

Geopolitical Impact

Impact of U.S. Tariffs on the Global Battery Recycling Market: Geopolitical tensions, particularly between the U.S. and China, are affecting the global battery recycling market. The U.S. tariffs on Chinese-made batteries are increasing the cost of new batteries, which may reduce demand for battery replacements and, in turn, reduce the number of used batteries available for recycling. As tariffs on Chinese-made batteries rise to 82% by January 2026, the cost of imported batteries is expected to significantly increase, potentially doubling their price. This will disrupt global supply chains and hinder the efficiency of battery recycling operations.

Regional Analysis

In 2024, the Asia Pacific region led the global battery recycling market, accounting for 39.4% of the market share. This dominance is driven by stringent environmental regulations and the growing adoption of electric vehicles (EVs) in countries like China, Japan, and South Korea. With the increase in EV adoption, the demand for efficient battery recycling solutions has intensified. China has introduced key recycling laws since 2016, such as the Circular Economy Development Plan (2021-2025), which promotes recycling and battery reuse. The regulatory support from both public and private investments in technological advancements is enhancing the efficiency of battery recycling processes, contributing to market growth in the region.

Recent Developments

In June 2025, BASF SE began commercial operations at its flagship Black Mass plant in Schwarzheide, Germany, capable of processing up to 15,000 tonnes/year of end-of-life lithium-ion batteries—equivalent to about 40,000 EV batteries annually. This facility marks a cornerstone in BASF’s integrated recycling value chain, spanning battery collection, dismantling, mechanical Black Mass production, and refining to extract critical metals like lithium, nickel, cobalt, and manganese.

In April 2024, BASF had already commissioned a prototype metal refinery at the same site to transform Black Mass into purified battery materials, with plans underway for a full-scale commercial refinery. These developments support compliance with the EU Battery Regulation and advance Europe’s autonomy in raw material supply for sustainable electromobility.

Accurec, based in Krefeld/Mülheim, continues to innovate in lithium recovery from spent EV batteries. Under the EU-funded EARLI project (launched June 2023), Accurec led the development of a thermochemical–electrochemical process to produce high-purity lithium hydroxide monohydrate from Black Mass. A January 2025 European technology matchmaking event highlighted Accurec’s mature, scalable lithium carbonate and Black Mass separation system, notable for low CO2 emissions and high yields. The company has also partnered with AMG Lithium under an MOU to supply recycled lithium carbonate as feedstock for further refining—a collaboration aimed at closing the lithium loop while reducing environmental impact.

Li-Cycle reported a 33% year-on-year rise in feedstock from U.S. battery energy storage systems (BESS) during 2024, processing over 100 MWh of materials in partnership with major BESS operators. However, financial pressure stalled construction of its Rochester (NY) Hub, leading to replacement of its CEO and CFO in May 2025 and the engagement of advisors to explore asset or business sales. Glencore has provided a US$10.5 million loan and made a US $40 million stalking-horse bid to acquire Li-Cycle’s assets. In November 2024, the company also secured a US$475 million DOE loan to support its Rochester plant.

Glencore has formalized a strategic partnership with Li-Cycle, entering a US $10.5 million loan agreement and issuing a US $40 million stalking-horse bid to acquire Li-Cycle’s North American assets during its financial restructuring. This move positions Glencore to secure access to recycled lithium and cobalt supply, aligned with its broader ambition to develop a sustainable battery materials business.

In 2024, Umicore inaugurated phase two of its Li-Refinery in Hobart, Tasmania, increasing recycling capacity to 14,000 tonnes of battery-grade nickel and cobalt per year by 2026. Backed by state and federal Australian funding, this expansion supports the EV ecosystem by reducing dependency on virgin metal imports. It also includes integration with electric vehicle battery supply chains in the Asia-Pacific region.

In April 2025, Exide Industries launched a pilot lithium-ion battery recycling unit in Kamalganj, India, capable of processing 1,200 tonnes/year of end-of-life batteries. The unit utilizes a combined mechanical and hydrometallurgical process to recover lead, plastics, and lithium compounds. This initiative aligns with India’s push to develop domestic recycling infrastructure and reduce import reliance.

Gravita India recently commissioned a new lead-acid battery recycling facility at its Rewari site, Rajasthan, boosting processing capacity by 30,000 tonnes/year. The company reported a 20% increase in recycled lead output in Q1 2025, further supported by a new environmental compliance framework that enhances emissions control and efficient slag disposal.

Li-Cycle in November 2024 secured a US $475 million Department of Energy loan to fund its Rochester (NY) “Hub” recycling plant, aimed to process 5 GWh/year of battery materials. However, due to financial challenges, it filed for creditor protection in May 2025 and underwent executive restructuring. Glencore’s bid and loan are part of ongoing negotiations.

Key Players Analysis

- BASF SE

- Accurec Recycling GmbH

- Fortum

- Glencore

- Umicore

- Exide Industries Ltd

- Gravita India Ltd

- Li-Cycle

- RecycLiCo Battery Materials

- Tata Chemicals Ltd.

- American Battery Technology Company

- Cirba Solutions

- Gopher Resource LLC

- East Penn Manufacturing

- Aqua Metals

- Eco-Bat Technologies

- Ganfeng Lithium Group Co., Ltd.

- Lithion Recycling Inc.

- EnerSys

- Redwood Materials, Inc.

- Element Resources LLC

- Contemporary Amperex Technology Co. Limited

- Stena Recycling

- REDUX Recycling GmbH

- Other Key Players

Conclusion

In conclusion, the battery recycling sector is maturing into a critical pillar of the clean energy transition. It combines robust market growth, regional leadership, and technological innovation. With supportive policy frameworks, this industry is poised to contribute significantly to resource security, environmental protection, and the sustainability of global battery supply chains.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)