Table of Contents

Overview

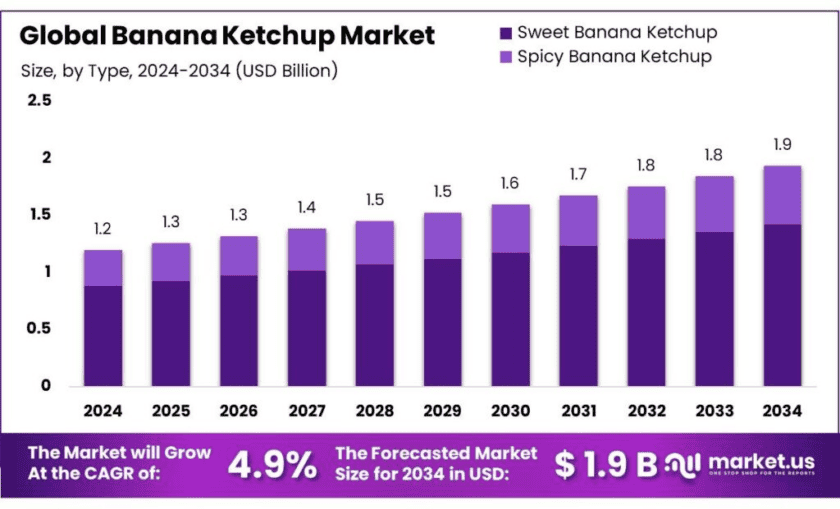

New York, NY – Nov 04, 2025 – The global banana ketchup market is projected to reach USD 1.9 billion by 2034, rising from USD 1.2 billion in 2024, at a CAGR of 4.9% between 2025 and 2034. In 2024, Asia Pacific led the market with a 38.4% share, accounting for approximately USD 0.4 billion in revenue. Originating in the Philippines during World War II, banana ketchup was created by Filipino food technologist María Y. Orosa as a substitute for tomato ketchup amid wartime shortages. Her innovation utilized the country’s plentiful bananas, reflecting her commitment to tackling malnutrition and fostering self-reliance in food production.

Today, banana ketchup is deeply ingrained in Filipino cuisine, enhancing popular dishes such as spaghetti, fried chicken, and silog breakfasts. The local banana industry underpins this demand, producing over 9 million metric tons annually across roughly 451,000 hectares of farmland. Key producing regions include Davao, Northern Mindanao, and SOCCKSARGEN, cultivating major varieties like Saba, Cavendish, and Latundan. The Philippines’ banana export industry remains robust, valued at around USD 1.6 billion in 2020, making it the second-largest exporter globally with 12% of total world export value.

Despite a decline in per-capita banana consumption from 50 kg/year in 2015 to 19 kg/year in 2020, the industry continues to expand due to supportive government programs. The Department of Agriculture’s High Value Crops Development Program has played a vital role in promoting banana production, processing, and innovation—encouraging value-added applications such as banana ketchup, which now represents both a cultural symbol and an export-driven product category for the Philippines.

Key Takeaways

- Banana Ketchup Market size is expected to be worth around USD 1.9 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 4.9%.

- Sweet Banana Ketchup held a dominant market position, capturing more than 73.6% of the global market.

- Glass Bottle packaging held a dominant market position, capturing more than 48.9% of the global banana ketchup market.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than 48.3% of the banana ketchup market share.

- Asia Pacific region is the dominant market for banana ketchup, holding a significant share of 38.40%, valued at USD 0.4 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/banana-ketchup-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.2Bn |

| Forecast Revenue (2034) | USD 1.9 Bn |

| CAGR (2025-2034) | 4.9% |

| Segments Covered | By Type (Sweet Banana Ketchup, Spicy Banana Ketchup), By Packaging (Glass Bottle, Plastic Bottle, Pouches and Sachets, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Grocery Stores, Online, Others) |

| Competitive Landscape | NutriAsia, Inc., Dole Food Company, Inc., McCormick & Company, Inc., Del Monte Foods, Inc., Hot-Headz! Ltd., Baron Foods Ltd., Fila Manila, Ben and Pat’s Sauce Co., Craft Hot Sauce |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159222

Key Market Segments

By Type Analysis – Sweet Banana Ketchup Dominates with 73.6% Market Share in 2024

In 2024, Sweet Banana Ketchup emerged as the leading product type, accounting for 73.6% of the global market share. Its dominance is largely attributed to its harmonious flavor profile that combines the natural sweetness of ripe bananas with a subtle tang of vinegar, making it a versatile condiment for both home and commercial use. This variety enjoys strong popularity across Southeast Asia, particularly in the Philippines, where it is a culinary staple accompanying dishes like fried chicken and spaghetti. The rising global demand for ethnic and distinctive flavor profiles—especially in markets such as the United States and Europe—has further propelled the product’s international appeal.

By Packaging Analysis – Glass Bottle Dominates Banana Ketchup Market with 48.9% Share in 2024

In terms of packaging, Glass Bottle formats commanded a 48.9% market share in 2024, maintaining their strong consumer preference globally. Glass bottles are widely favored for their premium aesthetic, product protection, and flavor-preserving qualities, which ensure the ketchup’s freshness and consistency over extended periods. Consumers perceive glass packaging as a hallmark of superior quality and authenticity, while manufacturers leverage its transparency to showcase the ketchup’s rich color and texture, enhancing shelf appeal. Growing environmental awareness has also contributed to the preference for glass, as it is fully recyclable and reduces plastic waste, aligning with global sustainability goals.

By Distribution Channel Analysis – Supermarkets & Hypermarkets Lead with 48.3% Share in 2024

When examined by distribution channel, Supermarkets and Hypermarkets led the global banana ketchup market in 2024, capturing 48.3% of total sales. These large retail formats remain the most accessible and convenient shopping venues for consumers, offering an extensive range of brands, flavors, and packaging options under one roof. The ability to compare products and access promotional offers, discounts, and attractive displays continues to draw significant consumer traffic. Urbanization and the expansion of organized retail networks have further cemented supermarkets’ role as the key sales platform, enabling broad visibility for both established and emerging banana ketchup brands.

List of Segments

By Type

- Sweet Banana Ketchup

- Spicy Banana Ketchup

By Packaging

- Glass Bottle

- Plastic Bottle

- Pouches and Sachets

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Grocery Stores

- Online

- Others

Regional Analysis

In 2024, the Asia Pacific region maintained its leadership in the global banana ketchup market, accounting for a commanding 38.4% share valued at approximately USD 0.4 billion. This dominance is deeply rooted in the region’s strong cultural and culinary connection to banana-based condiments, especially in the Philippines, where banana ketchup has become a household staple. Filipino cuisine’s frequent use of banana ketchup in dishes such as fried chicken, spaghetti, and breakfast meals continues to fuel consistent domestic demand and shape export opportunities.

The market’s growth across Asia Pacific is supported by favorable demographic and economic trends, including a large population base, rising disposable incomes, and an expanding middle class. These factors are collectively driving the consumption of convenience foods and ready-to-eat condiments across emerging economies. Additionally, rapid urbanization and evolving food habits in markets like Indonesia, Thailand, and Malaysia have created new consumer segments with a preference for unique, regionally inspired flavors such as banana ketchup.

Top Use Cases

Household And Diaspora Pantry Adoption: Banana ketchup is a repeat-purchase pantry item for Filipino households and the global diaspora. The Philippines counted 1.83 million Overseas Filipino Workers in 2021, sustaining demand for familiar condiments in host markets and ethnic aisles. Retailers serving these communities can grow basket size by stocking multiple brands, sizes, and heat levels targeted to diaspora clusters.

QSR/Fast-Casual Menu Localization in APAC: Abundant raw-material supply supports reliable menu use (dips, burger builds, spaghetti sauces). The Philippines produced 9.06 million tonnes of bananas in 2020, while the Davao region contributed 3.43 million tonnes (37.4%) in 2019—a strong base for processors and foodservice distributors specifying banana-ketchup SKUs. Chain operators can localize flavor at scale without fragile imports.

Export Value-Addition Adjacent to a Large Banana Trade: Moving from fresh bananas to higher-margin condiments taps a sizable trade flow. FAO reports world banana exports near 19.1–20 million tonnes/year in recent years, while Philippine banana exports were valued around USD 1.55–1.60 billion in 2020. Converting a fraction of export-grade or off-grade fruit into banana ketchup lifts unit value and stabilizes returns.

Retail Private-Label And Format Expansion: Grocery buyers can extend private-label condiments into tropical flavors with data-driven sizing. FAO notes ~135 million tonnes of global banana production in 2022 (up 8% vs. 2021), signaling ample upstream supply for sustained bottling runs. Multi-format offerings (glass, squeezy, portion packs) leverage category trade-ups and cross-merchandising with frozen snacks and meal kits.

Ingredient for Ready-to-Eat and Meal-Kit Platforms: Processors can use banana ketchup as a tangy base for marinades, glazes, and Filipino-style spaghetti sauces. With FAO estimating world banana trade ~20 million tonnes/year, industrial buyers can secure predictable inputs and develop SKUs for convenience channels (RTE trays, shelf-stable pouches). Clear sourcing and allergen-clean recipes improve acceptance in airline catering and institutional foodservice.

Farm-Gate Impact via Saba Utilization: Targeted ketchup programs can monetize cooking-type bananas. Philippine R&D data show Saba accounts for ~29% of national banana output, a variety well-suited for sauce processing. Structured offtake contracts for Saba grades reduce waste and smooth farmer income variability, while ensuring processors year-round raw-material continuity.

Recent Developments

NutriAsia, Inc.: In 2023, NutriAsia earned the Asia Pacific Environmental & Social Impact Award for its sustainable procurement, especially direct-to-farmer sourcing of Cavendish bananas crucial for its banana catsup production. The company’s export activity shows batches of banana sauce shipped to the U.S. in late 2024, such as 30,609 kg on 20 Nov 2024 and 35,954 kg on 7 Nov 2024 under HS code 2103.90.1.

Dole Food Company, Inc.: While best known for fresh bananas, Dole’s specialty-ingredients division lists banana ketchup applications using green banana powder as an ingredient. Dole’s fresh-fruit unit, a global producer of bananas and pineapples, reported revenues of US $6.5 billion in 2021 and supplies vertically-integrated banana volumes into value-added condiments.

McCormick & Company, Inc.: In 2024, McCormick recorded net income of approximately US $789 million, showcasing its broad flavor and seasoning portfolio. The company has publicly referenced Banana Ketchup in its “Flavor Forecast” series as a notable condiment trend, indicating interest in this specialty category. While McCormick does not list banana ketchup as a core product line, its positioning as a global flavor-house suggests potential to support banana ketchup development or partnerships in flavor systems.

Del Monte Foods, Inc.: Del Monte offers a banana ketchup variant (Extra Rich Banana Ketchup, 320 g) in the Philippines, priced at around ₱43.55 per bottle. The company, with annual U.S. retail sales of roughly US $1.73 billion reported in publicly-available summaries, sees banana ketchup as part of its condiments range in Southeast Asia—a targeted product addressing local taste preferences and reinforcing its regional production presence.

Hot‑Headz! Ltd.: In 2023, Hot-Headz! Ltd., a UK-based specialty sauce maker, expanded its product line with the “Habanero Banana Ketchup,” made with 30% Costa Rican bananas fused with rum and habanero chili. While precise revenue figures for 2023 or 2024 aren’t publicly disclosed, the brand positions itself in the premium niche of banana ketchup with bold flavour profiles, targeting adventurous consumers in the UK and online specialty channel.

Baron Foods Ltd.: In 2023, Baron Foods Ltd. of St Lucia offered banana ketchup in 155 g and 397 g formats, highlighting the use of local bananas and exotic herbs and spices. The company emphasises supporting Caribbean agriculture and positions its banana ketchup as a gourmet condiment suitable for marinades and barbecues, appealing to export-oriented specialty food markets.

Fila Manila: Founded in November 2020 by Filipino-American entrepreneur Jake Deleon, Fila Manila grew from around US$50,000 in sales in 2021 to about US$400,000 in 2022. The brand’s banana-based ketchup is vegan, gluten-free, made in the USA and featured at stores including Whole Foods Market and Target Corporation.

Ben and Pat’s Sauce Co.: Although best known for banana-pepper sauces rather than classic banana ketchup, the Massachusetts-based firm emphasises low-sugar condiments—its products contain just 1 gram of sugar per ounce, claimed to be 82% lower in sugar than a leading Sriracha brand. They leverage natural ingredients and gluten-free formulations as part of their positioning in the specialty sauce market.

Conclusion

In conclusion, the global banana ketchup market is on a steady growth trajectory, reflecting both strong cultural roots and expanding international appeal. Much of the demand continues to be anchored in the Asia Pacific region—especially the Philippines, where banana ketchup originated and remains a staple condiment. In 2020 the Philippines produced over 9 million metric tons of bananas across roughly 451,000 hectares of land, providing strong raw-material infrastructure for value-added products.

For manufacturers, exporters and retail brands, the key will be aligning supply-chain efficiencies, meeting evolving consumer standards, and expanding distribution beyond traditional domestic markets into global specialty, mainstream and online channels. With these levers actively managed, banana ketchup is well-positioned to move from a regional niche to a truly global condiment alternative.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)