Table of Contents

Introduction

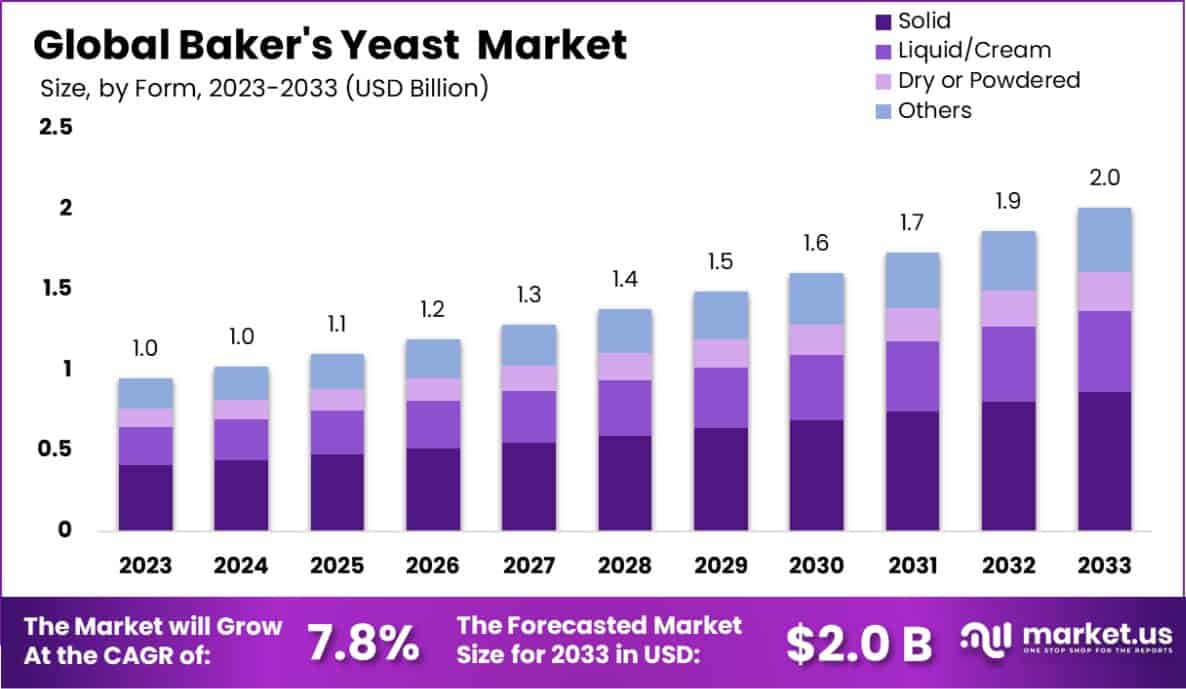

New York, NY – February 21, 2025 – The Global Baker’s Yeast Market is witnessing substantial growth, projected to reach USD 2.0 billion by 2033, with a CAGR of 7.8% from 2024 to 2033. This growth is primarily driven by increasing consumer demand for baked goods, advancements in yeast fermentation technologies, and the rising trend of home baking focusing on healthy, artisanal products.

The market consists of various forms, including solid, liquid, cream, and dry yeast, with solid forms dominating commercial applications due to their convenience and shelf life. Active dry yeast leads the product segment, favored for its versatility and longevity. The market is largely influenced by the bakery sector, which holds the largest share of end users, followed by food and feed applications.

Innovation priorities include organic and natural yeast varieties, which appeal to health-conscious consumers seeking clean-label products. Moreover, emerging markets present new opportunities owing to increasing urbanization and disposable incomes. However, the market faces challenges from fluctuating raw material prices, stringent regulations, and the rising popularity of yeast-free diets.

Key Takeaways

- The Global Baker’s Yeast Market is expected to be worth around USD 2.0 Billion by 2033, up from USD 1.0 Billion in 2023, and grow at a CAGR of 7.8% from 2024 to 2033.

- In the Baker’s Yeast Market, solid forms dominate, accounting for 43.1% of the market share.

- Active dry yeast leads product segmentation with a significant 72.1% share in the market.

- The bread application is paramount in the market, making up 52.1% of usage statistics.

- Bakeries are the largest end users, consuming 67.1% of all baker’s yeast sold globally.

- In North America, the Baker’s Yeast Market holds a 41.5% share, valued at USD 0.39 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/bakers-yeast-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.0 Billion |

| Forecast Revenue (2034) | USD 2.0 Billion |

| CAGR (2025-2034) | 7.8% |

| Segments Covered | By Form (Solid, Liquid and Cream, Dry or Powdered, Others), By Product (Active Dry Yeast, Inactive Dry Yeast), By Application (Cakes, Pastries, Bread, Biscuits, Others), By End Users (Bakery, Food, Feed, Others) |

| Competitive Landscape | ADM, AGRANO Gmbh & Co. KG, Angel Yeast Co. Ltd, Aryzta AG, Associated British Foods PLC, Cole’s Quality Food Inc., Conagra Brands, Inc., Daiya Foods Inc., Danone SA, Dun and Bradstreet, Inc, Europastry S.A., Fadayeast.Com, General Mills Inc., Goodrich Group, Grupo Bimbo S.A.B.de C.V., Kothari Fermentation And Biochem Ltd, LALLEMAND Inc., Lantmännen Unibake, Lesaffre International, London Dairy Co. Ltd, Oriental Yeast India Pvt Ltd, Vandemoortele NV |

Experts Review

- Government Incentives and Technological Innovations: Governments support the industry by promoting biotechnology developments that enhance yeast production efficiency and sustainability. Technological innovations have led to faster cultivation and higher-quality yeast strains, enabling diverse applications beyond baking.

- Investment Opportunities & Risks: The market offers significant investment opportunities due to its growth potential in emerging regions and consumer shifts towards organic products. However, risks include raw material price volatility and compliance with regional regulatory standards.

- Consumer Awareness and Technological Impact: Increasing consumer awareness of the health benefits of natural ingredients is bolstering market growth. Technological advancements have impacted the market positively by improving product quality and expanding yeast applications.

- Regulatory Environment: Strict food safety and production regulations impose challenges by increasing compliance costs and slowing innovation. Adhering to varied regional standards for production and labeling is crucial for market participants. These regulatory hurdles can affect the speed at which new products are introduced, impacting market dynamics.

➤ Directly Purchase a copy of the report – https://market.us/purchase-report/?report_id=136911

Emerging Trends

- Growing Demand for Plant-Based Products: As plant-based diets gain popularity, the demand for baker’s yeast is increasing, especially in the production of vegan and dairy-free products. Yeast helps in creating meat substitutes and plant-based bread, catering to a health-conscious consumer base.

- Increasing Health Awareness: Consumers are becoming more health-conscious, looking for yeast with added health benefits. This includes strains of baker’s yeast enriched with probiotics, which are used in functional foods to support gut health and overall wellness.

- Sustainable Production Practices: With sustainability becoming a priority, there’s a shift toward eco-friendly methods of producing baker’s yeast. Companies are focusing on reducing waste in yeast fermentation processes, using renewable energy sources, and improving production efficiency to lower their carbon footprint.

- Yeast in the Biotechnology Industry: Baker’s yeast is increasingly being used in the biotechnology sector, particularly for fermentation processes in biofuel production. This trend is driven by the need for sustainable energy solutions, where yeast plays a critical role in converting raw materials into biofuels.

- Enhanced Flavor Profiles: There is a growing trend toward enhancing the flavor profiles of bakery products using different yeast strains. Specially cultured baker’s yeast is now used to produce more complex and diverse tastes in bread and other baked goods, meeting consumer preferences for variety and gourmet flavors.

Use Cases

- Bread and Bakery Products: Baker’s yeast is primarily used in the production of bread, rolls, pastries, and other baked goods. It helps dough rise by fermenting the sugars in flour, producing carbon dioxide and alcohol. This makes it essential for creating light, fluffy textures in various bakery items.

- Bioethanol Production: Baker’s yeast is used in the bioethanol industry to ferment sugars from agricultural waste or crops like corn. The yeast converts these sugars into ethanol, which is then used as a renewable fuel source. This use case supports the growth of sustainable energy solutions.

- Probiotic and Functional Foods: Certain strains of baker’s yeast are utilized in the production of probiotic supplements and functional foods. These yeasts help promote gut health, improving digestion, and enhancing the immune system, making them important in the growing wellness and health food sectors.

- Alcoholic Beverage Production: Baker’s yeast is used in the fermentation of alcoholic beverages like beer and wine. In brewing, yeast ferments the sugars from malt or fruit, producing alcohol and carbon dioxide. Its ability to ferment efficiently makes it crucial for brewing a wide range of alcoholic drinks.

- Food Preservation: Baker’s yeast plays a role in food preservation, especially in traditional methods of pickling and fermentation. Yeast fermentation helps preserve the food by creating an environment that limits the growth of spoilage bacteria, extending the shelf life of products like cheeses and fermented vegetables.

Market Growth Opportunities

- Expansion in Plant-Based Foods: As the demand for plant-based diets grows, baker’s yeast offers a key ingredient for vegan and vegetarian food products. It can be used in creating meat alternatives, dairy-free bread, and other plant-based products, presenting a significant growth opportunity in the expanding plant-based food market.

- Rising Health and Wellness Trends: There is an increasing consumer demand for functional foods with health benefits. Baker’s yeast enriched with probiotics and other nutritional additives is gaining popularity in the wellness sector. Companies can explore this opportunity by producing yeast-based health supplements and fortified food products targeting gut health and immunity.

- Sustainability in Food Production: Consumers and industries are prioritizing sustainability. Baker’s yeast, which can be produced using environmentally friendly methods, is in demand for eco-conscious food brands. Growing interest in green and sustainable food production methods presents opportunities to develop yeast using renewable resources and sustainable practices.

- Growth of the Biofuels Market: As the world shifts towards renewable energy sources, baker’s yeast plays a vital role in the bioethanol industry. The growing adoption of biofuels offers an opportunity for yeast producers to partner with renewable energy companies, expanding their market reach in the biofuels sector.

- Increased Home Baking and Online Sales: With the rise in home baking, especially during and post-pandemic, there is a growing demand for small-scale packaging of baker’s yeast. The e-commerce boom also presents an opportunity for yeast manufacturers to target direct-to-consumer sales via online platforms, catering to the home-baking trend.

Recent Developments

1. AGRANO Gmbh & Co. KG

- Focus: AGRANO is a German company specializing in food ingredients, including yeast-based products.

- Recent Developments:

- Innovations: Likely working on sustainable yeast production methods to align with EU green initiatives.

- Partnerships: Potential collaborations with European bakeries for clean-label yeast products.

2. Angel Yeast Co. Ltd

- Focus: A leading global yeast producer based in China.

- Recent Developments:

- Innovations: Development of specialized yeast strains for plant-based meat alternatives (2022–2023).

- Acquisitions: Expansion into Southeast Asia and Africa to strengthen its global supply chain.

- Partnerships: Collaboration with food tech companies for yeast-based protein products.

3. Aryzta AG

- Focus: A Swiss-based company specializing in baked goods and yeast-related products.

- Recent Developments:

- Innovations: Introduction of low-carb and gluten-free yeast-based products (2023).

- Partnerships: Collaborations with European retailers for private-label baked goods.

4. Associated British Foods PLC (ABF)

- Focus: The parent company of AB Mauri, a major player in the yeast and bakery ingredients sector.

- Recent Developments:

- Innovations: Launch of yeast products for artisanal and industrial baking (2023).

- Acquisitions: Potential acquisitions to expand its yeast portfolio in emerging markets.

- Partnerships: Collaboration with universities for R&D in yeast fermentation technology.

5. Cole’s Quality Food Inc.

- Focus: A US-based company specializing in bakery ingredients, including yeast.

- Recent Developments:

- Innovations: Development of organic and non-GMO yeast products (2022–2023).

- Partnerships: Collaboration with local bakeries and food service providers.

Conclusion

Baker’s Yeast remains a versatile and essential ingredient across various industries, from food and beverages to biofuels and health products. As consumer preferences shift towards plant-based diets, health-focused foods, and sustainable practices, the demand for baker’s yeast is expected to grow. The ongoing innovations in yeast production, such as enhanced strains and sustainable methods, further present significant market opportunities. Companies that adapt to these trends and capitalize on emerging markets, such as functional foods and bioethanol, will be well-positioned for growth in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)