Table of Contents

Introduction

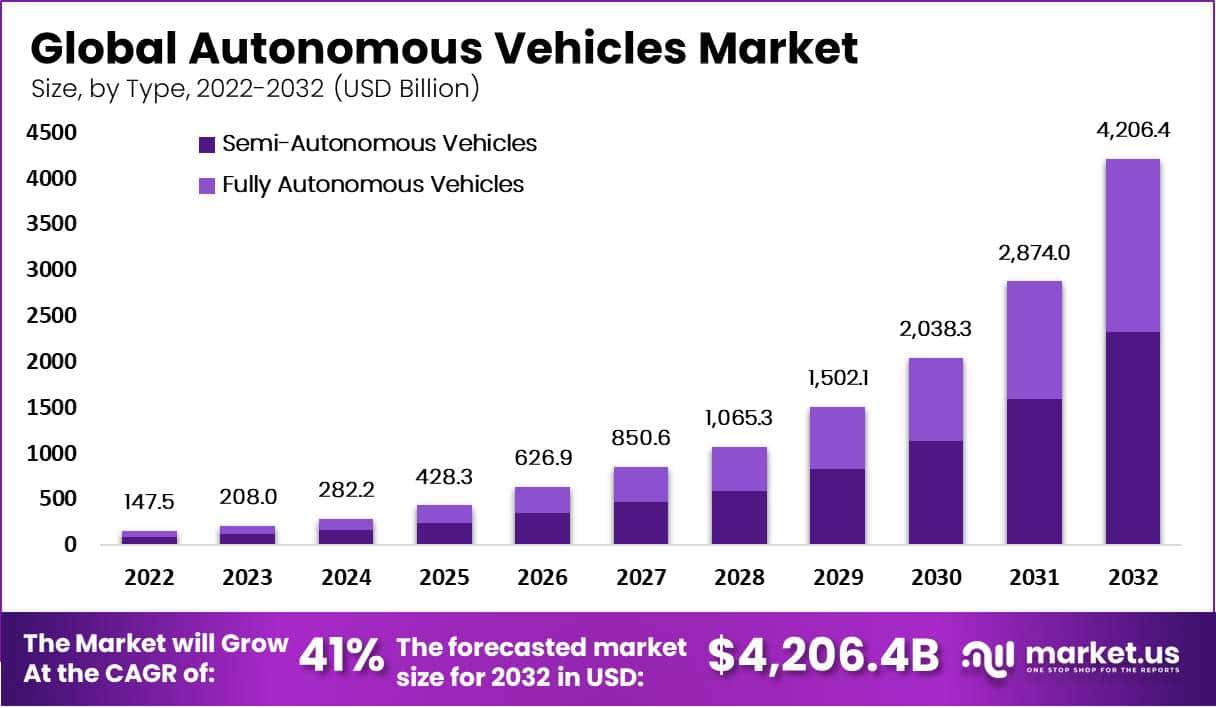

The Global Autonomous Vehicles Market is projected to expand from USD 208.0 billion in 2023 to approximately USD 4,206.4 billion by 2032, registering a compound annual growth rate (CAGR) of 41.0% over the forecast period from 2023 to 2032.

The Autonomous Vehicles Market is poised for significant growth over the next decade, driven by advancements in artificial intelligence (AI), sensor technology, and machine learning algorithms. The shift toward autonomous mobility represents not just a technological evolution but a transformative change in how transportation systems operate globally. While regulatory challenges and concerns around safety persist, the substantial investments from tech giants and automakers signal a long-term commitment to the development and commercialization of autonomous driving solutions.

The market is likely to witness increasing partnerships between technology companies and traditional automotive firms to accelerate the deployment of autonomous vehicle (AV) technologies and create robust ecosystems capable of supporting widespread adoption. Given the anticipated regulatory frameworks and infrastructure developments, autonomous vehicles are set to redefine urban transportation, logistics, and mobility-as-a-service (MaaS) models, contributing to a fundamental shift in the global automotive landscape.

The Autonomous Vehicles Market encompasses the development, production, and deployment of vehicles that operate without direct human control. These vehicles utilize a combination of advanced technologies, including AI, machine vision, radar, lidar, GPS, and onboard computing systems, to navigate and perform driving tasks autonomously.

The market includes different levels of automation, ranging from driver assistance (Level 1) to full autonomy (Level 5), where vehicles can drive without any human intervention under all conditions. Participants in this market include automotive manufacturers, technology firms, component suppliers, software developers, and mobility service providers, all working to create safer, more efficient, and innovative transportation solutions.

Several key growth factors are propelling the expansion of the Autonomous Vehicles Market. First, increasing investments by both established automotive players and technology companies are accelerating research and development (R&D) efforts. Secondly, government initiatives and regulatory support, particularly in regions like North America and Europe, are fostering an environment conducive to testing and deploying autonomous vehicles on public roads.

Additionally, rising demand for enhanced safety features, reduced traffic congestion, and improved fuel efficiency is encouraging the adoption of autonomous technologies. As consumers become more comfortable with semi-autonomous functionalities such as adaptive cruise control and lane-keeping assistance, the market is expected to mature further, paving the way for higher levels of autonomy.

The demand for autonomous vehicles is being driven by a confluence of factors, including the need for improved road safety, reduced human error, and greater convenience in mobility solutions. Moreover, the rise of ride-hailing services and mobility-as-a-service (MaaS) platforms is creating a robust demand for autonomous vehicle fleets that can operate efficiently and economically.

Urbanization trends and growing populations in megacities are also pushing the need for smarter transportation solutions that minimize congestion and pollution. As a result, consumers and enterprises alike are increasingly looking to autonomous vehicles to provide sustainable and efficient alternatives to traditional driving.

The Autonomous Vehicles Market offers several promising opportunities, particularly for stakeholders prepared to innovate and adapt. One of the most significant opportunities lies in the commercial and logistics sectors, where autonomous trucks and delivery vehicles can dramatically improve operational efficiencies and reduce costs. The expansion of autonomous ride-hailing and MaaS platforms presents another avenue for growth, as companies look to deploy driverless fleets that can optimize urban mobility and enhance customer experiences.

Additionally, regions in Asia-Pacific and the Middle East are emerging as lucrative markets due to their proactive investments in smart city projects and infrastructure, aiming to support autonomous mobility. With continuous technological advancements and supportive government policies, the market holds substantial potential for early movers and strategic partnerships that can leverage the evolving ecosystem.

Key Takeaways

- The global autonomous vehicles market is projected to grow from USD 208.0 billion in 2023 to USD 4,206.4 billion by 2032, at a CAGR of 41.0% from 2023 to 2032.

- Semi-autonomous vehicles dominate the global market with approximately 60% share due to consumer preference for driver assistance features and safety enhancements.

- Level 1 vehicles account for around 45% of the market, primarily due to their affordability and basic automation features like cruise control and lane assistance.

- The transportation sector holds over 65% of the application segment, driven by government initiatives and increasing demand for autonomous logistics and passenger vehicles.

- North America leads regionally with 45% market share, supported by regulatory approval and early adoption of autonomous driving technologies.

- The Asia Pacific region is projected to grow at a CAGR of 43%, propelled by rising investments in autonomous vehicle technology and increasing demand in emerging economies like China and India.

Autonomous Vehicles Statistics

- In 2024, autonomous vehicles (AVs) may reduce congestion, cutting fuel use by 0-4%, though increased driving distances (VMT) could offset this benefit.

- Eco-driving by AVs could cut fuel consumption by up to 20%, but if efficiency isn’t prioritized, these savings may not occur.

- Adjusting vehicle performance for comfort, not speed, could lower fuel usage by 5-23%.

- Crash avoidance features could lead to lighter, smaller cars, reducing fuel consumption by 5-23%.

- Optimizing vehicle sizes, especially with ride-sharing, could reduce energy use by 21-45%.

- Safer AVs could allow higher highway speeds, potentially increasing fuel use by 7-30%.

- Cheaper and more comfortable travel might boost overall travel, raising energy use by 4-60%.

- More accessibility with AVs could raise VMT and fuel use by 2-10%.

- Ride-sharing expansion may cut energy consumption by 0-20%.

- In 2022, 42,795 people died in crashes; 94% were due to human errors. AVs could reduce these crashes by 90%, saving $190 billion annually.

- The U.S. AV market might exceed $75 billion by 2030, up 350% from 2023.

- AVs could cut public transit energy use by 33% compared to personal vehicles.

- Waymo has driven over 20 million miles in 25 U.S. cities.

- Tesla’s autopilot has logged 3 billion miles to date.

- Over 1,400 self-driving cars are in testing now.

- Lyft and Aptiv have deployed 100,000+ robo-taxis in Las Vegas.

- By 2030, 58 million AVs are expected to be sold.

- The AV industry is growing at a rate of 16% per year.

- 25% of buyers are interested in AVs, especially those with long commutes.

- Only 26% of U.S. respondents preferred AVs in 2023, down from 35%, due to safety worries.

- Studies show AVs could lower accidents by 40% using ADAS features.

- By 2024, 18.43 million cars globally will have Level 2 automation (e.g., lane-keeping).

- In 2023, 21,150 AVs were in use, up from 16,960 in 2022. By 2024, this number should reach 26,560.

- 5.42 million AVs were sold in 2023, and 7.61 million are expected in 2024.

- In 2022, there were 1,450 self-driving car accidents, the highest recorded so far.

- About 10% of AV accidents lead to injuries, while around 2% cause fatalities.

- From 2021 to 2024, the NHTSA reported 3,979 AV incidents.

- Tesla was involved in 53.9% of all reported AV incidents.

- As of June 2024, 83 AV-related fatalities occurred.

- Level 4 AVs grew by 35% from 2023 to 2024.

- China leads in testing with over 8,000 AVs as of late 2023.

- The average AV generates 4 terabytes of data daily.

- AV failure rates dropped by 23% between 2023 and 2024.

- In 2023, AVs could detect obstacles 200 meters away.

- Top AV systems react in 0.1 seconds, while humans take 0.25 seconds.

- Lidar tech improved by 40% in resolution since 2022.

- In 2023, AVs had 0.14 accidents per million miles, versus 4.2 for human drivers.

- As of 2024, 29 U.S. states have AV laws.

- The EU finalized AV regulations in late 2023, effective 2025.

- There were 12 AV-related injuries worldwide in 2023, down 25% from 2022.

- 80% of AV accidents in 2023 happened during human transitions.

- In the U.S., 74% of adults aged 25-34 favor AVs.

- Among buyers, 58% are male, 42% female, showing a narrowing gap.

- Urban residents are 2.5 times more likely to use AVs than rural ones.

- In Asia, 73% are willing to use AVs, the highest globally.

- Europe saw a 28% rise in AV registrations from 2023 to 2024, led by Germany.

- California leads U.S. AV testing with 50+ companies holding permits as of 2024.

- Singapore launched the first commercial AV taxi service in late 2023, serving 15,000 riders in its first month.

- Japan aims for Level 4 AVs on roads by 2025, with tests in Tokyo.

- The UAE targets 25% of Dubai’s transport to be autonomous by 2030.

- South Korea invested $1.1 billion in AV infrastructure in 2023, focusing on smart highways and 5G networks.

Emerging Trends

- Shift Toward Autonomous Freight and Delivery Vehicles: Companies are increasingly focusing on developing autonomous trucks and delivery services rather than passenger robo-taxis. This shift prioritizes logistics applications due to higher demand, controlled environments on highways, and the potential for faster returns on investment compared to ride-hailing services.

- AI-Driven Real-Time Decision Making: AI algorithms are becoming more advanced, enhancing vehicles’ ability to make real-time decisions in complex traffic situations. These developments help vehicles better predict pedestrian behavior and respond to various road conditions, pushing the technology closer to achieving higher levels of autonomy and safety.

- 5G and Vehicle-to-Everything (V2X) Connectivity: Integration of 5G technology allows autonomous vehicles to communicate seamlessly with other vehicles and infrastructure. This real-time data exchange is vital for improving safety and efficiency, particularly in densely populated urban areas where quick information updates are crucial for managing traffic flow and hazards.

- Regulatory Progress and Global Standardization: Governments are actively developing frameworks and safety protocols to support autonomous vehicle deployment. These regulatory advancements are essential for building public trust and ensuring a smooth integration of AVs into mainstream transportation networks, with significant legislative progress in regions like Europe, the U.S., and Asia.

- Focus on User Experience and Human-Machine Interaction: Enhancing user experience has become a priority, with companies developing intuitive and interactive vehicle systems. This focus on improving human-machine interaction aims to boost passenger comfort and trust, addressing safety concerns and enhancing the perception of AV technology among consumers.

Top Use Cases

- Autonomous Trucking and Freight Transportation: Autonomous trucks are becoming a leading use case due to their efficiency in long-distance transportation. Companies are deploying autonomous trucks on highways to optimize freight routes and reduce driver shortages. In regions like North America, pilot programs focus on highway hubs, particularly in favorable weather areas like the Sun Belt. Autonomous trucks are expected to reduce operational costs by up to 30%, enhancing logistics profitability.

- Robo-Taxi Services: Robo-taxis, or autonomous ride-hailing services, are being tested in major cities like San Francisco, Phoenix, and some urban centers in China. While commercial-scale deployment is projected for 2026 or later, these services promise to revolutionize urban mobility by reducing the need for private car ownership and potentially decreasing traffic congestion by 15-20%. Early deployments show that each robo-taxi fleet could generate over $1 billion annually if operated at full capacity.

- Last-Mile Delivery Solutions: Autonomous vehicles for last-mile delivery, such as delivery bots and vans, are gaining traction. They are used for grocery, parcel, and small-item delivery in urban areas. Companies like Amazon and Nuro are investing heavily in these solutions, reducing delivery times by up to 50% and operating costs by approximately 40%. This use case is critical as e-commerce continues to grow, demanding efficient and timely delivery methods.

- Autonomous Public Transit and Shuttle Services: Public transit systems and autonomous shuttles are increasingly being tested for use in controlled environments like airports, university campuses, and urban centers. These shuttles aim to improve last-mile connectivity and decrease congestion. In some cities, they are projected to reduce public transportation operating costs by 25% while increasing passenger capacity by 10% without requiring additional infrastructure investments.

- Autonomous Agriculture and Construction Vehicles: In agriculture, autonomous tractors and harvesters are being utilized to optimize farming operations, boosting productivity by up to 20% and lowering labor costs. Similarly, construction sites are using autonomous vehicles for excavation, material transport, and site maintenance, enhancing safety and reducing manual labor needs. These applications are expected to grow, with the market for autonomous agriculture and construction machinery projected to exceed $10 billion annually by 2030.

Major Challenges

- Regulatory Uncertainty: One of the biggest hurdles is the lack of consistent regulations across different regions. Countries like Germany have developed robust guidelines, but many other regions lack unified frameworks. This inconsistency makes it difficult for companies to scale AV technologies globally. Regulatory alignment is crucial for full autonomy, and current fragmented policies could delay large-scale deployment by several years.

- High Development Costs: Developing autonomous vehicles, particularly at Level 4 and 5 automation, involves significant financial investment. Hardware and software systems, such as lidar sensors and AI algorithms, require billions in R&D. For example, early-stage autonomous truck projects alone may need investments between $0.6 and $1.5 billion. These high costs can act as a barrier, especially for smaller companies that lack substantial funding.

- Public Trust and Consumer Acceptance: Consumer hesitation remains a major obstacle. Incidents involving self-driving cars have heightened safety concerns, leading to skepticism about AV reliability. Surveys indicate that even with technological advancements, only a small portion of consumers currently express willingness to trust fully autonomous vehicles. To overcome this, companies must invest in public education and offer safe, transparent demonstrations.

- Data Privacy and Cybersecurity Risks: Autonomous vehicles depend heavily on data collection and connectivity, making them vulnerable to cyberattacks. Ensuring the protection of sensitive user data and vehicle systems is critical to prevent breaches that could compromise both privacy and safety. Developing strong encryption, real-time threat monitoring, and compliance with privacy regulations are necessary steps, but they add complexity and cost to the development process.

- Infrastructure Limitations: Existing road infrastructure is not yet fully equipped to support widespread AV deployment. The integration of smart traffic systems, vehicle-to-everything (V2X) communication, and dedicated lanes for AVs is necessary but requires substantial public and private investment. Without these upgrades, autonomous vehicles may not reach their full efficiency or safety potential, especially in urban areas with complex traffic patterns

Top Opportunities

- Expansion of Autonomous Freight and Logistics: The autonomous trucking sector presents significant growth potential. Given the increasing demand for efficient logistics solutions, deploying autonomous trucks on highways can optimize freight operations, cut labor costs, and reduce delivery times. The global logistics market is expected to integrate more autonomous solutions, particularly in North America and China, which could push the market’s growth by billions of dollars annually as companies invest in these technologies.

- Rise of Urban Robo-Taxi Services: The market for autonomous ride-hailing, or robo-taxi services, is set to expand in major cities like San Francisco, Shanghai, and Dubai. With cities investing in smart infrastructure and regulations increasingly favoring pilot programs, robo-taxis could dominate urban mobility, offering a convenient alternative to private car ownership. This shift could generate an estimated $1 billion in annual revenue per fleet once full-scale deployment occurs.

- Growth in Autonomous Last-Mile Delivery Solutions: E-commerce growth is fueling demand for efficient last-mile delivery services. Autonomous delivery robots and vehicles, such as those developed by companies like Nuro, are gaining traction. These solutions help reduce delivery costs by up to 40%, enhance efficiency, and meet rising consumer expectations for rapid deliveries. This opportunity could transform urban logistics and drive multi-billion-dollar investments globally.

- Integration of Autonomous Vehicles in Public Transportation: Governments in regions such as Europe, China, and the United States are investing in autonomous public transportation systems, including shuttles and buses, to improve urban mobility. Autonomous shuttles operating in controlled environments (like airports or city centers) are set to enhance public transport efficiency and reduce emissions. These systems are expected to lower operational costs for cities by 20-30% and expand market share significantly over the next decade.

- Emergence of Specialized Industrial Applications: The use of autonomous vehicles in sectors like agriculture, mining, and construction offers vast opportunities. Autonomous tractors, mining trucks, and construction machinery are being developed to improve safety and productivity while lowering labor costs. The market for autonomous agricultural and industrial vehicles is projected to grow at a robust pace, with the potential to reach tens of billions in value by 2030 as industries seek to automate and optimize their operations.

Key Player Analysis

- Tesla, Inc.: Tesla remains a dominant force in the autonomous vehicle market, leveraging its proprietary Autopilot and Full Self-Driving (FSD) technologies. With over 2 million vehicles on the road globally equipped with these systems, Tesla continually gathers vast amounts of driving data to enhance its AI models. The company’s focus on software-driven development and over-the-air updates provides it a competitive edge in rapidly iterating and improving autonomous capabilities.

- Waymo (Alphabet Inc.): As a subsidiary of Alphabet, Waymo is a leader in the development of autonomous ride-hailing services. The company has logged over 20 million miles on public roads and operates in key locations like Phoenix. Waymo’s partnerships, such as its integration with Uber, enhance its market reach. Waymo’s ongoing testing of fully autonomous Level 4 vehicles positions it as a significant player in scaling AV technology.

- General Motors (Cruise): GM’s Cruise is a significant player in the autonomous vehicle landscape, focusing on developing and deploying robo-taxis. Backed by a $2 billion investment from Microsoft and Honda, Cruise’s valuation reached $30 billion in 2023. The company aims to expand operations beyond San Francisco, targeting large-scale commercialization by 2030 with Level 4 autonomy vehicles.

- Volkswagen AG: Volkswagen has committed substantial resources to develop its autonomous technology through its CARIAD software subsidiary and partnerships with Mobileye. By 2023, Volkswagen began trials with 10 ID Buzz electric vans in Austin, Texas, equipped with Level 4 systems. This initiative highlights its strategy to expand its electric and autonomous fleet, aligning with global market demands.

- Toyota Motor Corporation: Toyota partners with tech companies like Pony.ai to advance autonomous mobility solutions. By 2023, Toyota had initiated joint ventures for autonomous ride-hailing services in China. The company’s extensive R&D investments and collaboration with tech firms demonstrate its approach to leveraging local expertise and resources for global deployment

Recent Developments

- In 2024, Nissan in Yokohama, Japan, started testing its new autonomous vehicle prototype using the Nissan LEAF model. This prototype includes 14 cameras, 10 radars, and 6 LIDAR sensors, allowing it to better navigate urban areas. The company plans to launch its autonomous mobility services by 2027.

- In 2024, Ansys in Pittsburgh, PA, announced a partnership with NVIDIA on March 18 to create advanced simulation tools. This partnership aims to enhance 6G technology, build digital twins, and integrate NVIDIA’s AI into Ansys products, pushing forward developments in autonomous systems.

- In 2024, Bayanat AI PLC from the UAE partnered with Oxa to develop autonomous vehicle solutions in the region. Supported by the Abu Dhabi Investment Office, this partnership is part of a broader plan to promote smart mobility innovations within the UAE.

- In 2024, Amazon continued its investment in autonomous vehicle technology through its $1 billion Industrial Innovation Fund. The company focuses on AI and AV startups, particularly those improving last-mile delivery and logistics in Asia.

Conclusion

The autonomous vehicles market is advancing rapidly, driven by technological innovation, strategic partnerships, and supportive regulations. While challenges such as high development costs, regulatory inconsistencies, and public trust issues remain, the industry shows promising growth potential, particularly in sectors like logistics, public transport, and last-mile delivery. The deployment of autonomous trucks, robo-taxis, and specialized industrial vehicles highlights the broad applications and economic benefits AV technology can offer.

Moving forward, market players will need to focus on overcoming these barriers while capitalizing on opportunities through infrastructure investment, consumer education, and enhanced safety measures to realize the full potential of a driverless future. As adoption scales and technology matures, autonomous vehicles are positioned to reshape mobility, driving efficiency and transforming urban landscapes globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)