Table of Contents

Overview

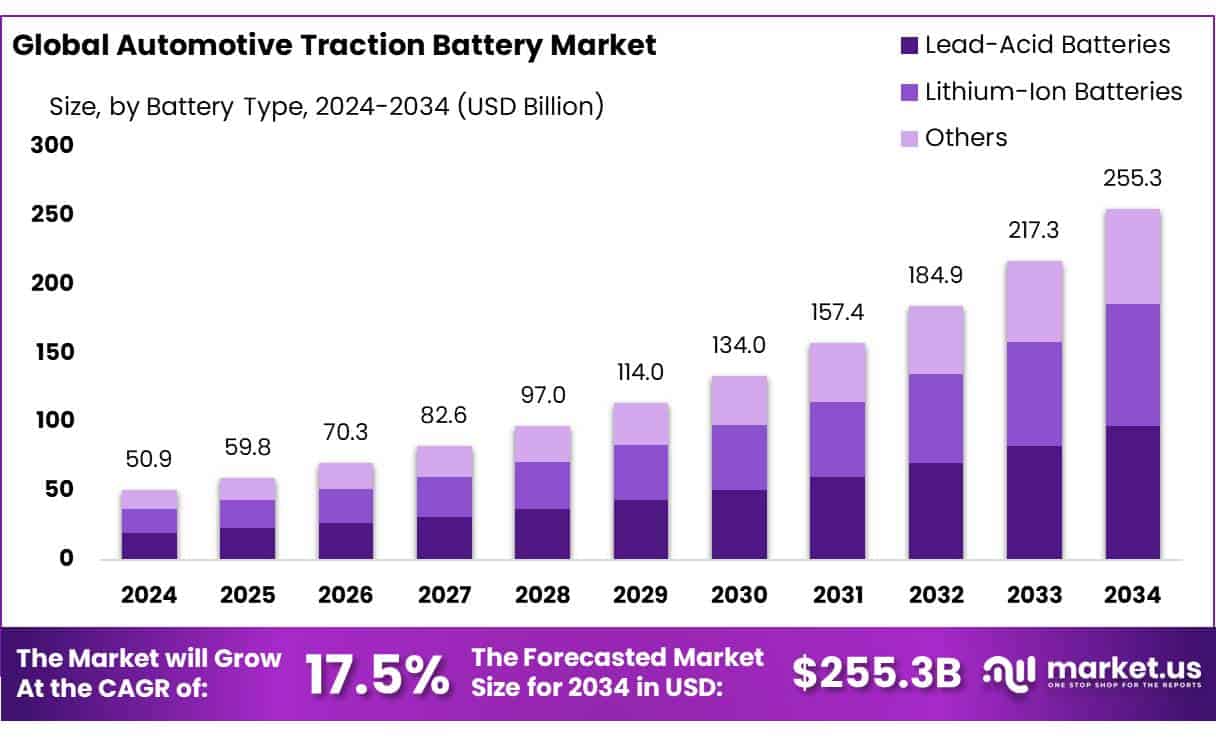

New York, NY – April 25, 2025 – The global Automotive Traction Battery Market is experiencing rapid growth, driven by the rising demand for electric vehicles (EVs) and supportive government policies promoting clean energy. The market, valued at USD 50.9 billion in 2024, is projected to reach USD 255.3 billion by 2034, growing at a strong 17.5% CAGR from 2025 to 2034.

Lead-Acid Batteries commanded a leading 38.3% share of the automotive traction battery market. Prismatic Batteries led the market in 2024, securing a 54.3% share. Their compact, rectangular design optimizes space and energy density, making them ideal for EV chassis integration in both passenger and commercial vehicles. The 50-100 kWh segment dominated in 2024, capturing a 44.3% market share. Passenger Cars dominated in 2024 with a 67.3% share, driven by rising consumer preference for electric vehicles, supported by stricter emissions regulations and incentives.

US Tariff Impact on Market

The imposition of new U.S. tariffs has significantly impacted the automotive traction battery market. In April 2025, the U.S. government introduced tariffs of up to 82% on Chinese battery imports, including a 25% tariff specifically on lithium-ion EV batteries.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/automotive-traction-battery-market/request-sample/

These measures have led to increased production costs for U.S. manufacturers, as many rely on imported components from China, Japan, and South Korea. The higher costs are expected to be passed on to consumers, potentially slowing EV adoption rates. Analysts forecast a potential reduction in U.S. EV sales by up to 15% in the short term due to these tariffs. Furthermore, the tariffs have prompted U.S. companies to reconsider their supply chains, with some investing in domestic production facilities to mitigate reliance on foreign imports.

Key Takeaways

- Automotive Traction Battery Market size is expected to be worth around USD 255.3 Bn by 2034, from USD 50.9 Bn in 2024, growing at a CAGR of 17.5%.

- Lead-Acid Batteries held a dominant market position, capturing more than a 38.3% share.

- Prismatic batteries held a dominant market position, capturing more than a 54.3% share.

- 50-100 kWh capacity segment held a dominant market position, capturing more than a 44.3% share.

- Battery Electric Vehicles (BEVs) held a dominant market position, capturing more than a 68.4% share.

- Passenger Cars held a dominant market position, capturing more than a 67.3% share.

- OEMs (Original Equipment Manufacturers) held a dominant market position in the automotive traction battery sector, capturing more than a 76.4% share.

- Asia Pacific (APAC) held the dominant position in the automotive traction battery market, capturing more than 47.5% of the total market share, valued at approximately $24.1 billion.

Analyst Viewpoint

The automotive traction battery market is experiencing a significant surge, driven by the global shift towards electric vehicles (EVs) and the demand for sustainable energy solutions. Lithium-ion and emerging solid-state batteries, which offer higher energy densities and improved safety profiles. Notably, companies like CATL are pioneering sodium-ion batteries, which are not only cost-effective but also present lower fire risks, making them a promising alternative in the EV sector.

From a consumer perspective, there’s a growing preference for EVs due to environmental concerns and the increasing availability of charging infrastructure. However, the market isn’t without its challenges. Investors should be mindful of risks such as fluctuating raw material prices, particularly for lithium and cobalt, which can impact battery costs. Moreover, while regions like Europe aim to bolster their battery production capabilities, there’s a growing reliance on Chinese manufacturers, raising concerns about technological dependencies.

Report Scope

| Market Value (2024) | USD 50.9 Billion |

| Forecast Revenue (2034) | USD 255.3 Billion |

| CAGR (2025-2034) | 17.5% |

| Segments Covered | By Battery Type (Lead-Acid Batteries, Lithium-Ion Batteries), By Battery Form (Prismatic, Pouch, Cylindrical), By Capacity (Less than 50 kWh, 50-100 kWh, 100-200 kWh, More than 200 kWh), By Propulsion Type (Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV)), By Vehicle Type (Passenger Cars, Commercial Vehicles), By End-user (OEMs, Aftermarket) |

| Competitive Landscape | GS Yuasa International Ltd, Contemporary Amperex Technology Co., Ltd. (CATL), BYD Company Ltd., LG Energy Solution, Panasonic Corp., SK Innovation Co., Ltd., Toshiba Corporation, Exide Group, EnerSys, Samsung SDI, Hitachi, Ltd., Mitsubishi Corp., East Penn Manufacturing, CALB Group Co Ltd, Leoch International Technology Ltd, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=138657

Key Market Segments

By Battery Type

- In 2024, Lead-Acid Batteries commanded a leading 38.3% share of the automotive traction battery market. Despite the rise of lithium-ion batteries, lead-acid batteries remain prevalent in cost-sensitive and legacy applications, particularly for starting, lighting, and ignition (SLI) functions in internal combustion engine (ICE) vehicles, as well as in some hybrid and electric vehicle (EV) setups. Their dominance stems from proven technology, affordability, and reliability.

By Battery Form

- Prismatic Batteries led the market in 2024, securing a 54.3% share. Their compact, rectangular design optimizes space and energy density, making them ideal for EV chassis integration in both passenger and commercial vehicles. Cylindrical Batteries, valued for their safety and reliability, and Pouch Batteries, prized for their lightweight flexibility, hold smaller market shares but are gaining traction in niche applications like high-performance or design-focused EVs. Prismatic batteries, however, maintain their edge due to their balance of performance, scalability, and manufacturing efficiency, with continued dominance expected.

By Capacity

- The 50-100 kWh segment dominated in 2024, capturing a 44.3% market share. This range appeals to mid-range EVs, offering 300-400 km of range, balancing performance, affordability, and practicality for daily and long-distance travel. Advancements in energy density and cost reductions, alongside government incentives and emission regulations, bolster this segment’s lead. It is projected to remain the market leader into 2025 due to its versatility.

By Propulsion Type

- Battery Electric Vehicles (BEVs) held a commanding 68.4% share in 2024, fueled by consumer demand for zero-emission vehicles, lower operating costs, and advancements in battery and charging infrastructure. Government incentives and stricter emission rules further accelerate BEV adoption.

By Vehicle Type

- Passenger Cars dominated in 2024 with a 67.3% share, driven by rising consumer preference for electric vehicles, supported by stricter emissions regulations and incentives. Advances in battery technology, including better energy density and faster charging, make BEVs increasingly practical.

Regional Analysis

- The Asia-Pacific (APAC) region led the automotive traction battery market, securing a 47.5% share valued at approximately USD 24.1 billion. This dominance is fueled by booming electric vehicle (EV) production in China, Japan, and South Korea. China, the world’s largest EV market, drives significant demand, supported by aggressive government electrification policies and incentives that boost high-performance traction battery adoption.

- North America holds a 22.1% market share, with the United States experiencing rapid EV sales growth. Initiatives like the Biden Administration’s EV Incentives Program and the Infrastructure Investment and Jobs Act, which funds EV infrastructure, are key drivers. Automakers such as Tesla and General Motors are scaling up EV production, further increasing traction battery demand.

- Europe accounts for 18.9% of the market, propelled by the European Union’s strict emission regulations and heavy investments in green technology. Countries like Germany, France, and Norway are seeing strong EV adoption, with automakers like Volkswagen, BMW, and Renault expanding their EV portfolios, driving demand for traction batteries.

- The Middle East & Africa (MEA) and Latin America hold smaller market shares but are poised for growth as electric mobility gains momentum. Governments in these regions are increasingly prioritizing emissions reduction and sustainable transport, which will spur demand for automotive traction batteries in the coming years.

Top Use Cases

- Battery Electric Vehicles (BEVs): Traction batteries power fully electric vehicles, offering zero-emission transport. They provide high energy density for long ranges, typically 300-400 km per charge. Popular in passenger cars, BEVs rely on these batteries for efficient, eco-friendly driving, supported by growing charging infrastructure and government incentives pushing sustainable mobility.

- Plug-In Hybrid Electric Vehicles (PHEVs): PHEVs use traction batteries alongside gasoline engines for flexible driving. The battery powers short electric-only trips, reducing fuel use and emissions. Ideal for drivers concerned about range, PHEVs switch to gasoline for longer journeys, making them a practical choice in markets transitioning to full electrification.

- Commercial Electric Vehicles: Traction batteries enable electric buses and trucks, supporting greener urban transport. High-capacity batteries (100-200 kWh) provide extended ranges for heavy-duty use. Fleet operators adopt these for lower operating costs and compliance with emission regulations, especially in cities prioritizing sustainable logistics and public transit solutions.

- Electric Two-Wheelers: Traction batteries power electric scooters and motorcycles, popular in Asia-Pacific for affordable, efficient urban mobility. Smaller batteries offer sufficient range for daily commutes. Their lightweight design and low energy costs make them a practical alternative to gasoline-powered two-wheelers in crowded cities.

- Starting, Lighting, and Ignition (SLI) Applications: Lead-acid traction batteries are widely used in traditional ICE vehicles for SLI functions. They provide reliable power for starting engines and supporting electrical systems like lights and infotainment. Cost-effective and durable, these batteries remain dominant in legacy vehicles despite the rise of lithium-ion alternatives.

Recent Developments

1. GS Yuasa International Ltd.

- GS Yuasa has developed high-capacity lithium-ion batteries for EVs, focusing on improved energy density and safety. The company is collaborating with Honda to establish a joint venture for battery production, targeting 20 GWh annual capacity. Their new LJX series offers longer life and faster charging. GS Yuasa is also investing in solid-state battery research.

2. Contemporary Amperex Technology Co., Ltd. (CATL)

- CATL unveiled its Shenxing Plus LFP battery in 2024, enabling a 600 km range in 10-minute fast charging. The company is also mass-producing condensed matter batteries with 500 Wh/kg energy density for electric aircraft. CATL signed supply deals with Tesla, BMW, and Mercedes, expanding global production in Germany and Hungary.

3. BYD Company Ltd.

- BYD launched its Blade Battery 2.0 with enhanced thermal stability and a 1,000 km range. The company is scaling production, targeting 600 GWh capacity. BYD supplies batteries to Tesla and Toyota, while also investing in sodium-ion batteries for cost-effective EVs. Their new “FinDreams Battery” brand aims to dominate the global market.

4. LG Energy Solution

- LG Energy Solution is producing NCMA (nickel-cobalt-manganese-aluminum) batteries for GM’s Ultium platform, improving energy density. LG also partnered with Toyota for EV battery supply.

5. Panasonic Corp.

- Panasonic is developing 4680 battery cells for Tesla, aiming for mass production. The company is also working on silicon-anode batteries for higher energy density. Panasonic’s new Kansas factory will supply EV makers in North America, with a focus on reducing cobalt usage.

Conclusion

The Automotive Traction Battery Market is rapidly evolving, driven by advancements in energy density, fast-charging capabilities, and cost reduction. Leading players like CATL, BYD, and LG Energy Solution are pushing innovation with next-gen lithium-ion, solid-state, and sodium-ion batteries. GS Yuasa and Panasonic are strengthening partnerships with automakers to scale production and improve battery performance.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)