Table of Contents

Introduction

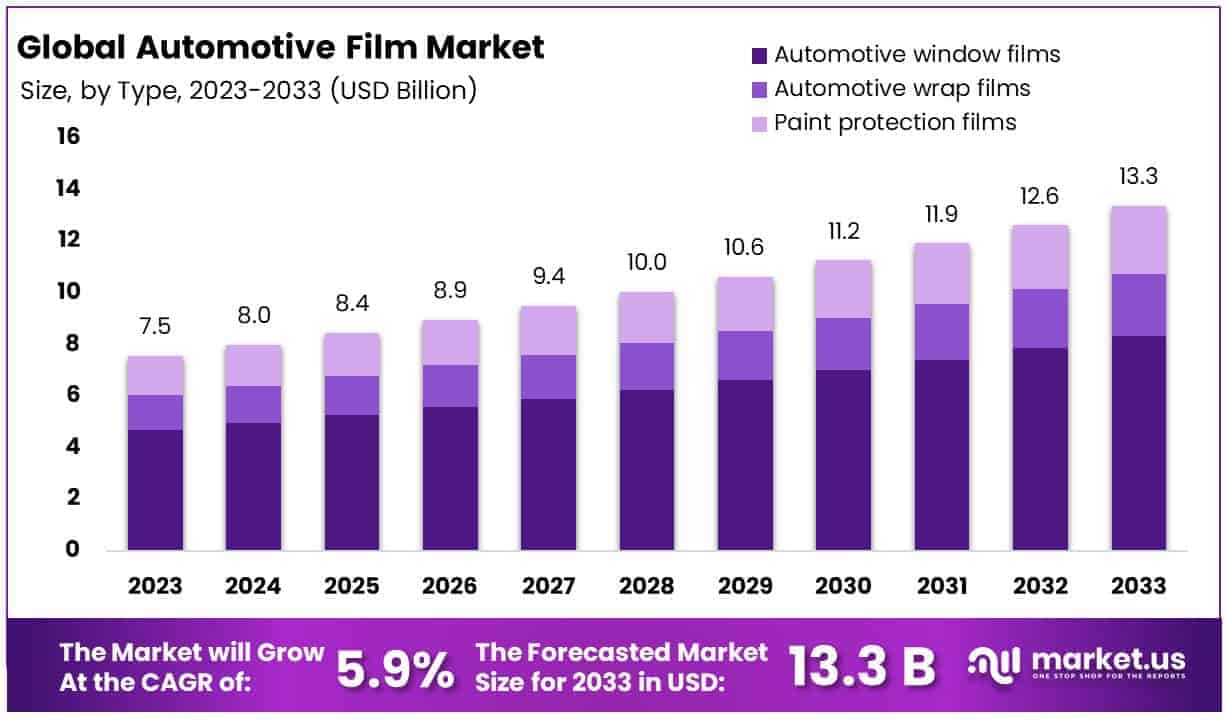

The Global Automotive Film Market is projected to grow from its current value of USD 7.5 billion in 2023 to an estimated USD 13.3 billion by 2033. This growth represents a compound annual growth rate (CAGR) of 5.90% over the forecast period from 2024 to 2033.

Automotive film refers to thin laminate films applied to the interior or exterior surfaces of vehicles for protection, aesthetic enhancement, or functionality. These films can include window tints, paint protection films, vinyl wraps, and ceramic coatings, each serving purposes such as UV protection, heat reduction, privacy, and paint preservation.

The automotive film market encompasses the production, distribution, and application of these films, catering to both consumer preferences and regulatory requirements across the global automotive industry. Growth in this market is driven by increasing awareness of vehicle maintenance, rising demand for luxury and customization options, and stringent regulations regarding UV protection and energy efficiency in vehicles.

Consumer demand continues to expand as drivers seek cost-effective ways to protect their investments and enhance vehicle appearance. Opportunities in this market are amplified by technological advancements in film durability and aesthetics, which attract a broader consumer base, as well as by the expansion into emerging markets where vehicle sales and awareness of maintenance benefits are rising. The automotive film market thus presents a dynamic landscape with strong growth prospects, fueled by evolving consumer trends and continuous product innovation.

Key Takeaways

- The Global Automotive Film Market is set to expand from USD 7.5 billion in 2023 to USD 13.3 billion by 2033, achieving a CAGR of 5.90%.

- Automotive Window Films are the leading sub-segment, capturing 62.4% of the market, favored for their UV protection, heat reduction, and privacy benefits, alongside regulatory and technological support.

- Exterior applications are the most popular, accounting for 51.3% of the market, driven by trends in vehicle customization and paint protection, enhanced by advancements in durability and performance.

- Passenger cars dominate the market with a 73.6% share, driven by consumer interest in personalization and maintenance, and recognition of film benefits like UV and heat protection.

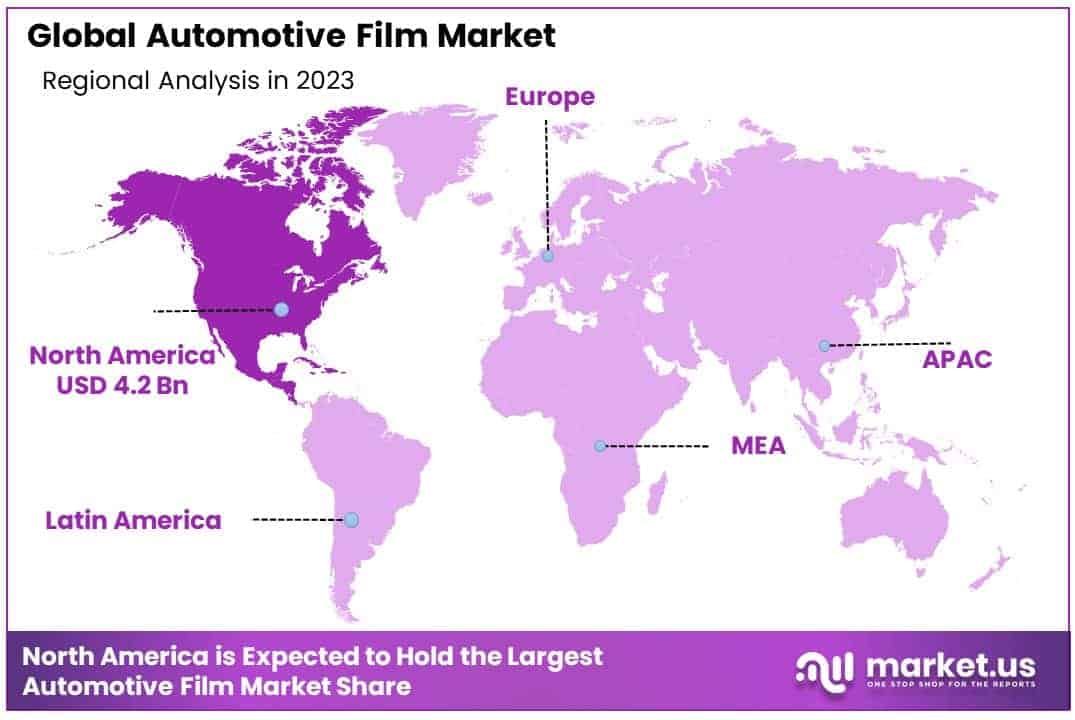

- North America holds the largest market share at 56.8%, propelled by strong consumer awareness, regulatory frameworks, and technological innovations.

- Europe has a significant presence too, with about 22% market share, with potential growth driven by rising consumer demand for automotive films and focused regulatory standards.

Key Segments Analysis

The Automotive Film Market is segmented into automotive window films, automotive wrap films, and paint protection films, with window films dominating the market at 62.4% share due to their benefits like UV protection, heat reduction, and privacy. This segment is supported by regulations promoting UV protection and energy efficiency, alongside technological advancements that enhance durability and clarity. While automotive wrap films focus on customization and branding, particularly for businesses and individual vehicle personalization, paint protection films cater to preserving vehicle exteriors from damage, increasingly favored by owners of premium vehicles for maintaining appearance and resale value.

The automotive film market is primarily segmented into Interior and Exterior applications, with the latter dominating at 51.3% market share due to its significant role in vehicle customization, paint protection, and aesthetic enhancement. Exterior films provide benefits like UV protection, heat reduction, and increased privacy, making them more appealing to consumers for their visible impact and value addition. Although the Interior segment holds a smaller market share, it is vital for protecting interior fabrics from UV damage and reducing heat in parked vehicles, with innovations in aesthetics and functionality likely to drive its growth. Together, both segments contribute to the market’s expansion by offering comprehensive solutions for vehicle protection and enhancement.

In the automotive film market, the Vehicle Type segment is split between Passenger Cars and Commercial Vehicles, with Passenger Cars taking the lead with a 73.6% market share. This dominance is driven by the high volume of passenger vehicles and the increasing consumer focus on vehicle customization and maintenance. Factors such as UV protection, heat reduction, and privacy are pivotal in boosting the demand for automotive films among passenger car owners. Additionally, the desire to maintain aesthetics and protect the car’s exterior promotes further interest in these films, supported by a variety of options and the rising popularity of DIY applications. While Commercial Vehicles hold a smaller market share, they are essential to the industry’s growth, catering to specific needs like branding and durability under tough conditions, thus underlining the diverse applications of automotive films across different vehicle types.

Emerging Trends

- Increased Adoption of Ceramic Films: Ceramic films are becoming popular due to their exceptional heat rejection capabilities, which keep cars cooler without requiring a dark, reflective appearance. This trend is driven by consumers seeking both aesthetic and functional benefits in automotive films.

- Advancement in Paint Protection Films (PPFs): There is a notable shift towards thermoplastic polyurethane (TPU) paint protection films, known for their durability, clarity, and self-healing properties. These films offer superior protection against minor scratches and environmental damage, responding to the growing demand for high-performance automotive films.

- Rise of High-Thickness PPFs: Automotive films are evolving with higher thickness to offer better protection against physical damages like rock chips. This trend reflects a move towards products that provide enhanced durability and protection.

- Smart Tinting Technologies: The integration of smart technologies into automotive films allows for electronically adjustable tints. This innovation caters to the need for versatility in tint density based on changing light conditions, enhancing both convenience and functionality.

- Eco-Friendly and Sustainable Films: With growing environmental awareness, there is an increasing demand for automotive films made from sustainable materials. These eco-friendly tints are designed to minimize environmental impact, aligning with global sustainability trends.

Top Use Cases

- UV Protection: Automotive window films are extensively used to block harmful UV rays, protecting both the passengers and the interior of the car from sun damage.

- Heat Reduction: By reducing the amount of heat entering a vehicle, automotive films can decrease the reliance on air conditioning, thus enhancing comfort and reducing energy consumption.

- Enhanced Privacy and Security: Films provide privacy for passengers and security from prying eyes, making them popular among vehicle owners who prioritize confidentiality.

- Safety: In the event of an accident, automotive films can help hold shattered glass together, reducing the likelihood of injury from broken glass.

- Aesthetic Enhancements: Automotive films are also used to improve the external appearance of vehicles, offering a range of colors and finishes that can be customized to the car owner’s preference.

Major Challenges

- Regulatory Challenges: Various regions have specific regulations regarding the darkness and reflectivity of automotive tints, posing compliance challenges for manufacturers and users.

- Installation Competence: Proper installation is crucial to the effectiveness and durability of automotive films. Poorly installed films can lead to bubbles, peeling, and aesthetic issues, diminishing the perceived value of the product.

- Technological Integration Issues: As vehicles become more equipped with sensors and advanced technologies, there is a challenge to develop films that do not interfere with these systems.

- Economic Constraints: Economic downturns and fluctuating raw material costs can impact the affordability and production costs of high-quality automotive films, potentially limiting market growth.

- Environmental Impact and Sustainability Concerns: The production and disposal of automotive films pose environmental challenges. There is a pressing need for innovation in recyclable and eco-friendly materials.

Top Opportunities

- Expanding into Emerging Markets: With the increasing vehicle ownership in emerging markets, there is a significant opportunity for the expansion of automotive film products.

- Innovations in Film Technology: Developing films that can integrate seamlessly with the latest vehicle technologies presents a considerable growth opportunity.

- Rising Demand for Premium Films: As consumer preferences shift towards high-quality, durable products, there is an opportunity to cater to the premium segment of the market.

- Customization and Personalization: Offering customized and personalized films can attract a niche market of car enthusiasts looking for unique aesthetic enhancements.

- Partnerships with Automotive Manufacturers: Collaborating directly with car manufacturers to offer pre-applied films could open new channels and increase market penetration.

Key Player Analysis

- Saint-Gobain is a notable player in the automotive film market, offering a variety of films that enhance vehicle safety and aesthetics. They focus on innovation and sustainability, providing products that meet the demands of modern automotive manufacturing and customization.

- Eastman Chemical Company has made significant strides in the automotive film industry by acquiring Ai-Red Technology, thus bolstering their presence in the Asia-Pacific region. Eastman is recognized for their wide range of window and paint protection films, which cater to both automotive and architectural applications.

- Avery Dennison Corporation specializes in a variety of automotive films, including those used for vehicle wrapping and tinting. They are known for their technological advancements and high-quality materials that cater to both aesthetic and functional needs of the automotive industry.

- LINTEC Corporation manufactures a broad spectrum of adhesive products suitable for automotive applications, including protective and decorative films. They emphasize innovation in their product offerings to meet diverse market requirements.

- Nexfil Co, Ltd. is a leader in the production of automotive window films, particularly known for their market dominance in Korea. Nexfil’s product line includes solar control films that are designed to enhance vehicle comfort and efficiency. They have a strong export presence, serving around 60 countries globally.

Regional Analysis

North America Leads Automotive Film Market with Largest Market Share of 56.8%

The automotive film market in North America has demonstrated significant growth, solidifying its position as the dominant region in the industry with a commanding 56.8% market share in 2023. This region’s market valuation stood at USD 4.2 billion, reflecting robust demand and advanced technological adoption in automotive films. Factors such as stringent regulations on vehicle emissions, a growing emphasis on vehicle aesthetics and maintenance, and high consumer spending capabilities have significantly contributed to the expansion of this market.

The North American automotive film industry is characterized by a mature market with high penetration of premium automotive films, including window films, wrap films, and paint protection films. These products are increasingly utilized for their benefits in energy efficiency, UV protection, and enhanced privacy, which align to the stringent regulatory and consumer demands of the region. As the market continues to evolve, North America is expected to maintain its lead, driven by continuous innovations and a strong presence of key industry players.

Recent Developments

- In 2023, Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., broadening its scope in the Asian Pacific automotive and architectural film markets. This strategic move supports Eastman’s growth ambitions in Performance Films, enhancing its specialty materials offerings and improving service quality across China and the broader region.

- In 2024, Tesla expanded its customization services by introducing wrap options for Model 3, Model Y, and Cybertruck at an additional location in Texas, beyond the existing facilities in California. This expansion underscores Tesla’s commitment to enhancing customer personalization and service.

- On February 7, 2023, The Fedrigoni Group announced two significant partnerships in China and France, aimed at enhancing its specialty papers production and R&D capabilities. This development is part of Fedrigoni’s strategy to innovate in high-end paper solutions and advanced materials technologies.

- In 2024, Garware Hi-Tech Films launched innovative Sun-Roof and Moon-Roof film kits, marking a significant step in automotive comfort and protection solutions. These products represent Garware’s focus on quality and innovation in vehicle enhancement technologies.

- On March 25, 2024, Vishay Intertechnology’s Specialty Thin Film division announced its Warwick factory’s certification to the IATF 16949:2016 standard, reflecting its commitment to high-quality manufacturing in electronic components for automotive applications.

- In 2023, PPG formed a joint venture with entrotech, Inc., named PPG Advanced Surface Technologies, to deliver advanced paint and film solutions for automotive and industrial sectors, illustrating PPG’s strategic focus on surface technologies and market expansion.

Conclusion

The automotive film market is poised for substantial growth over the next decade, with projections indicating a rise from a market value of USD 7.5 billion in 2023 to USD 13.3 billion by 2033. This growth, fueled by a compound annual growth rate of 5.90%, is supported by increasing consumer demand for vehicle maintenance and customization, as well as enhancements in film technology that offer better protection and aesthetic options. The market is segmented into various types of films, each catering to specific consumer needs, such as UV protection, heat reduction, and enhanced privacy. With the expansion into emerging markets and ongoing technological advancements, the automotive film industry presents promising opportunities for further expansion and innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)