Table of Contents

Introduction

The Global Automotive ECU market is projected to reach a value of approximately USD 213.4 billion by 2034, up from USD 118.1 billion in 2024, reflecting a compound annual growth rate (CAGR) of 6.1% over the forecast period from 2025 to 2034.

The Automotive Electronic Control Unit (ECU) refers to an embedded system in vehicles that controls various electrical systems and functions, such as engine management, safety features, infotainment, and climate control. These units are critical for the performance, safety, and functionality of modern vehicles. The Automotive ECU Market is a rapidly evolving sector driven by the increasing complexity of vehicles and the integration of advanced technologies like autonomous driving, electric vehicles (EVs), and connected car systems. Growth in this market is primarily propelled by rising consumer demand for advanced vehicle features, such as ADAS (Advanced Driver Assistance Systems), infotainment systems, and electric powertrains, which require more ECUs.

The shift towards electric vehicles (EVs) has further amplified the need for specialized ECUs that can manage battery systems, motor control, and energy recovery systems efficiently. Additionally, the rising emphasis on vehicle safety standards has spurred demand for ECUs that support real-time diagnostics, collision avoidance, and automated driving systems. Opportunities within the Automotive ECU Market are abundant, as the trend towards smart, connected, and autonomous vehicles continues to reshape the automotive landscape. The growing adoption of Industry 4.0 technologies, such as IoT (Internet of Things) and artificial intelligence (AI), is expected to open new avenues for innovation in ECU design and functionality.

Moreover, the market is poised for significant growth in emerging economies, where the adoption of modern vehicles with advanced electronics is steadily increasing. With expanding vehicle production and increasing consumer preference for high-tech automotive features, the Automotive ECU Market is set for sustained expansion.

Key Takeaways

- The global Automotive ECU market is forecasted to reach USD 213.4 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.1%.

- In 2024, the 32-bit ECU segment captured the largest market share of 41.5%, driven by its optimal balance of performance and cost-effectiveness.

- By vehicle type, passenger cars held a dominant share of 64.2% of the market in 2024.

- Powertrain applications led the Automotive ECU market in 2024, commanding a 27.6% share, with a focus on enhancing engine performance and fuel efficiency.

- Internal combustion engine (ICE) vehicles represented 72.2% of the Automotive ECU market in 2024, underscoring the continued prevalence of ICE technology.

Discover Market-Level Disruptions Driven by US Tariff Enforcement , Get sample Copy Of this Report at https://market.us/report/automotive-ecu-market/request-sample/

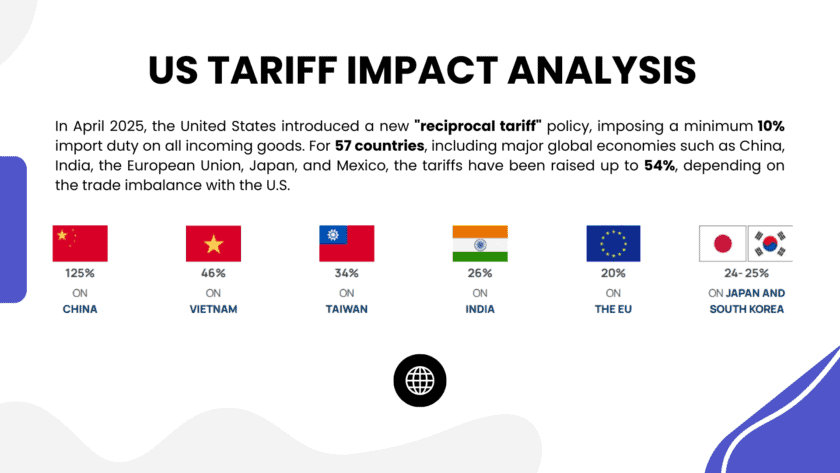

Automotive ECU U.S. Tariff Impact

- Increased Production Costs: The imposition of tariffs on automotive electronic control units (ECUs) imported into the U.S. leads to a rise in production costs for manufacturers. The additional financial burden affects both OEMs and suppliers, often resulting in higher prices for vehicles or components that depend on imported ECUs.

- Supply Chain Disruptions: The automotive supply chain, heavily reliant on global sourcing, is disrupted by tariffs. Manufacturers may experience delays or challenges in procuring ECUs, as alternative suppliers or domestic production options may not meet the volume or cost requirements, resulting in bottlenecks and extended lead times.

- Increased Vehicle Prices: As manufacturers absorb higher costs of importing ECUs, the price of finished vehicles equipped with these components may increase. This price hike can negatively impact consumer demand, especially in segments that rely on cost-sensitive buyers, such as economy cars and mass-market vehicles.

- Shift Toward Domestic Production: In response to tariff pressures, automakers may increase their focus on domestic manufacturing of ECUs. While this can mitigate the impact of tariffs, it may require significant capital investment in local production facilities or new supplier partnerships, potentially shifting supply chain dynamics within the U.S. automotive sector.

- Competitive Pressure on U.S. Manufacturers: Tariffs can lead to competitive disadvantages for U.S.-based automotive manufacturers that depend on international suppliers for ECUs. Imported ECUs could become more expensive, affecting price competitiveness against global counterparts who may have access to more affordable components from tariff-free regions.

- Incentives for Innovation and Automation: The increased costs driven by tariffs could spur innovation in the development of domestic ECU technologies. Manufacturers may focus on automation, improved efficiency, and advanced production techniques to reduce reliance on foreign-sourced ECUs, potentially driving technological advancements in the U.S. automotive industry.

- Impact on Aftermarket Parts: The tariff impact also extends to the aftermarket parts sector. ECUs used in repairs or replacements for vehicles could become more expensive, affecting repair costs and vehicle maintenance. This could further burden vehicle owners, especially in the long-term.

- Trade Relations and Policy Shifts: The imposition of tariffs could shift trade relations between the U.S. and key automotive component-exporting countries. Automakers may engage in lobbying or negotiations for tariff relief, or trade agreements may evolve, influencing long-term trade dynamics in the automotive sector.

- Market Realignment: Some automotive manufacturers may explore relocating ECU production to countries with favorable trade agreements or lower tariff burdens, leading to a realignment of global production networks. This could include shifts to regions like Mexico, Canada, or other countries within free-trade agreements, altering the landscape of the global automotive supply chain.

- Long-Term Economic Effects: In the long run, the sustained tariff on automotive ECUs could lead to broader economic consequences, such as a reduction in U.S. vehicle production or slower adoption of advanced automotive technologies that rely on imported components. This could affect overall industry growth and U.S. competitiveness in the global automotive market.

Emerging Trends

- Electric Vehicle (EV) Integration: The automotive industry is witnessing a significant shift towards electric vehicles, necessitating the development of specialized Electronic Control Units (ECUs) to manage complex systems such as battery management, powertrains, and regenerative braking.

- Advanced Driver Assistance Systems (ADAS): There is a growing incorporation of ADAS features like adaptive cruise control, lane-keeping assist, and automatic emergency braking. These systems require multiple ECUs to process sensor data and execute real-time vehicle responses.

- Connectivity and Over-the-Air (OTA) Updates: The rise of connected vehicles has led to the adoption of OTA software updates, allowing manufacturers to remotely update ECU software, enhancing vehicle performance and security without the need for physical servicing.

- Artificial Intelligence (AI) and Machine Learning (ML) Integration: AI and ML technologies are being integrated into ECUs to enable predictive maintenance, adaptive control systems, and enhanced driver experiences by processing vast amounts of sensor data in real-time.

- Vehicle-to-Everything (V2X) Communication: The development of V2X communication systems allows vehicles to interact with each other and infrastructure, improving traffic flow and safety. ECUs are central to managing these communication systems, facilitating safer and more efficient transportation networks.

Top Use Cases

- Powertrain Control: ECUs are utilized to manage engine functions, including fuel injection, valve timing, and spark timing, optimizing engine performance and fuel efficiency.

- Battery Management Systems (BMS): In EVs, ECUs monitor and control battery parameters such as voltage, temperature, and state of charge, ensuring safe and efficient battery operation.

- Infotainment Systems: ECUs facilitate the integration of multimedia, navigation, and connectivity features, enhancing the in-car user experience.

- Climate Control Systems: ECUs regulate heating, ventilation, and air conditioning (HVAC) systems, maintaining optimal cabin comfort and energy efficiency.

- Lighting Control: ECUs manage exterior and interior lighting systems, including adaptive headlights and ambient lighting, contributing to vehicle safety and aesthetics.

Major Challenges

- Cybersecurity Risks: As vehicles become more connected, the risk of cyberattacks increases. Ensuring the security of ECUs against potential threats is a critical challenge for manufacturers.

- Software Complexity: Modern vehicles may contain numerous ECUs with complex software, leading to integration and compatibility issues that can affect vehicle performance and safety.

- Supply Chain Disruptions: The automotive industry faces challenges related to the global semiconductor shortage, impacting the production and availability of ECUs.

- Regulatory Compliance: Manufacturers must navigate varying global standards and regulations concerning emissions, safety, and cybersecurity, which can complicate ECU development and deployment.

Semiconductorinsight - Cost Constraints: The development of advanced ECUs involves significant investment in research and development, potentially increasing vehicle costs and affecting affordability, especially in emerging markets.

Top Opportunities

- Growth in Emerging Markets: Increasing disposable incomes and urbanization in regions like Asia-Pacific are driving demand for vehicles equipped with advanced ECUs, presenting expansion opportunities for manufacturers.

- Advancements in Autonomous Driving: The development of autonomous vehicles requires sophisticated ECUs to process data from sensors and control vehicle systems, creating significant demand for advanced ECU technologies.

- Government Incentives for EV Adoption: Policies promoting electric vehicle adoption, such as subsidies and tax incentives, are increasing the demand for ECUs tailored for electric drivetrains and battery management systems.

- Integration of AI and ML: The incorporation of AI and ML into ECUs enables predictive maintenance and real-time data analysis, enhancing vehicle performance and reliability, and offering opportunities for innovation.

- Development of V2X Communication Systems: The implementation of V2X communication technologies requires advanced ECUs to manage interactions between vehicles and infrastructure, fostering safer and more efficient transportation networks.

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=138762

Regional Analysis

Asia Pacific Dominating Region with the Largest Market Share in Automotive ECU Market 50.3%

The Asia Pacific region is projected to dominate the global Automotive ECU (Electronic Control Unit) market, accounting for 50.3% of the total market share in 2024, valued at approximately USD 59 billion. This region’s dominance can be attributed to the rapidly expanding automotive manufacturing hubs in countries such as China, Japan, South Korea, and India, where the demand for advanced automotive technologies and components continues to surge. The growing adoption of electric vehicles (EVs) and the increasing focus on autonomous driving technologies are contributing to a higher demand for ECU systems, particularly in automotive sectors that require sophisticated vehicle management.

China, as the largest automotive producer and consumer, plays a pivotal role in driving the region’s market growth. The rapid shift toward electric mobility, along with significant investments in electric vehicle infrastructure, further fuels the demand for ECUs. Additionally, the adoption of smart technologies in vehicles, such as advanced driver assistance systems (ADAS), infotainment systems, and connectivity features, increases the need for multiple ECUs in modern automobiles.

The supportive government policies aimed at promoting eco-friendly vehicles and the rapid urbanization in this region are also facilitating robust market growth. The region’s market dominance is further cemented by the presence of leading automotive manufacturers and semiconductor suppliers, which together drive innovation and production in automotive ECU systems.

Despite the strong growth prospects in Asia Pacific, the imposition of tariffs, particularly from the U.S., on electronic components and parts imported from China, could affect the supply chain dynamics. These tariffs may increase the cost of raw materials and components used in ECU manufacturing, potentially leading to price inflation for end consumers and automotive manufacturers. However, the region’s strong market position and ongoing technological advancements are expected to help mitigate these challenges and maintain steady growth in the long term.

Recent Developments

- In January 7, 2025, NXP Semiconductors N.V. (NASDAQ: NXPI), a global leader in automotive technology, revealed its decision to acquire TTTech Auto in an all-cash deal valued at $625 million. TTTech Auto, headquartered in Vienna, Austria, specializes in developing safety-critical systems and middleware for software-defined vehicles (SDVs). The acquisition is expected to enhance NXP’s capabilities in delivering advanced solutions for vehicle safety, integration, and software updates, in collaboration with leading automotive OEMs.

- In February 6, 2025, Applied Intuition, Inc., a key provider of vehicle software solutions for both commercial and defense sectors, announced its acquisition of EpiSys Science, Inc. (EpiSci), an AI and trusted autonomy software specialist. This strategic acquisition strengthens Applied Intuition’s position as a leader in autonomy software development across diverse defense applications, spanning land, air, sea, and space domains.

- In 2023, Samvardhana Motherson International Ltd (SAMIL) confirmed its agreement to acquire a 100% stake in SAS Autosystemtechnik GmbH, located in Germany, for an enterprise value of 540 million euros. This deal, finalized by SAMIL’s subsidiary, Samvardhana Motherson Automotive Systems Group BV (SMRPBV), expands the company’s footprint in automotive technology, with SAS Autosystemtechnik previously part of Faurecia, under the FORVIA Group.

- In August 1, 2024, Renesas Electronics Corporation, a leading provider of semiconductor solutions, completed its acquisition of Altium Limited, a renowned global leader in electronic design systems. The acquisition, initially announced on February 15, 2024, allows Renesas to expand its portfolio and capabilities in the field of advanced electronics design tools.

Conclusion

The automotive Electronic Control Unit (ECU) market is experiencing significant growth, driven by the increasing complexity of modern vehicles and the integration of advanced technologies. The demand for ECUs is being propelled by factors such as the proliferation of electric vehicles (EVs), the adoption of Advanced Driver Assistance Systems (ADAS), and the implementation of over-the-air (OTA) software updates. Additionally, the rise of artificial intelligence (AI), machine learning (ML), and Vehicle-to-Everything (V2X) communication is enhancing the capabilities of ECUs, enabling real-time data processing and improved vehicle performance. The Asia Pacific region is leading the market, attributed to its robust automotive manufacturing base and growing consumer demand for technologically advanced vehicles. However, challenges such as cybersecurity risks, software complexity, and supply chain disruptions remain. Despite these hurdles, the automotive ECU market presents substantial opportunities for innovation and expansion, particularly in emerging economies where the adoption of advanced automotive technologies is on the rise.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)