Table of Contents

Overview

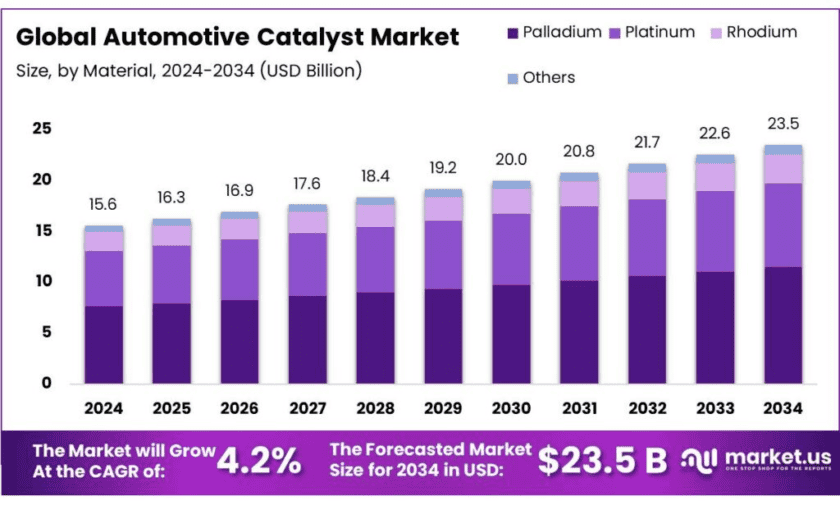

New York, NY – Oct 31, 2025 – The global automotive catalysts market is projected to reach approximately USD 23.5 billion by 2034, growing from USD 15.6 billion in 2024 at a CAGR of 4.2% between 2025 and 2034. In 2024, the Asia Pacific region dominated the global landscape, accounting for nearly 52.6% of total revenue, equivalent to about USD 8.2 billion. Automotive catalysts, commonly referred to as catalytic converters, are essential components in vehicle exhaust systems that transform harmful pollutants into less toxic substances such as water vapor (H₂O), carbon dioxide (CO₂), and nitrogen gas (N₂) through catalytic oxidation and reduction reactions.

These systems rely heavily on platinum group metals (PGMs) — primarily platinum (Pt), palladium (Pd), and rhodium (Rh) — which are coated onto a honeycomb ceramic substrate to enhance reaction efficiency and reduce emissions. However, the high cost of these precious metals continues to drive research into advanced catalyst materials and alternative formulations that maintain performance while reducing dependence on scarce resources. Over the past decade, more than 56% of total PGMs produced globally have been used for automotive catalyst manufacturing, underscoring their crucial role in reducing carbon monoxide (CO), hydrocarbons (HC), and nitrogen oxides (NOₓ) emissions.

The industry’s growth is also shaped by stringent environmental regulations aimed at improving air quality, particularly in emerging economies experiencing rapid vehicle production. This regulatory push, combined with high automobile demand, ensures consistent consumption of catalyst systems. Nevertheless, the wide variation in exhaust temperatures and fuel compositions continues to challenge catalyst durability and performance, making innovation in catalyst technology a key competitive priority across global markets.

Key Takeaways

- The global automotive catalysts market was valued at USD 15.6 billion in 2024.

- The global automotive catalysts market is projected to grow at a CAGR of 4.2% and is estimated to reach USD 23.5 billion by 2034.

- Based on the materials for automotive catalysts, palladium dominated the market in 2024, comprising about 48.9% share of the total global market.

- On the basis of the types of automotive catalysts, three-way catalysts were at the forefront of the market in 2024, accounting for 47.5% share of the total global market.

- Among the types of vehicles, the passenger vehicle dominated the market in 2024, accounting for around 55.1% of the market share.

- In 2024, most automotive catalysts were sold to original equipment manufacturers (OEMS) as they are an essential component of every new vehicle at the point of production.

- Asia Pacific was the largest market for automotive catalysts in 2024, accounting for around 52.6% of the total global consumption.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/automotive-catalysts-market/free-sample/

Report Scope

| Market Value (2024) | USD 15.6 Bn |

| Forecast Revenue (2034) | USD 23.5 Bn |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Material (Palladium, Platinum, Rhodium, Others), By Type (Two-Way Catalysts, Three-Way Catalysts, Diesel Oxidation Catalysts (DOC), Selective Catalytic Reduction (SCR)), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Others), By Sales Channel (OEM, Aftermarket) |

| Competitive Landscape | BASF SE, Johnson Matthey, Umicore, Cataler Corporation, Forvia SE, Cummins, Clariant, DCL International, Ecocat India, Tenneco, Interkat Catalyst GmbH, Heraeus Precious Metals, Klarius Products, N.E. Chemcat, Heesung Catalysts, Other Players. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=160991

Key Market Segments

Material Analysis: Palladium Automotive Catalysts Lead the Market with 48.9% Share in 2024

In 2024, palladium-based automotive catalysts held the dominant position in the global market, capturing a 48.9% share. These catalysts are preferred for gasoline engine applications due to their superior efficiency in oxidizing carbon monoxide (CO) and hydrocarbons (HC) at high temperatures. Palladium provides better thermal durability and enhanced resistance to sulfur poisoning compared to platinum, particularly in lean-burn conditions.

Type Analysis: Three-Way Automotive Catalysts Accounted for 47.5% Market Share in 2024

The three-way catalyst (TWC) segment dominated the market in 2024, with a 47.5% share. TWCs are specifically engineered to simultaneously reduce CO, HC, and NOx emissions, the three main pollutants from gasoline engines. Unlike two-way catalysts, which only address CO and HC, three-way systems include an additional NOx reduction function, enabling vehicles to meet Euro 6 and EPA Tier 3 emission standards efficiently. Diesel-powered vehicles, by contrast, rely on Diesel Oxidation Catalysts (DOC) and Selective Catalytic Reduction (SCR) systems to handle higher NOx emissions.

Vehicle Type Analysis Passenger Cars Dominate with 55.1% Market Share in 2024

In 2024, passenger cars led the automotive catalysts market with a 55.1% share, driven by their significantly larger production volumes compared to commercial vehicles. Approximately 67.7 million passenger cars were produced globally, versus about 10 million commercial vehicles in the same year. Passenger cars contribute most to global vehicular emissions due to higher ownership rates and frequent urban operation, necessitating strict compliance with emission norms.

Sales Channel Analysis OEM Segment Held 84.8% Share in 2024

The Original Equipment Manufacturer (OEM) sales channel dominated the market in 2024, capturing an 84.8% share. Catalysts are a mandatory installation in all new vehicles, as regulatory bodies require certified emission systems at the manufacturing stage. OEMs integrate custom-designed catalyst systems that match engine configurations for maximum efficiency and compliance with EPA, Euro, and Bharat Stage VI standards. The aftermarket segment remains comparatively smaller, as replacements are needed only after long operational cycles or damage.

List of Segments

By Material

- Palladium

- Platinum

- Rhodium

- Others

By Type

- Two-Way Catalysts

- Three-Way Catalysts

- Diesel Oxidation Catalysts (DOC)

- Selective Catalytic Reduction (SCR)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Others

By Sales Channel

- OEM

- Aftermarket

Regional Analysis

Asia Pacific Leads the Global Automotive Catalysts Market

In 2024, the Asia Pacific region dominated the global automotive catalysts market, holding a value of approximately USD 8.2 billion and commanding an estimated 52.6% share of total revenue. This leadership is driven by the region’s massive vehicle production base and increasingly stringent emission control regulations. Key countries such as China, India, Japan, and South Korea are among the world’s top automobile producers. In 2022, China produced over 27 million vehicles, maintaining its position as the world’s largest auto manufacturer, followed by Japan with 7.8 million units and India with nearly 5.5 million units.

This extensive automotive output directly translates to a surging demand for catalytic converters, which are essential for meeting emission standards. The region’s tightening environmental frameworks—such as China 6 and Bharat Stage VI (BS VI) in India—are reinforcing market growth. Notably, the BS VI norms reduced allowable nitrogen oxide (NOₓ) emissions in diesel vehicles by nearly 70% compared to earlier standards, pushing automakers to adopt more advanced catalyst systems.

Top Use Cases

Gasoline passenger cars meeting Tier 3 / Euro 6 limits: Three-way catalysts on gasoline cars cut CO, HC, and NOx to meet today’s tight fleet limits. In the U.S., the Tier 3 program phases to a fleet average of 30 mg/mi NMOG+NOx by 2025, forcing very high conversion efficiency across real-world driving. Europe’s light-duty rules (UNECE/Euro framework) similarly mandate stringent mass-per-km caps verified on certification cycles. These programs make advanced, thermally durable TWC formulations a default fit on nearly every new gasoline car.

Diesel trucks and buses using DOC/DPF/SCR systems: Heavy-duty diesels combine a diesel oxidation catalyst (DOC), a diesel particulate filter (DPF), and selective catalytic reduction (SCR). EPA documents show DPFs cut PM by ~85–90% or more, while SCR typically lowers NOx by ~70–90% when urea/DEF is dosed correctly. These aftertreatment stacks are central to meeting U.S. and EU heavy-duty requirements and to city low-emission zone commitments, with measurable air-quality gains on NOx and soot.

Off-road machines complying with Tier 4 / Stage V: Construction and agricultural engines adopted aftertreatment to meet EPA Tier 4 non-road standards that target ≈90% cuts in NOx and PM vs older tiers. Compliance typically relies on SCR (for NOx) plus DPF (for PM), mirroring highway practice but ruggedized for dust, vibration, and variable loads. Similar stringency under EU Stage V keeps catalyst demand resilient across excavators, tractors, and generators.

Catalyst recycling: recovering platinum-group metals (PGMs): End-of-life catalytic converters are a major secondary source of platinum, palladium, rhodium. The USGS reports that in 2023 about 42,000 kg palladium and 9,000 kg platinum were recovered from U.S. automobile catalytic converters, highlighting catalysts’ role as an “urban mine.” USGS also notes practical substitution between Pt and Pd in converters, giving refiners and automakers flexibility when prices swing.

India BS VI and Asia’s leadership in volume deployment: In India, BS VI slashed light-duty diesel NOx limits by ~68–70% vs BS IV, making DOC+DPF+SCR and robust calibration standard on modern diesels; similar tightening in China (China 6) drives high catalyst penetration across Asia’s massive production base. These policies translate directly into large volumes of catalysts installed on new vehicles each year.

Recent Developments

BASF SE: In 2023 BASF’s Catalysts division—covering mobile-emission catalysts for automotive applications—recorded sales of €11,818 million, down from the prior year, with noted pressure from lower volumes and precious-metal trading. The company also completed the spin-off of its mobile emissions catalysts and precious-metals services business into a standalone entity called “Environmental Catalyst and Metal Solutions (ECMS)” in July 2023.

Johnson Matthey PLC: For the year ended 31 March 2024, Johnson Matthey’s Catalyst Technologies business delivered underlying operating profit growth of 24%, achieving a margin of 13.8% despite weaker global auto markets. Meanwhile, JM announced in 2024 the opening of a new engineering centre in India, supporting its automotive catalyst and clean-air business through local innovation and engineering capacity.

Umicore N.V.: In 2023, Umicore’s Group revenue reached €3.9 billion, down from €4.2 billion in 2022, while the Automotive Catalysts business saw improved volumes despite a challenging metals-price environment. The light-duty vehicle segment made up 83% of its Automotive Catalysts revenues in the first half of 2023.

Cataler Corporation: Cataler focuses on exhaust-gas purification catalysts for gasoline cars, diesel cars and motorcycles, and in its Sustainability Report 2023 notes it aims to remove 650 million tons of CO, HC and NOₓ over 10 years via its installed catalysts. The company has also expanded development into fuel-cell electrode catalysts and carbon materials for next-generation mobility.

Forvia SE: In 2023, Forvia (formerly Faurecia) reported global light vehicle production of 90.3 million units (up 9.7% year on year) and reinforced its “Clean Mobility” unit, which covers emissions control systems including catalysts. While specific catalyst volumes are not broken out, the firm emphasises that its emissions-control business is among its strategic growth areas in the €27 billion-plus revenue mix.

Cummins Inc.: For the full year 2023, Cummins reported revenues of USD 34.1 billion (up 21% versus 2022) and net income of USD 735 million. While Cummins is primarily known for engines and power systems, its after-treatment division supplies catalytic components for diesel and gas engines, making the strong 2023 performance relevant to its catalyst-sector footprint.

DCL International Inc.: DCL provides rugged catalytic converters and SCR systems for off-highway, industrial and stationary engine applications; their MINE-X® and Metalcor® product lines emphasise durability under heavy-duty conditions, including thin-walled metallic catalyst elements rated for >1100 °C service.DCL holds ISO 9001:2015 certification and had over 1,000 SCR systems in operation worldwide by 2023.

Ecocat India Pvt. Ltd.: Ecocat India, part of the Vikas Group, produces exhaust-gas catalysts and after-treatment systems meeting Euro IV–VI norms for two-wheelers, three-wheelers, passenger cars, LCVs and HCVs.With over 30 years of experience and a team of more than 400 employees as of 2024, the firm focuses on diesel DOC, cDPF, SCR and tailored gasoline/CNG catalyst solutions.

Tenneco, Inc.: In 2023, Tenneco’s “Clean Air” or emissions-control business—covering automotive catalysts and full exhaust systems—continued to invest in next-generation technologies. For example, the company’s global operations include synthetic-fuel and advanced after-treatment research such as the NAMOSYN project to explore climate-neutral mobility. While corporate revenue figures for 2023 show ~$18.9 billion overall, the specific catalyst segment is embedded within this total.

Heraeus Precious Metals: In 2023, Heraeus generated approximately €25.6 billion in revenue, with their precious-metals unit delivering advanced catalysts and recycled materials for automotive catalyst systems and hydrogen/green-mobility applications. Their recycling and catalyst-coating technologies support after-treatment systems and precious-metal recovery for the automotive sector, reflecting their strategic role in enabling lower emissions and circular material flows.

Klarius Products Ltd: As of 2024, Klarius is the largest UK manufacturer of aftermarket emission-control components, offering more than 11,000 parts, including catalytic converters (CATs) for passenger and light commercial vehicles. The company focuses on high-volume replacement systems meeting UK/European legislative compliance, catering to the large installed base of petrol and diesel vehicles, thereby supporting continued demand for catalyst systems beyond OEM installations.

Conclusion

In conclusion, the global automotive catalysts sector continues to demonstrate strong resilience and growth prospects, driven by stringent vehicle emission standards and increasing global vehicle production. Even as electric vehicle adoption rises, internal combustion and hybrid drivetrains remain dominant in many regions—ensuring sustained demand for catalyst systems. Moreover, innovations in catalyst materials and recycling of platinum-group metals (PGMs) will be pivotal in reducing costs and aligning with sustainability goals. As a result, companies that combine regulatory compliance, cost-effective PGM use, and advanced catalyst formulations are well positioned for long-term success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)