Table of Contents

Introduction

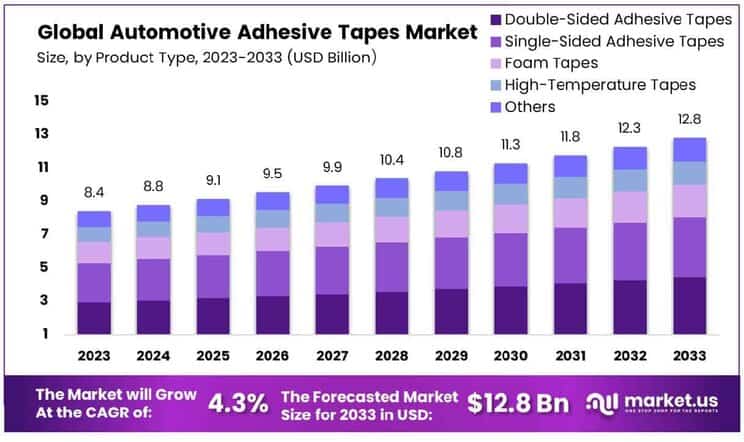

The Global Automotive Adhesive Tapes Market is projected to reach approximately USD 12.8 billion by 2033, up from USD 8.4 billion in 2023, reflecting a compound annual growth rate (CAGR) of 4.3% during the forecast period from 2024 to 2033.

The Automotive Adhesive Tapes market refers to the application of specialized adhesive tapes in the automotive industry, primarily used for bonding, sealing, insulation, and protection of automotive components. These tapes are employed in various automotive applications, including exterior trims, window glazing, wiring, and interior features like dashboard elements. The market for automotive adhesive tapes is experiencing significant growth due to rising automotive production, demand for lightweight and fuel-efficient vehicles, and advancements in adhesive technology.

Key growth factors include the increasing focus on improving vehicle performance, the shift toward electric vehicles (EVs), and the growing trend of automation in manufacturing processes. Additionally, the demand for sustainable and eco-friendly materials is driving the adoption of adhesive tapes as an alternative to traditional mechanical fastening methods. The market presents substantial opportunities for innovation in tape formulations, particularly in terms of heat resistance, strength, and environmental sustainability, which can unlock new applications and customer segments.

Key Takeaways

- The global Automotive Adhesive Tapes Market is expected to grow from USD 8.4 billion in 2023 to USD 12.8 billion by 2033, driven by a CAGR of 4.3% during the forecast period (2024-2033).

- Product Type is the leading segment, holding a 34.6% market share.

- The Applications segment follows closely, accounting for 30.1% of the market share.

- Within material types, the Polyethylene (PE) sub-segment is dominant, representing over 32.6% of the market.

- In terms of formulation, the Solvent-based sub-segment leads, capturing more than 43.4% of the market share.

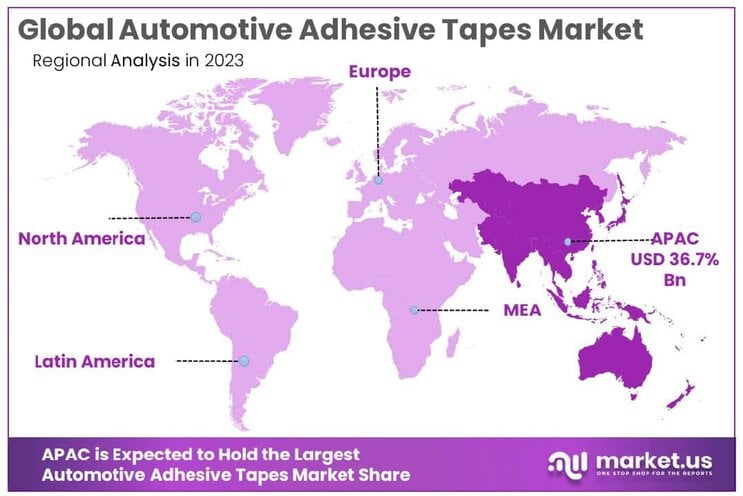

- The Asia-Pacific region holds the largest share of the market, commanding 36.7% of the global demand.

Key Segments Analysis

The Automotive Adhesive Tapes Market is dominated by double-sided adhesive tapes, which hold 34.6% of the market share, offering versatile bonding solutions for diverse materials without visible fasteners. Single-sided tapes are essential for masking, protection, and simple bonding tasks, while foam tapes provide cushioning, sealing, and vibration damping for improved comfort and noise reduction. High-temperature tapes are crucial for withstanding extreme heat in engine compartments and exhaust systems. The “Others” category includes specialized tapes like reinforced, filament, and transfer tapes, each catering to specific needs in vehicle assembly, safety, and performance.

The Automotive Adhesive Tapes Market is dominated by applications, which hold a 30.1% share. Key applications include interior adhesive tapes for upholstery attachment, dashboard assembly, and trim fixation; exterior tapes for bonding and sealing parts, enhancing aerodynamics and durability; electrical system tapes for insulating and securing components; paint masking tapes ensuring precision during painting for high-quality finishes; wire harnessing tapes for organizing and protecting electrical systems; and other specialized tapes for thermal management, noise reduction, and vibration damping, showcasing the versatility of adhesive tapes in addressing diverse automotive challenges.

In 2023, Polyethylene (PE) dominated the market with a 32.6% share, valued for its versatility, durability, and chemical resistance in automotive adhesive tapes. Polypropylene (PP) was favored for its mechanical properties and chemical resistance, widely used in bundling automotive components. Polyvinyl Chloride (PVC) offered excellent electrical insulation and flexibility, crucial for automotive electrical systems. Polyester (PET) tapes, known for high tensile strength and thermal stability, were key in high-temperature applications. Other materials, including foam, fabric, and non-woven substrates, provided specialized solutions for noise reduction, vibration damping, and interior finishing.

In 2023, solvent-based adhesives led the market with over a 43.4% share, prized for their strength and effectiveness despite environmental concerns over VOC emissions. Emulsion adhesives gained popularity as eco-friendly alternatives due to their lower VOC levels, especially in interior automotive applications. Hot melt adhesives, known for their fast bonding and versatility, solidified their position in assembly processes. Meanwhile, radiation-curable adhesives, valued for their quick curing and durable bonds, found a niche in high-speed manufacturing environments.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 8.4 Billion |

| Forecast Revenue (2033) | USD 12.8 Billion |

| CAGR (2024-2033) | 4.3% |

| Segments Covered | By Product Type (Double-Sided Adhesive Tapes, Single-Sided Adhesive Tapes, Foam Tapes, High-Temperature Tapes, Others), By Application(Interior, Exterior, Electrical Systems, Paint Masking, Wire Harnessing, Others), By Material(Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polyester (PET), Others), By Adhesive Chemistry(Solvent, Emulsion, Hot Melt, Radiation) |

| Competitive Landscape | 3M Company, Nitto Denko Corporation, ABI Tape Products, Sika Automotive AG, L&L Products, Inc., Saint-Gobain, PPG Industries, Lida Industry Co, Ltd., tesa SE, ThreeBond Holdings Co., Ltd., Berry Plastics, Adchem Corp., Lintec Corporation |

Emerging Trends

- Increased Demand for Lightweight Materials: Automotive manufacturers are shifting towards lightweight materials to improve fuel efficiency and reduce emissions. As a result, adhesive tapes are replacing mechanical fasteners in various applications. These tapes are lightweight, reduce vehicle weight, and contribute to better overall fuel economy.

- Integration with Electric Vehicles (EVs): With the growing adoption of electric vehicles, adhesive tapes are being used extensively in EV battery systems. Tapes help in securing battery components, enhancing insulation, and reducing vibrations. Additionally, the non-intrusive nature of adhesive tapes supports the integration of delicate electric components without compromising performance.

- Growth in Autonomous Vehicle Development: The rise of autonomous vehicles (AVs) has created a new market for automotive adhesives. Tapes are now being used in the development of advanced driver-assistance systems (ADAS) to secure sensors, cameras, and other electronic components. The growing demand for these technologies boosts the need for strong, reliable bonding solutions in AVs.

- Sustainability and Eco-Friendly Materials: Automotive manufacturers are increasingly focused on sustainability. Adhesive tape solutions that are eco-friendly, recyclable, or biodegradable are gaining traction. Companies are investing in research to develop tapes that can reduce the overall environmental impact of automotive production, such as reducing the need for harmful chemicals in the manufacturing process.

- Customization and Advanced Designs: The demand for customized adhesive solutions is rising in the automotive industry. Manufacturers are seeking highly specialized tapes for specific applications such as sealing, mounting, and noise reduction. Adhesive tapes are now being designed to offer higher durability, resistance to extreme temperatures, and better adhesive properties suited to various automotive materials.

Top Use Cases

- Sealing and Insulation: Automotive adhesive tapes are widely used for sealing gaps in vehicle components to prevent water ingress, improve insulation, and reduce noise. These tapes ensure that vehicles meet industry standards for weather resistance and soundproofing, enhancing comfort for passengers.

- Interior and Exterior Trim: Adhesive tapes are used to securely attach interior and exterior trim components such as dashboards, moldings, and decorative elements. Their strong bonding capabilities help in reducing the reliance on mechanical fasteners, ensuring smooth finishes and reducing assembly time.

- Wire Harnessing and Cable Management: Automotive adhesive tapes play a crucial role in wire harnessing and cable management. They are used to bundle wires together, securing them in place to prevent movement and vibration. This reduces wear and tear on cables, contributing to the overall durability of electrical systems in vehicles.

- Mounting and Bonding Automotive Parts: Tapes are increasingly used for mounting various automotive parts, such as side panels, lights, and mirrors, without the need for screws or bolts. This not only reduces weight but also helps in achieving a clean, seamless look. It also improves assembly efficiency in manufacturing.

- Temperature and Vibration Control: Tapes with heat-resistant properties are used in critical automotive areas such as engine compartments. These adhesive tapes help protect sensitive components from high temperatures while also reducing vibrations, which enhances vehicle performance and longevity.

Major Challenges

- Temperature Sensitivity: Automotive adhesive tapes face challenges in withstanding extreme temperature variations, especially in engine compartments and brake systems. Some tapes may lose their adhesive properties under high heat or cold, which can compromise their effectiveness and longevity.

- Surface Compatibility Issues: Different automotive materials, such as plastics, metals, and composites, often require specific types of adhesive tapes. Variations in surface texture and chemistry can lead to poor bonding performance, making it challenging to find universal solutions that work across various materials.

- Adhesion Durability Over Time: While adhesive tapes offer initial strong bonding, some may lose their adhesive strength over time due to exposure to UV rays, moisture, or chemicals. This degradation could impact the reliability of tape solutions, especially in long-term automotive applications.

- Cost of Advanced Adhesive Technologies: Advanced automotive adhesive tapes, particularly those designed for electric vehicles and high-performance applications, can be expensive. While they offer superior properties like temperature resistance and eco-friendliness, the high cost can limit their widespread adoption, particularly in mass-market vehicles.

- Environmental and Regulatory Concerns: As regulations around the automotive industry tighten, particularly in terms of environmental sustainability, manufacturers face increasing pressure to produce adhesive tapes that are not only effective but also meet stringent environmental standards. The need for recyclable or biodegradable materials has led to challenges in balancing performance with sustainability.

Top Opportunities

- Expansion in Electric and Hybrid Vehicle Markets: The shift toward electric and hybrid vehicles presents a significant growth opportunity for adhesive tapes. With more electric vehicle components requiring secure bonding, including batteries, wiring, and sensors, the demand for high-performance adhesive solutions is expected to rise. Automotive adhesive tapes are well-positioned to support the growth of this market segment.

- Growth in Lightweight Automotive Design: The push for lightweight automotive designs to improve fuel efficiency offers a substantial opportunity for adhesive tapes. As automotive manufacturers continue to replace traditional fasteners with adhesive solutions, there is an increasing need for high-performance bonding tapes that reduce vehicle weight while maintaining strength and durability.

- Customization of Adhesive Tapes for Specific Applications: As the automotive industry continues to focus on innovation and customized solutions, there is a growing opportunity for adhesive tape manufacturers to develop highly specialized products. For example, tapes designed for specific car models or for particular applications, such as insulation, noise reduction, or waterproofing, are becoming more common.

- Automotive Aftermarket Demand: The growing trend of vehicle customization and aftermarket modifications presents a significant opportunity for automotive adhesive tapes. These tapes are ideal for non-invasive installations such as decorative trim, spoilers, and other accessories, providing customers with an easy and cost-effective solution for personalizing their vehicles.

- Focus on Eco-Friendly and Sustainable Products: As consumer demand for environmentally friendly products increases, there is a growing opportunity for adhesive tape manufacturers to develop eco-friendly solutions. Adhesive tapes made from sustainable or biodegradable materials are gaining traction, especially in markets where environmental regulations are becoming stricter.

Key Player Analysis

- 3M Company: 3M is a global leader in adhesive technologies, with a diverse portfolio of products for automotive applications. The company’s adhesive tapes are known for their strong bonding capabilities, durability, and performance in extreme conditions.3M remains a dominant player in the automotive adhesive market. The company continues to innovate in both sustainable and high-performance adhesive solutions.

- Nitto Denko Corporation: Nitto Denko is a key player in the global automotive adhesive tapes market, particularly noted for its strong presence in Asia. The company specializes in high-performance adhesive tapes used for insulation, sealing, and assembly in automotive manufacturing. The company is highly focused on developing eco-friendly adhesive technologies.

- Sika Automotive AG: Sika Automotive is a global leader in automotive bonding, sealing, and adhesive solutions. Their adhesive tapes are designed to meet the stringent requirements of the automotive industry, providing superior adhesion to various materials such as metals, plastics, and composites.

- tesa SE: A subsidiary of Beiersdorf, tesa SE is a major supplier of adhesive tapes for various industrial sectors, including automotive. The company’s products are used in car assembly lines, offering solutions for sealing, masking, and bonding.

- PPG Industries: PPG Industries, primarily known for its coatings and paints, is also a significant player in the automotive adhesive tape market. PPG’s adhesive tapes are used in vehicle assembly for bonding and sealing applications. A strong focus on innovation and sustainable practices within the automotive sector.

Regional Analysis

The Asia-Pacific region dominates the global automotive adhesive tapes market, holding 36.7% of the market share in 2023. This dominance is driven by the rapid growth of the automotive industry in key countries like China, Japan, India, and South Korea. The region’s strong manufacturing base, increasing vehicle production, and demand for lightweight, fuel-efficient, and electric vehicles are key factors propelling the market. In particular, China’s automotive sector is expanding significantly, while Japan and South Korea are incorporating innovative adhesive solutions in advanced vehicle technologies. The growing demand for high-performance adhesive tapes in areas such as interior trim, wiring, and sensor bonding further strengthens Asia-Pacific’s leading position in the market.

Recent Developments

- In 2024, Mactac® Engineered Tapes & Laminates introduced two new product lines: the Macbond® 481 Series and Macbond LS55 Series. These innovative industrial tapes are designed to provide strong adhesive bonds for low, medium, and high surface energy materials, offering versatile solutions to meet diverse customer requirements.

- In January 2025, Avery Dennison Corporation, a leader in materials science and digital identification, announced that it will hold its fourth-quarter and full-year 2024 earnings call on January 30, 2025, at 11:00 a.m. ET. The earnings release will be available earlier that morning at approximately 6:45 a.m. ET.

- In 2023, tesa expanded its Site Sparta facility by adding 40,000 square feet of new space. This expansion includes production, product development, and testing areas, reinforcing tesa’s commitment to sustainability and the U.S. market. The move will also create 25 new local jobs across various departments in Michigan.

- On May 31, 2023, 3M announced a $146 million investment to expand its biopharma filtration capabilities. This initiative will support the rapidly growing biotech sector by enhancing manufacturing facilities and creating 60 new full-time positions in Europe.

Conclusion

The automotive adhesive tapes market is poised for steady growth, driven by increasing automotive production, advancements in adhesive technologies, and the rising demand for lightweight, fuel-efficient vehicles. As the industry shifts towards electric and autonomous vehicles, the need for specialized, high-performance adhesive tapes continues to expand, offering opportunities for innovation in both product design and sustainability. While challenges such as temperature sensitivity and surface compatibility persist, the market is well-positioned to address these issues through ongoing research and development. With the continued focus on eco-friendly materials and customized solutions, automotive adhesive tapes are expected to play a crucial role in shaping the future of vehicle manufacturing and aftermarket applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)