Table of Contents

Overview

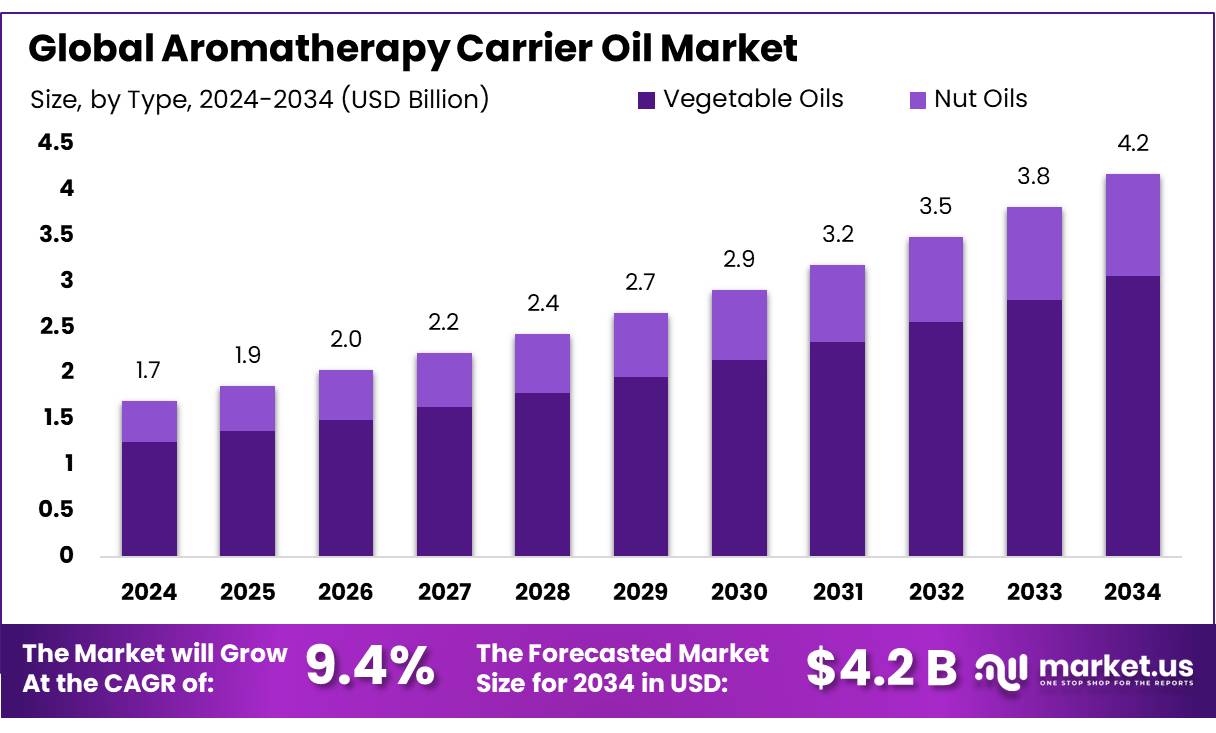

New York, NY – August 11, 2025 – The Global Aromatherapy Carrier Oil Market is projected to reach approximately USD 4.2 billion by 2034, up from USD 1.7 billion in 2024, with a compound annual growth rate (CAGR) of 9.4% during the forecast period from 2025 to 2034. In 2024, North America led the market, holding a 42.8% share and generating USD 0.7 billion in revenue.

The aromatherapy carrier oil sector includes natural, plant-based oils such as jojoba, sweet almond, coconut, and grapeseed. These oils act as inert carriers to dilute potent essential oils for safe use in topical applications, massage, or diffusers within aromatherapy and skincare. The quality and purity of these oils are vital for ensuring consistent performance and consumer safety.

Government initiatives are significantly driving market growth. For example, in April 2023, the U.S. Department of Agriculture (USDA) invested over USD 3.1 billion in agricultural sustainability projects, including organic farming initiatives that support essential oil production, enhancing the supply of raw materials for carrier oils.

In India, government efforts through the Ministry of AYUSH and the National Medicinal Plants Board have promoted the cultivation of medicinal and aromatic plants (MAP) across over 100,000 hectares. These initiatives, backed by funding exceeding INR 500 crore in recent budgets, support the cultivation of key carrier oil sources like almond, sesame, coconut, and jojoba, boosting exports and rural economies.

Key Takeaways

- The Global Aromatherapy Carrier Oil Market is projected to grow from USD 1.7 billion in 2024 to approximately USD 4.2 billion by 2034, registering a CAGR of 9.4% over the forecast period.

- Vegetable Oils held the dominant position, accounting for over 73.5% of the total market share.

- The Cosmetic segment led the market, capturing more than 37.1% of the global share.

- North America secured a strong market position, contributing around 42.8% of global revenue, with total sales estimated at USD 0.7 billion in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/aromatherapy-carrier-oil-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.7 Billion |

| Forecast Revenue (2034) | USD 4.2 Billion |

| CAGR (2025-2034) | 9.4% |

| Segments Covered | By Type (Vegetable Oils, Nut Oils), By Application (Cosmetic, Personal Care, Food and Beverages, Medical, Others) |

| Competitive Landscape | Edens Garden, Rocky Mountain Oils, LLC, Plant Therapy, Falcon, Florihana Distillerie, Moksha Lifestyle Products |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153907

Key Market Segments

By Type Analysis

In 2024, Vegetable Oils commanded a 73.5% share of the aromatherapy carrier oil market by type, fueled by their plant-based nature, easy skin absorption, and nutrient-rich profiles, making them ideal for blending with essential oils. Popular choices like coconut, jojoba, sweet almond, and grapeseed oils are favored for their non-reactive properties and suitability for diverse skin types.

The rising demand for chemical-free, plant-derived products has boosted vegetable oil use in wellness centers, spas, and personal care routines. By 2025, this segment is projected to retain its dominance, supported by increasing consumer awareness and the trend toward organic, clean-label ingredients. Their versatility in topical and diffuser applications further solidifies their significant market presence.

By Application Analysis

In 2024, the Cosmetic segment captured a 37.1% share of the aromatherapy carrier oil market by application, driven by growing consumer preference for plant-based, chemical-free products. Carrier oils like argan, jojoba, and almond are widely incorporated into skincare products such as facial serums, moisturizers, and massage oils due to their nourishing, hydrating, and anti-inflammatory benefits.

The shift toward clean beauty and heightened awareness of synthetic cosmetic side effects has accelerated the adoption of carrier oils in personal care. By 2025, this segment is expected to see steady growth, fueled by expanding wellness markets, product innovation, and the global push for sustainable, eco-friendly beauty solutions.

Regional Analysis

In 2024, North America led the aromatherapy carrier oil market, capturing a 42.8% share of global revenue, equivalent to roughly USD 0.7 billion. This leadership is driven by a strong consumer base for wellness products, well-developed retail channels, and high awareness of plant-based therapeutic oils.

Demand for natural and organic personal care products fuels the popularity of carrier oils like jojoba, almond, coconut, and grapeseed, widely used in massage, aromatherapy, and skincare. The region’s robust spa and wellness infrastructure, combined with extensive retail and e-commerce networks in the U.S. and Canada, supports deep market penetration.

Supportive regulations further strengthen the market. In the U.S., FDA guidelines on botanical ingredients and labeling promote transparency and quality, while Canada’s natural health product regulations ensure rigorous testing and safe formulations. These frameworks enhance consumer confidence, fostering growth in premium carrier oil products.

Top Use Cases

- Skincare Formulations: Carrier oils like jojoba and almond are widely used in facial serums, moisturizers, and lotions. Their nourishing and hydrating properties help improve skin health, reduce dryness, and soothe irritation, making them popular in clean beauty products for daily personal care routines.

- Massage Therapy: Oils such as coconut and grapeseed are staples in massage therapy due to their smooth texture and easy absorption. They dilute essential oils for safe skin application, enhancing relaxation and reducing muscle tension in spa and wellness settings.

- Hair Care Products: Carrier oils like argan and almond are used in shampoos, conditioners, and scalp treatments. They promote hair growth, improve scalp health, and add shine, appealing to consumers seeking natural solutions for hair care and nourishment.

- Aromatherapy Diffusers: Vegetable oils, including sweet almond, are used in diffusers to disperse essential oils safely. Their neutral properties ensure effective delivery of therapeutic aromas, supporting stress relief and mental well-being in homes and wellness centers.

- Pain and Inflammation Relief: Carrier oils like apricot kernel are applied in therapeutic blends to manage pain and inflammation. Their anti-inflammatory properties help soothe joint pain and muscle soreness, offering a natural alternative for wellness-focused consumers.

Recent Developments

1. Edens Garden

Edens Garden has expanded its line of organic carrier oils, introducing a new Cold-Pressed Avocado Oil rich in vitamins A, D, and E. They emphasize sustainable sourcing and rigorous quality testing. The company also launched a Carrier Oil Blends Collection, combining oils like Jojoba and Sweet Almond for enhanced skincare benefits. Their commitment to affordability and purity remains a key focus.

2. Rocky Mountain Oils (RMO)

RMO recently introduced a 100% Pure Squalane Oil, derived from sugarcane, as a lightweight, fast-absorbing carrier oil. They’ve also enhanced their Jojoba Oil with a new cold-pressed extraction method for higher nutrient retention. The company emphasizes transparency with batch-specific GC/MS testing reports available online.

3. Plant Therapy

Plant Therapy launched a KidSafe Carrier Oil Blend, designed for sensitive skin and safe for children. They’ve also introduced Organic Rosehip Seed Oil, sourced from Chile, with increased antioxidant properties. Their new “Carrier Oil of the Month” subscription allows customers to explore different oils monthly.

4. Falcon Essential Oils

Falcon has expanded its Fractionated Coconut Oil line with a new MCT (Medium-Chain Triglyceride) formulation for better absorption. They’ve also introduced a Hemp Seed Carrier Oil, rich in omega fatty acids, catering to the growing demand for CBD-infused aromatherapy products.

5. Florihana Distillerie

Florihana now offers certified organic and wildcrafted Argan Oil, sourced directly from Morocco. They’ve improved their Tamanu Oil extraction process for higher purity. Their “Bio” line ensures all carrier oils meet strict ECOCERT standards, appealing to eco-conscious consumers.

Conclusion

The Aromatherapy Carrier Oil Market is thriving due to rising demand for natural, plant-based solutions in skincare, massage, hair care, and wellness applications. Consumer preference for organic and sustainable products drives innovation and adoption across global markets, particularly in North America and the Asia-Pacific.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)