Table of Contents

Overview

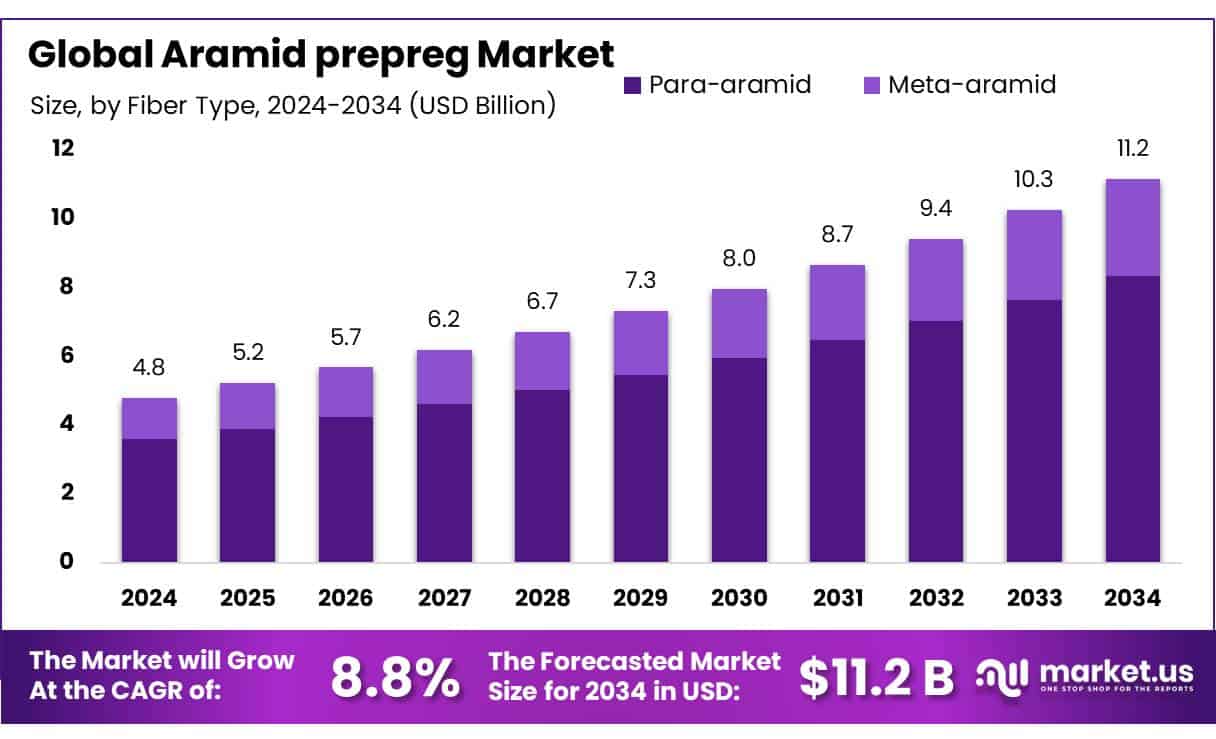

New York, NY – May 08, 2025 – The global Aramid Prepreg Market is set for strong growth, with its size expected to jump from USD 4.8 billion in 2024 to around USD 11.2 billion by 2034, growing at a steady CAGR of 8.8% from 2025 to 2034.

In 2024, Para-Aramid secured a commanding 74.7% of the global aramid prepreg market, driven by its outstanding tensile strength, heat resistance, and lightweight properties. Epoxy Resin captured a 47.3% share of the global aramid prepreg market, owing to its superior mechanical strength, durability, and compatibility with aramid fibers. Prepreg Tapes accounted for 56.4% of the aramid prepreg market, driven by their ease of handling and suitability for automated, high-precision manufacturing. The Aerospace sector led the global aramid prepreg market with a 39.1% share, driven by the demand for lightweight, high-strength materials to enhance fuel efficiency and structural integrity.

US Tariff Impact on Aramid Prepreg Market

The Donald J. Trump administration declared a trade war with the rest of the world, only to declare a 90-day pause on April 9, the day steep new tariffs would have been enforced. Some 75 countries, Trump says, have contacted administration officials to negotiate. But China, which has shown no signs of conciliation, will see a 145% tariff, Trump said in a Truth Social post that day. Trump is also instituting a broad 10% tariff on all countries during the moratorium.

➤ Get More Detailed Insights about US Tariff Impact @ – https://market.us/report/global-aramid-prepreg-market/request-sample/

Trump launched the war on April 2 by instituting the toughest trade barriers in generations. His administration levied new duties of 10% or more on most countries, though they exempt many chemicals and most pharmaceuticals, semiconductors, and energy products. An important impact of the proposed tariffs would be their effect on chemical demand. The global chemical industry overall will face a roughly 0.8% headwind, he says, while demand for chemicals serving durable goods and clothing markets could see as much as a 6% impact.

Key Takeaways

- Aramid Prepreg Market size is expected to be worth around USD 11.2 billion by 2034, from USD 4.8 billion in 2024, growing at a CAGR of 8.8%.

- Para-aramid held a dominant market position, capturing more than a 74.7% share in the global aramid prepreg market.

- Epoxy held a dominant market position, capturing more than a 47.3% share in the global aramid prepreg market.

- Prepreg Tapes held a dominant market position, capturing more than a 56.4% share in the aramid prepreg market.

- Aerospace held a dominant market position, capturing more than a 39.1% share in the global aramid prepreg market.

- North America held a dominant position in the global aramid prepreg market, accounting for 43.10% share and generating a market value of approximately USD 2 billion.

Report Scope

| Market Value (2024) | USD 4.8 Billion |

| Forecast Revenue (2034) | USD 11.2 Billion |

| CAGR (2025-2034) | 8.8% |

| Segments Covered | By Fiber Type (Para-aramid, Meta-aramid), By Resin Type (Ероху, Phenolic, Polyimide, Bismaleimide), By Form (Prepreg Tapes, Prepreg Sheets, Prepreg Fabrics), By End-Use (Aerospace, Defense, Automotive, Wind Energy, Electronics, Others) |

| Competitive Landscape | Axiom Materials, Inc., Sumitomo Chemical Co. Ltd., Hexcel Corporation, DowDuPont Inc., Gurit Holdings AG, SGL Carbon SE, Solvay Specialty Polymers, Mitsubishi Chemical Corporation, Evonik Industries AG, Cytec Solvay Group, Toray Advanced Materials Co. Ltd., Teijin Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=147744

Key Market Segments

By Fiber Type

- In 2024, para-aramid secured a commanding 74.7% of the global aramid prepreg market, driven by its outstanding tensile strength, heat resistance, and lightweight properties. Widely utilized in aerospace, defense, automotive, and protective apparel, para-aramid prepregs excel in extreme conditions while reducing component weight. With rising demand for advanced materials in the military and aviation sectors, manufacturers increasingly incorporate para-aramid into structural designs. Its recyclability and compliance with stringent environmental regulations further solidify its preference.

By Resin Type

- In 2024, epoxy resin captured a 47.3% share of the global aramid prepreg market, owing to its superior mechanical strength, durability, and compatibility with aramid fibers. Ideal for high-performance applications, epoxy-based prepregs are extensively used in aerospace, automotive, and industrial components, offering resistance to fatigue, moisture, and heat. The resin’s strong adhesion and suitability for automated manufacturing processes enhance its adoption in composite production. As industries prioritize lightweight, high-strength materials in 2024, epoxy remains the preferred resin for meeting rigorous structural and safety standards.

By Form

- In 2024, Prepreg Tapes accounted for 56.4% of the aramid prepreg market, driven by their ease of handling and suitability for automated, high-precision manufacturing. Aerospace, defense, and automotive industries favor prepreg tapes for their uniform resin distribution, consistent thickness, and ability to create lightweight, durable structures. These tapes ensure excellent fiber alignment, enhancing the mechanical performance of finished products. As demand for high-strength, lightweight composites grows in 2024, prepreg tapes remain a versatile and efficient solution for advanced engineering applications.

By End-Use

- In 2024, The Aerospace sector led the global aramid prepreg market with a 39.1% share, driven by the demand for lightweight, high-strength materials to enhance fuel efficiency and structural integrity. Aramid prepregs are critical in aircraft fuselages, interiors, and engine components due to their heat resistance and impact strength. With global air travel recovering and aircraft production accelerating, the adoption of aramid prepregs continues to rise. In 2024, stringent safety regulations and carbon emission reduction goals further cement their role in commercial and defense aviation.

Regional Analysis

- North America led the global aramid prepreg market in 2024, capturing a 43.1% share with a market value of around USD 2 billion. This dominance is driven by the region’s strong aerospace and defense sectors, major users of aramid-based composites. Leading aerospace firms utilize aramid prepregs in aircraft structures to reduce weight and improve safety. Support from the FAA and NASA, promoting advanced composites for fuel efficiency and stringent safety standards, further reinforces North America’s market leadership.

Top Use Cases

- Aerospace Components: Aramid prepreg is used in aircraft parts like fuselages, wings, and interiors. Its lightweight and high-strength properties improve fuel efficiency and safety. It resists heat and impact, making it ideal for engine components and structural panels, meeting strict aviation standards while reducing aircraft weight for better performance.

- Defense and Ballistic Protection: Aramid prepreg is critical for body armor, helmets, and vehicle armor. Its high tensile strength and impact resistance protect against bullets and shrapnel. Military and law enforcement rely on it for lightweight, durable gear, ensuring safety in hostile environments while maintaining mobility and comfort.

- Automotive Parts: In cars, aramid prepreg is used for brake pads, tires, and body panels. Its lightweight nature boosts fuel efficiency, especially in electric vehicles, while its strength enhances safety in crash-resistant structures. It’s also used in airbags and seat belts, improving durability and performance in high-stress conditions.

- Protective Clothing: Aramid prepreg is key in making fire-resistant and cut-proof clothing for firefighters, industrial workers, and military personnel. Its heat resistance and durability protect against extreme temperatures and hazards. The material’s flexibility ensures comfort, making it ideal for long-wear protective gear in dangerous work environments.

- Industrial Applications: Aramid prepreg reinforces conveyor belts, cables, and insulation materials in industries. Its strength and resistance to heat and chemicals ensure long-lasting performance in harsh conditions. It’s also used in electrical insulation and battery separators, enhancing safety and efficiency in industrial equipment and energy storage systems.

Recent Developments

1. Axiom Materials, Inc.

- Axiom Materials continues to innovate in high-performance aramid prepregs, focusing on aerospace and defense applications. The company recently expanded its product line to include ultra-lightweight, fire-resistant prepregs for next-gen aircraft interiors. Their advanced materials comply with stringent FAA and EASA regulations. Axiom also partnered with major OEMs to enhance supply chain efficiency.

2. Sumitomo Chemical Co. Ltd.

- Sumitomo Chemical has been advancing its aramid prepreg technology, particularly for automotive and electronics. The company introduced a new heat-resistant prepreg variant for electric vehicle (EV) battery components, improving thermal stability. Sumitomo is also investing in sustainable production methods to reduce environmental impact.

3. Hexcel Corporation

- Hexcel launched a next-generation aramid prepreg with enhanced impact resistance, targeting military armor and aerospace applications. The company expanded its manufacturing capacity in Europe to meet rising demand. Hexcel’s new prepregs offer better weight-to-strength ratios, making them ideal for UAVs and rotorcraft.

4. DowDuPont Inc. (Now DuPont de Nemours, Inc.)

- DuPont has been focusing on high-performance aramid prepregs for industrial and ballistic protection. Their latest Kevlar-based prepregs provide superior durability for helmets and vehicle armor. DuPont is also collaborating with defense agencies to develop next-gen protective solutions.

5. Gurit Holdings AG

- Gurit introduced a new range of eco-friendly aramid prepregs with reduced VOC emissions, catering to the marine and wind energy sectors. The company is also expanding in Asia to support the growing demand for lightweight composites in automotive and renewable energy applications.

Conclusion

The Aramid Prepreg Market is on a strong growth path. This surge is driven by rising demand in aerospace, automotive, defense, and renewable energy, where lightweight, high-strength materials are essential. Key factors like strict safety regulations, fuel efficiency needs, and advancements in composite technology are boosting adoption. Companies are innovating with heat-resistant, impact-proof, and eco-friendly prepregs to meet industry demands. Emerging markets and new applications in EV batteries, wind turbines, and sports gear offer exciting opportunities. With continuous R&D and expanding production, the aramid prepreg market is set for a dynamic future.