Table of Contents

Overview

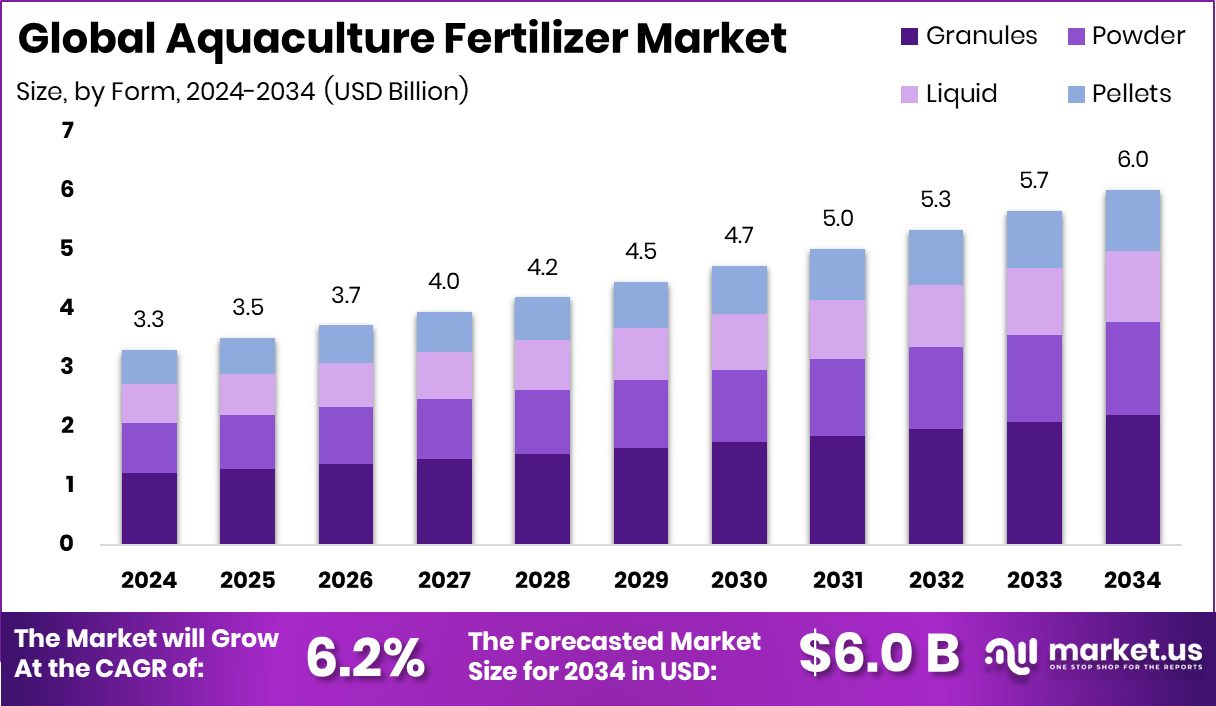

New York, NY – September 23, 2025 – The Global Aquaculture Fertilizer Market is projected to reach approximately USD 6.0 billion by 2034, up from USD 3.3 billion in 2024, representing a CAGR of 6.2% between 2025 and 2034. The Asia Pacific region dominates the market with a 43.7% share, driven by strong seafood demand and supportive government initiatives.

Aquaculture fertilizers are nutrient-based inputs designed to enhance the productivity of fish and aquatic farming systems. They supply essential nutrients such as nitrogen, phosphorus, and potassium, promoting the growth of natural feed organisms like plankton and algae. These organisms serve as a crucial food source for farmed fish, shrimp, and other aquatic species, reducing dependence on artificial feeds and supporting more sustainable aquaculture practices.

The market serves a diverse range of users, from small-scale farmers to large commercial aquaculture operations, underscoring its significance in global food security. Government programs and funding initiatives are further propelling growth. For instance, the European Union has allocated €5.7 million under its Blue Economy Initiative to support regenerative ocean farming and seaweed-focused projects, while an additional €9 million has been committed to large-scale sustainable seaweed initiatives.

In the U.S., the Department of Energy has invested USD 20 million across 10 algae-based biofuel projects, highlighting innovation in marine resource utilization. Key growth drivers include rising global seafood consumption and the need for sustainable farming practices. Fertilizers that enhance natural feed availability allow farmers to improve pond productivity efficiently while managing costs.

Innovations in converting seaweed waste into sustainable bioplastics, supported by a USD 1.5 million DOE grant to Umaro and Sway, further emphasize the market’s alignment with eco-friendly and resource-efficient practices. Overall, the aquaculture fertilizer market is poised for steady growth as the industry seeks to balance productivity, sustainability, and environmental stewardship.

Key Takeaways

- The Global Aquaculture Fertilizer Market is expected to be worth around USD 6.0 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- Granular form leads the aquaculture fertilizer market, holding a 36.7% share due to easy application methods.

- Nitrogenous fertilizers account for 26.3%, driving strong growth with their essential role in pond productivity improvement.

- Finfish cultivation dominates usage at 49.1%, highlighting fertilizers’ importance in supporting high-yield aquaculture systems globally.

- Pond soil conditioning captures a 39.4% share, proving critical for maintaining balanced ecosystems and sustaining aquatic health.

- The Asia Pacific market value reached USD 1.4 billion, driven by extensive aquaculture practices.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/aquaculture-fertilizer-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.3 Billion |

| Forecast Revenue (2034) | USD 6.0 Billion |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Form (Granules, Powder, Liquid, Pellets), By Fertilizer Type (Nitrogenous Fertilizers, Phosphatic Fertilizers, Potassic Fertilizers, Compound, Organic, Chelated Micronutrient Fertilizers, Others), By Cultured Species (Finfish, Crustaceans, Mollusks, Seaweed and Algae, Others), By Application Method (Pond Soil Conditioning, Water Column Fertilization, Foliar/Direct Plant Fertilization in Integrated Systems, Others) |

| Competitive Landscape | URALCHEM JSC, Sinofert Holdings Limited, Yara International ASA, Nutrien Limited, The Mosaic Company, OCP SA, ICL Group Ltd, Sinochem Group Co., Ltd., Ostara Nutrient Recovery Technologies Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156984

Key Market Segments

By Form Analysis

Granular fertilizers led the aquaculture fertilizer market in 2024, capturing a 36.7% share. Their dominance stems from ease of handling, stable storage, and slow-release nutrient delivery, ideal for sustaining plankton growth in aquaculture ponds. Granules ensure a consistent nutrient supply (nitrogen, phosphorus, potassium), enhancing water productivity in intensive and semi-intensive systems. Compared to liquids, granules minimize nutrient loss, offering cost-effective application and versatility across species like fish and shrimp.

By Fertilizer Type Analysis

Nitrogenous fertilizers held a 26.3% market share in 2024, driven by their role in boosting phytoplankton growth, a key food source for aquaculture. Their rapid solubility enhances pond fertility, supporting fish and shrimp growth in both small-scale and commercial operations. Cost-effective and widely adopted, nitrogenous fertilizers reduce reliance on external feeds, improving sustainability. Their strong market position reflects their ability to optimize yields amid growing global seafood demand.

By Cultured Species Analysis

Finfish farming dominated with a 49.1% share in 2024, fueled by high demand for species like tilapia, carp, and catfish. Fertilizers enhance pond ecosystems by promoting phytoplankton and zooplankton, essential for finfish diets. Widely used in Asia-Pacific, Africa, and Latin America, fertilizers maintain pond fertility, reduce feed costs, and support sustainable production. The finfish segment’s lead underscores its role in meeting global protein needs.

By Application Method Analysis

Pond soil conditioning accounted for 39.4% of the market in 2024, driven by its impact on pond bottom quality and nutrient availability. By enriching soil organic matter, this method fosters plankton growth, stabilizes water chemistry, and counters nutrient depletion from repeated farming. Its sustained nutrient release supports long-term productivity and reduces feed dependency. Soil conditioning’s prominence reflects its effectiveness in enhancing pond health and sustainability.

Regional Analysis

Asia-Pacific led the market with a 43.7% share (USD 1.4 billion) in 2024, driven by extensive aquaculture in China, India, Vietnam, and Indonesia. Fertilizers are critical for pond productivity and food security in these regions. North America and Europe focus on sustainable fertilizer use under strict regulations, while the Middle East & Africa see rising demand as aquaculture diversifies food sources. Latin America’s shrimp and tilapia farming boosts fertilizer use for export-driven growth. Asia-Pacific’s scale and demand solidify its market dominance.

Top Use Cases

- Stimulating Plankton Growth in Fish Ponds: Farmers add fertilizers to ponds to boost tiny plants and animals that fish eat naturally. This helps young fish grow faster without needing extra feed, keeping costs low and water healthy for better harvests.

- Enhancing Shrimp Farm Productivity: In shrimp ponds, fertilizers balance nutrients to grow more plankton, the main food for larvae. This simple step improves survival rates and speeds up growth, making farms more efficient and profitable for coastal communities.

- Conditioning Pond Bottom Soils: Before stocking fish, fertilizers enrich pond soils to fix acidity and add organic matter. This creates a strong base for water quality, supporting long-term health and steady yields without frequent re-treatments.

- Supporting Algae Production for Feed: Fertilizers help grow algae in tanks as a fresh food source for fish and shellfish. This natural method cuts down on processed feeds, promoting healthier animals and sustainable practices in controlled farm setups.

- Recycling Waste into Pond Nutrients: Farm waste like fish sludge is turned into bio-fertilizers for pond use. This closes the loop by reusing nutrients to feed plankton, reducing external inputs, and helping farms stay eco-friendly while boosting output.

Recent Developments

1. URALCHEM JSC

URALCHEM, a major Russian producer of nitrogen fertilizers, has been focusing on navigating the geopolitical landscape and supply chain disruptions. While not exclusively for aquaculture, their ammonium nitrate and UAN products are fundamental for pond productivity. Recent developments involve securing alternative export routes and markets for their products, which remain a key input for agricultural and aquaculture sectors in various regions.

2. Sinofert Holdings Limited

As a leading fertilizer subsidiary of Sinochem Group, Sinofert is deeply integrated into China’s vast aquaculture industry. Their recent focus is on developing and distributing specialized compound fertilizers tailored for different pond environments and species. They emphasize products that promote beneficial phytoplankton blooms, improve water quality, and enhance the natural food web, supporting sustainable intensive aquaculture practices throughout Asia.

3. Yara International ASA

Yara is leveraging its expertise in mineral fertilizers to advance sustainable aquaculture. Their recent development is the focused promotion of tailored fertilization programs. By providing precise nutrient solutions, they help farmers stimulate the growth of natural feed (zooplankton), reducing reliance on external feed inputs and improving the environmental footprint of pond-based aquaculture, particularly for species like shrimp and tilapia.

4. Nutrien Limited

Nutrien’s recent developments in aquaculture are linked to their broader commitment to sustainable agriculture. They provide essential potash and phosphate products crucial for pond fertilization. Their strategy involves educating farmers on optimal nutrient management to promote a healthy aquatic ecosystem. This enhances natural productivity and supports the base of the food chain, contributing to more efficient and resilient aquaculture operations.

5. The Mosaic Company

The Mosaic Company focuses on providing phosphate and potash-based solutions for pond fertilization. Their recent developments emphasize best management practices for using their products, like MicroEssentials, to establish robust phytoplankton blooms. This improves water quality by reducing ammonia and nitrite, provides natural food, and shades out problematic weeds, supporting healthier and more productive pond environments for fish farming.

Conclusion

Aquaculture Fertilizers as a key player in feeding the world’s growing appetite for seafood. They make farms smarter by naturally boosting food chains in water, cutting waste, and easing pressure on wild oceans. With smarter tech and green options on the rise, these tools promise healthier ponds, stronger yields, and a balanced planet, paving the way for farming that nourishes both people and nature without strain.