Table of Contents

Overview

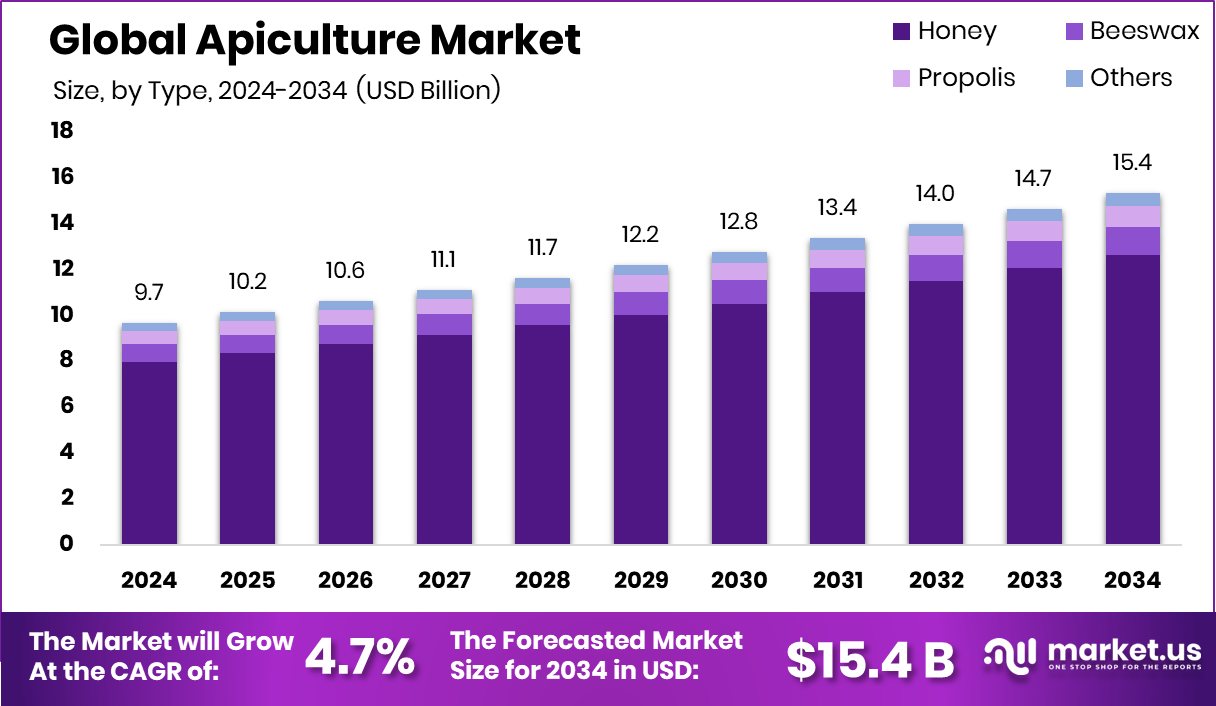

New York, NY – August 22, 2025 – The Global Apiculture Market is projected to grow from USD 9.7 billion in 2024 to USD 15.4 billion by 2034, achieving a CAGR of 4.7% from 2025 to 2034. The Asia-Pacific region, with a market size of USD 3.7 billion, is experiencing significant growth due to the increasing adoption of beekeeping practices.

Apiculture, commonly known as beekeeping, involves the maintenance of bee colonies for the production of honey, beeswax, royal jelly, and other bee-derived products. Beyond product generation, apiculture supports pollination, which is critical for agricultural productivity and biodiversity. Beekeeping can be practiced on both small and large scales, contributing to healthy ecosystems and enhanced crop yields.

The apiculture market encompasses the production, processing, and distribution of honey, bee-derived products, and pollination services. It includes a range of operations, from small-scale local beekeepers to large commercial enterprises serving global markets. The market is influenced by environmental factors, consumer preferences for natural products, and the growing role of pollination in sustainable agriculture.

The apiculture market is driven by increasing consumer awareness of the health benefits of honey and other natural bee products. The demand for organic, chemical-free food items has fueled the popularity of high-quality, raw honey. Additionally, the critical role of bees in pollinating crops is enhancing agricultural output, further boosting the market’s growth.

Government initiatives, such as India’s allocation of ₹500 crore for apiculture and a $5 million fund to support beekeepers, are also fostering industry development. Rising interest in wellness and herbal remedies has expanded the use of honey, propolis, and royal jelly in food, skincare, and medicinal products. The shift toward sustainable and eco-friendly products further supports the growing demand for apiculture products, broadening their market appeal.

Key Takeaways

- The Global Apiculture Market is expected to be worth around USD 15.4 billion by 2034, up from USD 9.7 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- Honey dominates the apiculture market with an 82.3% share, driven by rising demand for natural sweeteners.

- Traditional beekeeping holds 67.7% of the market share, reflecting its widespread adoption among small- and medium-scale beekeepers.

- The Food and Beverages sector accounts for a 67.9% share of the apiculture market demand.

- Strong honey consumption drives the Asia-Pacific’s 38.2% market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/apiculture-market/request-sample/

Report Scope

| Market Value (2024) | USD 9.7 Billion |

| Forecast Revenue (2034) | USD 15.4 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Type (Honey, Beeswax, Propolis, Others), By Methods (Traditional Beekeeping, Modern Beekeeping), By End Use (Food and Beverages, Medical, Cosmetics, Others) |

| Competitive Landscape | Capilano Honey Ltd., Organic Bee Farms, Dabur Ltd., NOW Foods, Koster Keunen LLC, Barkman Honey, Heavenly Organics, Strahl & Pitsch Inc., Miller’s Honey, Durham’s Bee Farm |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155121

Key Market Segments

By Type: Honey

In 2024, honey commanded an 82.3% share of the global apiculture market, reinforcing its position as the leading product type. Its dominance stems from widespread use as a natural sweetener across food, beverage, pharmaceutical, and personal care industries, driven by its nutritional benefits, antioxidants, and medicinal properties.

The rising popularity of functional foods and traditional remedies further fuels demand, with premium monofloral and specialty honeys gaining traction among high-end consumers. Strong export markets and growing domestic consumption solidify honey’s pivotal role, supported by its cultural significance and alignment with health and nutrition trends.

By Methods: Traditional Beekeeping

Traditional beekeeping held a 67.7% share of the apiculture market in 2024, leading the methods segment. Its prominence is due to its simplicity, low cost, and accessibility, particularly for small-scale and rural beekeepers.

This method aligns with sustainable, natural farming practices, producing honey and bee products perceived as authentic and eco-friendly. Traditional beekeeping also supports biodiversity by fostering natural bee habitats and holds cultural value in many regions, enhancing its appeal in artisanal and niche markets. Its economic and environmental benefits ensure its continued dominance.

By End Use: Food and Beverages

The food and beverage sector accounted for 67.9% of apiculture product usage in 2024, dominating the end-use segment. Honey’s role as a natural sweetener, flavor enhancer, and nutritional additive drives its widespread use in bakery goods, confectionery, dairy, beverages, and functional foods.

The global shift toward clean-label, natural ingredients bolsters demand, as honey’s antioxidant, antimicrobial, and preservative properties add health and shelf-life benefits. The growing market for artisanal and organic honey varieties further strengthens this sector’s lead, aligning with consumer demand for healthier, premium products.

Regional Analysis

In 2024, the Asia-Pacific led the global apiculture market with a 38.2% share, valued at USD 3.7 billion. High honey consumption, extensive beekeeping, and favorable climates drive the region’s dominance, with major contributions from China, India, and New Zealand. China stands out as a top honey exporter.

Rising demand for natural sweeteners, organic products, and traditional remedies fuels growth, while North America and Europe follow, driven by consumer awareness and functional food trends. The Middle East & Africa and Latin America show steady growth, supported by pollination services and sustainable farming. Asia-Pacific’s robust production and export capabilities, combined with government support, ensure its continued leadership in the global apiculture market.

Top Use Cases

- Honey Production: Beekeepers raise honey bees to produce high-quality honey for food, cosmetics, and health products. Modern hives and sensors help monitor bee health and optimize honey yield. This meets growing consumer demand for natural sweeteners, driving revenue for small and large-scale beekeepers in local and global markets.

- Crop Pollination: Bees are vital for pollinating fruits, vegetables, and oilseed crops. Farmers hire beekeepers to place hives in fields, boosting crop yields. This service supports agriculture, ensures food security, and provides beekeepers with additional income through pollination contracts with farmers.

- Beeswax and By-Products: Apiculture produces beeswax, propolis, and royal jelly used in candles, skincare, and supplements. These products are popular in eco-friendly and wellness markets. Beekeepers use modern extraction methods to ensure purity, tapping into growing demand for sustainable, natural goods and creating diverse revenue streams.

- Urban Beekeeping: Cities are adopting apiculture to promote biodiversity and local honey production. Rooftop hives in urban areas support healthier bees due to fewer pesticides and diverse plants. This trend appeals to eco-conscious consumers and creates opportunities for small-scale beekeepers to sell unique, city-sourced honey products.

- Data-Driven Beekeeping: Technology like hive sensors and APIs tracks temperature, humidity, and bee activity. This data helps beekeepers optimize hive placement, detect diseases early, and improve yields. By integrating weather and market data, beekeepers make smarter decisions, enhancing efficiency and profitability in competitive markets.

Recent Developments

1. Capilano Honey Ltd.

Capilano has focused on brand evolution and market trust, officially rebranding to “Capilano Honey” in 2023, retiring the “Allowrie” brand to unify under its flagship name. This move consolidates its product lines, emphasizing authenticity and strengthening consumer confidence in Australian honey. They continue to invest in supply chain transparency and traceability initiatives in response to market demands.

2. Organic Bee Farms

Organic Bee Farms has expanded its product line beyond raw honey into the wellness sector with new organic propolis and bee pollen supplements. They emphasize sustainable, chemical-free beekeeping practices and have strengthened their educational outreach about the role of bees in the ecosystem. Their focus remains on providing pure, single-origin organic honey directly to consumers and retailers.

3. Dabur Ltd.

Dabur is leveraging technology to enhance its supply chain with its TrustBee initiative. This traceability program uses QR codes on honey jars, allowing consumers to track the product’s journey from the hive to the shelf. This effort aims to combat adulteration and assure purity, a critical development in the Indian market. They continue to be a dominant volume leader in branded honey.

4. NOW Foods

NOW Foods has significantly expanded its bee-derived wellness offerings. Recent developments include new formulations featuring Bee Propolis, Royal Jelly, and Bee Pollen in various delivery formats like sprays and softgels. They emphasize rigorous quality testing for purity and potency, catering to the growing consumer demand for natural supplements and supporting sustainable sourcing practices for their entire range of products.

5. Koster Keunen LLC

Koster Keunen, a leading beeswax refiner, is innovating in sustainability by developing honey-and beeswax-based alternatives for cosmetic and personal care formulations. Their recent developments include new emulsifying waxes and sustainable, upcycled wax blends that help brands replace synthetic and petroleum-derived ingredients. This focuses on the circular economy and meeting the clean beauty market’s demand for natural, biodegradable components.

Conclusion

Apiculture is a growing industry with diverse opportunities in honey production, pollination services, and by-products like beeswax. Urban beekeeping and data-driven technologies are expanding their reach and efficiency. As consumer demand for natural, sustainable products rises, apiculture offers strong economic potential for farmers and businesses, supporting both local economies and global food systems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)