Table of Contents

Overview

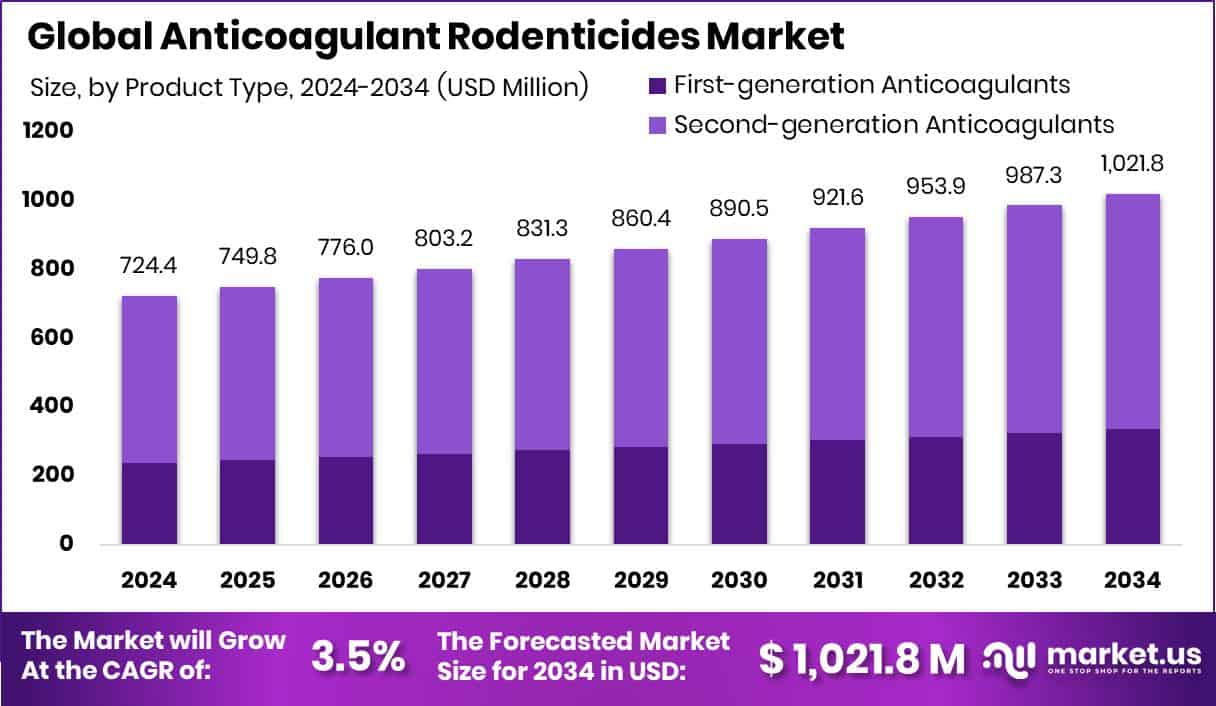

New York, NY – August 18, 2025 – The global anticoagulant rodenticides market is set to reach USD 1,021.8 million by 2034, rising from USD 724.4 million in 2024, with a projected CAGR of 3.5% from 2025 to 2034. North America remains the leading region, holding a 42.80% share worth USD 310.0 million. Anticoagulant rodenticides work by blocking the vitamin K cycle, which prevents blood clotting and causes internal bleeding in rodents. Their effectiveness against both rats and mice makes them widely used in agriculture, food storage, and urban pest control.

Market growth is supported by rising urbanization, stricter hygiene standards in food facilities, and growing awareness of food contamination risks. Climate change, which is altering rodent breeding cycles, is further pushing the demand for year-round control solutions. Public health bodies continue to drive usage through large-scale rodent management campaigns, while farmers and households increasingly recognize rodent damage to crops, grains, and infrastructure.

In addition, funding and innovations in related fields indirectly support market expansion. For example, the Maine Pellet Fuels Association received USD 100,000, Sway raised USD 5 million to launch seaweed pellets, a cardboard-to-pellet project secured USD 95,000, and a planned wood pellet plant in Australia obtained USD 5.5 million. These investments highlight sustainability trends that also encourage stronger pest control measures.

Key Takeaways

- The Global Anticoagulant Rodenticides Market is expected to be worth around USD 1,021.8 million by 2034, up from USD 724.4 million in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- In the Anticoagulant Rodenticides Market, second-generation anticoagulants hold a 67.9% share, showing strong dominance.

- Pellets account for a 44.6% share in the Anticoagulant Rodenticides Market, favored for ease of application.

- Agriculture leads the Anticoagulant Rodenticides Market with 36.8% share, driven by crop protection and storage safety.

- Strong demand in North America drove 42.80%, USD 310.0 Mn.

➤ Curious about the content? Explore a sample copy of this report—

https://market.us/report/anticoagulant-rodenticides-market/request-sample

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 724.4 Million |

| Forecast Revenue (2034) | USD 1,021.8 Million |

| CAGR (2025-2034) | 3.5% |

| Segments Covered | By Product Type (First-generation Anticoagulants (Warfarin, Chlorophacinone), Second-generation Anticoagulants (Bromadiolone, Difenacoum)), By Form (Pellets, Blocks, Powder/Spray, Others), By Application (Agriculture, Pest Control Companies, Warehouses, Urban Centers, Households, Others) |

| Competitive Landscape | BASF, Syngenta, PelGar International, Rentokil Initial plc, UPL, Bell Labs, Kalyani Industries Limited, Heranba Industries Ltd., NEOGEN Corporation, Liphatech, Inc. |

➤ Directly purchase a copy of the report— https://market.us/purchase-report/?report_id=155445

Segments Analysis

By Product Type Analysis

In 2024, second-generation anticoagulants dominated the anticoagulant rodenticides market by by-product type with a 67.9% share. Their popularity stems from high potency and the ability to eliminate rodents with a single feeding, making them more effective for severe infestations than first-generation products. Their longer persistence in rodent bodies ensures thorough control, even where alternative food sources are abundant.

This strong market share reflects wide adoption in agricultural storage, urban pest control, and commercial facilities that require quick results. Regulatory approval across multiple regions, as well as advancements such as moisture-resistant baits and targeted delivery systems, have further driven uptake. Demand remains particularly high in areas with dense urbanization and climate-driven rodent growth, where breeding cycles are intensifying.

Although stricter environmental regulations encourage careful use, second-generation anticoagulants remain the preferred choice due to their proven success against resistant rodent populations. Their dominance in 2024 underscores the balance between efficacy, convenience, and the pressing need for dependable rodent management across critical sectors.

By Form Analysis

In 2024, pellets led the anticoagulant rodenticides market by form, holding a 44.6% share. Their dominance comes from easy handling, accurate dosage, and strong palatability that ensure effective rodent control in varied settings. Designed to be durable and moisture-resistant, pellets perform well in both indoor and outdoor environments, including agricultural fields, warehouses, and urban areas.

Their compact size enables precise placement in bait stations, cutting waste and reducing risks to non-target species. With longer shelf life and stability in humid or fluctuating climates, pellets remain highly reliable. Uniform distribution of active ingredients guarantees rodents consume lethal doses quickly, which is vital in heavy infestation zones.

Rising use in food storage sites and public health programs highlights their effectiveness under strict hygiene standards. Ongoing innovations—such as flavor enhancements to attract rodents and deterrents to safeguard non-target animals—are further strengthening their adoption. Their strong share in 2024 reinforces pellets’ position as a versatile, efficient, and trusted solution for anticoagulant rodenticide applications worldwide.

By Application Analysis

In 2024, agriculture led the anticoagulant rodenticides market by application with a 36.8% share. This leadership is driven by the urgent need to protect crops, stored grains, and farm infrastructure from rodent damage, which causes heavy economic losses. Rodents threaten agricultural output by eating and contaminating food supplies, damaging irrigation systems, and disrupting soil structures.

Anticoagulant rodenticides provide reliable, long-term control in large-scale farming, where infestations spread quickly. Second-generation formulations are widely used for managing resistant populations with fewer applications, lowering labor and operational costs. The integration of these solutions into pest management programs has further boosted adoption.

Demand rises sharply during post-harvest seasons, as farmers work to secure stored commodities from contamination. In addition, supportive government pest control guidelines and stronger food safety awareness have reinforced product usage. Agriculture’s 36.8% share in 2024 underscores its central role in driving demand, positioning anticoagulant rodenticides as a critical safeguard for global food security.

Key Market Segments

By Product Type

- First-generation Anticoagulants

- Warfarin

- Chlorophacinone

- Second-generation Anticoagulants

- Bromadiolone

- Difenacoum

By Form

- Pellets

- Blocks

- Powder/Spray

- Others

By Application

- Agriculture

- Pest Control Companies

- Warehouses

- Urban Centers

- Household

- Others

Regional Analysis

In 2024, North America led the anticoagulant rodenticides market with a 42.80% share worth USD 310.0 million. Its dominance is supported by strict food safety rules, advanced pest control systems, and strong awareness of the economic and health risks from rodent infestations. High agricultural output, extensive grain storage, and dense urban populations sustain steady demand for rodent control. Favorable regulations permit controlled use of second-generation anticoagulants, ensuring safety alongside effectiveness.

Europe ranks next, driven by strict hygiene standards in food production and rising pest management needs across cities and farms. Asia Pacific is growing quickly due to urbanization, expanding agriculture, and government-backed pest control programs. Latin America and the Middle East & Africa are emerging markets, where commercial farming and pest awareness are expanding.

In North America, leadership is reinforced by innovations such as moisture-resistant baits and smart bait stations, which improve efficiency and lower environmental risks. Together, regulatory backing, strong infrastructure, and rapid technology adoption secure the region’s leading role in the global market.

Top Use Cases

Urban Disease Control in Tropical Cities: In Singapore, anticoagulant bait use helped curb rodent activity in mixed-use urban areas. After the intervention, analyses showed a 62.7% reduction in rodents caught, a 25.8-unit drop in bait consumption, and a 61.9% decline in bait station damage—demonstrating these products’ effectiveness in reducing disease-vector rodent populations.

Essential Tool During Severe Outbreaks: Anticoagulant rodenticides are indispensable during sudden, massive rodent outbreaks or when protecting critical food supplies. Experts report their critical role in managing high-density infestations and supporting conservation-based interventions, particularly under Integrated Pest Management (IPM) frameworks.

Agricultural and Household Rodent Management: These products are the most common method for managing rodent pests in agricultural and residential areas. In places like California, first-generation anticoagulants such as chlorophacinone are used extensively—nearly a million pounds annually—to control ground squirrels, voles, and other pests on farms.

Wildlife Conservation Concern – Non-Target Exposure: Use of anticoagulant rodenticides in agricultural or urban settings has led to unintended poisoning in wildlife, including raptors and predatory mammals. This highlights the ecological risks these chemicals pose beyond their target species.

Public Health Strategy Against Rodent-Borne Illness: As a cheap and effective method, anticoagulant baits are widely used in public health efforts to curb rodents that spread illnesses. Their deployment in city sanitation programs helps reduce rodent populations and lower disease transmission risks.

Recent Developments

- In October 2024, BASF relaunched its well-known Neosorexa® brand with the upgraded Neosorexa® Plus Blocks, powered by flocoumafen, a stronger anticoagulant than before. These blocks are designed to be both soft and durable, offering high palatability, weather resistance, and rapid effectiveness even against resistant rodents.

- In February 2024, Syngenta unveiled SecureChoice, a ready-to-use digital monitoring system that runs continuously. Using motion and vibration sensors linked to a wireless hub and online dashboard, it enables quick detection of rodent activity and faster, more efficient pest management.

Conclusion

The anticoagulant rodenticides market is shaped by rising urbanization, stricter food safety rules, and the urgent need to protect crops and stored grains from rodent damage. With second-generation formulations and pellet forms showing dominance in 2024, their effectiveness in managing resistant infestations keeps demand strong.

North America leads with advanced infrastructure and regulatory support, while Asia Pacific is witnessing rapid growth. Despite environmental concerns, innovations like weather-resistant baits and smart monitoring ensure these products remain vital for reliable rodent control worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)