Table of Contents

Overview

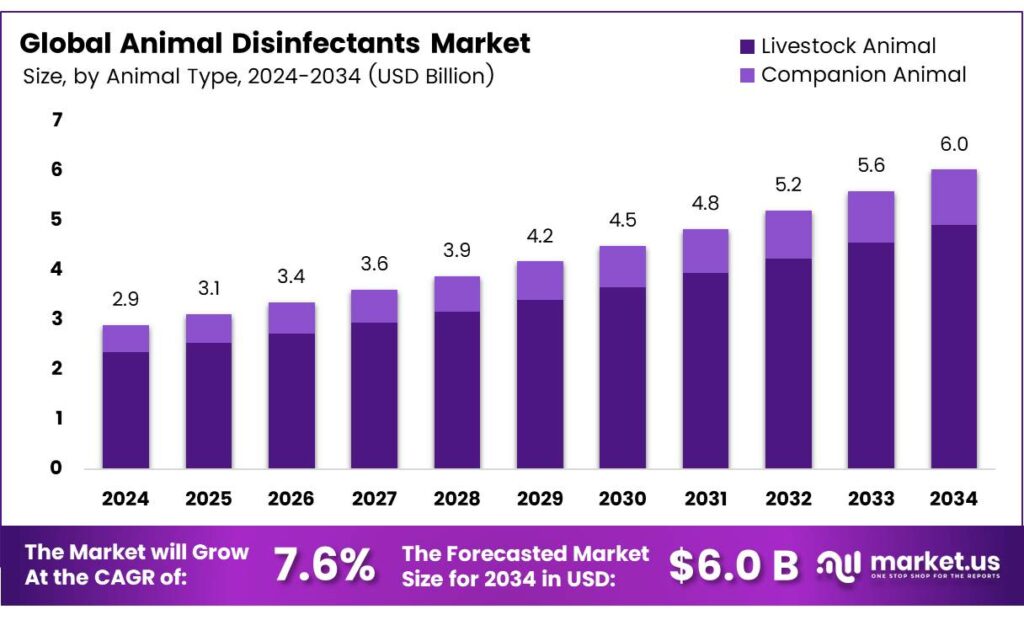

New York, NY – September 29, 2025 – The Global Animal Disinfectants Market is projected to grow from USD 2.9 billion in 2024 to approximately USD 6.0 billion by 2034, expanding at a CAGR of 7.6% during 2025–2034. Animal disinfectants are essential for maintaining hygiene and disease control in farms, poultry houses, veterinary clinics, and aquaculture facilities.

Over the years, the industry has advanced from basic cleaning agents to specialized chemical and biological formulations designed for livestock environments. Rising livestock density in developing regions and the globalization of meat and dairy trade have increased the risks of infectious diseases such as swine fever and avian influenza. This has pushed farms and animal-care facilities to adopt effective disinfection practices as a preventive strategy.

Among the wide range of disinfectants, peroxygen compounds such as hydrogen peroxide and peracetic acid have gained strong recognition. These agents are rapid oxidizers, effectively destroying or inactivating microbes while being relatively low in toxicity and environmentally friendly. Their effectiveness became evident during the United Kingdom’s hydrogen peroxide and peracetic acid, which have gained strong recognition.

These agents are rapid oxidizers, effectively destroying or inactivating microbes while being relatively low in tox2000 foot-and-mouth disease outbreak, when fast-acting disinfectants were critical. Peracetic acid and vapor-phase hydrogen peroxide stood out for their sterilizing power, making them reliable tools in animal health protection. A key advantage of these disinfectants is that they often leave no harmful residues, making them safe for both animals and the environment.

Products based on peroxymonosulfates and oxidized water are increasingly seen as the future of sustainable livestock hygiene. When choosing disinfectants for animal-care settings, regulatory approval is crucial. In the United States, products must carry an EPA registration number, ensuring their claims are scientifically validated and officially recognized. While common agents such as household bleach are widely used, only certain EPA-registered formulations meet the standards required for reliable veterinary and agricultural disinfection.

Key Takeaways

- The Global Animal Disinfectants Market is projected to grow from USD 2.9 billion in 2024 to USD 6.0 billion by 2034, at a CAGR of 7.6%.

- Alcohol-based disinfectants held a 19.8% market share in 2024, valued for their broad-spectrum efficacy against bacteria, fungi, and viruses.

- Livestock animals accounted for an 81.5% share of the market in 2024, underscoring their critical role in global food supply chains.

- Liquid disinfectants dominated with a 58.3% share in 2024, favored for ease of use and effective coverage in animal facilities.

- Poultry farms captured a 31.7% market share in 2024, driven by high disease risks like avian influenza and Salmonella.

- Livestock farms held a 49.0% share in 2024, reflecting the need for hygiene to prevent disease outbreaks in cattle and swine.

- North America led the market in 2024 with a 32.8% revenue share (USD 0.9 billion), fueled by strict biosecurity and intensive farming practices.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-animal-disinfectants-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.9 Billion |

| Forecast Revenue (2034) | USD 6.0 Billion |

| CAGR (2025-2034) | 7.6% |

| Segments Covered | By Product (Alcohol-based Disinfectant, Iodine-containing Disinfectant, Aldehyde Disinfectant, Peroxide Disinfectant, Quaternary Ammonium Compounds, Lactic Acid Disinfectant, Others), By Animal Type (Livestock Animal, Companion Animal), By Form (Liquid, Powder, Foam, Others), By Application (Poultry Farm, Dairy Farming, Aquaculture, Swine, Equine, Others), By End User (Livestock Farms, Integrated Protein Processors, Veterinary Clinics, Animal Transport and Logistics) |

| Competitive Landscape | Neogen Corporation, Zoetis Inc., Solvay Group, Kersia Group, Steroplast Healthcare Limited, GEA Group, PCC Group, G Shepherd Animal Health, Sanosil Ag, Delaval Inc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157562

Key Market Segments

By Product

Alcohol-Based Disinfectants Hold 19.8% Share

In 2024, alcohol-based disinfectants accounted for a 19.8% share of the animal disinfectants market, valued for their rapid action against bacteria, fungi, and viruses. These disinfectants are favored for their quick-drying properties and ease of use in sanitizing equipment, surfaces, and small enclosures, particularly in high-risk areas prone to cross-contamination. Their compatibility with modern farm practices and minimal residue makes them a preferred choice for livestock and poultry farmers. Growing biosecurity awareness is expected to sustain demand for these fast-acting solutions.

By Animal Type

Livestock Dominates with 81.5% Share

Livestock applications led the market in 2024, capturing an 81.5% share, driven by the critical need to protect animal health amid rising global demand for meat, milk, and other animal-derived products. Heightened biosecurity measures to combat diseases like avian influenza, foot-and-mouth disease, and African swine fever have fueled disinfectant use. The expansion of large-scale poultry and dairy operations, particularly in high-population regions, and stringent global hygiene standards are expected to maintain livestock’s market dominance.

By Form

Liquid Disinfectants Command 58.3% Share

Liquid disinfectants held a 58.3% market share in 2024, valued for their versatility, deep penetration, and wide coverage in barns, poultry houses, and livestock facilities. Their ease of application via spraying, misting, or water mixing makes them ideal for both small- and large-scale operations. Compatibility with modern spraying equipment and automated systems enhances efficiency, while rising concerns over disease outbreaks and stricter biosecurity standards are expected to drive continued reliance on liquid formulations in 2025.

By Application

Poultry Farms Capture 31.7% Share

Poultry farms accounted for a 31.7% share of the animal disinfectants market in 2024, driven by high-density operations and the need to prevent diseases like avian influenza, Newcastle disease, and Salmonella. Regular disinfection of poultry houses, hatcheries, and feed areas is critical to maintaining bird health and ensuring consistent egg and meat production. With global poultry demand rising and stricter biosecurity regulations in place, disinfectant use in this sector is expected to remain robust.

By End User

Livestock Farms Lead with 49.0% Share

Livestock farms dominated the market in 2024 with a 49.0% share, reflecting the need for routine disinfection of housing, feeding equipment, and water systems to prevent disease outbreaks. As global demand for meat and dairy grows, livestock farms are prioritizing biosecurity to ensure animal health and food safety. Support from government and industry regulations further drives the adoption of disinfectants as a standard practice in livestock management.

Regional Analysis

In 2024, North America led the animal disinfectants market with a 32.8% share, valued at USD 0.9 billion. This dominance is driven by advanced livestock systems, strict biosecurity regulations, and high compliance in poultry, swine, and dairy operations. Routine sanitation in hatcheries, milking parlors, and transport vehicles, supported by established distribution networks, sustains demand for products like quaternary ammonium compounds and peroxygen blends.

Periodic disease outbreaks, such as avian influenza, reinforce the need for effective disinfectants, while innovations in rapid-kill, low-corrosivity solutions and automated dispensing systems are expected to drive mid single-digit growth. Canada’s modernized supply chains and Mexico’s expanding poultry and pork sectors further bolster regional demand.

Top Use Cases

- Livestock Barn Hygiene: Farmers use disinfectants to clean walls, floors, and pens in livestock barns, wiping out harmful germs that cause infections. This simple step keeps cows and pigs healthy, cuts down on sickness spread, and boosts farm output by ensuring animals stay strong and productive in crowded spaces.

- Poultry House Sanitation: In busy poultry farms, disinfectants are sprayed over coops and nesting areas to stop viruses like bird flu from taking hold. This easy routine protects chickens from quick outbreaks, supports steady egg laying, and helps farmers meet food safety rules without big disruptions to daily operations.

- Dairy Equipment Cleaning: Milk producers apply disinfectants to milking machines, tanks, and udder dips to kill bacteria that spoil milk. This quick process keeps dairy fresh and safe for consumers, reduces waste from bad batches, and lets farmers focus on high-quality output with less worry about health risks.

- Swine Facility Disinfection: Pig farms rely on disinfectants for foot baths and transport tools to block diseases like swine fever. By soaking boots and gear in these solutions, handlers prevent germ carryover, safeguard herd growth, and maintain smooth breeding cycles for better meat supply.

- Aquaculture Water Treatment: Fish and shrimp farms add disinfectants to ponds and nets to clear algae and parasites that harm sea life. This straightforward method improves water clarity, speeds up fish growth, and ensures safe seafood harvest, making it easier for producers to scale up sustainably.

Recent Developments

1. Neogen Corporation

Neogen continues to innovate with its biosecurity portfolio, recently launching Synergize—a powerful disinfectant concentrate effective against key pathogens like PRRS and PEDV. This launch underscores their focus on providing proven solutions for critical disease challenges in livestock production. The company also emphasizes its global support and training resources to help farms implement robust biosecurity protocols, aiming to protect animal health and producer profitability.

2. Zoetis Inc.

Zoetis is strengthening its integrated biosecurity offerings by combining disinfectants like KenoTM MX with on-farm consultation and diagnostic services. Their recent focus is on providing comprehensive solutions, including monitoring tools and technical expertise, to help producers prevent disease incursion and spread. This approach moves beyond product sales to become a holistic partner in veterinary health management, ensuring disinfectants are used optimally within a full biosecurity system.

3. Solvay Group

Solvay is advancing its disinfectant chemistry with a strong emphasis on sustainability. Their recent developments include promoting the environmental profile of products based on hydrogen peroxide and peracetic acid, which break down into harmless by-products. They are focusing on high-efficacy, lower-toxicity solutions that meet evolving regulatory demands and the industry’s growing preference for greener chemistries without compromising on performance against viruses and bacteria.

4. Kersia Group

Following its acquisition of Virox Animal Health, Kersia has significantly expanded its portfolio, integrating the powerful Accelerated Hydrogen Peroxide (AHP) platform. A recent key development is the global rollout of their AHP-based disinfectants, known for efficacy, safety, and short contact times. This strategic move solidifies Kersia’s position as a global leader in biosecurity, offering a wider range of solutions from farm to food processing.

5. Steroplast Healthcare Limited

Steroplast has been actively expanding its distribution and marketing of its comprehensive Farm Shield disinfectant range across the UK and Europe. A key recent development is their increased focus on providing bundled biosecurity kits and accessible technical guidance for farmers. This strategy aims to make effective disease prevention more practical and manageable for livestock and poultry operations, emphasizing user-friendly solutions and support.

Conclusion

Animal Disinfectants play a key role in modern farming by building stronger biosecurity walls against everyday threats. With farms getting bigger and global food needs rising, these tools help keep animals well and operations smooth, cutting health worries and waste. Smarter formulas and eco-friendly options will drive even wider use, turning hygiene into a smart edge for sustainable growth across livestock, poultry, and beyond.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)