Table of Contents

Overview

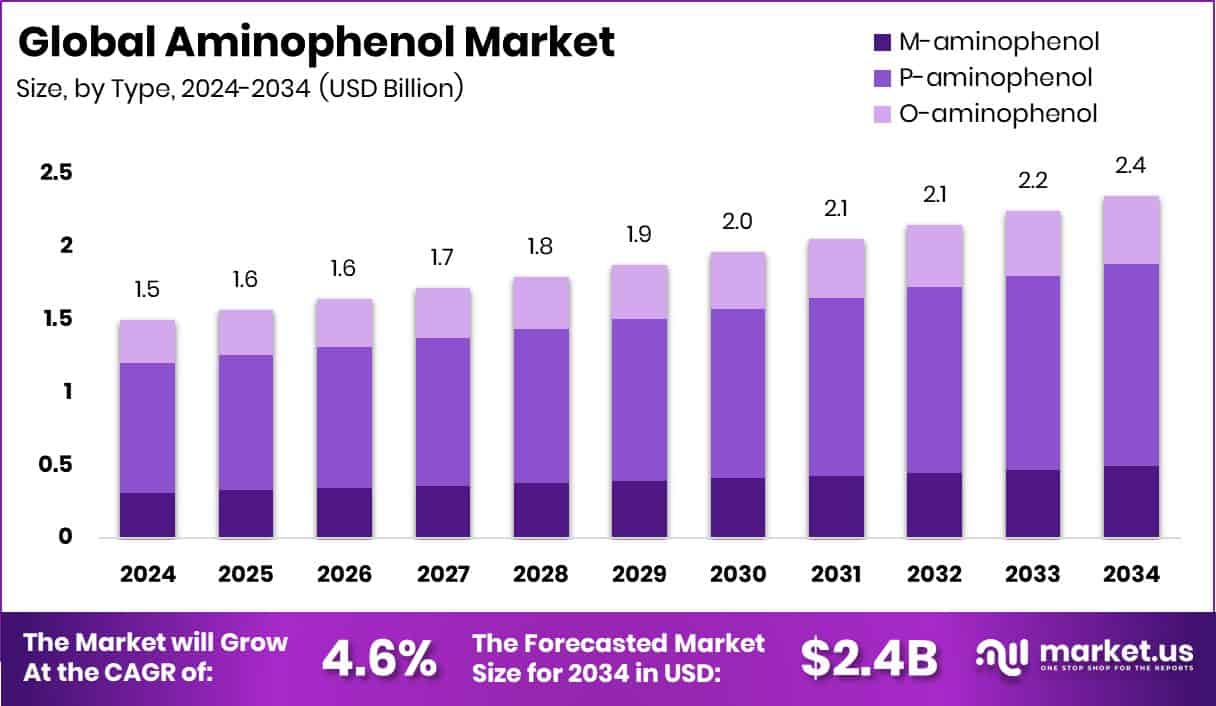

New York, NY – October 16, 2025 – The global Aminophenol Market is projected to reach USD 2.4 billion by 2034, up from USD 1.5 billion in 2024, growing at a CAGR of 4.6% (2025–2034). Asia Pacific leads with 43.8% of the global share, supported by industrialization and healthcare expansion.

Aminophenol, derived from phenol with an amino (–NH₂) group, exists as ortho, meta-, and para-isomers and is vital for pharmaceuticals, dyes, agrochemicals, and specialty chemicals. Para-aminophenol is a core intermediate for paracetamol, linking growth to rising healthcare demand. Its use in dyes, cosmetics, and hair colors adds volume, while agricultural applications strengthen consumption through herbicide and pesticide synthesis.

Regulatory pushes for higher-purity chemicals are shifting demand toward refined aminophenol grades. Growth opportunities lie in specialty and agrochemical applications, as emerging markets—particularly in Asia, Africa, and Latin America—expand local production capacity. Investment trends also reinforce this outlook: Kotak arm’s Rs 375 crore injection into Cropnosys highlights agrochemical growth, while Pili’s US$15.8 million Series A and the GEF Council’s USD 668 million environmental funding emphasize ongoing capital flow into sustainable chemical innovation.

These combined forces of healthcare expansion, agricultural demand, and innovation funding position aminophenols as versatile and increasingly valuable intermediates across multiple global industries.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-aminophenol-market/request-sample/

Key Takeaways

- The Global Aminophenol Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- In 2024, P-aminophenol dominated the aminophenol market, holding a 43.3% share globally.

- Dye intermediates captured a 44.9% share in the aminophenol market during 2024.

- Pharmaceuticals accounted for 39.6% of the acetaminophen market in 2024.

- The Asia Pacific generated USD 0.6 billion, supported by strong pharmaceutical and dye industries.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=161183

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 2.4 Billion |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Type (M-aminophenol, P-aminophenol, O-aminophenol), By Application (Dye Intermediates, Synthesis Precursors, Fluorescent Stabilizers, Other), By End-use (Pharmaceuticals, Agrochemicals, Antioxidants, Chemicals, Others) |

| Competitive Landscape | Wego Chemical Group, Loba Chemie, Taixing Yangzi Pharm Chemical Co., Ltd., CDH Fine Chemicals, Anhui Bayi Chemical Industry Co. Ltd., Parchem, Glentham Life Sciences Ltd, Liaoning Shixing Pharmaceutical & Chemical Co., Ltd. |

Key Market Segments

By Type Analysis

In 2024, P-aminophenol dominated the By Type segment of the Aminophenol Market with a 43.3% share, owing to its vital role as a pharmaceutical intermediate, especially in paracetamol production. Its chemical versatility and high purity make it equally valuable in hair dyes, colorants, and photographic developers, broadening its industrial relevance.

Continuous demand from the pharmaceutical and cosmetic sectors reinforced its market strength, while proven safety and production efficiency supported large-scale manufacturing. These attributes helped sustain consistent adoption across the global chemical industries. The compound’s balance of functional stability, cost-effectiveness, and adaptability ensured its commanding presence.

With healthcare expansion and cosmetic innovation boosting consumption, P-aminophenol maintained its leadership in 2024, serving as a cornerstone material in both essential drug synthesis and value-added consumer formulations, underscoring its pivotal position in the global aminophenol market structure.

By Application Analysis

In 2024, Dye Intermediates dominated the by-application segment of the aminophenol market with a 44.9% share, driven by widespread use in producing high-performance dyes and pigments for the textile, leather, and paper industries. Aminophenol-based intermediates deliver exceptional color stability, brightness, and fastness, making them vital in both synthetic and natural dye formulations.

Rising global textile output and the growing preference for durable, vivid coloring agents further reinforced this leadership. Their adaptability across multiple dyeing methods and proven ability to enhance shade depth and uniformity have made them indispensable for manufacturers seeking consistent color quality.

Supported by industrial expansion in emerging regions and continued innovation in eco-friendly dye chemistry, the Dye Intermediates segment retained its leading position in 2024, underscoring aminophenol’s critical role in modern pigment and textile manufacturing chains worldwide.

By End-use Analysis

In 2024, the pharmaceuticals segment led the end-use category of the Aminophenol Market, commanding a 39.6% share. This dominance stemmed from the extensive application of p-aminophenol as a vital intermediate in producing paracetamol and several other drug formulations. Its high purity, strong chemical stability, and scalability in synthesis made it indispensable for pharmaceutical manufacturing.

Growing global healthcare needs and the surging output of over-the-counter pain relief and fever management medicines further boosted demand. As healthcare accessibility expanded across both developed and emerging regions, consumption of aminophenol-based intermediates rose steadily.

These combined factors secured the pharmaceuticals segment’s leadership in 2024, establishing aminophenol as a cornerstone raw material for large-scale drug production and reinforcing its strategic importance within the broader healthcare-driven chemical supply chain.

Regional Analysis

In 2024, Asia Pacific led the global Aminophenol Market with a 43.8% share, valued at USD 0.6 billion, driven by rapid pharmaceutical expansion and rising dye manufacturing in China, India, and Japan. Strong chemical infrastructure, industrialization, and healthcare investments reinforced its leadership.

North America maintained steady growth through advanced production technologies and strict regulatory standards, ensuring a reliable supply for pharmaceutical and personal care uses.

Europe remained a key contributor, supported by a robust pharmaceutical base and a focus on sustainable chemical synthesis.

The Middle East & Africa region progressed moderately, with consumption growing alongside emerging local manufacturing and industrial diversification. Latin America recorded stable growth due to expanding healthcare systems and increased agrochemical utilization, with government initiatives promoting domestic chemical production.

Collectively, these regional dynamics positioned Asia Pacific as the dominant hub, while other markets advanced through modernization, sustainability efforts, and diversified industrial demand.

Top Use Cases

- Pharmaceutical intermediate (especially p-aminophenol → paracetamol): p-Aminophenol is converted into paracetamol (acetaminophen) and other drugs thanks to its –NH₂ and –OH groups providing a reactive site. Its purity and stability make it ideal for large-scale pharmaceutical synthesis.

- Hair dyes and permanent colorants: Aminophenols (p, m, o) are used in permanent hair dye formulas, where they penetrate hair fibers and react to develop color inside the structure.

- Dye intermediates for textiles, inks & pigments: Aminophenols act as building blocks for azo, sulfur, and other dye molecules, contributing brightness, color stability, and fastness in fabrics, inks, and plastics.

- Photographic developing agent (black & white): In traditional black & white photography, 4-aminophenol is used in developer solutions to reduce silver halide crystals into metallic silver, forming the image (e.g. in Rodinal).

- Catalyst ligand in chemical reactions: Aminophenol derivatives serve as ligands in metal complexes for catalysis (homogeneous catalysis, redox, CO₂ reduction, hydrogen evolution) because their structure can coordinate metals and mediate reactions.

- Additives, coatings, antioxidants & polymer precursors: They are used in coatings (for adhesion, corrosion resistance), as antioxidants in oils, polymer monomers, and additives in rubber. Their dual functional groups allow them to interact with many systems.

Recent Developments

- In July 2025, Wego Chemical entered into a legally binding agreement with the Center for Environmental Health (CEH) to address past failures in reporting chemical import data in accordance with U.S. EPA regulations. This agreement relates to their broader chemical import and distribution operations.

- In August 2024, The Anhui Bayi Chemical Industry Co. Ltd. received a statement of non-compliance with GMP (Good Manufacturing Practices), citing “severe violations, lack of GMP knowledge, and contamination of the final product, p-aminophenol.” This suggests regulatory or quality control issues around their acetaminophen (or related API) production.

Conclusion

The Aminophenol market continues to evolve through its diverse applications in pharmaceuticals, dyes, cosmetics, and agrochemicals. Its role as a vital intermediate in drug and colorant synthesis keeps demand steady across industrial sectors. Innovation in cleaner synthesis methods, sustainable formulations, and expanding chemical infrastructure in emerging economies is shaping future growth.

The industry’s progress depends on consistent quality standards, efficient production technologies, and increased focus on environmental responsibility. Rising healthcare needs, coupled with growing demand for advanced intermediates, ensure aminophenol’s continued importance. Collaboration between manufacturers, research institutes, and regulatory bodies will further strengthen its position in global chemical development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)