Table of Contents

Overview

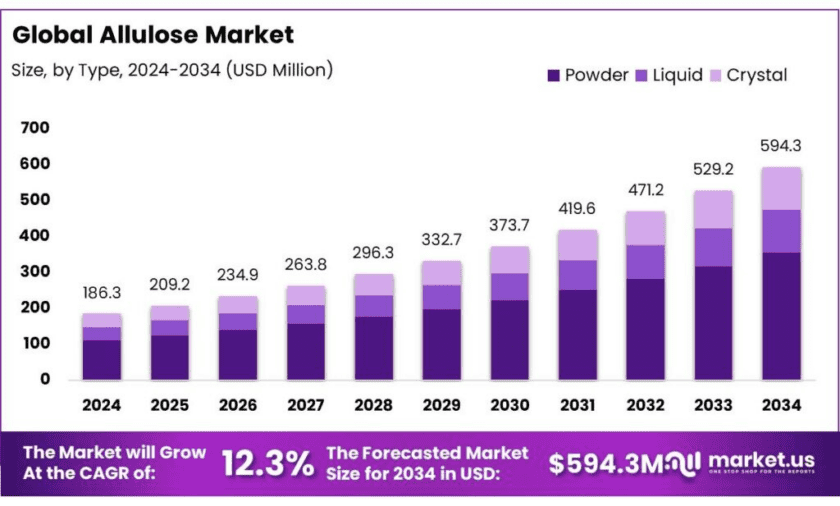

New York, NY – Nov 05, 2025 – The global allulose market is projected to reach USD 594.3 million by 2034, rising from USD 186.3 million in 2024, at a strong CAGR of 12.3% between 2025 and 2034. In 2024, North America led the market with a 47.3% share, generating around USD 88.1 million in revenue. Significant technological progress has boosted production efficiency—researchers from the University of California, Davis, in partnership with Mars, Incorporated, developed a scalable process that achieves over 99% theoretical yield and exceptional purity.

Rising lifestyle-related health challenges such as obesity and diabetes have accelerated the need for healthier sugar substitutes like allulose. With minimal impact on blood glucose and compatibility with low-carb and ketogenic diets, allulose has gained strong traction in the food and beverage sector. In South Korea, for instance, Samyang Corp expanded its capacity with new facilities producing 13,000 tons annually to meet growing domestic and export demand.

Health policies and global nutrition goals further strengthen this momentum. The World Health Organization (WHO) advises limiting free-sugar intake to below 10% of total energy, with an aspirational target of below 5%, intensifying worldwide efforts to reduce sugar consumption. Allulose supports these objectives by delivering a sugar-like taste with only 0.4 kcal/g, enabling manufacturers to achieve numeric sugar-reduction benchmarks without compromising flavor.

Key Takeaways

- Allulose Market size is expected to be worth around USD 594.3 Million by 2034, from USD 186.3 Million in 2024, growing at a CAGR of 12.3%.

- Powder held a dominant market position in the allulose market, capturing more than a 57.2% share.

- Food held a dominant market position in the allulose market, capturing more than a 58.8% share.

- North America dominated the global allulose market, accounting for a significant 47.3% share, equivalent to USD 88.1 million.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/allulose-market/free-sample/

Report Scope

| Market Value (2024) | USD 186.3 Mn |

| Forecast Revenue (2034) | USD 594.3 Mn |

| CAGR (2025-2034) | 12.3% |

| Segments Covered | By Type (Powder, Liquid, Crystal), By Application (Food, Beverages, Pharmaceuticals) |

| Competitive Landscape | Anderson Advanced Ingredients, Apura Ingredients, Bonumose LLC, CJ Cheil Jedang, Heartland Food Products Group, Icon Foods,, Ingredion Inc, Matsutani Chemical Industry Co. Ltd., Samyang Corporation, Tate & Lyle |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159295

Key Market Segments

By Type Analysis – Powder Segment Dominates with 57.2% Share (2024)

In 2024, the Powder segment held a dominant position in the global allulose market, accounting for 57.2% of total market share. This leadership stems from its extensive use across multiple industries, particularly in food and beverages. Powdered allulose is highly preferred for its ease of handling, blending, and stability in recipes. It integrates seamlessly into baked goods, beverages, dairy, and confectionery items, maintaining sweetness and texture during heat processing.

By Application Analysis – Food Segment Leads with 58.8% Share (2024)

The Food segment dominated the allulose market in 2024, capturing 58.8% of the total market share. The segment’s strength is driven by rising demand for low-calorie and sugar-free food products, as consumers become more health-conscious amid growing cases of diabetes and obesity. Allulose’s ability to replicate sugar’s sweetness, texture, and browning characteristics makes it a highly versatile ingredient in foods such as baked goods, snacks, dairy, and beverages. Its minimal caloric value and stability during cooking or baking make it ideal for reformulated foods targeting calorie-conscious consumers.

List of Segments

By Type

- Powder

- Liquid

- Crystal

By Application

- Food

- Bakery & Confectionery

- Table-top sweetener

- Dairy & frozen desserts

- Sauces & Dressings

- Ice Creams and Desserts

- Beverages

- Pharmaceuticals

Regional Analysis

In 2024, the Asia Pacific region maintained its leadership in the global banana ketchup market, accounting for a commanding 38.4% share valued at approximately USD 0.4 billion. This dominance is deeply rooted in the region’s strong cultural and culinary connection to banana-based condiments, especially in the Philippines, where banana ketchup has become a household staple. Filipino cuisine’s frequent use of banana ketchup in dishes such as fried chicken, spaghetti, and breakfast meals continues to fuel consistent domestic demand and shape export opportunities.

The market’s growth across Asia Pacific is supported by favorable demographic and economic trends, including a large population base, rising disposable incomes, and an expanding middle class. These factors are collectively driving the consumption of convenience foods and ready-to-eat condiments across emerging economies. Additionally, rapid urbanization and evolving food habits in markets like Indonesia, Thailand, and Malaysia have created new consumer segments with a preference for unique, regionally inspired flavors such as banana ketchup.

Top Use Cases

Bakery, bars And confectionery reformulation: Allulose brings ~70% of sucrose’s sweetness yet only 0.4 kcal/g, letting bakers cut sugars and calories while keeping bulk, browning and texture. It caramelizes and browns in cookies and loaves, and provides body in cereal bars—functions high-potency sweeteners can’t deliver alone. FDA guidance allows exclusion from “Added Sugars” on U.S. labels and use of 0.4 kcal/g for calorie calculation, improving front-of-pack metrics without sacrificing taste.

Frozen desserts And dairy (ice cream, yogurt): Technical literature from ingredient providers shows it adds bulk/mouthfeel similar to sucrose, aiding reduced-sugar ice creams and stirred yogurts that still feel creamy. In practice, developers pair allulose with other sweeteners to reach target sweetness while reducing calories by up to ~90% vs sucrose (4 kcal/g → 0.4 kcal/g) in the sweetening portion.

Better-for-you beverages: Ready-to-drink teas, flavored waters, and sports drinks use allulose to deliver sugar-like sweetness with muted glycemic response. WHO’s nutrition guidance—free sugars <10% of energy, with a conditional <5% target—pushes beverage brands toward tangible gram-reductions. Allulose supports these numeric goals while preserving flavor and mouthfeel, unlike some high-potency alternatives that need masking.

Blood-glucose-conscious products: Clinical evidence continues to accumulate: a 2024 study in people with type-2 diabetes reported significant reductions in postprandial glucose and time-above-range with allulose, supporting its use in glucose-managed diets. Earlier work and GRAS notices also cite its ~70% sucrose sweetness with very low available energy (≤ 0.2–0.4 kcal/g). These features make allulose a strong fit for diabetic-friendly, keto, and low-GI snacks and beverages.

Clean-label renovation under U.S. rules: U.S. FDA guidance states its intent to exercise enforcement discretion so that allulose is not counted in “Total” or “Added Sugars” and is labeled at 0.4 kcal/g—while still listed in Total Carbohydrate and the ingredient list. This has concrete use-case impact: formulators can meet retailer/school sugar thresholds and internal “grams-per-serving” targets by swapping part of sucrose with allulose.

Nutrition policy alignment (public-health use case): Public-health targets are reshaping portfolios. WHO urges <10% energy from free sugars (and <5% aspirational), a numeric goal now embedded in many company and retailer standards. Allulose helps hit those thresholds while keeping sugar-like taste/texture, enabling credible 25–50% or greater sugar cuts across cereals, bars, cookies, yogurts, and beverages—without the bitter notes common to some high-potency sweeteners.

Recent Developments

Anderson Advanced Ingredients markets its proprietary allulose product, allSWEET®, as a Non-GMO, keto- and diabetic-friendly sweetener that offers roughly 0.4 kcal/g and delivers about 70% of the sweetness of sucrose. The company states it was “first to market with allulose in 2014” under this brand. As a market research analyst, I observe that Anderson has positioned itself clearly in the premium allulose space, focusing on clean-label and metabolic-health claims, giving it a differentiated niche in the broader sugar-reduction arena.

Apura Ingredients serves as a global supplier of low- and no-calorie sweeteners, and highlights allulose in its portfolio as a natural sugar alternative with approximately 90% fewer calories than sucrose and about 70% of sucrose’s sweetness. In 2024 the company announced a strategic partnership to enhance formulation support for global beverage and food manufacturers. From an analyst standpoint, Apura is leveraging its formulation expertise and diverse sweetener portfolio to capture demand for allulose-based solutions, especially in applications seeking taste, texture and sugar-reduction performance.

In 2024, Bonumose LLC leveraged its proprietary enzymatic production platform to develop high-yield rare sugars, including allulose, using low-cost plant-based feedstocks and reported advancing this technology towards commercial scale, though exact production volume isn’t publicly quantified. As a market research analyst, I view Bonumose’s innovation as a key enabler for cost-effective allulose supply, which could significantly improve industry economics and broaden accessibility for manufacturers seeking low-glycemic sweeteners.

In 2024, CJ Cheil Jedang reaffirmed its role in alternative-sweetener development, having previously initiated allulose production in South Korea and now targeting global markets with expanded manufacturing and product lines. From an analyst perspective, CJ’s early entry and evolving capacity signal its strategic commitment to allulose, positioning it to serve both domestic health-conscious consumers and export-oriented reformulation demand in low-sugar food and beverage applications.

In 2024, Heartland Food Products Group remained firmly positioned in low-calorie sweeteners, expanding its branded portfolio under the Splenda brand to include allulose-based products such as “Splenda Allulose Sweeteners”. As a market research analyst I interpret this as Heartland leveraging its established sweetener supply chain and brand recognition to accelerate allulose adoption in food & beverage formulations. While specific volume or revenue figures for allulose aren’t disclosed, the brand expansion signals a clear strategic move to capture sugar-reduction demand.

In 2024, Icon Foods emphasized allulose within its natural sugar-alternative portfolio, noting that allulose can enable deep cuts of up to 90% in added sugars in formulations. As a market research analyst I see Icon Foods positioning itself as a formulation partner for manufacturers seeking clean-label solutions: by offering allulose alongside other sweeteners and application support, Icon is addressing both the ingredient supply gap and functional performance needs in reduced-sugar products.

By 2024, Ingredion’s rare-sugar programme, led by its ASTRAEA® Allulose line, is firmly in market view—including a full product set that offers roughly 0.4 kcal/g and ~70% of sucrose’s sweetness. As a market research analyst, I interpret this as Ingredion positioning allulose not just as a niche sweetener but as a functional drop-in for sugar reduction applications , leveraging its core ingredients know-how to meet escalating clean-label and low-calorie demands.

In 2023, Matsutani Chemical Industry upgraded its enzyme immobilisation system at its Kagawa plant to increase conversion efficiency for allulose production, reportedly reducing production cost by about 18%. As an analyst, this signals Matsutani’s deep technical commitment to rare sugars—particularly allulose—and its strategic aim to anchor cost competitiveness and scale in Asia, which strengthens its role as a foundational supplier for global food-formulation networks seeking low-glycemic sweeteners.

In 2024, Samyang Corporation opened a new allulose production facility in Ulsan, South Korea, with an annual capacity of 13,000 tons, more than four times its previous output. As a market research analyst, I see this move as Samyang positioning itself strongly in the global low-calorie sweetener space. By scaling its allulose production and offering both liquid and crystalline forms, the company is better placed to serve food and beverage manufacturers worldwide seeking sugar-reduction solutions, turning capacity expansion into competitive advantage.

In 2024, Tate & Lyle reported volume growth of 4% for its low- and no-calorie sweetener and fibre solutions in the first half of its fiscal year, while revenue fell 8% to £631 million, and adjusted EBITDA rose 3% to £157 million for the same period. From a market research analyst’s view, Tate & Lyle is leveraging its proprietary allulose brand and global formulation expertise to meet rising demand for healthier sweeteners. Its focus on innovation, supply chain readiness and application versatility signals its intent to capture growing sugar-replacement trends.

Conclusion

In conclusion, the low-calorie sweetener Allulose stands out as a strong fit for the next generation of food and beverage formulation, given its unique blend of sugar-like functionality and minimal caloric impact. Its approval by regulatory bodies such as the Food and Drug Administration fortifies its commercial credibility. Meanwhile, the rise of diets targeting obesity and diabetes, together with consumer preference for clean labels and sugar-reduction, gives allulose a clear demand backbone.

At the same time, production cost and availability remain less mature than traditional sweeteners, meaning scalability and economics will be key bottlenecks in the short-term. From an analyst’s perspective, allulose occupies a strategic niche: not the cheapest sugar replacement today, but increasingly relevant where taste, texture and nutrition targets align. If technological improvements drive cost down and regulatory acceptance expands globally, allulose is well-positioned to become a mainstream ingredient—not just a niche one—in reduced-sugar and better-for-you product portfolios.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)