Table of Contents

Overview

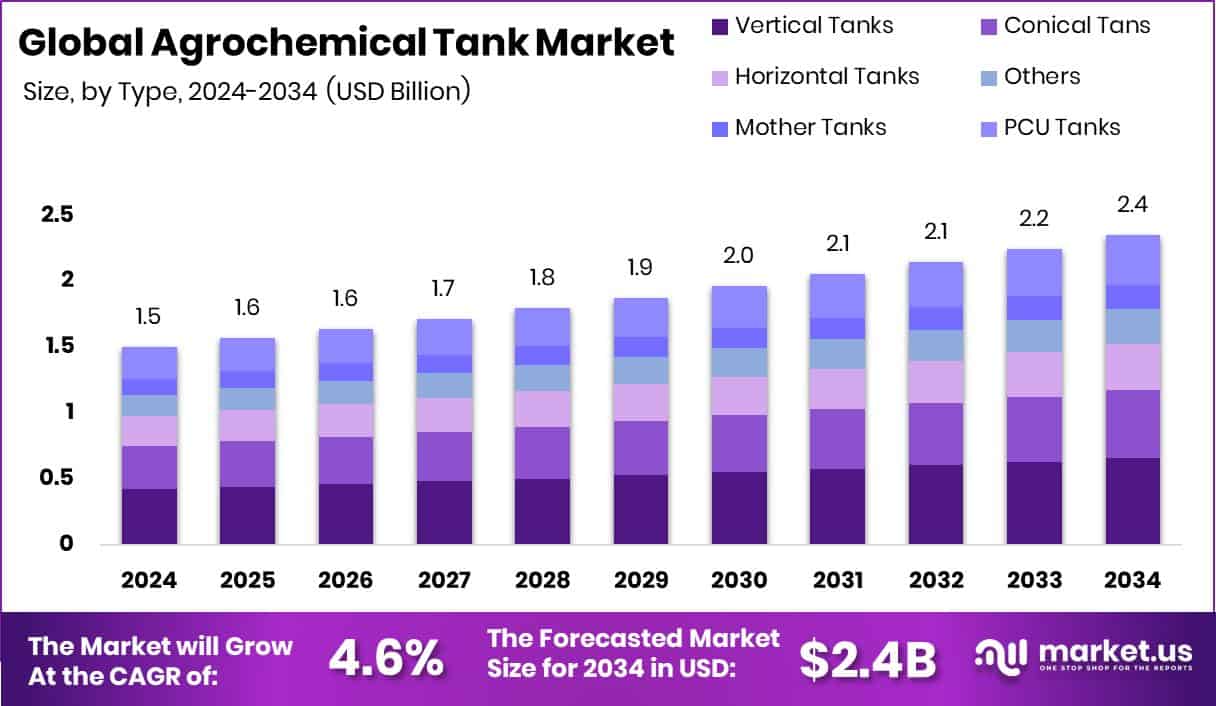

New York, NY – Nov 03, 2025 – The global agrochemical tank industry is poised to grow from around USD 1.5 billion in 2024 to approximately USD 2.4 billion by 2034, fueled by a projected CAGR of 4.6% from 2025 to 2034. North America commands a leading position with a 43.9% share, equivalent to roughly USD 0.6 billion. These tanks—designed for safe storage, mixing, and handling of pesticides, herbicides, and fertilizers—feature corrosion-resistant materials and align with the rise of precision agriculture, mechanized farming, and stricter chemical-safety mandates.

Meanwhile, the organic spices and herbs market—covering naturally cultivated items such as turmeric, cumin, coriander, ginger, basil, and oregano—is being propelled by consumer demand for clean-label foods, the health appeal of organic diets, and the growing global reach of ethnic cuisine.

Alongside this, robust funding activity underscores investor interest in sustainable agrifood infrastructure: for instance, Arbuda Agrochemicals launched an NSE Emerge IPO for 6.4 million shares to retire ₹120 crore of debt and set up a new ALP production line; Kotak Fund invested USD 45 million in Cropnosys, marking its third agrachem investment; and the Global Environment Facility approved USD 68 million for agrifood‐systems innovations.

Together, these developments signal a convergence of efficiency advances in farm chemical handling and heightened consumer focus on healthier organic foods—creating a potent combination of infrastructure investment, modern farming practices, and wellness-oriented food demand.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-agrochemical-tank-market/request-sample/

Key Takeaways

- The Global Agrochemical Tank Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 4.6% from 2025 to 2034.

- Vertical tanks dominate the agrochemical tank market, accounting for 38.3% due to their efficient design.

- Tanks below 30,000 liters lead with 38.6%, supporting small- to medium-scale farming operations globally.

- Water storage tanks hold the largest share at 41.9%, driven by rising irrigation and crop needs.

- The North America Agrochemical Tank Market value stood strong at USD 0.6 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159664

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.5 Billion |

| Forecast Revenue (2034) | USD 2.4 Billion |

| CAGR (2025-2034) | 4.6% |

| Segments Covered | By Type (Vertical Tanks, Conical Tanks, Horizontal Tanks, Others), Mother Tanks, PCU Tanks, By Size (500-1500 liters, 15000 – 30000 liters, Less Than 30,000 liters), By Application (Water Storage Tanks, Chemical Storage Tanks, Fertilizer Storage Tanks, Wine/Fuel Storage Tanks, Others) |

| Competitive Landscape | CF Industries, BASF, AdvanSix, Yara International, Orica, Solvay, Arkema, Nufarm, ICL Group, Haifa Group |

Key Market Segments

By Type Analysis

In 2024, Vertical Tanks dominated the By Type segment of the Agrochemical Tank Market, accounting for a 38.3% share. Their dominance stems from advantages such as easy installation, large storage capacity, and adaptability across various agrochemical applications. Farmers and distributors favor vertical designs for bulk storage of fertilizers and pesticides, offering safe and efficient chemical handling.

These tanks are valued for their durability, space efficiency, and cost-effectiveness, making them integral to modern agricultural operations. As precision farming and improved chemical management gain traction, vertical tanks continue to be the most dependable and widely used storage option, reinforcing their leading position in the agrochemical tank market.

By Size Analysis

In 2024, the <30,000 liters category led the By Size segment of the Agrochemical Tank Market, holding a 38.6% share. These tanks are widely favored for their flexibility, mobility, and efficiency in medium to large-scale farming operations. Farmers and distributors use them extensively to store and transport fertilizers, pesticides, and other agrochemicals in practical, manageable volumes—ensuring safe handling and minimal wastage.

Their balance between storage capacity and operational ease makes them highly cost-effective for diverse agricultural applications. The widespread adoption of <30,000-liter tanks highlights their role as reliable, adaptable storage solutions essential to advancing modern farming efficiency and promoting responsible chemical management across agricultural supply systems.

By Application Analysis

In 2024, Water Storage Tanks dominated the By Application segment of the Agrochemical Tank Market, capturing a 41.9% share. Their prominence stems from their vital role in providing a reliable water source for mixing and diluting agrochemicals before field application. These tanks are indispensable for maintaining efficient irrigation systems and ensuring accurate chemical blending during farming operations.

Farmers depend on them for consistent water availability, which supports safe handling and precise application of fertilizers and pesticides. The strong demand for water storage tanks highlights their importance in enhancing agricultural productivity, promoting sustainability, and ensuring effective management of agrochemicals across diverse farming environments.

Regional Analysis

In 2024, North America led the Agrochemical Tank Market with a 43.9% share, valued at USD 0.6 billion, driven by advanced farming technologies, high adoption of modern storage systems, and a strong focus on safe chemical handling. Europe maintained steady progress, emphasizing sustainability and compliance with strict chemical management regulations.

The Asia Pacific region exhibited strong growth potential due to its vast agricultural base and rising mechanization, boosting demand for durable tank systems. Meanwhile, the Middle East & Africa and Latin America are steadily expanding as awareness of chemical safety and efficient farming grows.

Though still developing their agricultural infrastructure, these regions present promising opportunities. Overall, North America’s leadership underscores the market’s shift toward improved agrochemical management, while emerging regions lay the groundwork for long-term expansion.

Top Use Cases

- Bulk storage for cost efficiency and scalability: Larger-capacity agrochemical tanks enable farms or distributors to purchase inputs in bulk and store them safely under chemical-resistant conditions. This lowers unit cost per litre and supports larger operations.

- Rinsate or waste-chemical containment: After application, agrochemical tanks (or associated vessels) are used to collect waste-rinse or leftover chemical solutions in mixing pads. This prevents unwanted discharge into soil, waterways or the environment.

- Water supply for dilution and irrigation: A crucial role for tanks is storing clean water that’s used to dilute agrochemicals or irrigate the crop after application. Reliable water tanks help ensure mixtures are safe, well-blended, and effective.

- Transport and dispensing of chemical sprays: Mobilised tanks (mounted or portable) are used to safely deliver mixed sprays to fields and connect to sprayer equipment or irrigation systems. This supports efficient application and limits manual handling of concentrated chemicals.

- Safe storage of agrochemicals on-farm: These tanks serve as secure containers to store agrochemicals in a dedicated, controlled space — away from livestock, food, or water sources. Proper storage extends shelf-life, prevents contamination, and protects people, animals and the environment.

- Mixing pesticide and fertilizer solutions: Farmers use agrochemical tanks to prepare the right blend of pesticides, herbicides, or fertilisers before spraying. Mixing within a tank helps combine chemicals efficiently and reduce separate passes across fields. However, tank mixing must follow proper order and compatibility rules to avoid clumping, layering, or reduced efficacy.

Recent Developments

- In May 2025, AdvanSix announced sales of USD 378 million (up ~12% from prior year), net income of USD 23.3 million, and adjusted EBITDA of USD 51.6 million. They noted improved volumes, strong plant-nutrient performance, and the effect of a USD 26 million insurance settlement tied to an earlier supply disruption.

- In July 2024, CF Industries announced a collaboration with POET to pilot the use of low-carbon ammonia fertilizer in corn production, aiming to reduce the carbon intensity of ethanol production.

- In December 2024, the board of BASF India approved the demerger of its Agricultural Solutions business into a standalone company. The move is part of BASF’s global strategy (by the parent company BASF SE) to separate its “Agricultural Solutions” division (which handles seeds, traits, crop-protection products, and digital farming tools) and potentially list a minority stake in it.

Conclusion

The agrochemical tank market is evolving rapidly, driven by advancements in precision farming, safety standards, and sustainable agricultural practices. Farmers and distributors are increasingly adopting durable, chemical-resistant tanks to ensure efficient storage, mixing, and handling of fertilizers and pesticides. Rising awareness of environmental protection and improved crop productivity is further shaping demand.

Innovations in materials, automation, and leak-proof systems are enhancing operational safety and reducing waste. Additionally, growing investments in modern agricultural infrastructure and government initiatives promoting safe chemical usage continue to strengthen market growth, making agrochemical tanks a vital component of efficient and responsible farming systems worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)