Table of Contents

Introduction

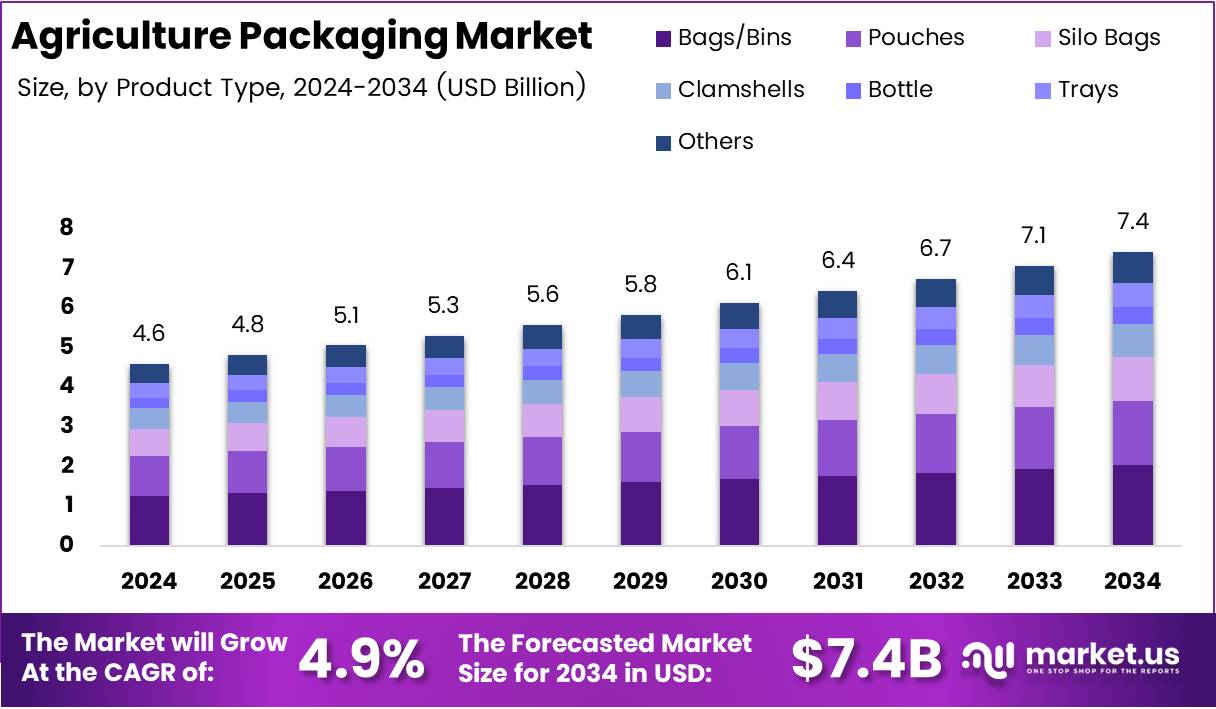

The Global Agriculture Packaging Market is projected to reach USD 7.4 Billion by 2034, up from USD 4.6 Billion in 2024, advancing at a CAGR of 4.9% between 2025 and 2034. The market reflects a clear transformation as sustainability drives packaging innovations across the agriculture value chain.

Consumer preferences are shifting rapidly, and producers are responding with eco-friendly packaging solutions that balance durability with recyclability. This transition is not only supported by regulations but also reinforced by growing consumer demand for sustainable options. Consequently, companies are investing heavily in green materials and advanced packaging technologies.

Furthermore, global trade dynamics and the rise of organic farming have boosted demand for packaging that ensures protection, shelf life extension, and minimal food waste. These factors collectively position agriculture packaging as a key enabler of sustainable food systems worldwide.

Key Takeaways

- The Global Agriculture Packaging Market is expected to be worth USD 7.4 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 4.9% from 2025 to 2034.

- Bags/Bins represent the leading product category with 27.4% market share due to their adaptability across agricultural storage needs.

- Plastic materials dominate the market with 48.2% share, driven by superior moisture barrier properties and durability.

- Medium-barrier packaging holds 48.3% market share, offering optimal protection-to-cost ratios for mainstream agricultural products.

- Small capacity packaging (up to 25 kg) leads with 43.8% market share, providing easy handling and reducing product waste risks.

- Food Grains represent the largest application segment, capturing 41.6% market share, driven by global production volumes and storage needs.

- Asia Pacific holds the largest share of the market with 45.8%, valued at USD 2.1 Billion, due to eco-friendly packaging demand and sustainable agriculture practices.

Market Segmentation Overview

Bags/Bins dominate with 27.4% share, attributed to their flexibility and wide use across food grains, fertilizers, and bulk produce. Their stackable design reduces logistics costs while safeguarding product quality during long transport. This category remains the most adaptable across diverse agricultural contexts.

Plastic materials lead with 48.2%, driven by strong resistance to moisture, chemicals, and physical stress. Rigid plastics provide reusable options for high-value products, while flexible plastics grow in adoption due to their lightweight, cost-efficient features. Both categories reinforce plastic’s dominance despite sustainability concerns.

Medium-barrier packaging captures 48.3%, balancing cost and performance. It prevents moisture penetration at competitive costs, making it suitable for staple crops like rice and wheat. In contrast, high-barrier packaging is positioned for premium segments, while low-barrier options continue to serve bulk commodities.

Packaging with capacities ≤25 kg holds 43.8% share, primarily due to ease of handling and preference among small farmers and consumers. Medium-capacity formats cater to mid-scale operations, while larger sizes are favored by industrial farms where bulk transportation efficiency is critical.

Food Grains dominate with 41.6%, fueled by massive global consumption. Packaging solutions in this category emphasize freshness, pest resistance, and long-term storage. Seeds & Pesticides follow closely, given their stringent packaging needs to protect against contamination and maintain efficacy.

Drivers

One major driver is consumer demand for sustainable packaging. According to surveys, 54% of U.S. consumers bought products with eco-friendly packaging in the last six months, and 90% prefer brands prioritizing sustainability. These trends are pushing manufacturers toward biodegradable, recyclable, and renewable materials.

Another driver is technological advancements in packaging materials. Modified atmosphere packaging (MAP) and active packaging extend shelf life and reduce spoilage, crucial for perishable products. Such innovations align with government initiatives targeting food waste reduction and sustainability goals.

Use Cases

Agriculture packaging plays a critical role in protecting perishable produce during transport. For example, fruits and vegetables packaged with moisture-resistant films arrive fresher in retail markets, directly reducing food waste and maintaining consumer trust.

Another use case is seed and pesticide packaging, where contamination prevention is essential. Specialized containers and barrier films ensure seed viability and pesticide stability, directly impacting farm productivity and compliance with safety standards.

Major Challenges

A major challenge is the lack of regulatory standardization. Countries impose different packaging requirements, complicating compliance and inflating costs. For small players, this complexity limits entry into international trade.

Another challenge is the short shelf-life of agricultural products. Even advanced packaging cannot indefinitely prevent spoilage. This forces companies to balance high protection costs with the reality of perishable goods, often straining margins.

Business Opportunities

E-commerce in agriculture presents a huge growth opportunity. With consumers purchasing organic foods and fresh produce online, demand for robust, protective packaging is rising. Packaging designed for long-distance shipping ensures quality delivery and expands market reach.

Another opportunity is biodegradable and compostable packaging. With 80% of consumers willing to pay more for eco-friendly goods and accepting a 9.7% price premium, businesses that innovate in this area stand to capture significant market share.

Regional Analysis

Asia Pacific dominates with 45.8% share, valued at USD 2.1 Billion. Rapid urbanization in China and India, combined with strong adoption of eco-friendly practices, has elevated the region as the leader. Demand for fresh produce and organic farming boosts sustainable packaging adoption.

North America is a strong secondary market. Rising U.S. regulatory support for biodegradable packaging, coupled with consumer willingness to pay for sustainable products, creates fertile ground for market expansion. Continuous R&D investment reinforces the region’s competitive edge.

Recent Developments

- Jul 2025 – Bambrew secures USD 10.3M in funding to expand eco-friendly packaging production and enhance sustainable material innovation.

- Nov 2024 – Ukhi raises USD 1.2M in pre-seed funding to advance bio-packaging solutions and strengthen market positioning.

- Jul 2025 – Canpac Trends acquires Saptagiri Packagings Pvt. Ltd., enhancing its premium and sustainable packaging capabilities.

- Mar 2024 – AgroFresh acquires Pace International LLC, expanding its post-harvest solutions and extending shelf life for agricultural produce.

Conclusion

The Global Agriculture Packaging Market is on a steady growth path, projected to reach USD 7.4 Billion by 2034. Sustainability remains the industry’s defining trend, with eco-friendly packaging becoming essential rather than optional. Companies that innovate in biodegradable solutions, smart packaging, and e-commerce-ready formats will thrive in the coming decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)